Cloud Computing in Construction – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Cloud Computing in Construction Market Overview

The cloud computing revenues in the construction industry was valued at USD 20.8 billion in 2021 and is expected to grow at a CAGR of more than 16% between 2021 and 2026. This strong market growth will be particularly driven by the greater adoption of digitally transformative technologies across the industry, particularly with the focus on increasing efficiency and reducing the costs of business and project operations.

Digitalization has been slow in the construction industry as it relies heavily on manual labor and mechanical technologies, resulting in low productivity. The key barriers to the uptake of more advanced technologies, like cloud computing, are the high upfront investment costs and complex technical requirements. Companies should invest in cloud computing measures across all stages of a construction project, from design to operations. In particular, the use of cloud platforms for project management has significantly improved productivity across the entire project timeline, streamlining communication between stakeholders, mitigating risks, decreasing budgets, and helping to meet schedules.

The cloud computing in construction market report covers an in-depth understanding of various trends, challenges in the construction industry, and the impact of cloud computing in the construction sector. The report also covers case studies, company-level insights, and sector scorecards for benchmarking the leading cloud computing players.

| Market Size (2021) | USD 20.8 billion |

| CAGR (2021-2026) | >16% |

| Key Value Chain Components | Cloud Computing Stack and Cloud Professional Services |

| Leading cloud computing adopters in construction | Balfour Beatty, Caterpillar, John Holland, Komatsu, PCL Construction, Petrofac, Skanska, TechnipFMC, and Vinci |

| Leading cloud computing vendors | Alibaba, Alphabet, Amazon, Cisco, Cloud Software Group, Dell Technologies, Docker, DXC Technology, Huawei, Inspur, Kyndryl, Microsoft, Oracle, Progress Software, Rackspace, SAP, and VMware |

| Specialist cloud computing vendors in construction | Autodesk, Bentley Systems, CMiC, CoConstruct, Construction Industry Solutions (COINS), LTIMindtree, Novade Solutions, Procore, and RIB Software |

For more insights on the cloud computing in construction market forecasts, download a free sample report

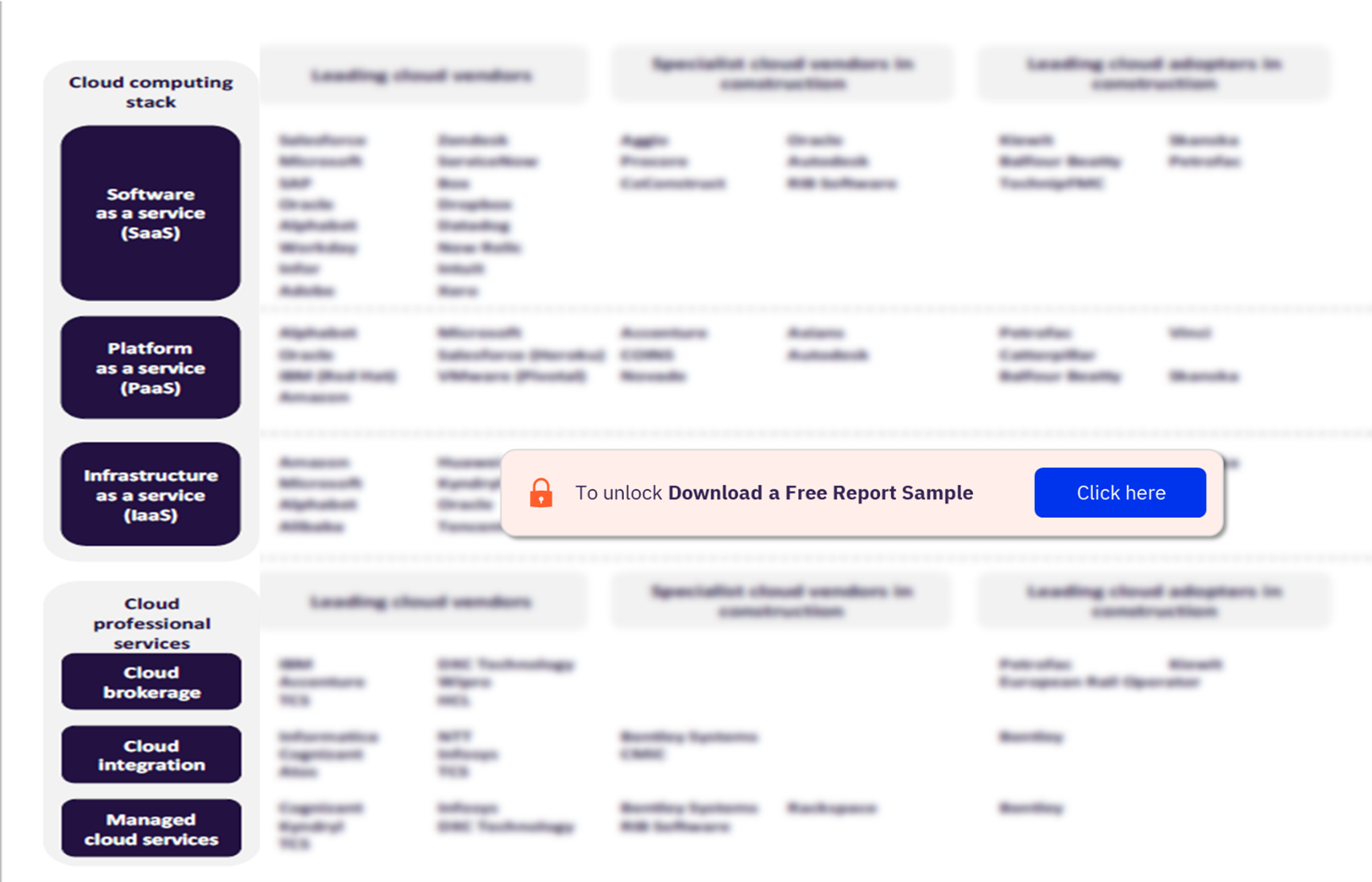

Cloud Computing in Construction Market - Value Chain Insights

The key value chain components in cloud computing in the construction industry are cloud computing stack and cloud professional services.

Cloud Computing Stack: The cloud computing stack value chain component comprises of Platform as a Service (PaaS) and Infrastructure as a Service (IaaS). In the IaaS and PaaS markets, traditional IT stack infrastructure vendors, specializing in everything from databases and operating systems to virtualization, computing, storage, and networking, face competition from public cloud service providers. The latter use subscription-based, pay-as-you-use business models to offer a full portfolio of IT infrastructure, as well as tools and platforms for application developers. Despite their incumbency, many traditional IT infrastructure vendors, including DXC Technology, Dell, and Fujitsu, now offer cloud-based, IT-as-a-service options alongside traditional IT solutions.

Cloud Computing in Construction Value Chain Analysis

For more insights on the cloud computing in construction market, download a free sample report

Cloud Computing in Construction Market Data Analysis

The cloud computing revenues in the construction market was valued at USD 20.8 billion by 2026 driven by rising adoption of digitally transformative technologies across the industry, particularly with the focus on increasing efficiency and reducing the costs, of business and project operations. Leading construction companies will focus on digitally transformative technologies to increase their project operations’ efficiency and support company growth and flexibility. This will further lead cloud computing in the construction market to grow at a CAGR of more than 16% during 2021-2026.

The cloud computing in the construction industry analysis also covers:

- Mergers and acquisitions

- Patent trends

- Company filing trends

- Hiring trends

- Social media trends

- Cloud computing timeline

For more information on the cloud computing in construction market size, download a free sample report

Cloud Computing in Construction Market – Competitive Landscape

The leading players in cloud computing in the construction market are classified as follows –

Leading cloud computing adopters in construction – Balfour Beatty, Caterpillar, John Holland, Komatsu, PCL Construction, Petrofac, Skanska, TechnipFMC, and Vinci are some of the leading cloud computing adopters in construction

Leading cloud computing vendors – Alibaba, Alphabet, Amazon, Cisco, Cloud Software Group, Dell Technologies, Docker, DXC Technology, Huawei, Inspur, Kyndryl, Microsoft, Oracle, Progress Software, Rackspace, SAP, and VMware are the key leading cloud computing vendors.

Specialist cloud computing vendors in construction – Autodesk, Bentley Systems, CMiC, CoConstruct, Construction Industry Solutions (COINS), LTIMindtree, Novade Solutions, Procore, and RIB Software are the leading specialist cloud computing vendors in construction sector.

Construction Sector Scorecard

The scorecard approach is used to predict tomorrow’s leading companies within each sector using a thematic, valuation, and risk screens.

Construction Sector Scorecard

For more analysis on the construction sector scorecard, download a free sample report

Scope

- This report provides an overview of the cloud computing theme. The detailed value chain comprises two segments: cloud computing stack (SaaS, PaaS, Iaas), and cloud professional services. Leading and challenging vendors are identified across both segments.

- It identifies construction challenges, such as ESG, sourcing, and safety, and an impact assessment of cybersecurity on the construction industry, addressing these challenges.

- It includes three case studies, outlining market-leading use cases of cybersecurity in construction to solve specific challenges such as operational technology vulnerabilities and secure procurement processes.

- It contains comprehensive industry analysis, including forecasts for cybersecurity revenues in construction to 2025, and insight from GlobalData’s Job Analytics and Social Media Analytics databases. It contains details of M&A deals driven by the cybersecurity theme, and a timeline highlighting cybersecurity milestones and events in construction.

- The report has extensive coverage and analysis of relevant companies’ positions in the cybersecurity theme. This includes leading adopters, vendors, and specialist cybersecurity vendors in construction.

- It includes GlobalData’s unique thematic scorecard that ranks construction companies according to their positioning in the ten themes most important to the industry, of which cybersecurity is one.

Key Highlights

According to GlobalData forecasts, the global cloud computing industry was worth $421.7 billion in 2019. By 2026, it will have grown at a compound annual growth rate (CAGR) of 16% to $1,158.8 billion. In the construction sector, cloud computing revenues will reach $44.6 billion by 2026, up from $14.8 billion in 2019.

The construction industry has been generally slow to digitalize and adopt new technologies. As an industry, it relies heavily on manual labor and mechanical technologies, resulting in low productivity. The key barriers to the uptake of more advanced technologies, like cloud computing, are the high upfront investment costs and complex technical requirements. Despite this, the disruptive cloud computing benefits for the industry in the long term are becoming too significant to ignore.

Reasons to Buy

- This report will help you to understand cloud computing and its potential impact on the construction sector.

- Benchmark your company against your competitors, by comparing how prepared 46 companies in the construction sector are for cybersecurity disruption.

- Identify and differentiate between the leading cybersecurity vendors and formulate an adoption plan for your company.

- Position yourself for future success by investing in the right cybersecurity technologies. Cut through the noise with GlobalData’s priority ratings for each cybersecurity technology for each segment of the industry (conceptual design, feasibility studies, planning and permitting, financing, design and engineering, construction, and operations and maintenance).

- Develop relevant and credible sales and marketing messages for construction companies by understanding key industry challenges and where cybersecurity use cases are most useful.

- Identify attractive investment targets by understanding which companies are most advanced in the themes that will determine future success in the construction industry.

Microsoft

SAP

Alphabet

Workday

Adobe

Infor

Zendesk

ServiceNow

Box

Dropbox

New Relic

Datadog

Intuit

Xero

Aggio

Procore

CoConstruct

Autodesk

RIB Software

Kiewit

Balfour

Beatty

TechnipFMC

Skanska

Oracle

IBM (Red Hat)

Amazon

Salesforce (Heroku)

VMware (Pivotal)

COINS

Novade

Axians

Petrofac

Catterpillar

Vinci

Alibaba

Huawei

Kyndryl

Tencent

LTIMindtree

Cisco

John Holland

Growing Underground

Komatsu

IBM

Accenture

TCS

DXC Technology

Wipro

HCL

Informatica

Atos

NTT

Bentley Systems

CMiC

Cognizant

Infosys

DXC

Technology

Rackspace

Table of Contents

Frequently asked questions

-

What was the cloud computing market size in the construction industry in 2021?

In the construction sector, cloud computing revenues was valued at USD 20.8 billion in 2021.

-

What will be the cloud computing market growth in the construction industry?

In the construction sector, cloud computing market will grow at a CAGR of more than 16% during 2021-2026.

-

What are the key value chain components in cloud computing in the construction market?

Cloud computing stack and cloud professional services are the key value chain components in the cloud computing in the construction market.

-

Which are the leading specialist cloud computing vendors in construction market?

Autodesk, Bentley Systems, CMiC, CoConstruct, Construction Industry Solutions (COINS), LTIMindtree, Novade Solutions, Procore, and RIB Software are the leading specialist cloud computing vendors in construction market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.