Colombia Baby Food Market Size by Categories, Distribution Channel, Market Share and Forecast, 2022-2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Colombia Baby Food Market Report Overview

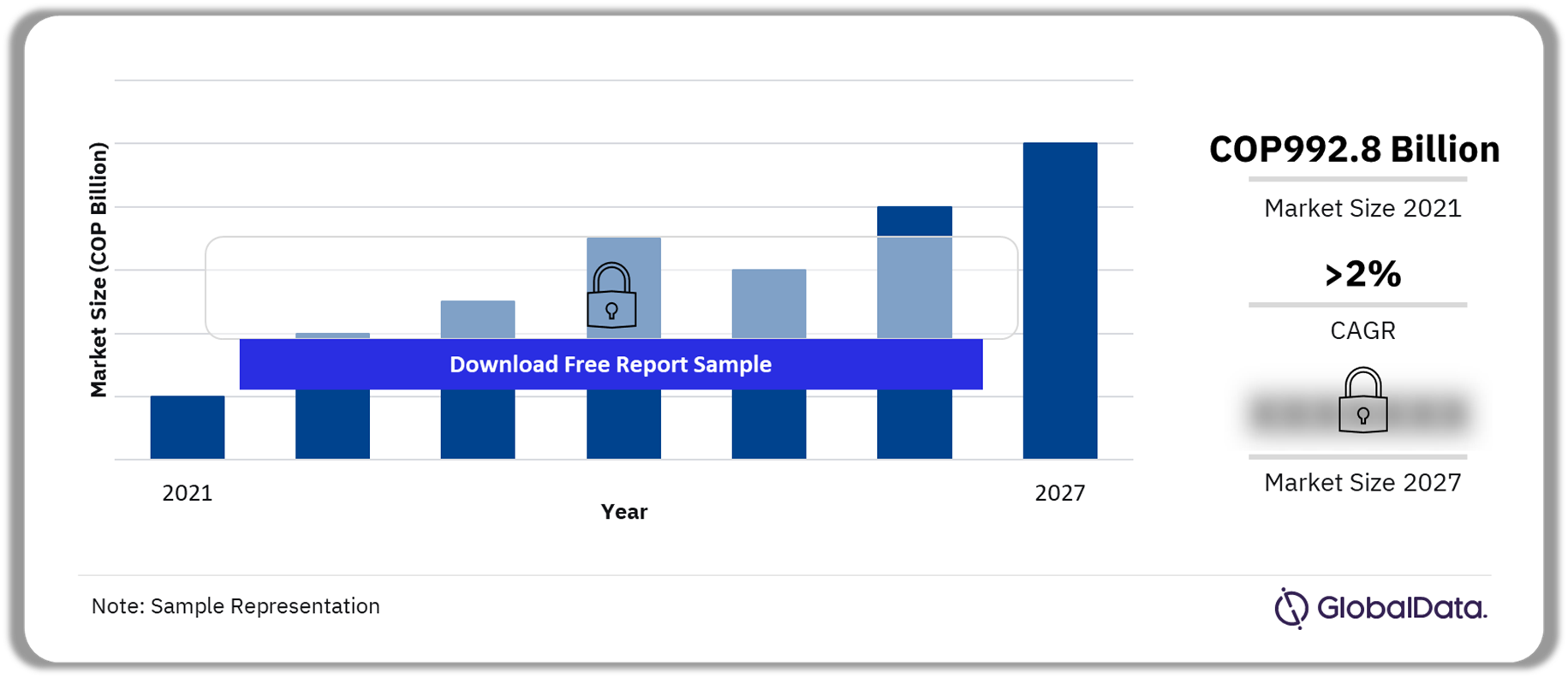

The Colombia baby food market size was valued at COP992.8 billion in 2021 and is expected to grow at a CAGR of more than 2% during 2021-2027. The Colombia baby food market outlook includes demographic and socio-economic trends to aid clients in effective decision-making.

Colombia Baby Food Market Outlook 2021-2027 (COP Billion)

Buy the Full Report for the Colombia Baby Food Market Revenue, Download a Free Report Sample

The Colombia baby food market insights cover current and future trends that will influence the baby food industry. This report collates multiple data sources to offer a comprehensive baby food sector overview in Colombia.

| Market Size (2021) | COP992.8 billion |

| CAGR (2021-2027) | >2% |

| Historical Period | 2015-2021 |

| Forecast Period | 2021-2027 |

| Key Categories | · Baby Milks

· Baby Wet Meals & Other · Baby Cereals & Dry Meals · Baby Drinks · Baby Finger Food |

| Key Distribution Channels | · Drugstores & Pharmacies

· Hypermarkets and Supermarkets · Convenience Stores · Department Stores |

| Leading Manufacturers | · Nestlé

· Abbott Laboratories · Groupe Lactalis · The Kraft Heinz Company · Mead Johnson (Reckitt Benckiser) · Alpina |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Colombia Baby Food Market Trends

Women’s participation in the Colombian workforce has been increasing steadily. In 2020, women accounted for more than 40% of the Colombian workforce. Furthermore, favorable maternity and paternity leaves are encouraging parents to cater to the critical needs of their newborns. As per the law, mothers are entitled to two 30-minute breaks a day, during work hours, to express milk to their child during the first six months following birth. The Colombian government is also planning to improve child nutrition by increasing the average duration of exclusive breastfeeding. In September 2010, the government announced a collaboration with Pfizer Nutrition for a program to improve infant nutrition. These favorable government policies will further boost the baby food demand in Colombia.

Buy the Full Report for Detailed Colombia Baby Food Trends Analysis, Download PDF

Colombia Baby Food Market Segmentation by Categories

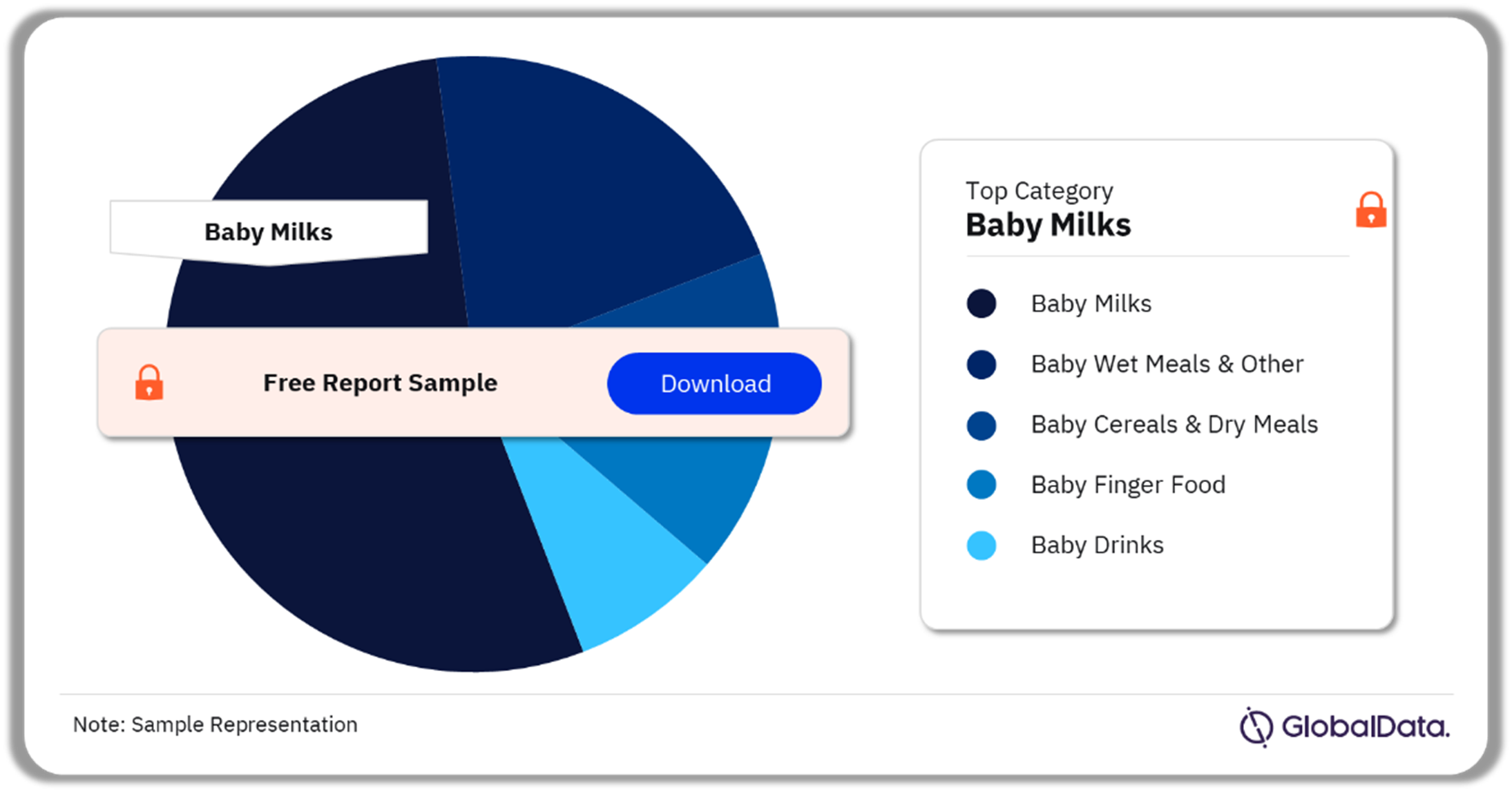

Baby milks category held the largest Colombia baby food market share in 2021

The key categories in the US baby food market are:

- Baby Milks

- Baby Wet Meals & Other

- Baby Cereals & Dry Meals

- Baby Drink

- Baby Finger Food

The baby milk category accounted for the highest Colombia baby food value in 2021. This category comprises breast milk substitutes for infants aged from birth to three years old. Products include first-stage milk, and follow-on milk, among others. The first-stage milk remained the largest segment Colombian baby milk in 2021. Manufacturers continue to launch new formulations for products, including new ingredients. In 2021, Nestlé was the sales leader in the category in terms of both value and volume.

Buy the Full Report for Categorical Colombia Baby Food Market Outlook, Download a Free Sample Report

Segments Covered in US Baby Food Market Report

Colombia Baby Food Categories Outlook (Value, COP Billion, 2015-2027)

- Baby Milks

- Baby Wet Meals & Other

- Baby Cereals & Dry Meals

- Baby Drinks

- Baby Finger Food

Colombia Baby Food Distribution Channel Outlook (Value, COP Billion, 2015-2027)

- Drugstores & Pharmacies

- Hypermarkets and Supermarkets

- Convenience Stores

- Department Stores

Colombia Baby Food Market Segmentation by Distribution Channels

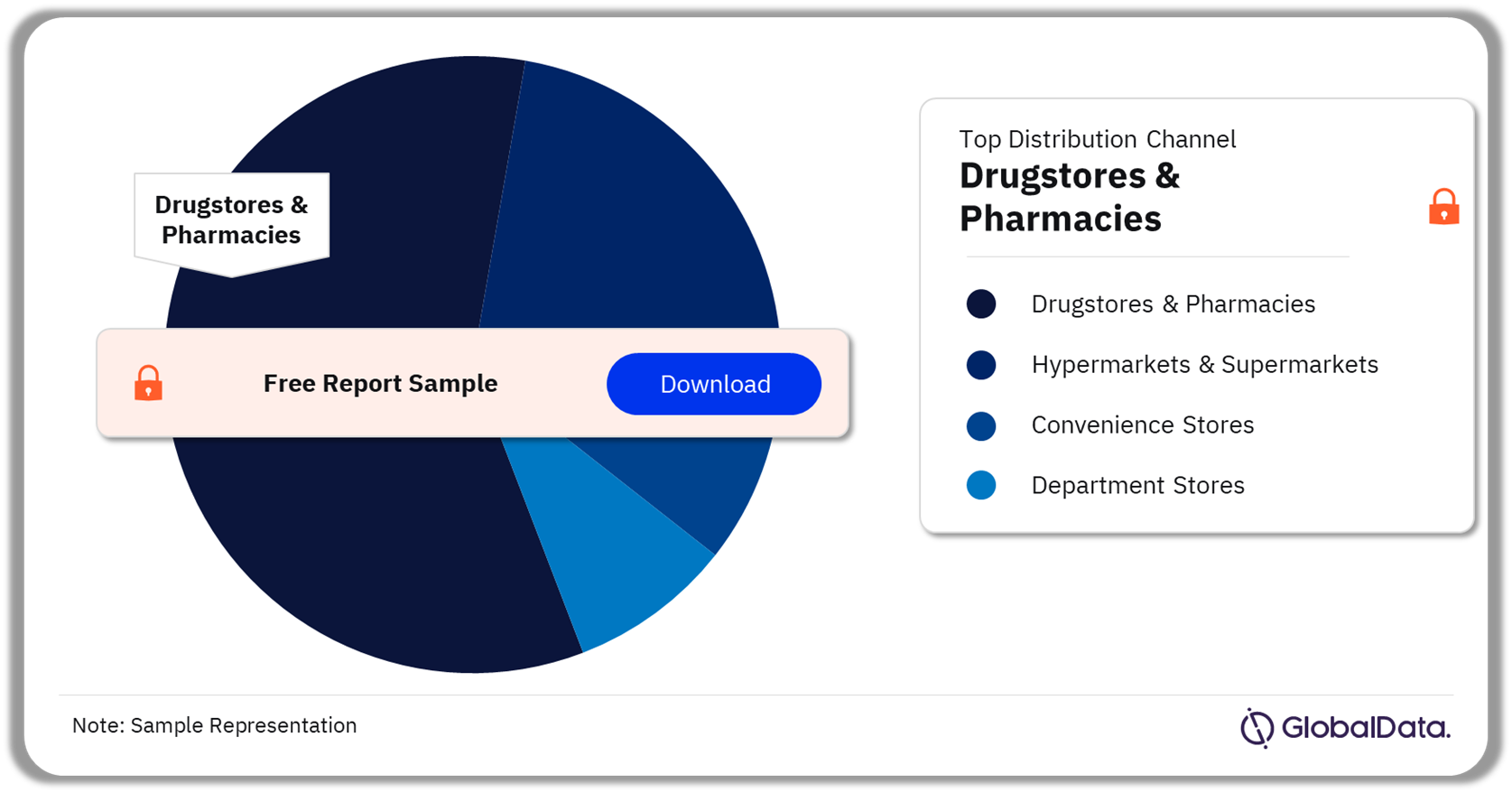

Drugstores & pharmacies dominated with the highest baby food sales in 2021

The key distribution channels in the Colombia baby food market analysis are:

- Drugstores & Pharmacies

- Hypermarkets & Supermarkets

- Convenience Stores

- Department Stores

Drugstores & pharmacies were the leading distribution channels for baby food in 2021. Colombian drugstores & pharmacy chains have been expanding aggressively. Furthermore, several foreign chains are also seeking to carve out shares in the market. Hypermarkets & supermarkets and convenience stores followed the lead among the other distribution channels.

Buy the Full Report for Colombia Baby Food Market Insights by Distribution Channels, Download PDF Sample

Colombia Baby Food Market - Competitive Landscape

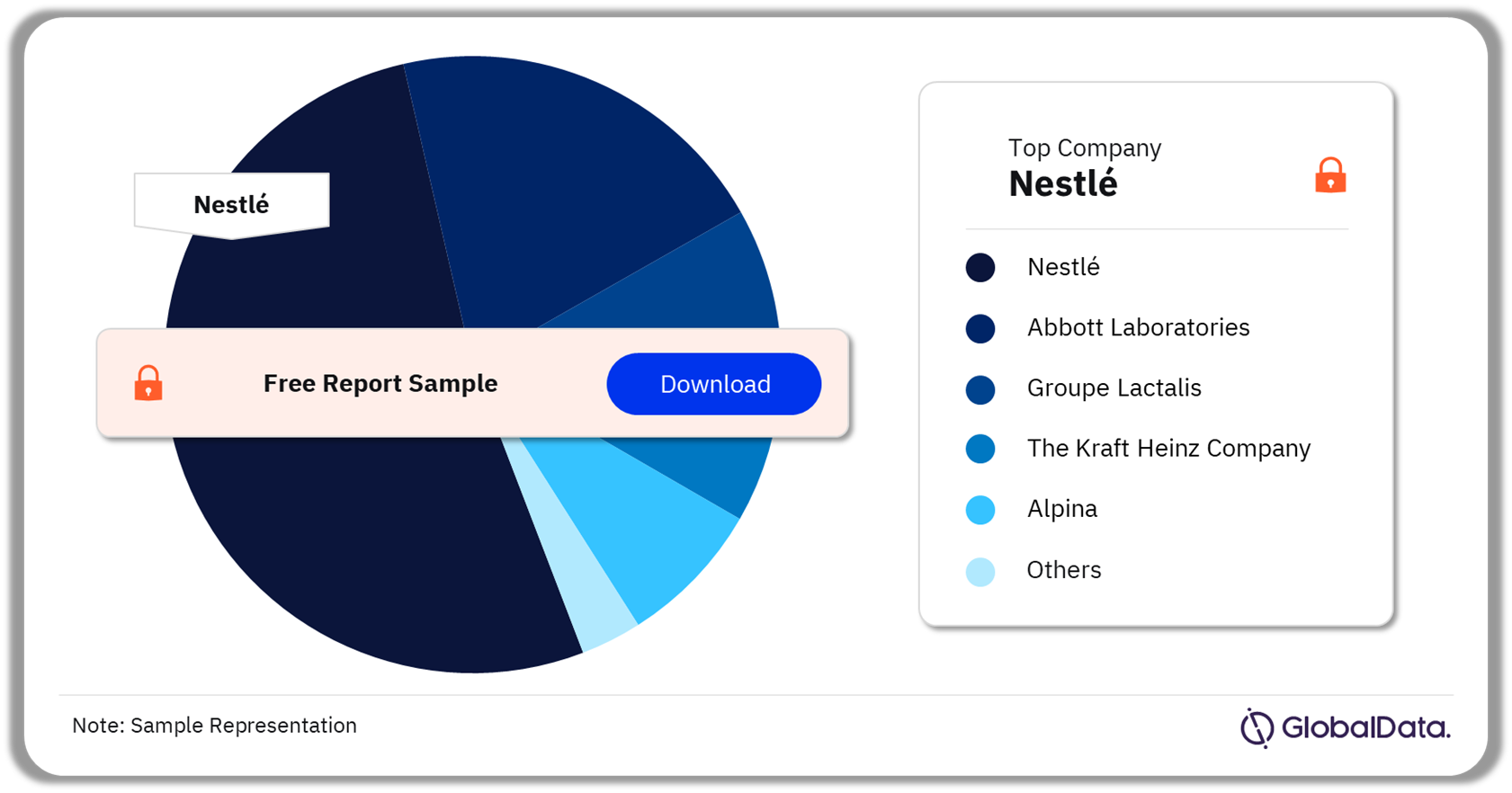

Nestlé was the leading baby food manufacturer in Colombia during 2021

The leading Colombian baby food companies are:

- Nestlé

- Abbott Laboratories

- Groupe Lactalis

- The Kraft Heinz Company

- Mead Johnson (Reckitt Benckiser)

- Alpina

Nestlé garnered the highest Colombian baby food market share both in value and volume in 2022. Abbott Laboratories and Groupe Lactalis followed the lead among other baby food companies. Nestlé offers baby food products across its key brands including Nestogeno, Nan, Klim, Alfaré, Gerber, and Althéra.

Buy the Full Report for the Colombia Baby Food Manufacturers, Download a Free Sample Report

Scope

This report provides:

- Consumption data based upon a unique combination of industry research, fieldwork, market sizing work. In-house expertise to offer extensive trends and dynamics data affecting the industry.

- Detailed company profiles considering their entry in the baby food industry with key product sectors.

- Market profile of the various product sectors with their key features & developments. Extensive insights about product segmentation, per capita trends, and the various manufacturers & brands.

- Baby food industry retailing overview with company revenues along with the distribution channel insights.

- Future projections considering various baby food market trends that are likely to affect the industry.

Reasons to Buy

- Evaluate important changes in consumer behavior and identify profitable markets and areas for product innovation.

- Analyse current and forecast behavior trends in each category to identify the best opportunities to exploit.

- Understand individual product category consumption to align your sales and marketing efforts with the latest trends in the market.

- Investigate which categories are performing the best and how this is changing market dynamics.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Colombia baby food market size in 2021?

The baby food market size in Colombia was valued at COP992.8 billion in 2021.

-

What is the Colombia baby food market growth rate?

The baby food market in Colombia will grow at a CAGR of more than 2% during 2021-2027.

-

Which was the leading category in the Colombia baby food market in 2021?

Baby milks was the leading category in the Colombia baby food market in 2021.

-

Which was the dominant distribution channels of the Colombia baby food market in 2021?

Drugstores & pharmacies held the largest Colombia baby food market share in 2021.

-

Which are the leading baby food market manufacturers in Colombia?

The leading manufacturers in the Colombia baby food market are Nestlé, Abbott Laboratories, Groupe Lactalis, The Kraft Heinz Company, Mead Johnson (Reckitt Benckiser), and Alpina.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.