Buy Now Pay Later (BNPL) Market Size, Share, Trends and Analysis by Spend Category, Region and Segment Forecast to 2026

Powered by ![]()

Access in-depth insight and stay ahead of the market

Explore actionable market insights from the following data in our ‘Buy Now Pay Later (BNPL)’ report:

- Make informed decisions about market entry, technology adoption, and project planning

- Identify your competitors’ capabilities to stay ahead in the market

- Identify promising segment analysis (spend category), growth trends, regional trends, and markets to expand your regional presence, product portfolio, or successful investment

- Anticipate expected changes in demand and adjust your business development strategies

- Identify ongoing potential projects across regions

How is our Buy Now Pay Later (BNPL) report different from other reports in the market?

- The report presents in-depth market sizing and forecasts at a segment level for 18 countries, including historical and forecast analysis for 2019-2021 for market assessment.

- The report highlights segmentation at Spend category level – furniture, electrical goods & home appliances, clothing & footwear, sports & fitness equipment, travel & accommodation, media & entertainment, health & beauty, and food & drink, among others.

- The report offers technological trends, along with driving and challenging factors impacting the BNPL market. The report further presents an overview of different use cases and capabilities of BNPL, which is expected to help stakeholders to understand and identify new application areas.

- The growth innovation matrix included in the report divides the market players into four categories i.e., flagbearers, contenders, specialists, and experimenters, which will help the value chain participants to understand how competition is performing based on their revenue growth and R&D efforts.

- Competitive profiling and benchmarking of key players in the market to provide a deeper understanding of industry competition

We recommend this valuable source of information to anyone involved in:

- BNPL companies

- Fintech companies

- Lending companies

- Retail banks

- E-commerce platform

- Consulting firms

- Financial advisors

- Private equity firms

- Venture capital firms

To Get a Snapshot of the BNPL Market Report, Download a Free Report Sample

Buy Now Pay Later Market Report Overview

The Buy Now Pay Later (BNPL) market size will be valued at $309.2 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 25.5% over the forecast period. Online payments are rapidly growing as more consumers are taking advantage of online shopping thereby favoring BNPL market growth. BNPL over the last couple of years has gained popularity as an alternative credit option, a trend expected to continue during the forecast period. The payment method has emerged as a popular choice with GenZ and Millennials.

Although the BNPL market is gaining traction, the apparent benefits of BNPL could also pose a risk for both the borrowers and lenders. For instance, if a borrower defaults on an installment it could potentially accumulate to amount of debt. More the debt, the customers will have to pay late fees in case of delays. This brings about the importance of regulating the sector to subdue the vicious cycle of passing on the borrowers’ debt to BNPL providers, which is further passed on to credit agencies, negatively impacting their credit scores.

Buy Now Pay Later Market Outlook, 2019-2026 ($ billion)

View Sample Report for Additional Insights on the BNPL Market Forecast, Download a Free Report Sample

The sector has been able to grow so rapidly partly due to a lack of regulation. However, governments worldwide are reviewing the sector while considering imposing rules to protect customers/borrowers from going into debt. These regulations will most likely hamper the BNPL providers revenue growth, who largely make profits from defaulting customers. For instance, the Consumer Financial Protection Bureau (CFPB) has undertaken an initiative in regulating the trade in recent years. As a result, consumer protection measures have been strengthened, creating a fairer competitive environment for BNPL providers. This has also fostered increased trust and adoption of BNPL as a payment option among consumers, contributing to further market growth.

BNPL is a short-term financing service that allows consumers to pay for online purchases of goods and services at a later date. The payment can be made in one go or in multiple installments. If payments are made within the specific due dates, no interest is charged to the customer. The study is exclusive of B2B transactions and focuses on B2C BNPL market growth.

| BNPL Market Size (2023) | $309.2 billion |

| BNPL Market Size (2026) | $565.8 billion |

| CAGR (2022-2026) | 25.5% |

| Forecast Period | 2022-2026 |

| Historic Period | 2019-2021 |

| Report Scope & Coverage | Revenue Forecast, Competitive Index, Country-Level BNPL Transactions, and Growth Trends |

| Spend Category Segment | Furniture, Electrical Goods & Home Appliances, Clothing & Footwear, Sports & Fitness Equipment, Travel & Accommodation, Media & Entertainment, Health & Beauty, Food & Drink, and Others |

| Key Companies | Affirm Inc; Afterpay Ltd; Amazon Payments, Inc; Klarna Bank AB; Mastercard Inc; PayPal Holdings Inc; Sezzle Inc; Splitit Payment Ltd; Visa Inc; and Zip Co Ltd |

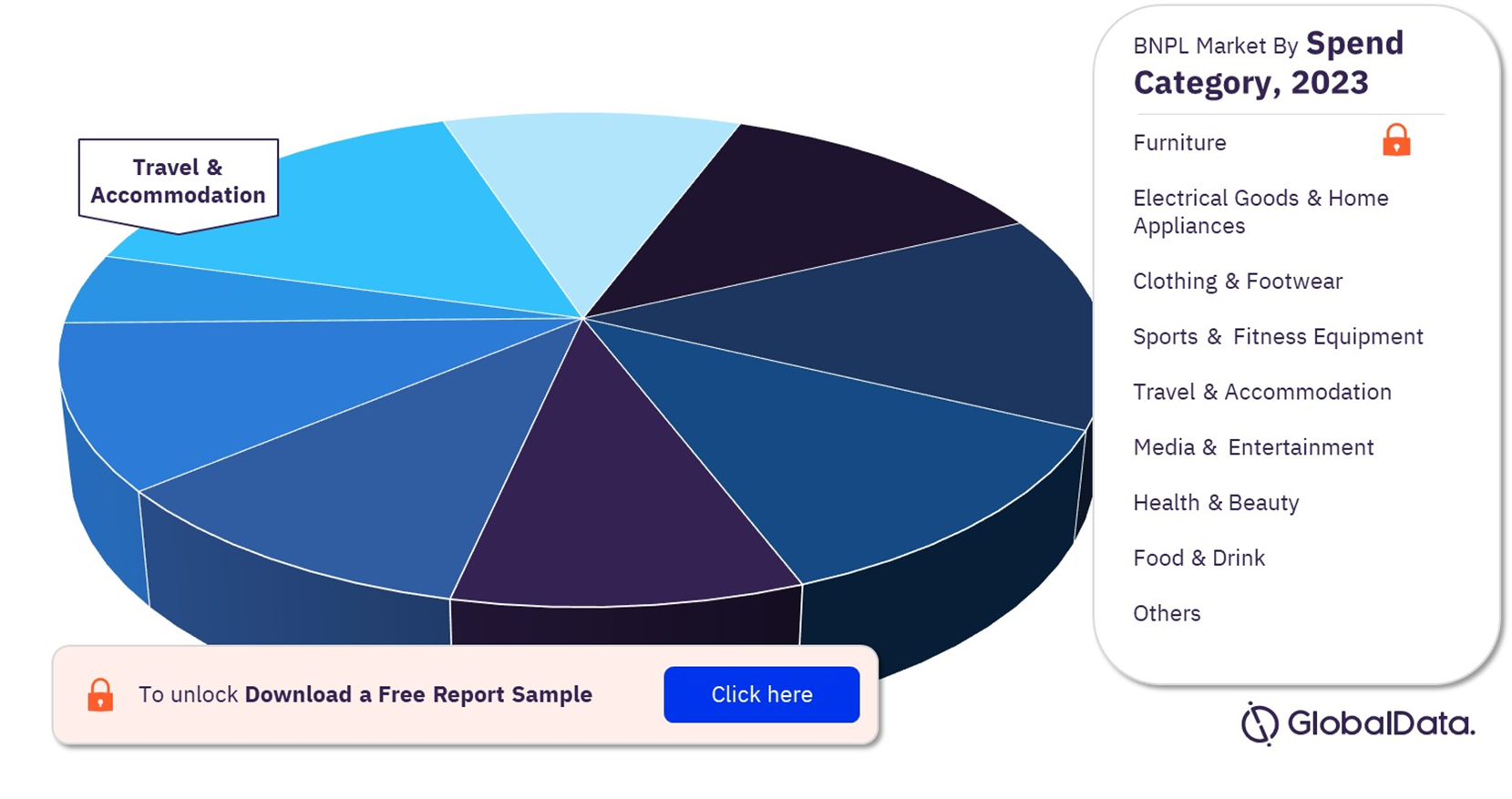

BNPL Market Segmentation by Spend Category

The Buy Now Pay Later primary spend categories include furniture, electrical goods & home appliances, clothing & footwear, sports & fitness equipment, travel & accommodation, media & entertainment, health & beauty, food & drink, and others.

As of 2023, the BNPL spend in the travel & accommodation category captured substantial transaction value of the overall transactions globally. Although travel now and pay later concept existed for a long period, the category post pandemic has witnessed rapid expansion, largely attributed to revenge travel.

Buy Now Pay Later Market Share by Spend Category, 2023 (%)

Fetch Sample PDF for Segment-Specific Revenues and Shares, Download a Free Report Sample

In addition to this, BNPL spend across five primary categories including food & drink, health & beauty, media & entertainment, electrical goods & home appliances, clothing & footwear footwear are likely to capture nearly 60.0% of the transaction values in 2023. Pay in installments has been widely used by retailers to entice consumers to shop and spend more. With the proliferation of retailers selling their products online, the demand for buy now pay later services has heightened. As such, most retailers, rely on third-party companies to handle back-office functions. This short-term financing has significantly fueled apparel sales in recent years, and the trend will continue to gain traction during the forecast period. As of 2023, the BNPL transaction value in fashion & apparel segment is anticipated to witness a significant growth from 2023 to 2026.

BNPL Market Analysis by Region

North America is projected to account for over 40.0% of the global BNPL transaction value, growing at a significant rate from 2023 to 2026. High credit card usage in the region, particularly the US will favor the proliferation of BNPL services in the American markets. As consumers look for flexible and convenient ways to shop and pay, the US BNPL market is estimated to witness healthy demand over the forecast period. Entry of companies like Mastercard is expected to blur out the line between buy now pay later and credit card services.

The Europe Buy Now Pay Later transaction value captured around 30.0% of the overall market size in 2023. The regional demand was led by the UK and Germany collectively accounting for a substantial market share of the BNPL transactions. The onset of the pandemic and the subsequent surge in online shopping impelled the regional demand for BNPL services. Favorable government regulation in the UK is expected to further drive the BNPL market size over the forecast period.

Europe BNPL Market Share by Country, 2023 (%)

View Sample Report for Additional Insights on the Buy Now Pay Later Market Size Projections, Download a Free Report Sample

In June 2022, the UK government regulated that BNPL lenders are needed to carry out affordability checks, to safeguard borrowers from fraud, and adhere to financial promotion rules to ensure Buy-Now Pay-Later advertisements are properly conveyed. Furthermore, lenders offering BNPL payment options for the products need to be approved by FCA. In case of any grievances, borrowers can get a complaint registered to the Financial Ombudsman Service (FOS). Apart from the European market, the Asia Pacific BNPL market is also expected to witness substantial growth over the forecast period.

Buy Now Pay Later Market - Competitive Landscape

The Buy Now Pay Later industry is highly fragmented. However, with growth of start-ups and new venture launches the competition is gradually intensifying. Key players in the BNPL market include, Klarna, PayPal, Zip, Paytm, Afterpay, Affirm, and Laybuy, among other. These prominent companies have implemented various strategies, such as mergers & acquisitions, product portfolio expansion, contracts, and collaborations, to increase their market penetration, geographical presence, and thus strengthen their foothold in the industry. For instance, in March 2023, MANGOPAY extended its strategic collaboration with PayPal to offer markets with quick access to PayPal’s worldwide payment services. Moreover, in April 2023, PayPal and Venmo partnered with Visa to trial its new program, Visa+. This new service seeks to assist people transfer money safely and rapidly among diverse person-to-person (P2P) digital payment apps.

Leading Players in the Buy Now Pay Later Market

- Affirm Inc

- Afterpay Ltd

- Amazon Payments, Inc

- Klarna Bank AB

- Mastercard Inc

- PayPal Holdings Inc

- Sezzle Inc

- Splitit Payment Ltd

- Visa Inc

- Zip Co Ltd

Entry of key BFSI giants such as American Express, Visa, Mastercard, etc. over the next few years is expected drive industry consolidation. Over the years, smaller players will be captured by e-commerce giants so as to integrate flexibility of BNPL services across their business model.

Other BNPL Market Vendors Mentioned

ADDI.; American Express Co; Ant Group Co Ltd; Apple Pay Ltd; Barclays Plc; Behalf, Inc.; Biller; Billie GmbH; Block Inc; Bread Financial Holdings Inc; Bumper International Ltd; Citigroup Inc; Curve; Divido Financial Services, Ltd; The Goldman Sachs Group Inc; Grab Holdings Inc; JPMorgan Chase & Co; Laybuy Holdings Ltd; Limepay; Monzo Bank Ltd; Openpay Group Ltd; One97 Communications Ltd. (Paytm); Revolut Ltd; Banco Santander SA; Veem Inc; and Zilch Technology Limited.

To Know More About Leading Buy Now Pay Later Market Vendors, Download a Free Report Sample

Buy Now Pay Later (BNPL) Market Scope

GlobalData Plc has segmented the BNPL market report by spend category and region:

BNPL Spend Category Outlook (Revenue, USD Million, 2019-2026)

- Furniture

- Electrical Goods & Home Appliances

- Clothing & Footwear

- Sports & Fitness Equipment

- Travel & Accommodation

- Media & Entertainment

- Health & Beauty

- Food & Drink

- Others

BNPL Regional Outlook (Revenue, USD Million, 2019-2026)

- North America

- US

- Canada

- Europe

- Germany

- The UK

- Italy

- France

- Spain

- The Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific

- South & Central America

- Brazil

- Mexico

- Argentina

- Rest of South & Central America

- Middle East & Africa

- United Arab Emirates (UAE)

- Kingdom of Saudi Arabia (KSA)

- Turkey

- Rest of the Middle East & Africa

The market intelligence report provides an in-depth analysis of the following –

- BNPL market outlook: analysis as well as historical figures and forecasts of revenue opportunities for spend category and regional segments.

- The competitive landscape: an examination of the positioning of leading players in the BNPL market.

- Porter’s five forces analysis: demonstrates the strength of suppliers and buyers along with market competition in the market

- Company snapshots: analysis of the market position of leading service providers in the BNPL market.

- Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

Scope

This report provides overview and service addressable market for Buy Now Pay Later (BNPL) market.

It identifies the key trends impacting growth of the market over the next 12 to 24 months.

It includes global market forecasts for the BNPL market and analysis of patents, jobs, social media activities, and venture funding trends.

It contains details of M&A deals in the BNPL space, and a timeline highlighting milestones in the development of BNPL market.

The detailed value chain consists of three layers: Consumer device layer, BNPL layers (lending, security provider, ecommerce platform, open banking, and credit bureau), and payment processing layer.

Key Highlights

The Buy Now Pay Later (BNPL) market size will be valued at $309.2 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 25.5% over the forecast period. Online payments are rapidly growing as more consumers are taking advantage of online shopping thereby favoring BNPL market growth.

Reasons to Buy

This market intelligence report offers a thorough, forward-looking analysis of the global BNPL market spend category, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in BNPL markets.

The report highlights key spend category segments (furniture, electrical goods & home appliances, clothing & footwear, sports & fitness equipment, travel & accommodation, media & entertainment, health & beauty, food & drink, and others)

With more than 20 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in BNPL markets.

The broad perspective of the report coupled with comprehensive, actionable detail will help BFSI stakeholders, service providers, and other BNPL players succeed in growing the BNPL market globally.

Key Players

Affirm IncAfterpay Ltd

Amazon Payments, Inc

Klarna Bank AB

Mastercard Inc

PayPal Holdings Inc

Sezzle Inc

Splitit Payment Ltd

Visa Inc

Zip Co Ltd

Table of Contents

Table

Figures

Frequently asked questions

-

What will be the BNPL market size in 2023?

The BNPL market size will be valued at $309.2 billion in 2023.

-

What will be the BNPL market size in 2026?

The BNPL market size is expected to reach $565.8 billion by 2026.

-

What is the BNPL market growth rate?

The BNPL market is expected to grow at a CAGR of 25.5% during the forecast period (2022-2026).

-

What are the key BNPL market drivers?

A significant increase in online shopping due to remote working, social distancing norms during COVID-19, are stimulating the growth of the BNPL market worldwide.

-

What are the key BNPL market segments?

Spend Category Segments: Furniture, Electrical Goods & Home Appliances, Clothing & Footwear, Sports & Fitness Equipment, Travel & Accommodation, Media & Entertainment Health & Beauty, Food & Drink, and Others

-

Which are the leading BNPL companies?

The leading BNPL companies are Affirm Inc; Afterpay Ltd; Amazon Payments, Inc; Klarna Bank AB; Mastercard Inc; PayPal Holdings Inc; Sezzle Inc; Splitit Payment Ltd; Visa Inc; and Zip Co Ltd

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports