Chronic Kidney Disease Market Size and Trend Report including Epidemiology and Pipeline Analysis, Competitor Assessment, Unmet Needs, Clinical Trial Strategies and Forecast, 2021-2031

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Accessing in-depth market trends and insights from the ‘Chronic Kidney Disease’ market report will enable you to:

- Understand the epidemiology, disease etiology, and management of chronic kidney disease, to get a better overview of the market.

- Analyze topline chronic kidney disease drugs market revenue, the annual cost of therapy, and anticipated sales for major late-stage pipeline drugs.

- Assess the current and pipeline therapies, unmet needs, and market outlook for the US, 5EU, and Japan over the 10-year forecast period.

- Identify the emerging novel trends under development and get a detailed analysis of late-stage pipeline drugs to gain a competitive advantage.

- Gain actionable insights on key industry drivers, restraints, and challenges and understand their impact on the chronic kidney disease market.

- Explore the current and future market competition in the global chronic kidney disease therapeutics market.

How is the ‘Chronic Kidney Disease’ report unique from other reports in the market?

Getting access to the ‘Chronic Kidney Disease’ market report today will help you:

- Develop and design your in-licensing and out-licensing strategies, using a detailed overview of current pipeline products and technologies to identify companies with the most robust pipelines.

- Develop business strategies by understanding the trends shaping and driving the global CKD therapeutics market.

- Drive revenues by understanding the key trends, innovative products and technologies, market segments, and companies likely to impact the global CKD market in the future.

- Formulate effective sales and marketing strategies by understanding the competitive landscape and by analysing the performance of various competitors.

- Identify emerging players with potentially strong product portfolios and create effective counter-strategies to gain a competitive advantage.

- Track drug sales in the global CKD therapeutics market from 2021 to 2031.

- Organize your sales and marketing efforts by identifying the market categories and segments that present maximum opportunities for consolidations, investments, and strategic partnerships.

We recommend this valuable source of information to anyone involved in:

- Pharmaceutical/Biotech/Drug Manufacturing Industries (Big Pharma, Small Biotech, Start-ups, etc.),

- Pharmaceutical Industry Suppliers (e.g., Consulting Companies, CMOs, CDMOs, CROs, Technology Vendors)

- Consulting and Professional Services (e.g., Investment Companies, Investment Banks, Equity Companies, etc.)

- Pharma Manufacturers/ Distributors (Innovative, Biotech, Generics, Biosimilars, Rare/Orphan Disease)

- Financial Institutions (Investors in Pharma/Biotech, Pricing Consultancies)/Parallel Trade Organisations

- Healthcare Organisations (Payers, HTA Bodies, Reimbursement Groups, Government Healthcare Organizations)

- Clinical Research Organisations (CROs)

To Get a Snapshot of the Chronic Kidney Disease Report

Chronic Kidney Disease Market Report Overview

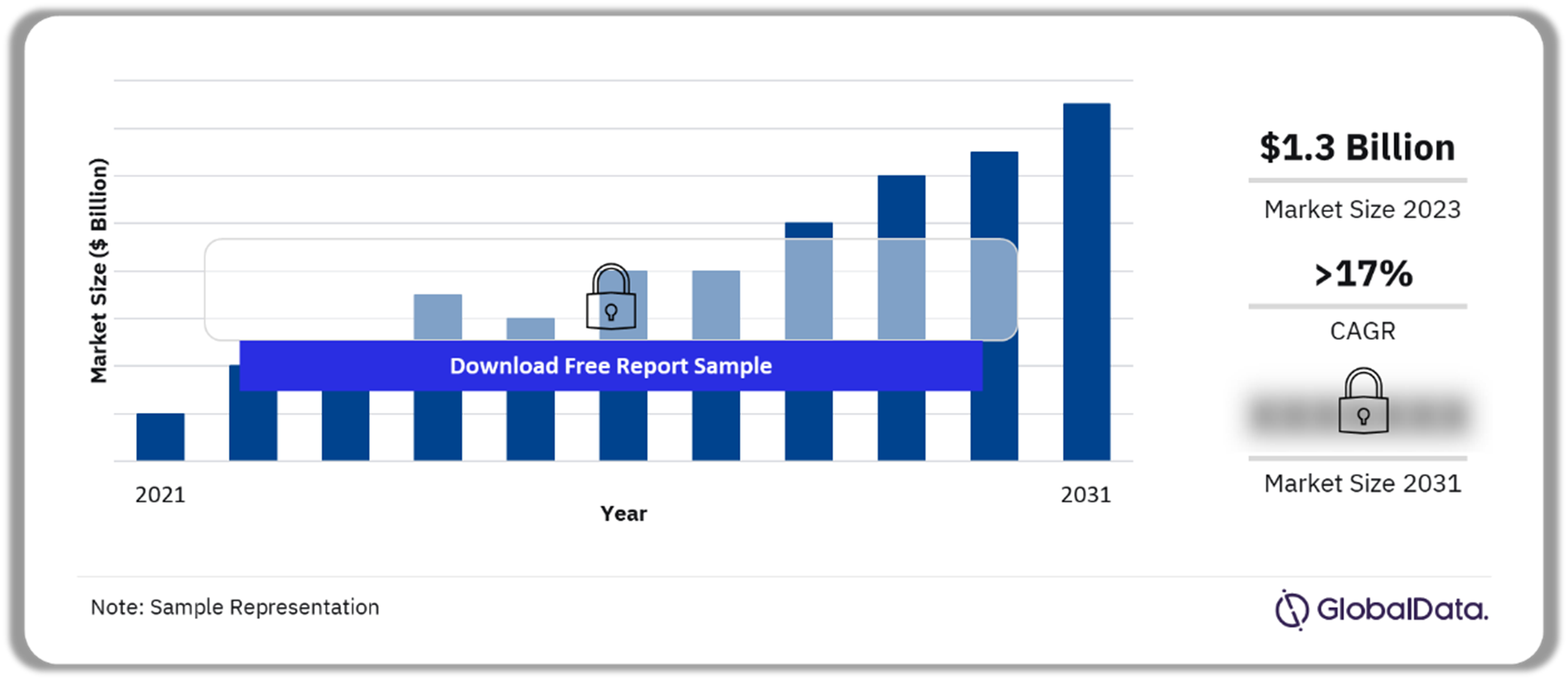

The chronic kidney disease (CKD) market size was valued at $1.3 billion across the 7MM in 2021. The market is expected to grow at a CAGR of more than 17% during the forecast period. Chronic kidney disease, or chronic renal disease, is a condition characterized by a gradual loss of kidney function over time. This leads to the accumulation of excess fluid and waste in the body. In the early stages, CKD is a largely asymptomatic condition. As the disease progresses, the symptoms worsen and eventually lead to kidney failure.

CKD manifests when both kidneys are damaged sufficiently to hinder the removal of metabolic products from the body and the ability to provide mineral balance. Each stage of CKD requires different diagnostic tests and treatments for the management of the disease. Currently, there is no cure for CKD, but treatments can slow the progression of the disease. Additionally, CKD patients are advised to undergo renal replacement therapy (RRT) when the kidneys fail in the advanced stages of the disease. RRT includes renal dialysis and kidney transplantation, which help to sustain and maintain life, blood pressure (BP), the balance of chemicals (electrolytes) for the functioning of the heart and muscles, and the production of vitamin D and red blood cells in CKD patients.

Chronic Kidney Disease Market Outlook 2021-2031 ($ Billion)

Buy the Full Report to Gain More Information On The Chronic Kidney Disease Market Forecast, Download A Free Report Sample

The chronic kidney disease market research report provides an overview of the risk factors, comorbidities, and global and historical trends for CKD in the seven major markets (7MM: US, France, Germany, Italy, Spain, UK, and Japan). It also includes a 10-year epidemiological forecast for total prevalent cases and diagnosed prevalent cases of CKD. The total and diagnosed prevalent cases of CKD are further segmented by age, sex, and stage in these markets.

| Market size (Year – 2021) | $1.3 billion |

| Growth rate (CAGR) | >17% |

| Forecast period | 2021-2031 |

| Key age segments | 18-29 Years, 30-39 Years, 40-49 Years, 50-59 Years, 60-69 Years, 70-79 Years, and Above 80 Years |

| Key sex segments | Men and Women |

| Key stage | Stage I, Stage II, Stage IIIa, Stage IIIb, Stage IV, And Stage V |

| Key dialysis dependence types | Non-Dialysis Dependent and Dialysis Dependent |

| Key players | AstraZeneca, Boehringer Ingelheim, Mitsubishi Tanabe Pharma, Reata Pharma, Novo Nordisk, and KBP- Biosciences |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Chronic Kidney Disease: Market Drivers

The major driver for the CKD market growth will be the increased use of drugs from different classes in combination with each other, which will lead to increased treatment costs. The uptake of sodium-glucose co-transporter inhibitors will be the strongest driver of the market in the 7MM. According to KOLs, combination therapy will become a mainstay in CKD treatment during the forecast period. This, in turn, will be the major driver of the market, despite the patent expirations of most currently marketed drugs and generic erosion.

Buy the Full Report for Chronic Kidney Disease Market Drivers, Download a Free Sample Report

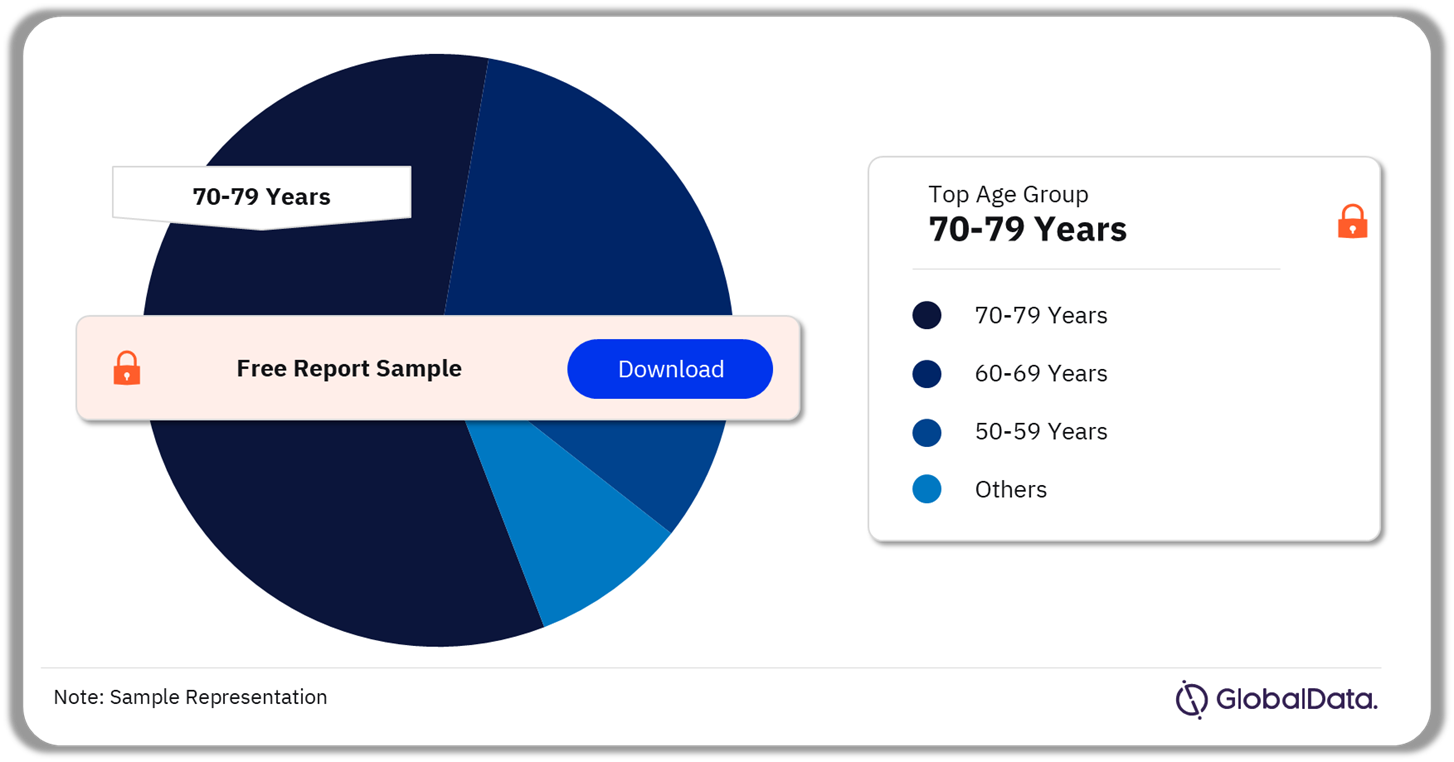

Chronic Kidney Disease Market Segmentation by Age Group

The chronic kidney disease market can be segmented based on age into 18-29 years, 30-39 years, 40-49 years, 50-59 years, 60-69 years, 70-79 years, and above 80 years.

In 2021, for the 7MM combined, adults ages 70-79 years contributed the highest proportion of the diagnosed prevalent cases of chronic kidney disease followed by the age group 60–69 years and ages 80 years and older.

Chronic Kidney Disease Market Analysis by Age Group, 2021 (%)

Buy the Full Report for More Age Segment Insights in the Chronic Kidney Disease Market, Download a Free Report Sample

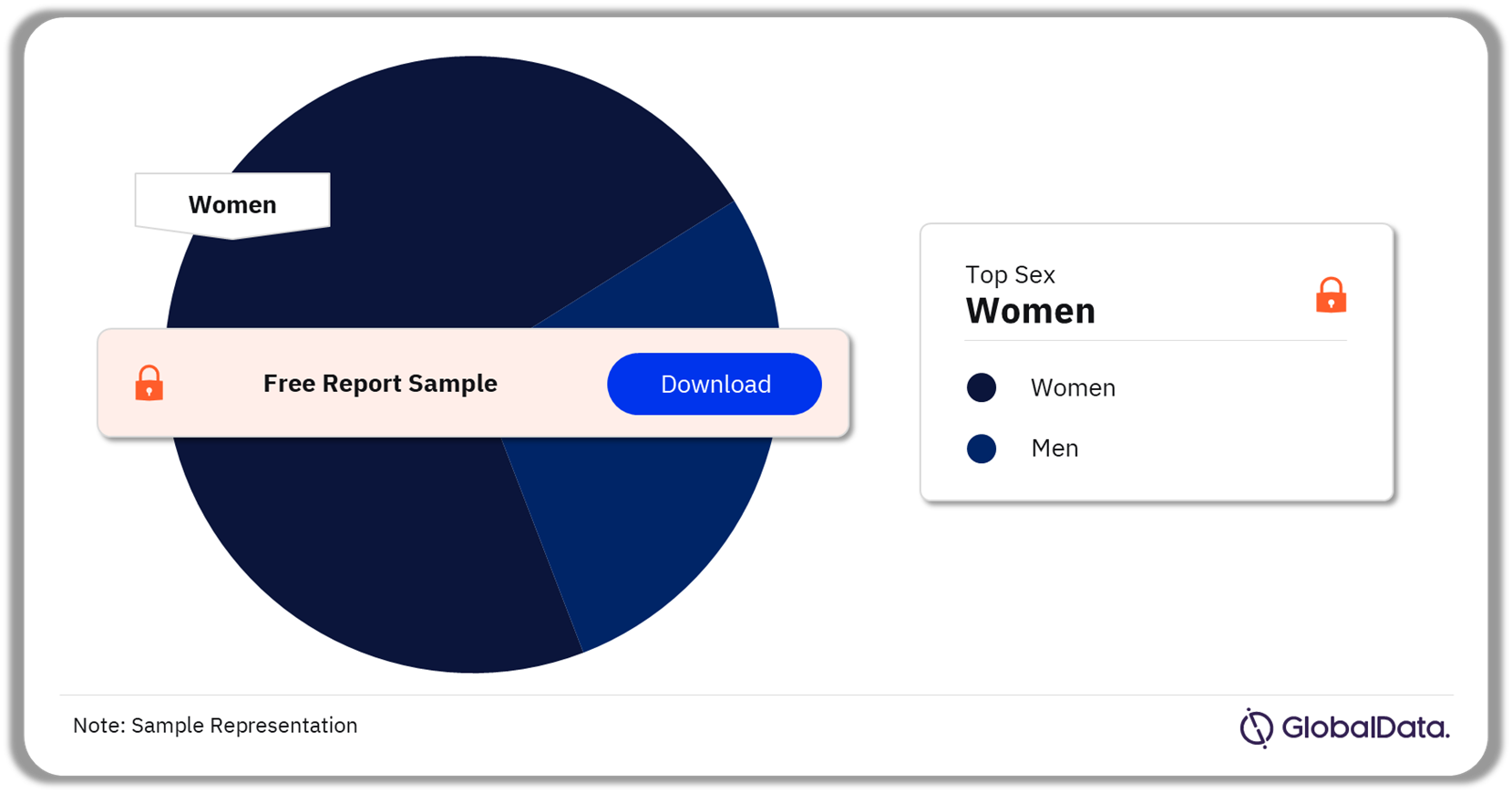

Chronic Kidney Disease Market Segmentation by Sex

The chronic kidney disease market can be segmented based on sex into men and women.

In the 7MM combined, the number of diagnosed prevalent cases of CKD was higher in women than in men in 2021. However, in Germany and Japan, the number of diagnosed prevalent cases of CKD was observed to be higher in men than in women. France had the smallest variation in the number of diagnosed prevalent cases between men and women.

Chronic Kidney Disease Market Analysis by Sex, 2021 (%)

Buy the Full Report for More Sex Segment Insights in the Chronic Kidney Disease Market, Download A Free Report Sample

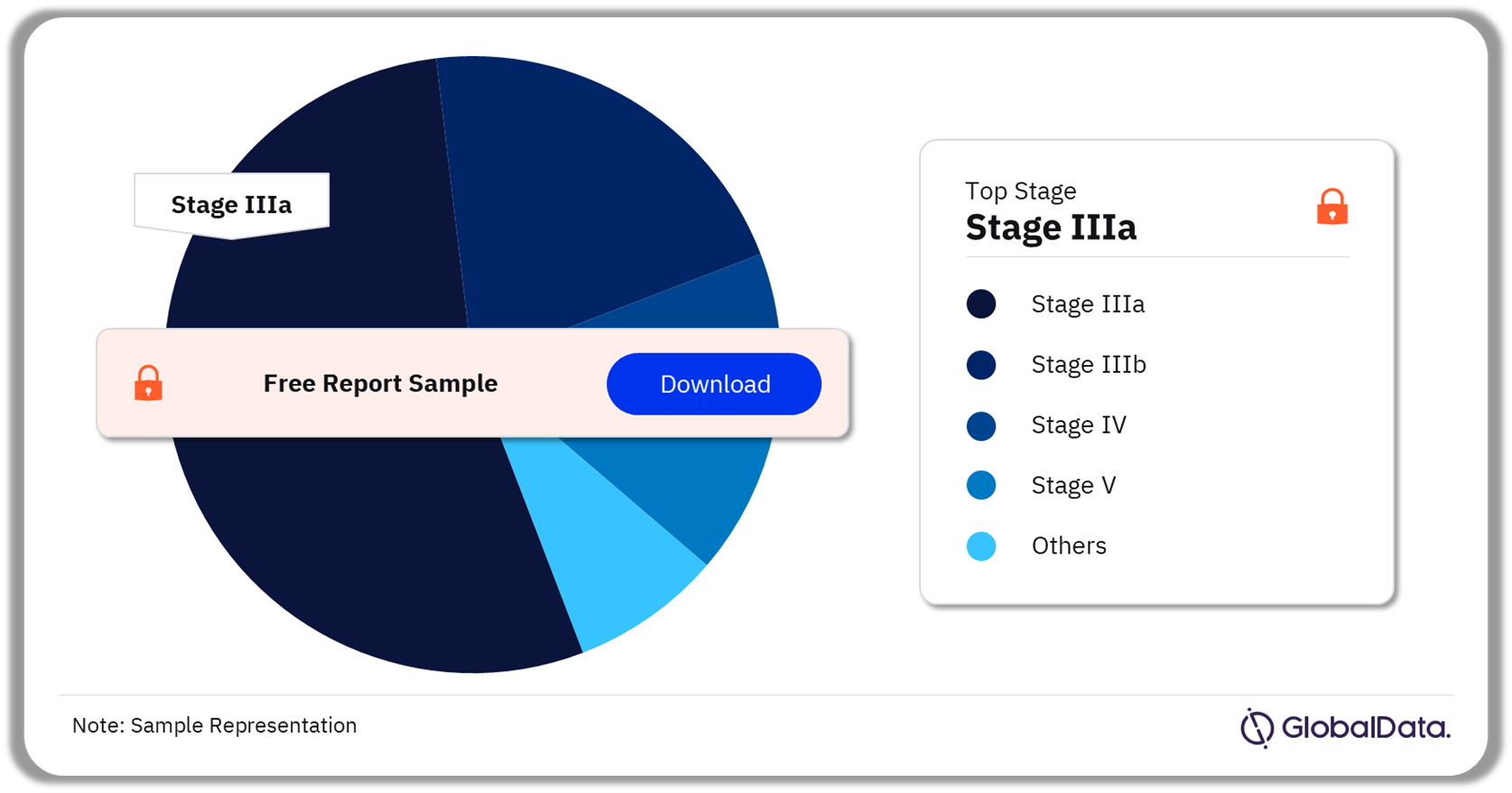

Chronic Kidney Disease Market Segmentation by Stages

The chronic kidney disease market can be further divided into six stages: stage I, stage II, stage IIIa, stage IIIb, stage IV, and stage V.

In the 7MM, the highest number of diagnosed prevalent cases of CKD was in stage IIIa followed by stages IIIb and stage II. Among the 7MM, Japan had the highest number of diagnosed prevalent cases of CKD in stage IIIa followed by the US. This difference in stage-specific diagnosed prevalent cases might be driven by the varying stage-specific diagnosis rate in the markets.

Chronic Kidney Disease Market Analysis by Stages, 2021 (%)

Buy the Full Report for More Stage Insights in the Chronic Kidney Disease Market, Download A Free Report Sample

Key Dialysis Dependence Types in the Chronic Kidney Disease Market

The chronic kidney disease market can be divided into two types based on dialysis dependence: non dialysis dependent and dialysis dependent.

In the 7MM, the US had the highest number of diagnosed prevalent cases of CKD that were non-dialysis dependent followed by Japan and Germany. For dialysis-dependent CKD, the US had the highest number of diagnosed prevalent cases followed by Japan and Germany.

Chronic Kidney Disease Market Analysis by Dialysis Dependence, 2021 (%)

Buy the Full Report for More Insights On Dialysis Dependence Types, Download A Free Report Sample

Chronic Kidney Disease Market: Key Players

Some of the key players in the CKD market are AstraZeneca, Boehringer Ingelheim, Mitsubishi Tanabe Pharma, Reata Pharma, Novo Nordisk, and KBP- Biosciences.

Leading Chronic Kidney Disease Market Players

Buy the Full Report for Additional Insights about the Key Players in the Chronic Kidney Disease Market, Download a Free Sample Report

Scope

- Overview of Chronic Kidney Disease- including epidemiology, disease etiology, and management.

- Topline CKD drugs market revenue, the annual cost of therapy, and anticipated sales for major late-stage pipeline drugs.

- Key topics covered include assessment of current and pipeline therapies, unmet needs, current and future players, and market outlook for the US, 5U, and Japan over the 10-year forecast period.

- Pipeline analysis: Emerging novel trends under development, and detailed analysis of late-stage pipeline drugs.

- Analysis of the current and future market competition in the global CKD therapeutics market. Insightful review of the key industry drivers, restraints, and challenges

Key Highlights

The proportion of people at risk of developing CKD is expected to increase over the 10-year forecast period due to the growing disease prevalence.

The potential launch of 5 late-stage pipeline agents will increase the number of patients who can be offered pharmacological treatment options. In addition, novel drugs in late-stage development are expected to have a high annual cost of therapy (ACOT), a factor that will contribute to notable profitability.

Despite multiple therapies currently available to CKD patients, there is still a high level of unmet need within the treatment space. The most recognizable is the need for novel therapies targeting new mechanisms and improving access to novel therapies.

Reasons to Buy

The report will enable you to:

- Develop and design your in-licensing and out-licensing strategies, using a detailed overview of current pipeline products and technologies to identify companies with the most robust pipelines.

- Develop business strategies by understanding the trends shaping and driving the global CKD therapeutics market.

- Drive revenues by understanding the key trends, innovative products and technologies, market segments, and companies likely to impact the global CKD market in the future.

- Formulate effective sales and marketing strategies by understanding the competitive landscape and by analyzing the performance of various competitors.

- Identify emerging players with potentially strong product portfolios and create effective counter-strategies to gain a competitive advantage.

- Track drug sales in the global CKD therapeutics market from 2021 to 2031.

- Organize your sales and marketing efforts by identifying the market categories and segments that present maximum opportunities for consolidations, investments, and strategic partnerships.

Boehringer Ingelheim

Mitsubishi Tanabe Pharma

Reata Pharma

Novo Nordisk

KBP- Biosciences

Table of Contents

Table

Figures

Frequently asked questions

-

What was the chronic kidney disease market size in 2021?

The chronic kidney disease market size was valued at $1.3 billion in 2021 across the 7MM.

-

What is the chronic kidney disease market growth rate?

The chronic kidney disease market is forecast to grow at a CAGR of more than 17% during the forecast period.

-

What are the key age segments in the chronic kidney disease market?

The chronic kidney disease market can be segmented based on age into 18-29 years, 30-39 years, 40-49 years, 50-59 years, 60-69 years, 70-79 years, and above 80 years.

-

What are the key sex segments in the chronic kidney disease market?

The chronic kidney disease market can be segmented based on sex into men and women.

-

What are the key stages in the chronic kidney disease market?

The chronic kidney disease market can be further divided into six stages: stage I, stage II, stage IIIa, stage IIIb, stage IV, and stage V.

-

What are the key dialysis dependence types in the chronic kidney disease market?

The chronic kidney disease market can be divided into two types based on dialysis dependence: non-dialysis dependent and dialysis dependent.

-

Who are the key players in the chronic kidney disease market?

Some of the key players in the CKD market are AstraZeneca, Boehringer Ingelheim, Mitsubishi Tanabe Pharma, Reata Pharma, Novo Nordisk, and KBP- Biosciences.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Genito Urinary System And Sex Hormones reports