Brazil Ice Cream Market Size and Trend Analysis by Categories and Segment, Distribution Channel, Packaging Formats, Market Share, Demographics and Forecast, 2021-2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

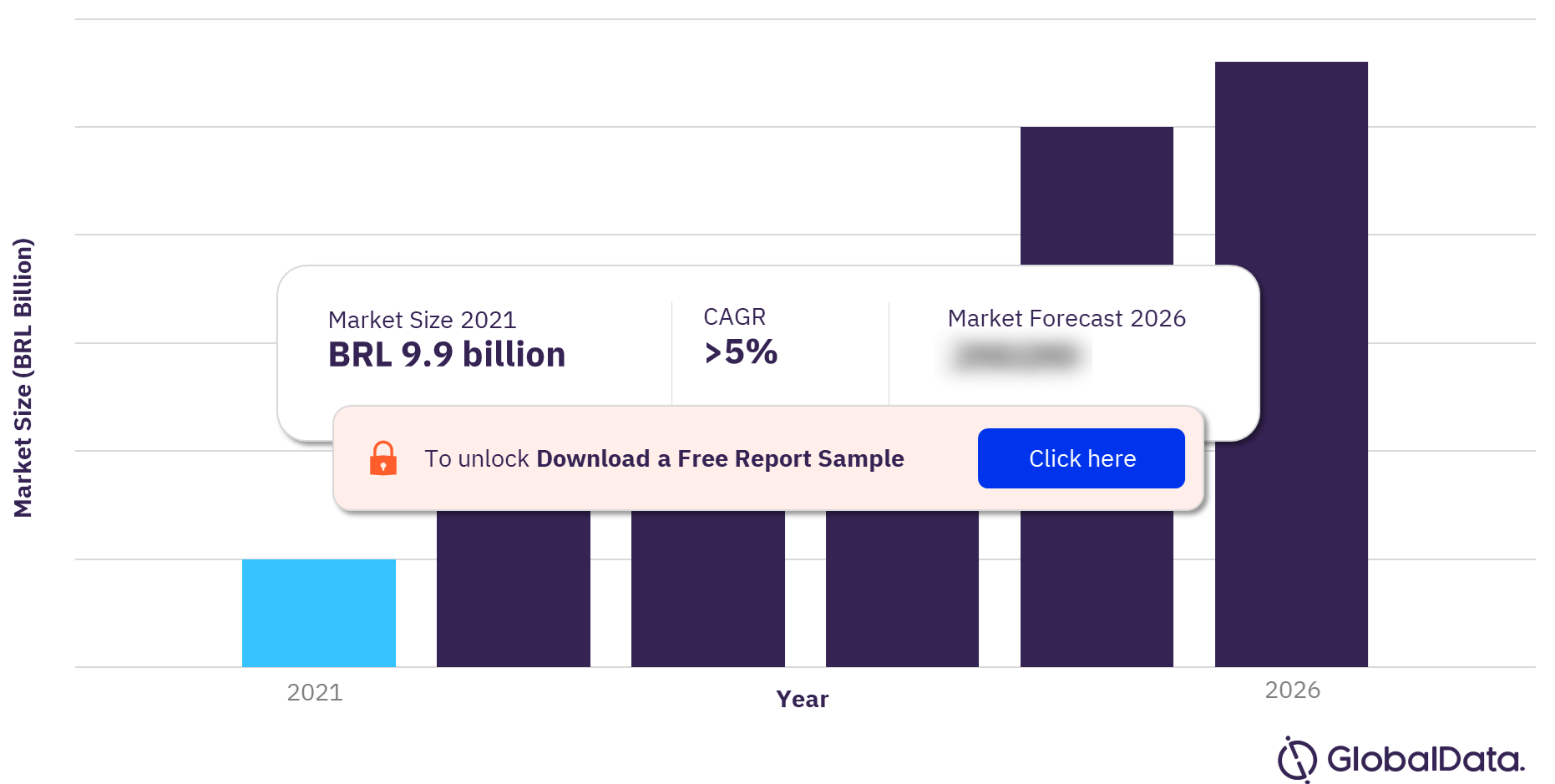

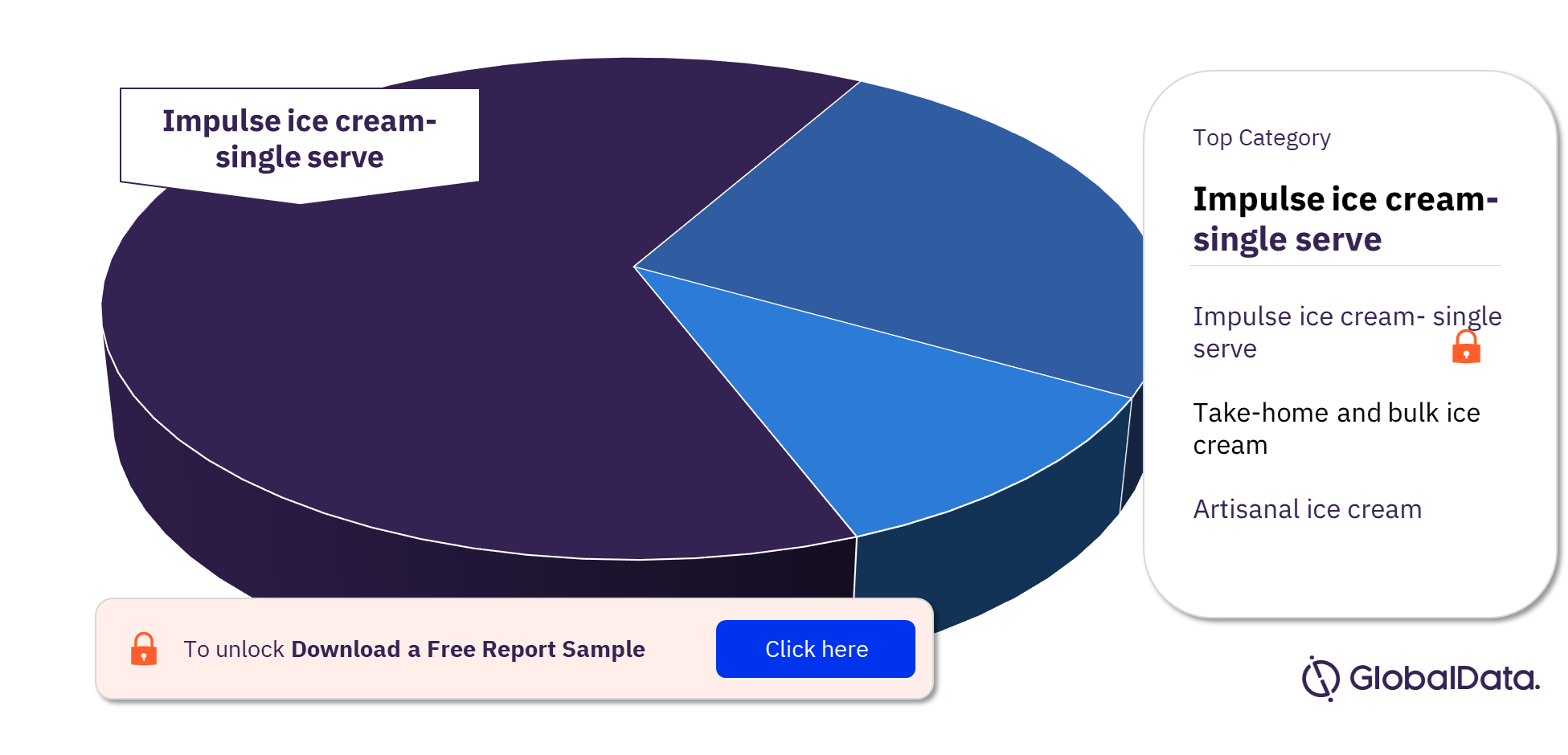

The Brazil ice cream market was valued at BRL9.9 billion ($1.9 billion) in 2021 and is expected to achieve a CAGR of more than 5% during the forecast period. Impulse ice cream – single serve was the largest category in the market in terms of value in 2021.

The Brazil ice cream market research report provides insights on high growth markets to target, trends in the usage of packaging materials, types and closures category level distribution data and companies market shares.

Brazil Ice Cream Market Overview

For more insights on the Brazil ice cream market forecast, download a free sample report

Brazil Ice Cream Market Segmentation by Cities

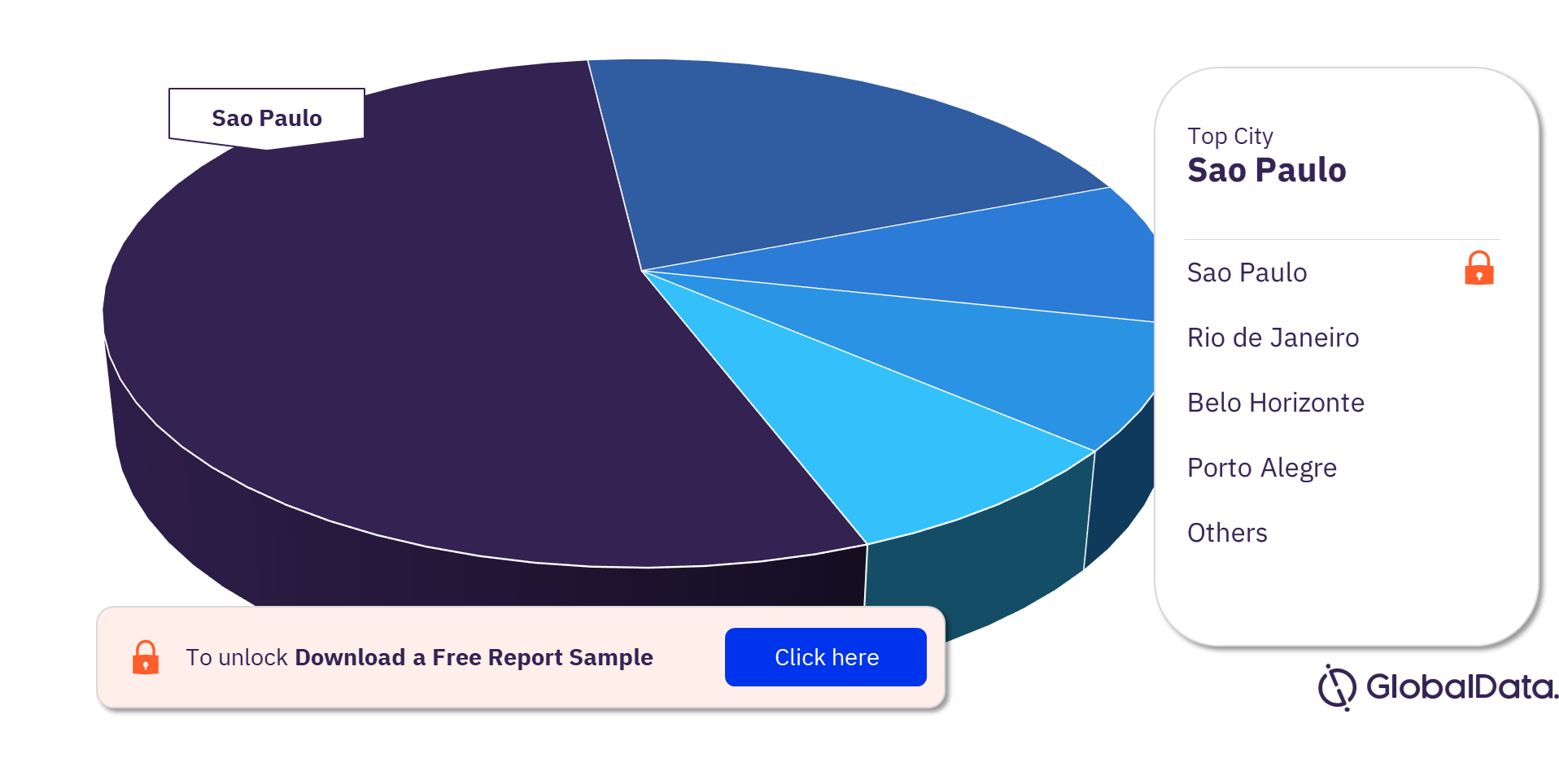

The key cities in the Brazil ice cream market are Sao Paulo, Rio de Janeiro, Belo Horizonte, Porto Alegre, Salavador, Fortaleza, Recife, Curitiba, and Belem. Sao Paulo emerged as the largest ice cream market in Brazil in terms of volume, in 2021, followed by Rio de Janeiro and Belo Horizonte.

Brazil Ice Cream Market Segmentation Analysis by Cities

For more insights on the key cities in the Brazil ice cream market, download a free sample report

Brazil Ice Cream Market Segmentation by Category

The key categories in the Brazil ice cream market are impulse ice cream – single serve, take-home and bulk ice cream and artisanal ice cream. Impulse ice cream – single serve was the largest category in terms of per capita consumption in 2021.

Brazil Ice Cream Market Segmentation Analysis by Categories

For more category insights in the Brazil ice cream market, download a free sample report

Brazil Ice Cream Market Segmentation by Distribution Channel

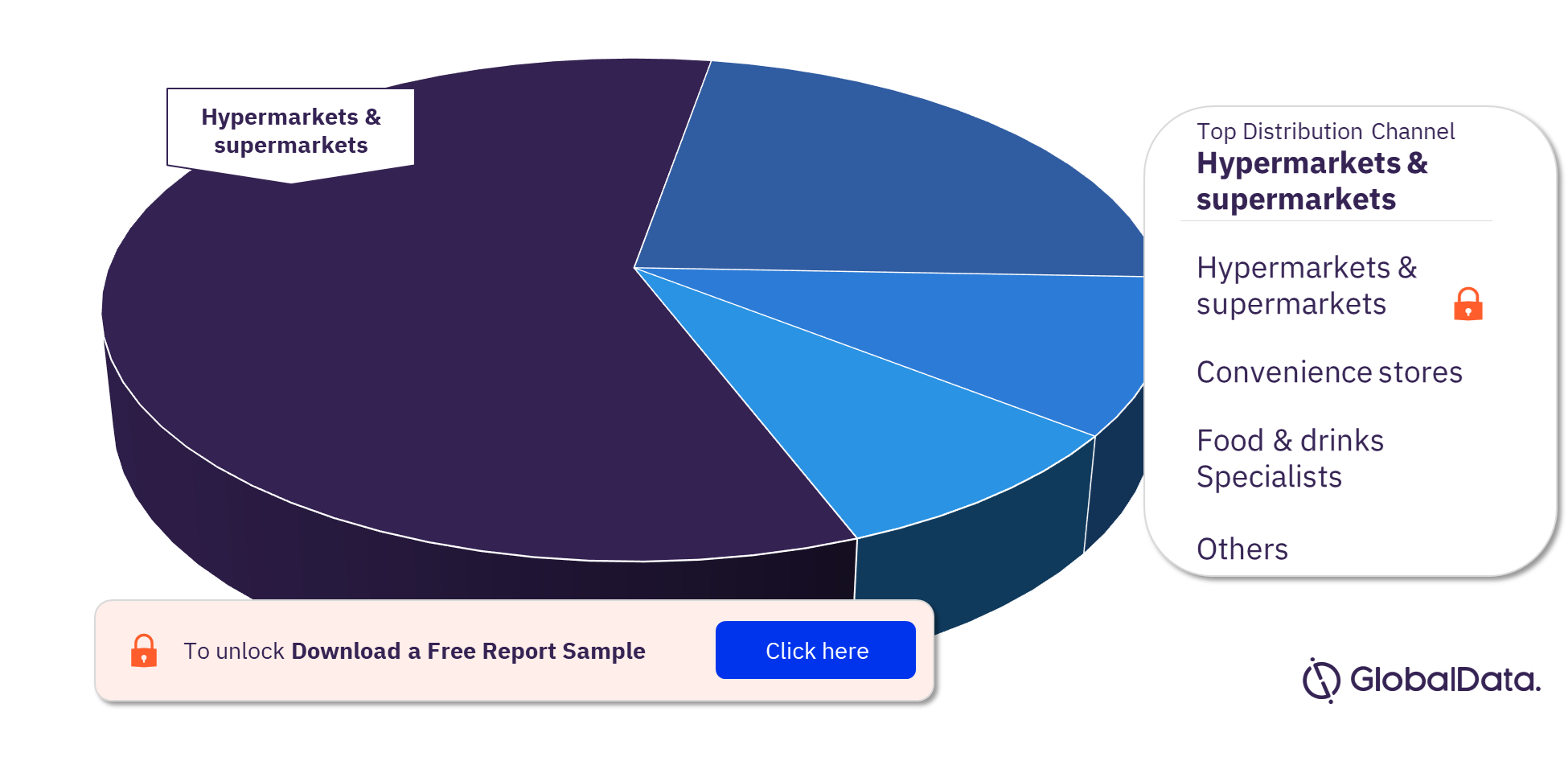

The key distribution channels in the Brazil ice cream market are hypermarkets & supermarkets, convenience stores, food & drinks specialists , dollar stores, and others. Hypermarkets & supermarkets was the leading distribution channel in the Brazil ice cream sector in 2021.

Brazil Ice Cream Market Segmentation Analysis, by Distribution Channel

For more distribution channel insights in the Brazil ice cream market, download a free sample report

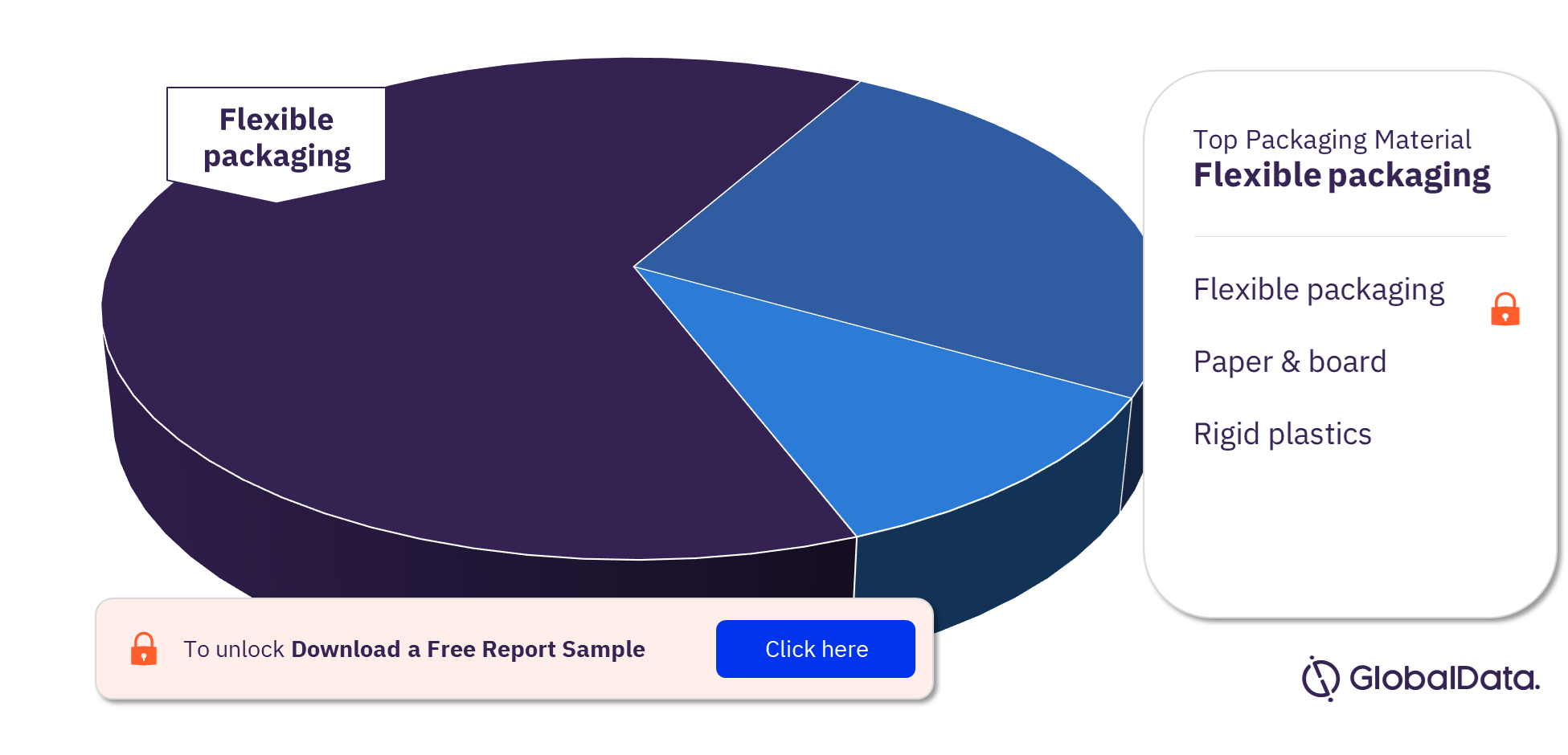

Brazil Ice Cream Market Segmentation by Packaging Material

The key packaging materials in the Brazil ice cream market are flexible packaging, rigid plastics, and paper & board. Flexible packaging was the most used pack material in the Brazil ice cream sector.

Brazil Ice Cream Market Segmentation Analysis, by Packaging Material

For more packaging material insights in the Brazil ice cream market, download a free sample report

For more packaging material insights in the Brazil ice cream market, download a free sample report

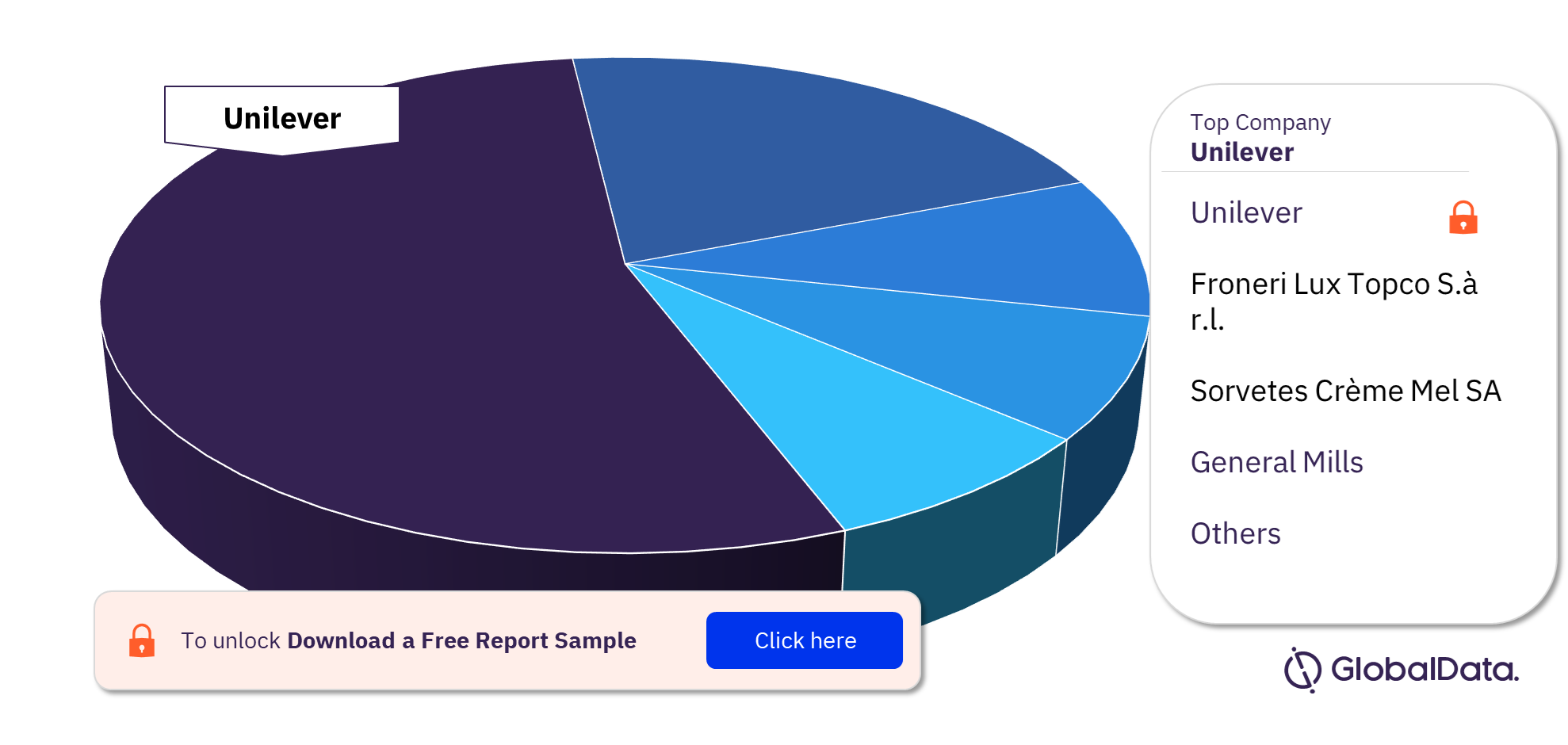

Brazil Ice Cream Market - Competitive Landscape

Some of the leading players in the Brazil ice cream market are Unilever, Froneri Lux Topco S.à r.l., Sorvetes Crème Mel SA, General Mills, Artisanal Producers, and others. Unilever held the highest share of the Brazil ice cream sector.

Brazil Ice Cream Market Analysis, by Leading Players

To know more about the leading players in the Brazilian ice cream market, download a free sample report

To know more about the leading players in the Brazilian ice cream market, download a free sample report

Brazil Ice cream Market Overview

| Market Size 2021 | BRL9.9 billion ($1.9 billion) |

| CAGR (2021-2026) | >5% |

| Key Cities | Sao Paulo, Rio de Janeiro, Belo Horizonte, Porto Alegre, Salavador, Fortaleza, Recife, Curitiba, and Belem |

| Key Categories | Impulse Ice Cream – Single Serve, Take-Home and Bulk Ice Cream and Artisanal Ice Cream |

| Key Distribution Channels | Hypermarkets & Supermarkets, Convenience Stores, Food & Drinks Specialists, Dollar Stores, and Others |

| Key Packaging Materials | Flexible Packaging, Paper & Board, and Rigid Plastics |

| Key Players | Unilever, Froneri Lux Topco S.à r.l., Sorvetes Crème Mel SA, General Mills, Artisanal Producers, and others |

Scope

This report provides:

- Sector data: Overall sector value and volume data with growth analysis for 2016-2026

- Category coverage: Value and growth analysis for butter & spreadable fats, cheese, cream, dairy-based & soy-based desserts, drinkable yogurt, fromage frais & quark, milk, soymilk & soy drinks and yogurt with inputs on individual segment share within each category and the change in their market share forecast for 2021-2026

- Leading players: Market share of companies (in value terms) and private labels (in value terms) in 2021

- Distribution data: Percentage of sales within each category through distribution channels such as cash & carries & warehouse clubs, convenience stores, department stores, food & drinks specialists, hypermarkets & supermarkets, e-retailers, “dollar stores”, variety stores & general merchandise retailers, vending machines, drug stores & pharmacies, health & beauty stores and other general retailers.

- Packaging data: consumption breakdown for package materials and pack types in each category, in terms of percentage share of number of units sold. Pack material data for glass, flexible packaging, rigid plastics, paper & board and rigid metal; pack type for: jar, bag/sachet, tub, stand up pouch, carton – folding, can, carton – liquid, pillow pouch, bottle, cup, aerosol, tube, tray, film, wrapper, clamshell, box, foil and other pack type, closure type for: flip/snap top, screw top, prize off, twist off, plastic tie, foil, sports cap, film, cap, lever closure, crown and other closure types, primary outer types for: carton – folding, bag, sleeve and shrink wrap.

Key Highlights

- Per capita consumption and per capita expenditure of ice-cream were higher in the Brazil than the regional level but less than the global level in 2021

- Hypermarkets & supermarkets accounted for the largest volume share of in the Brazilian ice cream sector in 2021

- Take-home and bulk ice cream, recorded highest volume sales across leading cities in the Brazil

- “Kids & babies” represent the largest subset of the ice cream sector in the Brazil

Reasons to Buy

- Identify high potential categories and explore further market opportunities based on detailed value and volume analysis

- Existing and new players can analyze key distribution channels to identify and evaluate trends and opportunities

- Gain an understanding of the total competitive landscape based on detailed company share analysis to plan effective market positioning

- Our team of analysts have placed a significant emphasis on changes expected in the market that will provide a clear picture of the opportunities that can be tapped over the next five years, resulting in revenue expansion

- The packaging analysis report helps manufacturers, in identifying the most commonly used packaging materials in the sector

- Analysis on key macro-economic indicators such as real GDP, nominal GDP, consumer price index, household consumption expenditure, population (by age group, gender, rural-urban split, and employed people and unemployment rate. It also includes economic summary of the country along with labor market and demographic trends.

Froneri Lux Topco S.à r.l.

Artisanal Producers

Sorvetes Creme Mel SA

General Mills Inc.

Paviloche

Abracadabra Ice Cream

Diletto La Basque

Sottozero

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Brazil ice cream market size in 2021?

The Brazil ice cream market size was BRL9.9 billion ($1.9 billion) in 2021.

-

What is the Brazil ice cream market growth rate?

The Brazil ice cream market is expected to achieve a CAGR of more than 5% during 2021-2026.

-

Which are the key cities in the Brazil ice cream market?

Sao Paulo, Rio de Janeiro, Belo Horizonte, Porto Alegre, Salavador, Fortaleza, Recife, Curitiba, and Belem are the key cities in the Brazil ice cream market.

-

What are the key categories of the Brazil ice cream market?

The key categories in the Brazil ice cream market are Impulse ice cream – single serve, take-home and bulk ice cream and artisanal ice cream.

-

What are the key distribution channels of the Brazil ice cream market?

The key distribution channels in the Brazil ice cream market are hypermarkets & supermarkets, convenience stores, food & drinks specialists, dollar stores, and others.

-

What are the key packaging materials used in the Brazil ice cream market?

The key packaging materials used in the Brazil ice cream market are flexible packaging, paper & board, and rigid plastics.

-

Who are the leading players in the Brazil ice cream market?

Some of the leading players in the Brazil ice cream market are Unilever, Froneri Lux Topco S.à r.l., Sorvetes Crème Mel SA, General Mills, Artisanal Producers, and others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.