Cloud Computing in Travel and Tourism – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Cloud Computing in Travel and Tourism

The travel and tourism industry has undergone a tremendous change in the last 10 to 15 years, moving from bricks-and-mortar travel agents towards online. Cloud technologies are the bedrock enabling this change. Investment in the cloud technology stack depends on company size and business requirements. Small and medium-sized travel companies tend to invest in software-as-a-service (SaaS) solutions, which provide out-of-the-box scalable applications. Amazon Web Services (AWS) is the preferred public cloud provider with clients including Trip.com, Hilton, Expedia, Delta Air Lines, and Airbnb. It is the leading public cloud provider for travel companies.

The cloud computing in travel and tourism thematic intelligence report takes an in-depth look at look at how important cloud computing is in the travel and tourism sector. The report also highlights companies making their mark within the theme, and the relative position of these companies within the airlines, rail, road transport, and lodging sectors is summarized.

Cloud Computing in Travel and Tourism – Industry Analysis

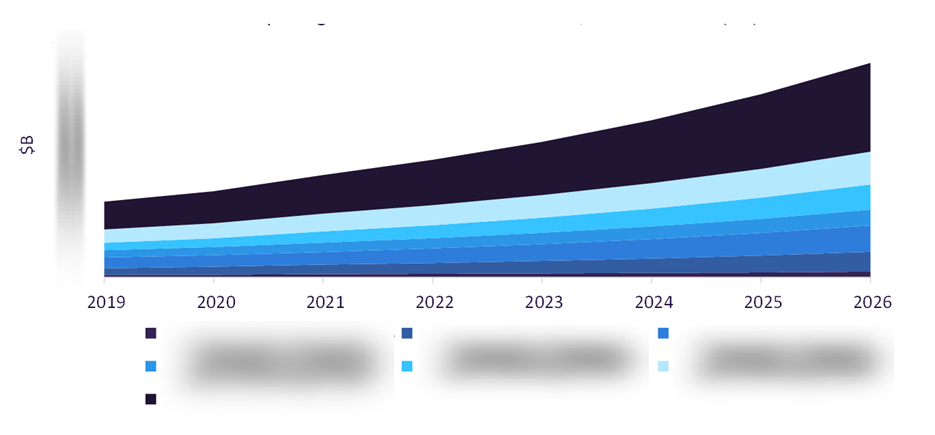

Cloud computing spending in travel and tourism was worth $8.6 billion in 2021. Cloud computing in travel and tourism is forecast to grow at a CAGR of more than 15% between 2021 and 2026.

Travel and tourism companies have traditionally been slow to adopt new technologies, with many companies using outdated systems. However, more and more companies have realized the potential of cloud computing and storage for globally distributed businesses needing scalability and adaptability.

Cloud computing in travel and tourism industry analysis also covers:

- Mergers and acquisitions

- Company filings trends

- Hiring trends

- Cloud computing Timeline

Cloud Computing in Travel and Leisure Revenue, 2019-2026 ($ Billions)

To gain more information on the cloud computing market forecast, download a free report sample

Cloud Computing in Travel and Tourism - Value Chain Analysis

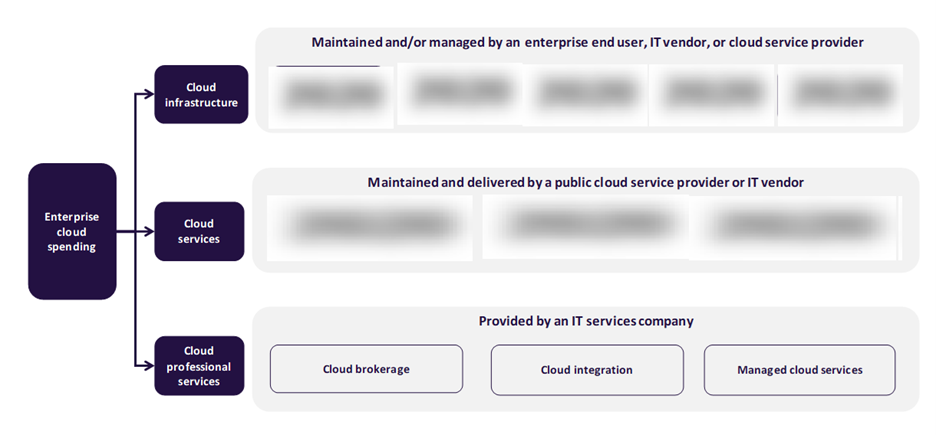

GlobalData’s cloud computing value chain consists of cloud infrastructure, cloud services, and cloud professional services. Enterprise cloud spending falls into three broad categories. The first of these, cloud infrastructure, includes the hardware and software used to build, operate, and manage a cloud environment, whether it is public, private, or hybrid. Enterprises invest in infrastructure for building and operating a private cloud for various reasons, including data compliance obligations, data privacy, and maintaining guaranteed performance levels. Some enterprises build their private cloud, while others invest in a turnkey private cloud solution.

Cloud professional services: The key layers of cloud professional services are cloud brokerage, cloud integration, and managed cloud services.

Cloud computing Value Chain Analysis

For more insights on the cloud computing value chains, download a free report sample

Leading Cloud Computing Adopters in Travel & Tourism Industry

Some of the leading travel & tourism companies that are currently deploying cloud computing are as follows:

- Airbnb

- Delta Air Lines

- Dubai Airports Company

- easyJet

To know more about the leading cloud computing adopters in the travel & tourism industry, download a free report sample

Leading Cloud Computing Vendors in Travel & Tourism Industry

Some of the leading vendors associated with the cloud computing theme are:

- Alibaba

- Alphabet (parent company of Google)

- Amazon

- Cisco

To know more about the leading cloud computing vendors in the travel & tourism industry, download a free report sample

Specialist Cloud Computing Vendors in Travel & Tourism Industry

Some of the specialist cloud computing vendors in the travel and tourism sector are:

- A-ICE

- Amadeus

- Infor

- Relito

To know more about the specialist cloud computing vendors in the travel & tourism industry, download a free report sample

Airports Sector Scorecard – Cloud Computing Theme

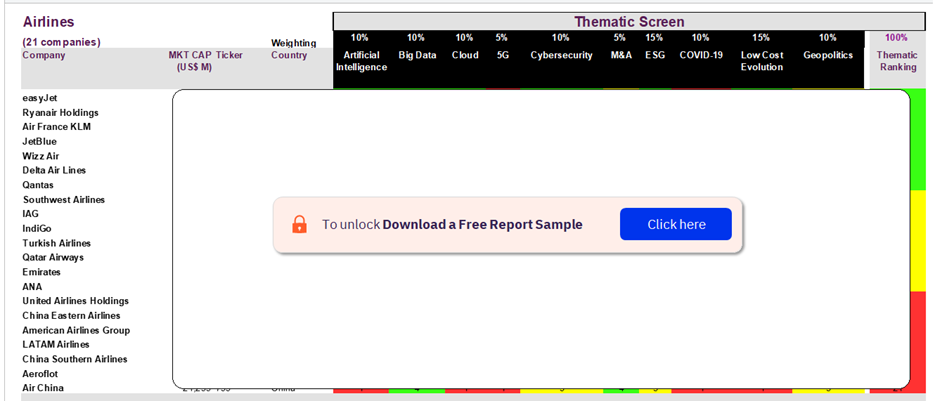

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecards have three screens: a thematic screen, a valuation screen, and a risk screen. The airport sector scorecard has three screens:

- The thematic screen tells us who are the overall leaders in the 10 themes that matter most, based on our thematic engine.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- Our risk screen ranks companies within a sector based on overall investment risk.

Airports Sector Scorecard – Thematic Screen

To know more about the sector scorecards, download a free report sample

Cloud Computing in Travel and Tourism Market Overview

| Report Pages | 57 |

| Regions Covered | Global |

| Market Size (2021) | $8.6 billion |

| CAGR (2021-2026) | >15% |

| Value Chains | Cloud Infrastructure, Cloud Services, and Cloud Professional Services |

| Leading Cloud Computing Adopters | Airbnb, Delta Air Lines, Dubai Airports Company, and easyJet |

| Leading Cloud Computing Vendors | Alibaba, Alphabet (parent company of Google), Amazon, and Cisco |

| Specialist Cloud Computing Vendors | A-ICE, Amadeus, Infor, and Relito |

Scope

- This report provides an overview of the cloud in travel and tourism.

- This report explains why the cloud will continue to grow in importance for the travel and tourism industry.

- This report outlines how the correct cloud strategy can enhance the traveler experience and contribute to operational efficiency and scalability, highlighting different cloud strategies and architectures used by industry players.

- This report provides examples of what companies and organizations in the travel and tourism industry are doing in reaction to this theme, and how they create differentiation.

- We highlight travel and tourism companies that are leading in this theme.

Key Highlights

- Investment in the cloud technology stack depends on company size and business requirements. Software as a service (SaaS) is the biggest investment area for travel and tourism companies, followed by platform-as-a-service (PaaS). Many applications used for day-to-day operations, both customer-facing and business-to-business (B2B), are now mostly cloud-based. AWS is the leading public cloud provider for travel companies with clients including Trip.com, Hilton, Expedia, Delta Air Lines, and Airbnb.

- Due to the travel disruptions caused by COVID-19 restrictions, seamless travel experiences with multiple touch points and personalized features are going to be an important investment area for travel and tourism companies. Eventually, cloud computing technologies will enable a seamless experience across the traveler’s journey, inside and outside the airport.

- Leading lodging companies with strong cloud strategies are Hilton, Princess Cruises, Wyndham Hotels and Resorts, and Radisson Hotel Group.

- Leading airlines and airports with strong cloud strategies are Changi Airport Group, Dubai Airports, Delta Air Lines, and Etihad Airways.

- Leading travel intermediaries with strong cloud strategies are Skyscanner (Trip.com), Airbnb, Booking.com, and Expedia Group.

Reasons to Buy

- To access market size and grown forecasts of the cloud in the travel and leisure market

- To identify cloud leaders and laggards across lodging and cruises, airlines, and airports

- To understand the key challenges facing the travel and tourism industry, and how these challenges increase the need for cloud computing.

- To access primary research case study examples of cloud vendors and investment in the travel and tourism industry.

- To understand cloud computing adoption using alternative datasets and analysis showing M&A activity mentions of cloud technologies in company filings, and cloud hiring trends in the travel and tourism sector.

- GlobalData’s thematic research ecosystem is a single, integrated global research platform that provides an easy-to-use framework for tracking all themes across all companies in all sectors. It has a proven track record of identifying important themes early, enabling companies to make the right investments ahead of the competition, and securing that all-important competitive advantage.

Airbnb

Alibaba

Alphabet

Amadeus

Amazon

A-OCE

Booking.com

Box

Changi Airport Group

Cisco

Cloud Software Group

Cognizant

Datadog

Dell Technologies

Delta Air Lines

Docker

Dropbox

Dubai Airports

Dubai Airports Company

DXC Technology

easyJet

Etihad Airways

Expedia Group

Guangzhou Baiyun International Airport

Hilton

Huawei

IBM

Infor

Infosys

Inspur, Intuit

Kyndryl

Lufthansa

Mandarin Oriental Hotel Group

Microsoft

Oracle

Princess Cruises

Progress Software

Rackspace

Raddison Hotel Group

Relito

Rosen Hotels and Resorts

Ryanair

Sabre

Salesforce

SAP

ServiceNow

Shiji

SITA

Southwest Airlines

TCS

Travelodge Hotels

Travelport

Trip.com

TUI

United Airlines

Vmware

Workday

Wyndham Hotels & Resorts

Xero

Zendesk

Table of Contents

Frequently asked questions

-

What was cloud computing spending in the travel and tourism market in 2021?

Cloud computing spending in the travel and tourism sector was worth $8.6 billion in 2021.

-

What is cloud computing in the travel and tourism market growth rate?

Cloud computing in travel and tourism is forecast to grow at a CAGR of more than 15% between 2021 and 2026.

-

What are the components of the cloud computing value chain?

GlobalData’s cloud computing value chain consists of cloud infrastructure, cloud services, and cloud professional services.

-

Which leading travel & tourism companies are currently deploying cloud computing?

Some of the leading travel & tourism companies that are currently deploying cloud computing are Airbnb, Delta Air Lines, Dubai Airports Company, and easyJet.

-

Which leading vendors are associated with the cloud computing theme?

Some of the leading vendors associated with the cloud computing theme are Alibaba, Alphabet (parent company of Google), Amazon, and Cisco.

-

Which are the specialist cloud computing vendors in the travel and tourism sector?

Some of the specialist cloud computing vendors in the travel and tourism sector are A-ICE, Amadeus, Infor, and Relito.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.