Cloud Computing Market Trends and Analysis by Infrastructure, Product/Service, Vertical, Enterprise Size Band and Segment Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Accessing the in-depth insights from the ‘Cloud Computing’ report can help:

- Understand the current and future state of the market, allowing businesses to make informed decisions about market entry, product development, and investments.

- Identify competitors’ capabilities to stay ahead in the market.

- Identify segments and get an understanding of various stakeholders across different stages of the entire value chain.

- Anticipate changes in demand and adjust the business development strategies.

- Identify potential regions and countries for growth opportunities.

How is our ‘Cloud Computing’ report different from other reports in the market?

- The report presents in-depth market sizing and forecasts at a segment level for more than 20 countries, including historical and forecast analysis for the period 2020-2027 for market assessment.

- The report offers detailed segmentation by:

-

- IT Infrastructure – Service and Software/Application

- Product/Service – Cloud Management Platforms, Infrastructure as a service (IaaS), Platform as a service (PaaS), Software as a service (SaaS), Hybrid Cloud Services, Managed Cloud Services, and Private Cloud Services

- Vertical – BFSI, Information Technology, Manufacturing, Retail, Energy, Government, Transport & Logistics, and Others

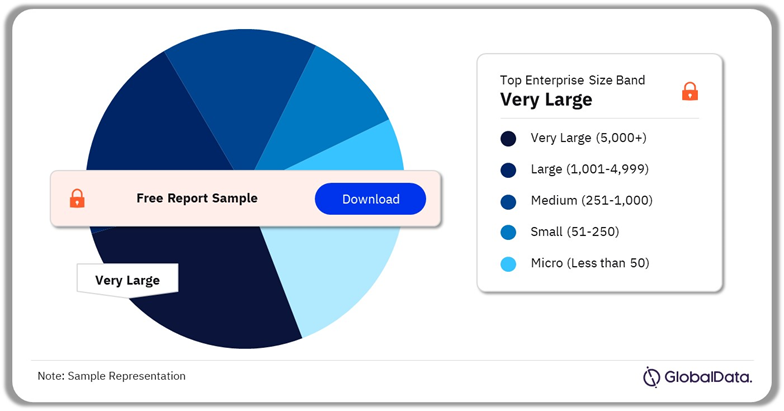

- Enterprise Size Band – Micro (Less than 50), Small (51-250), Medium (251-1000), Large (1001-4999), and Very Large (5000+)

- Region – North America, Europe, Asia-Pacific, South & Central America, and Middle East & Africa

- The report covers key market trends and challenges impacting the cloud computing market.

- The report covers dashboard analytics for M&A deals, venture financing/private equity deals, job activity, and patent activities.

- The value chain in the report can help identify key companies involved in each stage of the value chain. This helps in understanding the competitive landscape and potential collaboration opportunities.

- Competitive profiling and benchmarking of key companies in the market to provide a deeper understanding of industry competition.

- The report can be a valuable tool for stakeholders to improve their operations, increase customer satisfaction, and maximize profitability by analyzing the latest cloud computing trends, tracking market growth and demand, and evaluating the existing competition in the market.

We recommend this valuable source of information to:

- Venture Capital/Equity Firms/Investment Firms

- SaaS, IaaS, and PaaS Provider Companies

- Tech Startups

- Cloud Integration Companies

- Cloud Professional Service Companies

- Cloud and Seed Companies

Get a Snapshot of the Cloud Computing market, Download a Free Report Sample

Cloud Computing Report Overview

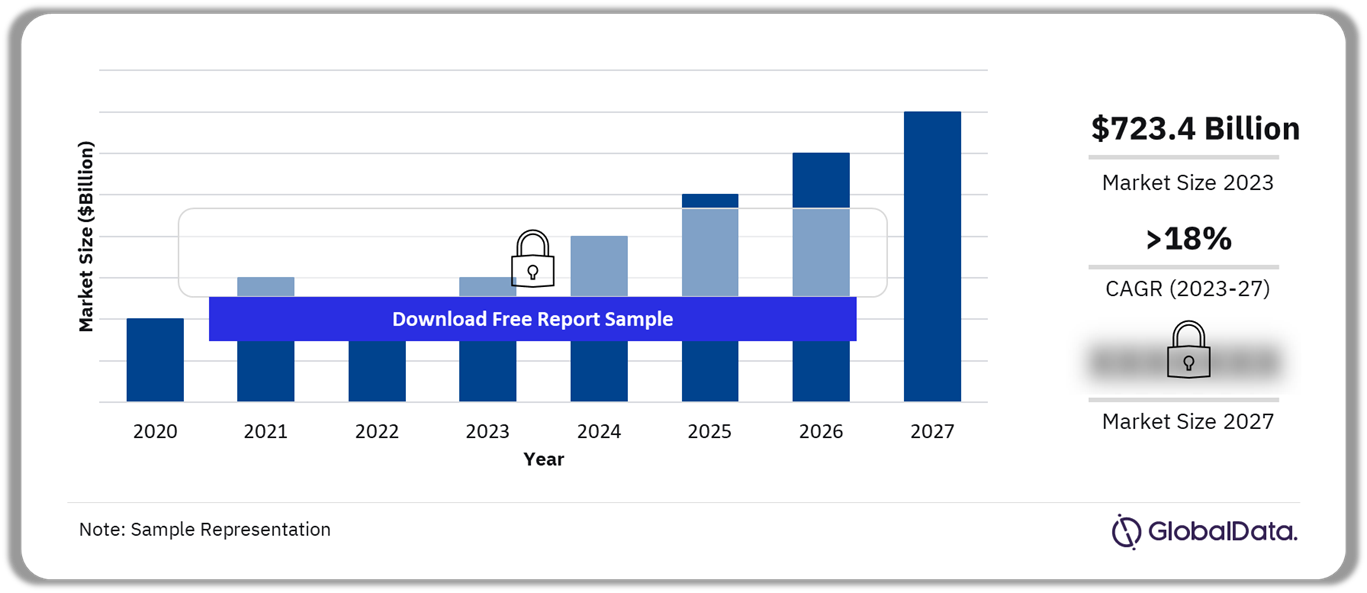

The cloud computing market size revenue was valued at $723.4 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of more than 18% over the forecast period. The anticipated growth is fueled by several key factors, including the seamless integration of IoT devices, escalating demand for artificial intelligence (AI), widespread adoption of microservices architecture, and the increasing utilization of the DevOps model. These factors are driving a transformative shift in how businesses leverage cloud technology to focus on their core competencies while offloading infrastructure management and driving digital transformation across their organizations.

The increasing need for AI has greatly accelerated the adoption of cloud services. The competition among cloud service providers to deliver top-notch AI platforms and services is intensifying in the business landscape, driven primarily by the surge in generative AI. The opportunity to attract AI-intensive tasks to their cloud platforms by offering robust models and tools for AI-driven solutions is inducing innovation. As a result, the trend has sparked significant partnerships between cloud providers and leading AI startups, demonstrated by Microsoft’s agreement with OpenAI and AWS’s collaboration with Anthropic.

Cloud Computing Market Outlook, 2020-2027 ($Billion)

Buy the Full Report for Additional Insights on the Cloud Computing Market Forecast

The growing demand for cloud computing is linked to the integration of IoT. The widespread use of IoT devices is driving the expansion of the cloud computing market, necessitating scalable storage, and processing solutions for the large influx of data. IoT deployments often involve many geographically dispersed devices. Cloud computing facilitates centralized management and control of these devices, providing robust analytics tools and services that empower organizations to process and analyze IoT data in real-time.

In addition, application lifecycle management (ALM) is a significant driver of the cloud computing market, as businesses increasingly rely on cloud-based tools and platforms to streamline software development, deployment, and maintenance processes. ALM solutions hosted in the cloud offer scalability, collaboration, and integration capabilities, enabling organizations to efficiently manage the entire lifecycle of their applications from ideation to retirement while leveraging the benefits of cloud infrastructure and services.

Although cloud computing has revolutionized business operations by offering scalability, agility, and cost-effectiveness, concerns over data security and privacy remain significant barriers to widespread adoption. Despite these challenges, adopting mitigation strategies such as a thorough assessment of cloud service providers and implementing data encryption and access controls can enhance overall security and facilitate compliance with data privacy regulations.

| Market Size (2023) | $723.4 billion |

| CAGR (2023 – 2027) | >18% |

| Forecast Period | 2023-2027 |

| Historic Data | 2020-2022 |

| Report Scope & Coverage | Revenue Forecast, Value Chain, Company Landscape, Company Profiles, Market Trends & Challenges, and M&A analysis |

| IT Infrastructure | Service and Software/Application |

| Product/Service | Cloud Management Platforms, Hybrid Cloud Services, IaaS, Managed Cloud Services, PaaS, Private Cloud Services, and SaaS |

| Vertical | BFSI, Information Technology, Manufacturing, Retail, Energy, Government, Transport & Logistics, and Others |

| Enterprise Size Band | Micro (Less than 50), Small (51-250), Medium (251-1000), Large (1001-4999), and Very Large (5000+) |

| Region | North America, Europe, Asia-Pacific, South & Central America, and Middle East & Africa |

| Key Countries | US, Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Singapore, Australia, Saudi Arabia, UAE, South Africa, Brazil, Argentina, Chile, and Colombia |

| Key Companies | Microsoft Corp., Alphabet Inc., Amazon.com Inc., Alibaba Group Holding Ltd., Tencent Holdings Ltd., Oracle Corp., Cisco Systems Inc., Salesforce Inc., International Business Machines Corp. (IBM), SAP SE, and ADOBE Inc. |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

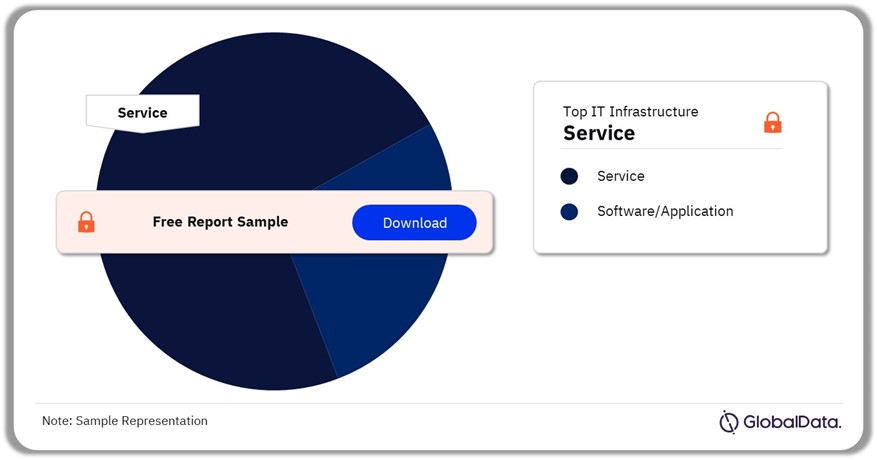

Cloud Computing Market Segmentation by IT Infrastructure

The market is segregated by IT infrastructure into software/application and service. While software and applications are important, services tend to hold the major market share. This is because cloud services encompass a wide range of offerings, including infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS), among others. The service segment is the backbone of cloud computing, allowing organizations to leverage scalable, on-demand resources without requiring heavy upfront investment in hardware or software.

The shift towards cloud-native solutions has spurred innovation and accelerated digital transformation initiatives across industries. As a result, enterprises are increasingly prioritizing investments in cloud services to drive operational efficiency, enhance competitiveness, and unlock new avenues for growth.

Cloud Computing Market Share by IT Infrastructure, 2023 (%)

Buy the Full Report for More Information on the Cloud Computing Market by IT Infrastructure

Software plays a crucial role in the domain of cloud computing IT infrastructure, enabling the functionality and management of cloud-based infrastructure. Software solutions are essential for deploying, managing, securing, and optimizing cloud resources and workloads. For instance, software solutions such as AWS Management Console and Azure Portal provide centralized interfaces for managing cloud resources, monitoring performance, and optimizing costs. These platforms offer features such as resource provisioning, monitoring, and billing management, simplifying the management of complex cloud environments.

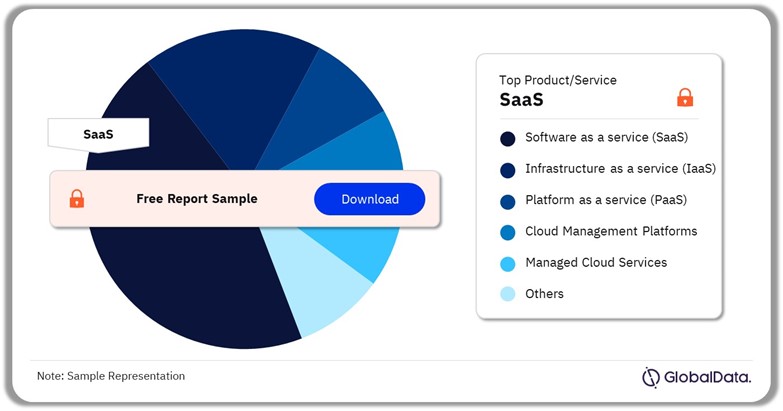

Cloud Computing Market Segmentation by Product/Service

The SaaS segment by product/service will hold the largest market share in 2023. SaaS models typically operate on a subscription basis, spreading costs over time rather than requiring a substantial upfront investment. This makes them appeal to businesses looking to manage their expenses efficiently.

Furthermore, businesses across industries are undergoing digital transformation to stay competitive in the digital age. In addition to SaaS, IaaS and PaaS offer the essential infrastructure and resources required for enterprises to upgrade their IT systems, optimize workflows, and introduce inventive digital offerings. With IaaS, organizations can outsource their hardware needs to cloud providers, eliminating the need for expensive data centers and equipment maintenance. PaaS further enhances cost efficiency by providing pre-configured development platforms and tools, reducing development time and resources.

Cloud Computing Market Share by Product/Service, 2023 (%)

Buy the Full Report for More Information on Cloud Computing Market by Product/Service

Moreover, private cloud services have been gaining significant traction in recent years. Many organizations are opting for private clouds due to the increased control, security, and customization they offer compared to public cloud solutions. One of the key advantages of private clouds is that they allow organizations to host their resources in their own data centers or dedicated environments, providing more control over data security and regulatory compliance.

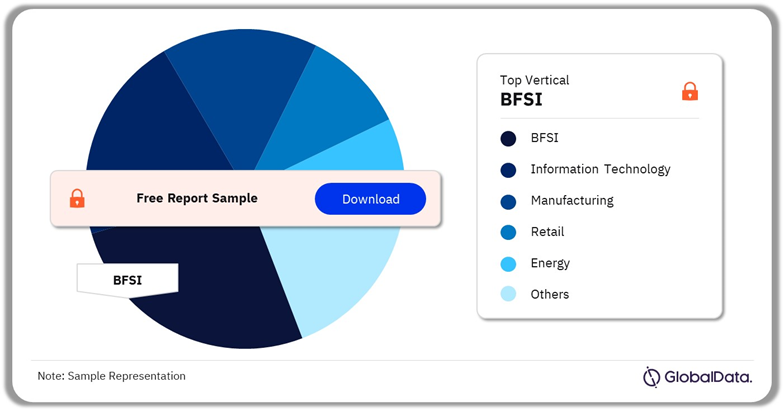

Cloud Computing Market Segmentation by Vertical

this vertical segment is expected to experience steady growth, with an anticipated CAGR exceeding 15% during the forecast period.

The manufacturing industry has also played a significant role in driving market growth. Cloud technology provides several benefits to manufacturers, allowing them to streamline operations, improve efficiency, and foster innovation across different facets of their business. Cloud-based technologies are transforming manufacturing, enabling advancements such as artificial intelligence, the Internet of Things, and data management warehousing.

Cloud Computing Market Share by Vertical, 2023 (%)

Buy the Full Report for More Information on Cloud Computing Market by Vertical

Additionally, the government sector is a major contributor to the growth of cloud computing. Many governments have launched digital transformation initiatives aimed at modernizing their IT systems and embracing cloud computing as a key enabler.

Cloud Computing Market Segmentation by Enterprise Size Band

The enterprise size band segment is categorized into very large, large, medium, small, and micro. In 2023, the very large enterprise size band captured a sizeable market share exceeding 35%, and the segment is anticipated to witness strong growth, recording a CAGR surpassing 15% over the forecast period.

Large enterprises have played a crucial role in the adoption of cloud computing. Such enterprises often have a worldwide presence with operations spanning multiple geographies. Cloud computing enables these organizations to deploy applications and services, ensuring consistent performance, reliability, and compliance with local regulations through the cloud provider’s infrastructure and data center footprint.

Cloud Computing Market Share by Enterprise Size Band, 2023 (%)

Buy the Full Report for More Information on the Cloud Computing Market by Enterprise Size Band

Small and medium-sized businesses (SMBs) are also major contributors to the growth of the market. While large enterprises have substantial IT resources and budgets, SMBs often have limited resources and face unique challenges that make cloud computing particularly attractive for their needs. Cloud computing provides SMBs with the flexibility and agility they need to respond quickly to market changes, seize new opportunities, and stay competitive in today’s fast-paced business environment.

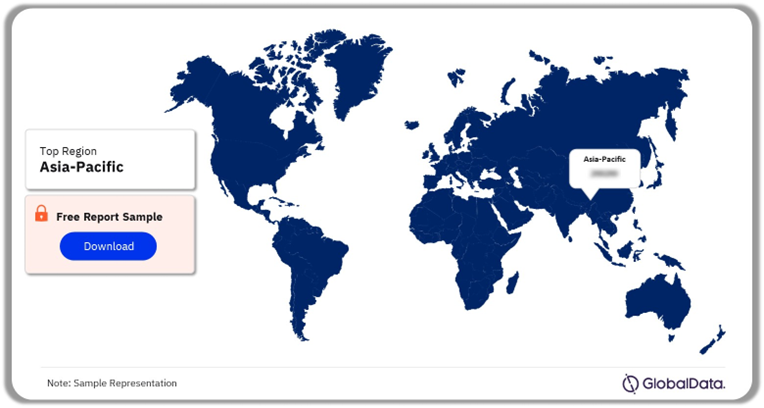

Cloud Computing Market Analysis by Region

Asia-Pacific held the highest share in 2023, capturing over 30% of the overall market size. China and Japan led the regional market, collectively accounting for over 50% of the regional market in 2023. In particular, the Chinese government has been actively promoting cloud adoption as part of its broader digital transformation efforts, which has fueled the growth of both domestic and international cloud service providers in the country.

North America, particularly the US, has been at the forefront of cloud adoption, with a robust ecosystem of cloud providers, tech companies, and enterprises leveraging cloud services. The region is home to many tech giants and startups that continuously drive innovation in cloud computing. As cloud technologies continue to evolve, North America is poised to remain a key driver of growth and innovation in the cloud computing landscape.

Cloud Computing Market Share by Region, 2023 (%)

Buy the Full Report for Regional Insights into the Cloud Computing Market

The growth of the cloud computing market in South & Central America is a significant trend. The region is home to many emerging markets such as Brazil, Argentina, and Chile with growing economies and populations. Governments in the region are actively promoting the adoption of cloud computing as part of their efforts to drive economic growth and improve public services.

Cloud Computing Market – Competitive Landscape

The industry is highly competitive. Established giants such as Microsoft, AWS, and Google continuously innovate their product offerings and service models to maintain their competitive edge. Furthermore, traditional IT companies, telecommunications companies, and even startups are entering the cloud market, adding to the competitive landscape. This competition benefits customers by driving innovation, improving service quality, and driving down prices as providers vie for customers’ business.

The worldwide enthusiasm surrounding generative AI has led to increased complexity in managing infrastructure and applications. As a result, companies are actively pursuing innovation and introducing AI-related products to gain a larger market share. As part of this strategy, in April 2014, IBM made a significant move by acquiring HashiCorp Inc., a cloud software company specializing in tools for managing digital infrastructure. The deal, valued at $6.4 billion, is aimed at expanding IBM’s portfolio of cloud-based software products, capitalizing on the growing demand for AI solutions.

In the dynamic landscape of cloud computing, strategic collaborations and acquisitions play a pivotal role in maintaining a competitive edge. For instance, in April 2024, Orange Egypt and Huawei announced a strategic partnership aimed at introducing Huawei Cloud services to the Egyptian market. This collaboration aims to address the unique needs of businesses across various sectors and sizes in Egypt.

Leading Companies in the Cloud Computing Market

- Microsoft Corp.

- Alphabet Inc.

- Amazon.com Inc.

- Alibaba Group Holding Ltd.

- Tencent Holdings Ltd.

- Oracle Corp.

- Cisco Systems Inc.

- Salesforce Inc.

- International Business Machines Corp. (IBM)

- SAP SE

- ADOBE Inc.

Other Cloud Computing Vendors Mentioned

Google LLC, VMware LLC, KT Cloud Co. Ltd., SB Technology (Sandbox AQ), and Fujitsu Limited, among others.

Buy the Full Report to Know More About Leading Cloud Computing Companies

Cloud Computing Market Segments

GlobalData Plc has segmented the cloud computing market report by IT infrastructure, product/service, enterprise size band, vertical, and region:

Cloud Computing Market IT Infrastructure Outlook (Revenue, $Million, 2020-2027)

- Service

- Software/Application

Cloud Computing Market Product/Service Outlook (Revenue, $Million, 2020-2027)

- Cloud Management Platforms

- SaaS

- IaaS

- PaaS

- Hybrid Cloud Services

- Private Cloud Services

- Managed Cloud Services

Cloud Computing Market Enterprise Size Band Outlook (Revenue, $Million, 2020-2027)

- Micro (Less than 50)

- Small (51-250)

- Medium (251-1000)

- Large (1001-4999)

- Very Large (5000+)

Cloud Computing Market Vertical Outlook (Revenue, $Million, 2020-2027)

- BFSI

- Information Technology

- Manufacturing

- Retail

- Energy

- Government

- Transport & Logistics

- Others

Cloud Computing Market Regional Outlook (Revenue, $Million, 2020-2027)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- Singapore

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

- South & Central America

- Brazil

- Argentina

- Chile

- Colombia

- Rest of South & Central America

Scope

• This report provides overview and service addressable market for global cloud computing market.

• It identifies the key trends and challenges impacting growth of the cloud computing market over the next 12 to 24 months.

• It includes global market forecasts for the cloud computing market along with value chain, company profiling and benchmarking of key companies in the market.

• It covers detailed segmentation by IT Infrastructure, product/service, vertical, enterprise size band, and regional segmentation.

• The report includes dashboard analytics section that covers M&A deals, venture financing/private equity deals, job activity, and patent activities.

Key Highlights

The cloud computing market size revenue was valued at $723.4 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 18.1% over the forecast period. The anticipated growth is fueled by several key factors, including the seamless integration of IoT devices, escalating demand for artificial intelligence (AI), widespread adoption of microservices architecture, and the increasing utilization of the DevOps model. These factors are driving a transformative shift in how businesses leverage cloud technology to focus on their core competencies while offloading infrastructure management and driving digital transformation across their organizations.

Reasons to Buy

• This market intelligence report offers a thorough, forward-looking analysis of the global cloud computing market by IT infrastructure, product/service, vertical, enterprise size band, regional, and key trends in a concise format to help executives build proactive and profitable growth strategies.

• Accompanying GlobalData’s Forecast products, the report examines the trends, challenges, and macro impact assessment in the cloud computing market.

• Detailed segmentation by IT Infrastructure – service and software/application; by product/service – Cloud Management Platforms, Infrastructure as a service (IaaS), Platform as a service (PaaS), Software as a service (SaaS), Hybrid Cloud Services, Managed Cloud Services, and Private Cloud Services, and SaaS; by vertical – BFSI, Information Technology, Manufacturing, Retail, Energy, Government, Transport & Logistics, and Others; and by enterprise size band – Micro (Less than 50), Small (51-250), Medium (251-1000), Large (1001-4999), and Very Large (5000+). Additionally, the report also emphasizes segmentation across various regions.

• The report includes 100+ charts and tables providing in-depth analysis of the market size, forecast, and supporting factors which are tailor-made for an executive-level audience, with enhanced presentation quality.

• The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from key market companies, which enables executives to quickly get up to speed with the current and emerging trends in cloud computing markets.

• The competitive section of the report covers company profiling and benchmarking of key companies in the market to provide a deeper understanding of industry competition.

• The broad perspective of the report, coupled with comprehensive, actionable detail, will help cloud computing vendors and other related companies succeed in the growing cloud computing market globally.

Alphabet Inc.

Amazon.com Inc.

Alibaba Group Holding Ltd.

Tencent Holdings Ltd.

Oracle Corp.

Cisco Systems Inc.

Salesforce Inc.

International Business Machines Corp. (IBM)

SAP SE

ADOBE Inc.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the cloud computing market size in 2023?

The cloud computing market size was valued at $723.4 billion in 2023.

-

What is the cloud computing market growth rate?

The cloud computing market is expected to grow at a CAGR of more than 18% during the forecast period.

-

What are the key cloud computing market trends?

The key trends shaping the cloud computing market include IoT device integration, increasing AI demand, custom hardware development, microservices architecture adoption, application lifecycle management (ALM), and the DevOps approach.

-

Which was the leading IT infrastructure component in the cloud computing market in 2023?

Services held the largest market share within the cloud computing market’s IT infrastructure segment in 2023.

-

Which was the leading product/service in the cloud computing market in 2023?

In 2023, Software as a Service (SaaS) held the largest market share among cloud computing products/services.

-

What was the leading vertical in the cloud computing market in 2023?

The BFSI sector dominated the cloud computing market in 2023, holding the largest share across verticals.

-

What was the leading enterprise size band in the cloud computing market in 2023?

In 2023, the Very Large enterprise segment captured the largest market share within the cloud computing market across enterprise size bands.

-

Which was the leading regional market in the cloud computing market in 2023?

Asia-Pacific accounted for the largest cloud computing regional market share in 2023.

-

Which are the leading cloud computing companies globally?

The leading cloud computing companies are Microsoft Corp., Alphabet Inc., Amazon.com Inc., Alibaba Group Holding Ltd., Tencent Holdings Ltd., Oracle Corp., Cisco Systems Inc., Salesforce Inc., International Business Machines Corp. (IBM), SAP SE, and ADOBE Inc.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Technology reports