Costa Rica Insurance Industry – Key Trends and Opportunities to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

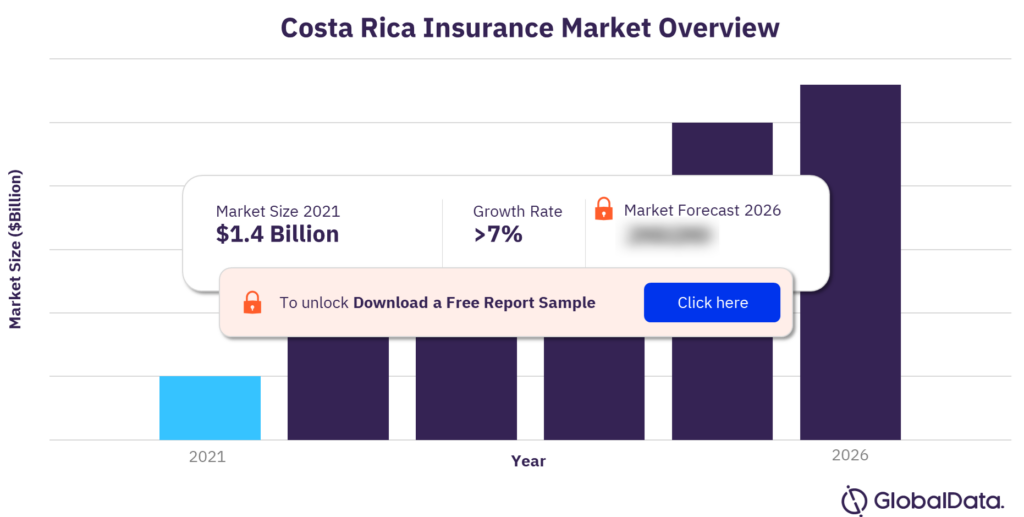

Costa Rica Insurance Market Overview

The gross written premium of Costa Rica insurance industry was $1.4 billion in 2021. The market is expected to grow at a rate of more than 7% during the period 2020 to 2026. The Costa Rica Insurance Industry research report provides in-depth market analysis, information, insights, and a detailed outlook by product category of the industry. It provides values for key performance indicators such as gross written premium, penetration, premium accepted and ceded, profitability ratios, and premium by line of business, during the review period and forecast period.

The report also analyzes distribution channels operating in the segment, gives a comprehensive overview of the Costa Rican economy and demographics, and provides detailed information on the competitive landscape in the country. The report gives insurers access to information on segment dynamics and competitive advantages, and profiles of insurers operating in the country. The report also includes details of insurance regulations, and recent changes in the regulatory structure.

Costa Rica insurance market overview

For more insights on this report, download a free report sample

Key Costa Rica Insurance Industry Trends

Tin Leg Travel Insurance introduced a new travel insurance product to offer the best possible protection from the COVID-19 pandemic. Tin Leg Silver is a new policy that offers extensive cancellation and medical benefits connected to the COVID-19 pandemic, as well as delay benefits that may match the admission requirements that some nations, such as Costa Rica, have set in the light of the pandemic.

AIG Travel introduced optional lodging expense coverage for travelers excluded from boarding a commercial aircraft back to the US as a result of receiving a positive COVID-19 test. Residents of the United States and the District of Columbia who travel to Costa Rica will have access to a customized version of the Lodging Expense Bundle to meet the country’s new entry requirement that US-based visitors obtain and show proof of a travel insurance policy that covers up to a certain amount in lodging expenses.

Key Costa Rica Insurance Industry Segments

The key segments of the Costa Rica insurance industry are life insurance and general insurance. The general insurance segment dominates the market. Motor insurance was the largest sub-segment of the general insurance segment in 2021, followed by liability and property insurance. Marine, aviation and transit (MAT) insurance was the fastest-growing line of business within general insurance. Commercial general insurance is made up of property insurance, liability, financial lines, and MAT. Retail general insurance consists of motor insurance.

Costa Rica insurance industry analysis, by key segments

For more key segment insights, download a free report sample

Key Costa Rica Insurance Industry Companies

Some of the key insurance companies in Costa Rica insurance industry are Instituto Nacional de Seguros, ASSA Compania de Seguros SA., Pan American Life Insurance de Costa Rica SA, Aseguradora Del Istmo (Adisa) SA, Seguros del Magisterio SA, Mapfre Seguros Costa Rica, SA, Qualitas Compania de Seguros, Oceanica de Seguros, and Best Meridian Insurance Company.

Market Report Overview

| Market size (2021) | $1.4 billion (GWP) |

| Growth Rate (2020 to 2026) | >7% |

| Key segments | Life Insurance and General Insurance |

| Key companies | Instituto Nacional de Seguros, ASSA Compania de Seguros SA., Pan American Life Insurance de Costa Rica SA, Aseguradora Del Istmo (Adisa) SA, Seguros del Magisterio SA, Mapfre Seguros Costa Rica, SA, Qualitas Compania de Seguros, Oceanica de Seguros, and Best Meridian Insurance Company |

Scope

This report provides:

- Comprehensive analysis of the Costa Rica insurance industry.

- Historical values for the Costa Rican insurance industry for the report’s review period and projected figures for the forecast period.

- A detailed analysis of the key categories in the Costa Rican insurance industry, and market forecasts to 2026.

- Profiles of the top life insurance companies in Costa Rica and outlines the key regulations affecting them.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to the Costa Rican insurance industry, and each category within it.

- Understand the demand-side dynamics, key market trends and growth opportunities in the Costa Rican insurance industry.

- Assess the competitive dynamics in the Costa Rican insurance industry.

- Identify growth opportunities and market dynamics in key product categories.

ASSA Compania de Seguros SA

Pan American Life Insurance de Costa Rica SA

Aseguradora Del Istmo (Adisa ) SA

Mapfre Seguros Costa Rica, SA

Qualitas Compania de Seguros

Oceanicade Seguros

Best Meridian Insurance C ompany

Table of Contents

Frequently asked questions

-

What was the Costa Rica insurance market gross written premium in 2021?

The gross written premium of Costa Rica insurance market was $1.4 billion in 2021.

-

What is the Costa Rica insurance market growth rate?

The insurance market in Costa Rica is expected to grow at a rate of more than 7% from the period 2020 to 2026.

-

What are the key segments of the Costa Rica insurance market?

The key segments of the Costa Rica insurance market are life insurance and general insurance.

-

What are the key companies in the Costa Rica insurance market?

Some of the key insurance companies in Costa Rica insurance market are Instituto Nacional de Seguros, ASSA Compania de Seguros SA., Pan American Life Insurance de Costa Rica SA, Aseguradora Del Istmo (Adisa) SA, Seguros del Magisterio SA, Mapfre Seguros Costa Rica, SA, Qualitas Compania de Seguros, Oceanica de Seguros, and Best Meridian Insurance Company.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports