Cloud Computing in Insurance – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Cloud Computing in Insurance Market Analysis Overview

Cloud computing refers to the provision of IT infrastructure and platform services to deliver a flexible, scalable, and on-demand IT environment. The cloud is now the dominant model for delivering and maintaining enterprise IT resources, including hardware, software, and platforms and tools for application developers. Key segments for the insurance sector include cloud services, specifically software as a service (SaaS), platform as a service (PaaS), and infrastructure as a service (IaaS).

Customer purchasing behavior is driving a need for more tailored products. Insurance products are becoming less standardized and increasingly bespoke to target specific audiences. The key characteristics of the cloud – scalability, agility, and speed – allow insurers to reduce their product development time. Applications can be developed, tested, rolled out, and maintained cost-effectively and efficiently.

The cloud computing in insurance market thematic intelligence report assesses how insurance, combined with other emerging technologies, can be used across the insurance value chain. It provides an overview of the current landscape, as well as key players, while also highlighting opportunities for the use of insurance in the future. The report provides an industry-specific analysis based on GlobalData databases and surveys.

| Report Pages | 54 |

| Regions Covered | Global |

| Market Size (2021) | $16.6 billion |

| CAGR (2021-2026) | >14% |

| Value Chains | Cloud Infrastructure, Cloud Services, and Cloud Professional Services |

| Forecast Period | 2021-2026 |

| Leading Cloud Computing Vendors | Alibaba, Alphabet (parent company of Google), and Amazon |

| Leading Cloud Computing Adopters | AIA, Allianz, and Aviva |

| Specialist Cloud Computing Vendors | Acturis, Applied Systems, and Charles Taylor |

Cloud Computing in Insurance - Data Analysis

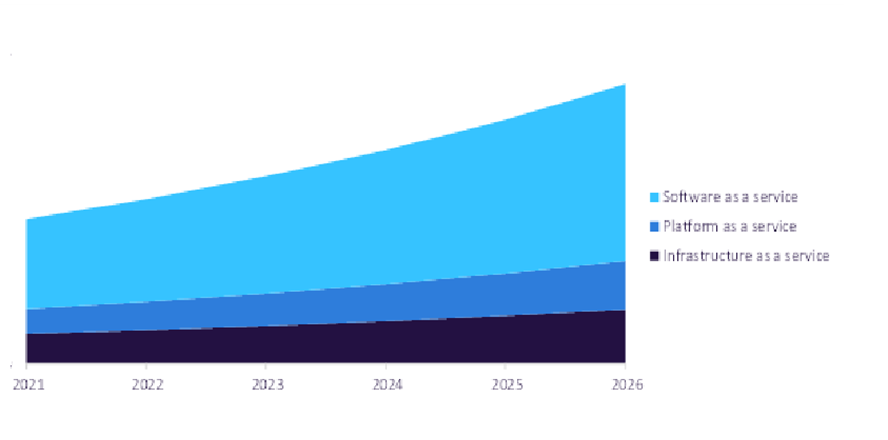

The total global spending by insurers on IaaS, PaaS, and SaaS was $16.6 billion in 2021. The market is expected to achieve a CAGR of more than 14% between 2021 and 2026. SaaS represents the largest portion of the insurance industry’s cloud services revenue and will grow in dominance over the coming years. SaaS will continue to streamline processes such as risk profiling, claims management, and customer service, enabling incumbent insurers to compete with insurtechs.

The cloud computing in insurance data analysis also covers:

- Mergers and acquisitions

- Patent trends

- Company filings trends

- Hiring trends

- Social Media trends

- Cloud computing timeline

Global Cloud Services Revenue in the Insurance Sector, 2021-2026 ($ billion)

For more insights into the cloud computing in insurance revenue forecast, download a free report sample

Cloud Computing in Insurance- Value Chain Analysis

The cloud computing value chain consists of three segments- cloud infrastructure, cloud services, and cloud professional services.

Cloud services (PaaS and IaaS)

In the IaaS and PaaS markets, traditional IT stack infrastructure vendors, specializing in everything from databases and operating systems to virtualization, computing, storage, and networking, face competition from public cloud service providers. The latter use subscription-based, pay-as-you-use business models to offer a full portfolio of IT infrastructure, as well as tools and platforms for application developers. Despite their incumbency, many traditional IT infrastructure vendors, including DXC Technology, Dell, and Fujitsu, now offer cloud-based, IT-as-a-service options alongside traditional IT solutions.

Cloud Computing Value Chain Analysis

For more insights into the cloud computing value chain, download a free report sample

Leading Cloud Computing Adopters in Insurance

Some of the leading insurance companies that are currently deploying cloud computing:

- AIA

- Allianz

- Aviva

Leading Cloud Computing Vendors

Some of the leading vendors in the cloud computing theme:

- Alibaba

- Alphabet (parent company of Google)

- Amazon

Specialist Cloud Computing Vendors in Insurance

Some of the specialist cloud computing vendors in the insurance sector:

- Acturis

- Applied Systems

- Charles Taylor

To know more about the leading cloud computing vendors, adopters, and specialist vendors in the insurance industry, download a free report sample

Life Insurance Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our life insurance sector scorecard has three screens: a thematic screen, a valuation screen, and a risk screen.

- The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- The risk screen ranks companies within a particular sector based on overall investment risk.

Life Insurance Sector Scorecard – Thematic Screen

To know more about the sector scorecards, download a free report sample

Other sector scorecards included in this report:

- Non-life insurance sector scorecard

Segments Covered in the Report

Cloud Computing in Insurance Value Chain Outlook (Value, $ billion, 2021-2026)

- Cloud Infrastructure

- Cloud Services

- Cloud Professional Services

Reasons to Buy

- Access market size and growth forecasts for cloud computing in insurance.

- Identify cloud leaders and laggards across life and non-life insurance.

- Understand the key challenges facing the insurance industry, and how these challenges increase the need for cloud computing.

- Access primary research case study examples of cloud vendors and investments in the insurance industry.

- Understand cloud computing adoption using alternative datasets and analysis showing M&A activity, mentions of cloud technologies in company filings, and cloud hiring trends in the insurance sector.

Acturis

Allianz

Applied Systems

Aviva

AXA

Charles Taylor

Cloud Foundry

Discovery

Duck Creek Technologies

EIS

FIS

Guidewire

IBM (Red Hat)

Infosys (EdgeVerge Systems)

Lemonade

Munich Re

Oscar Health

Ping An

Shift Technology

Swiss Re

Table of Contents

Frequently asked questions

-

What are the components of the cloud computing value chain?

The cloud computing value chain consists of three segments which are cloud infrastructure, cloud services, and cloud professional services.

-

Who are the leading cloud computing vendors in the insurance industry?

Some of the leading vendors in the cloud computing theme are Alibaba, Alphabet (parent company of Google), and Amazon.

-

Who are the leading cloud computing adopters in the insurance industry?

Some of the leading insurance companies that are currently deploying cloud computing are AIA, Allianz, and Aviva.

-

Who are the specialist cloud computing vendors in the insurance industry?

Some of the specialist cloud computing vendors in the insurance sector are Acturis, Applied Systems, and Charles Taylor.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports