Cybersecurity in Mining – Thematic Research

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

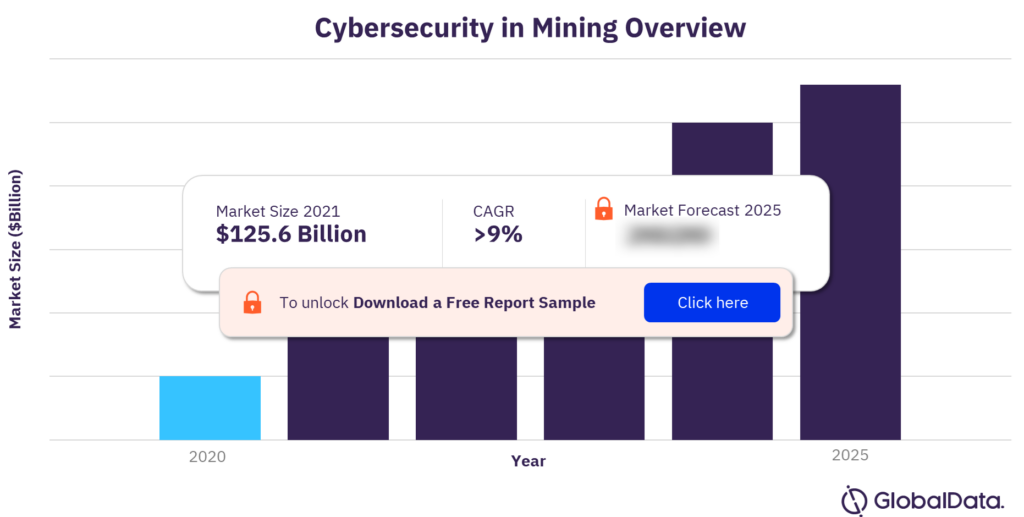

The global cybersecurity market size was $125.6 billion in 2020. The market is projected to grow at a CAGR of 9% during the period 2020-2025. Cybersecurity is the practice of defending computers, servers, mobile devices, electronic systems, networks, and data from malicious attacks. The IoT sensors, augmented reality (AR) devices, autonomous vehicles, and drones that improve mining operations are equally capable of halting activity if they fall prey to cyberattacks. The operational technology (OT) networks of mining operations are particularly vulnerable to cyberattacks due to their lower security maturity than corporate networks.

Cybersecurity in mining overview

For more insights on this report, download a free report sample

What are the key value chains in cybersecurity in mining industry?

The key value chain in cybersecurity in mining industry are cybersecurity hardware, cybersecurity software, and cybersecurity services.

Cybersecurity Hardware

With chips now being used in mission-critical servers and safety-critical applications, protecting chips from cyberattacks is becoming more critical and more expensive. Systems vendors such as Apple and Amazon are increasingly designing their own chips rather than buying commercially developed devices and intellectual property (IP) created by third-party developers. These vendors are developing their own ecosystems and requirements, and security is a key concern.

Cybersecurity Software

The software element of our cybersecurity value chain comprises the following areas: identity management, network security, endpoint security, threat detection and response, cloud security, data security, email security, application security, unified threat management, and vulnerability management.

Cybersecurity Services

The services element of the cybersecurity value chain comprises the following areas: managed security services, post-breach response services, and risk and compliance services. Services are typically outsourced because of the complexity of addressing cybersecurity-related issues, such as staying on top of vulnerabilities, identifying and responding to threats, and meeting compliance requirements.

Who are the key cybersecurity adopters in the mining industry?

The key cybersecurity adopters in the mining industry are Anglo American, Antofagasta, BHP, Nippon Steel, and Rio Tinto.

Who are the key cybersecurity vendors in the mining industry?

The key cybersecurity vendors in the mining industry are Accenture, Alphabet, Check Point Software, Cisco, Cloudflare, CrowdStrike, Darktrace, Dell Technologies, Fortinet, and IBM.

Who are the key specialist cybersecurity vendors in the mining industry?

The key specialist cybersecurity vendors in the mining industry are ABB, Dragos, Malwarebytes, and Nozomi Networks.

Market report scope

| Market size (Year – 2020) | $125.6 billion |

| CAGR | >9% |

| Forecast period | 2020-2025 |

| Key value chains | Cybersecurity Hardware, Cybersecurity Software, and Cybersecurity Services |

| Key adopters | Anglo American, Antofagasta, BHP, Nippon Steel, and Rio Tinto |

| Leading vendors | Accenture, Alphabet, Check Point Software, Cisco, Cloudflare, CrowdStrike, Darktrace, Dell Technologies, Fortinet, and IBM |

| Key specialist vendors | ABB, Dragos, Malwarebytes, and Nozomi Networks |

This report provides:

- An overview of the cybersecurity value chain, case studies of cybersecurity deployments in mining, market size and growth forecasts, specialist cybersecurity vendors for mining companies, and analysis of the mining companies leading in cybersecurity adoption.

- A detailed value chain comprising the 14 segments of cybersecurity (including hardware, software, and services), with leading and specialist vendors, and leading mining adopters identified across all segments.

- Industry analysis, including forecasts and cybersecurity revenues to 2025, alongside sector-specific analysis using GlobalData’s deals, patents analytics, company filing, and hiring trends.

- An overview of M&A deals driven by the cybersecurity theme and a timeline highlighting milestones in the development of cybersecurity.

- Analysis of the leading adopters in mining, their key moves in the theme, and their position in our thematic scorecards.

- Breakdown of the key challenges in the mining industry, and how cybersecurity technologies can help to solve those challenges, including digitalization, productivity, and ESG.

Reasons to Buy

- Position yourself for success by understanding the ways in which cybersecurity can help to solve the major challenges for the mining industry, such as those of digitalization, ESG, and COVID-19.

- Identify the leading, and specialist vendors of cybersecurity solutions for the mining industry. Discover what each vendor offers, and who some of their existing clients are.

- Quickly identify attractive investment targets in the mining industry by understanding which companies are most likely to be winners in the future based on our thematic scorecard.

- Gain a competitive advantage in the mining industry over your competitors by understanding the potential of cybersecurity solutions in the future.

ABB

Accenture

Acronis

Airbus (Stormshield)

Akamai

Alert Logic

Alibaba

Alphabet (Google)

Alphabet (Siemplify)

Amazon

AMD

Analog Devices

Anglo American

AngloGold Ashanti

Antofagasta

AnyVision

Appgate

Apple

Applied Risk

Aqua Security

Arcon

AT&T

Atos

Attivo Networks

Aveva

Aware

BAE Systems

Baidu

Barracuda

Barracuda Networks

BeyondTrust

BHP

BioEnable

Blackberry

BMC Helix

Boliden

Broadcom

BT

Cadence Design Systems

Capgemini

Cato

Check Point Software

Checkmarx

China Telecom

China Unicom

CipherCloud

Cisco

Claroty

Clear Secure

Clearview

Cloudcheckr

Cloudera

Cloudflare

CloudPassage

CMITech

Code42

Cognitec

Cognizant

Contrast Security

CrowdStrike

CyberArk

Cyberbit

Cybereason

Cynet

D3 Security

Darktrace

Dashlane

Delinea

Dell Technologies

Deutsche Telekom

Dragos

Duo Security

DXC Technology

ekey

Equifax

Ermetic

Exabeam

Expanse

Extreme

EY

Eyelock

F5 Networks

FireEye

First Quantum Minerals

Forcepoint

Forescout

ForgeRock

Fortescue Metals

Fortinet

Foxpass

Fugue

Fujitsu

GitLab

HCL Technologies

Helpsystems

Herjavec Group

HID Global

Hitachi

Horizon Robotics

HPE

Huawei

IBM

IBM (Red Hat)

Idemia

iFlytek

Illumio

Ilumio

Impulse

Informatica

Infosys

Innovatrics

Intel

Invicti

iProov

Iris ID

IriusRisk

Ironscales

Ivanti

Ivanti (MobileIron)

Juniper Networks

Kairos

Kaspersky Labs

KnowBe4

KPMG

KT

Lacework

LastPass

Lockheed Martin

LogMeIn

LogMeOnce

Logrhythm

Lookout

Lumen Technologies

Malwarebytes

ManageEngine

Marsh

Marvell

Megvii

Mentor Graphics

Micro Focus

Micron Semiconductor

Microsoft

Mimecast

NCC

Netskope

Nippon Steel

Nokia

NordPass

Nornickel

Northrop Grumman

Nozomi Networks

NTT Data

NXP Semiconductors

NXT-ID

Okta

Okta

Onapsis

One Identity

OneLogIn

OneSpan

OneTrust

Oracle

Orange

Orca Security

Palantir

Palo Alto Networks

Perimeter 81

Ping Identity

Portnox

Proofpoint

PwC

Qualys

Rapid7

Raytheon BBN

Raytheon Technologies

RedSeal

Renesas

Resolver

Rio Tinto

RSA

Ruckus

SAIC

SailPoint Technologies

Samsung Electronics

SecureAuth

SecureOne

Secureworks

Securonix

SenseTime

SentinelOne

Singtel (Trustwave)

Skybox Security

Skyhigh Security

Snyk

Softbank (Arm)

SonicWall

Sophos

South32

Splunk

STMicroelectronics

Sumo Logic

Swimlane

Synopsys

Tanium

Tata Consultancy Services

Tata Steel

Tech Mahindra

Tech5

Teck Resources

Telstra

Tenable

Tessian

Thales

ThreatConnect

Threatmetrix

Threatmodeler

TitanHQ

Trellix

Trellix

Trend Micro

TrueFace.AI

Untangle

Vedanta

Veracode

Verizon

Versa

VMware

VMware

WatchGuard

Waterfall

WhiteHat Security

Wipro

Yubico

and Zscaler.

Table of Contents

Frequently asked questions

-

What was the global cybersecurity revenue in 2020?

The global cybersecurity revenue was valued at $125.6 billion in 2020.

-

What is the global cybersecurity growth rate?

The global cybersecurity market is projected to grow at a CAGR of 9% during the period 2020-2025.

-

What are the key value chains in cybersecurity in mining industry?

The key value chain in cybersecurity in mining industry are cybersecurity hardware, cybersecurity software, and cybersecurity services.

-

Who are the key cybersecurity adopters in the mining industry?

The key cybersecurity adopters in the mining industry are Anglo American, Antofagasta, BHP, Nippon Steel, and Rio Tinto.

-

Who are the key cybersecurity vendors in the mining industry?

The key cybersecurity vendors in the mining industry are Accenture, Alphabet, Check Point Software, Cisco, Cloudflare, CrowdStrike, Darktrace, Dell Technologies, Fortinet, and IBM.

-

Who are the key specialist cybersecurity vendors in the mining industry?

The key specialist cybersecurity vendors in the mining industry are ABB, Dragos, Malwarebytes, and Nozomi Networks.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.