Diamond Mining Market by Reserves and Production, Assets and Projects, Demand Drivers, Key Players and Forecast to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Empower your strategies with our Global Diamond Mining to 2026 report and make more profitable business decisions.

Diamond Mining Market Report Overview

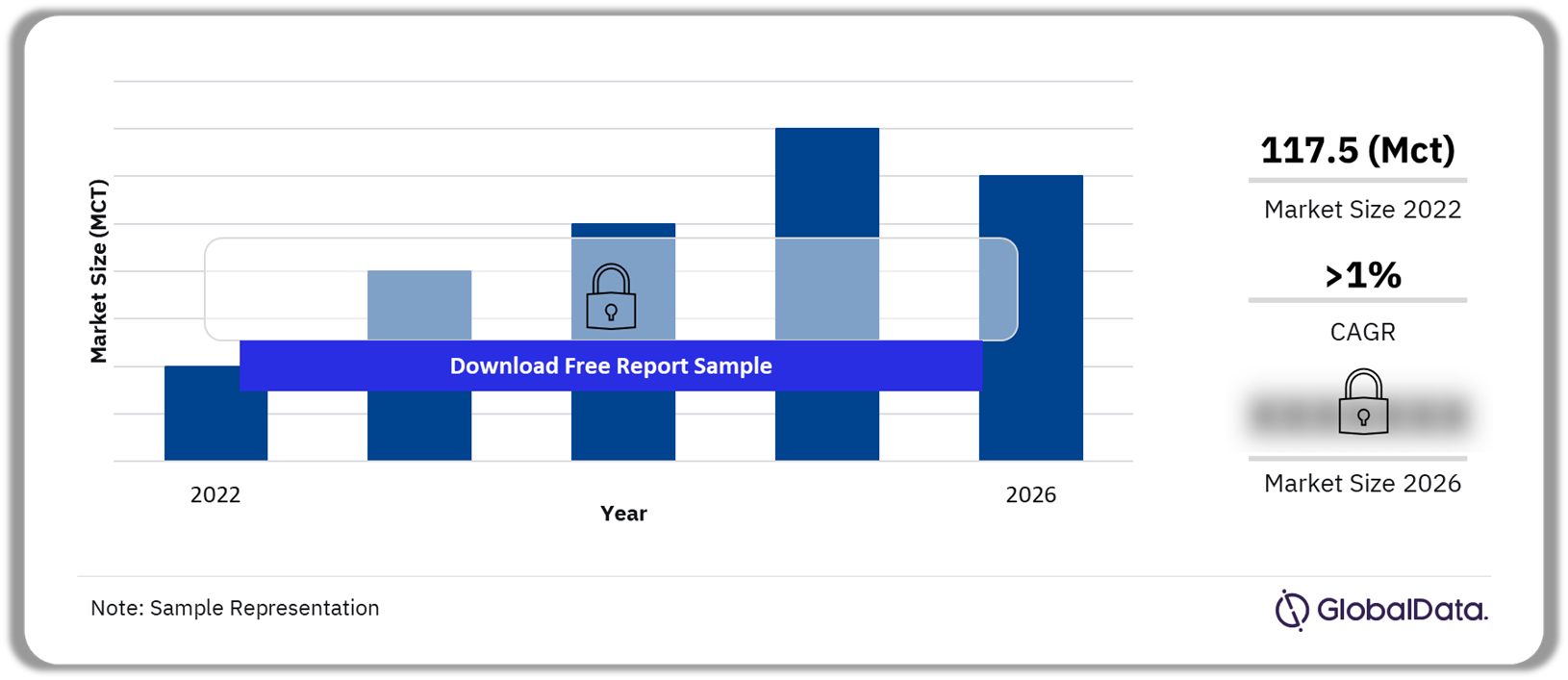

The rough diamond production was estimated at 117.5 million carats (Mct) in 2022, primarily due to natural depletion of existing deposits and a lack of new capacity additions.

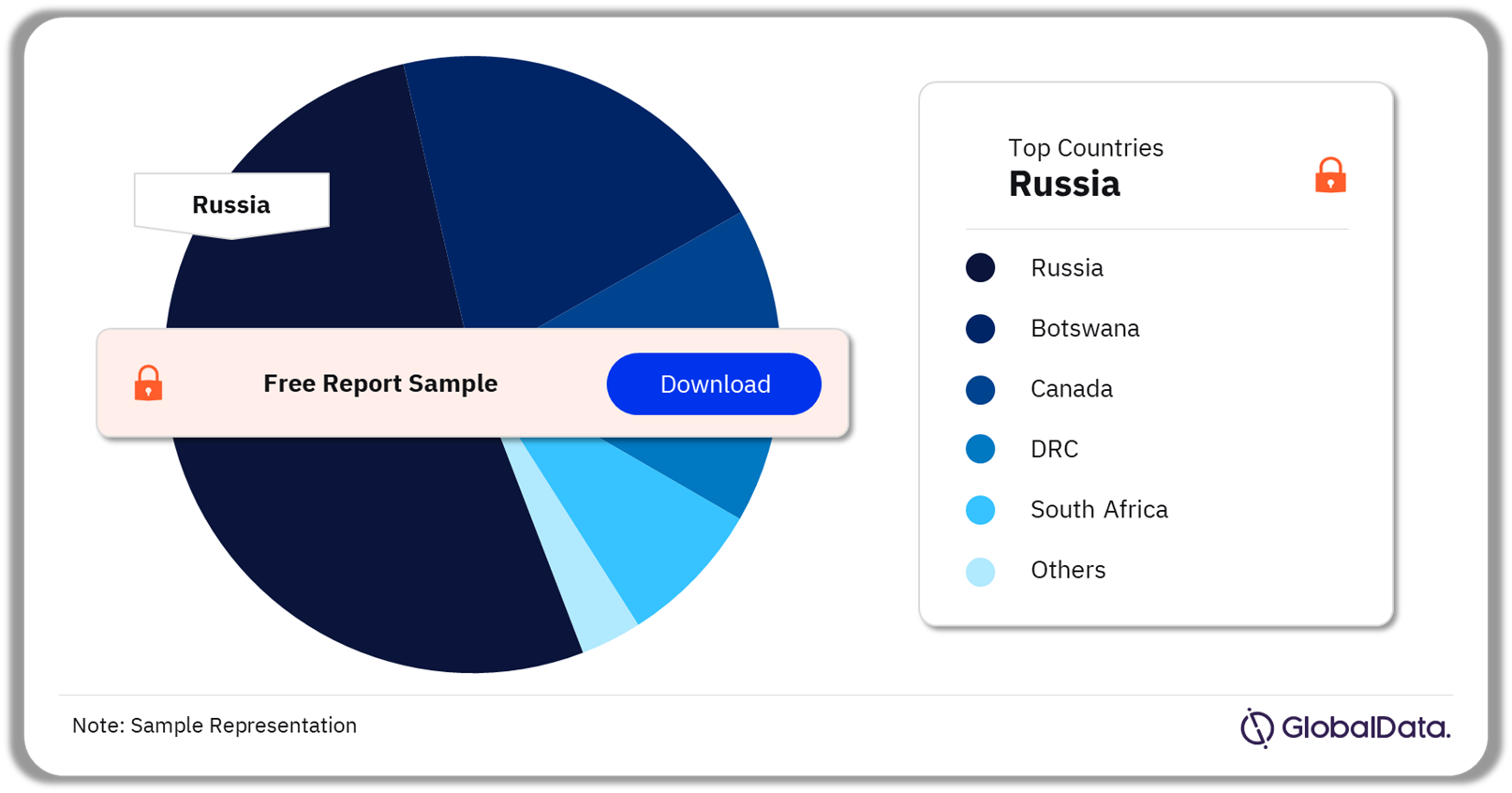

As of January 2022, global diamond reserves stood at 1.8 billion carats (Bct). Russia, Botswana, the DRC and South Africa collectively accounted for more than 92% of the global share. Major discoveries in Russia, Botswana and South Africa has resulted in an increase in global reserves in the recent years. Orapa, Jwaneng, Udachny, Catoca, and Ekati are amongst the largest diamond reserves in the world.

Diamond Mining Market Outlook, 2022-2026 (Mct)

Buy the Full Report to Gain More Information about the Diamond Mining Market Forecast, Download A Free Report Sample

The diamond mining market research report contains an overview of the global diamond mining industry including key demand-driving factors affecting the industry. It provides detailed information on reserves, reserves by country, production, production by country, production by the company, major operating mines, competitive landscape, and major exploration and development projects.

| Market Size in terms of Volume (2022) | 117.5 million carats (Mct) |

| Forecast Period | 2023-2026 |

| Historic Period | 2016-2022 |

| Key Countries | Russia, Botswana, Canada, DRC, South Africa, Angola, and Others. |

| Active Mines | Jwaneng Mine, Gahcho Kue Project, Venetia Mine, Udachny Mine, and Cullinan Mine |

| Exploration Projects | Jay Project, Venetia Underground Project, Karowe Expansion Project, Mazaruni River Project, and Luele Project |

| Development Projects | Lomonosov Pipe Project, Kennady North Project, WO Property, IGE Tshikapa Project, Tonguma Project, and Bunder Project |

| Leading Producers | Alrosa, Anglo American, Rio Tinto and Petra Diamonds Ltd |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Diamond Mining Market Dynamics

Russia was the world’s largest producer in 2022. However, the diamond industry was impacted by ongoing regional political tensions and international sanctions imposed on certain Russian mining companies. Following the invasion of Ukraine by Russia, the US and, more recently, the UK imposed sanctions on Alrosa and banned diamond imports from the country. These sanctions prevent the company from obtaining financing and, as a result, from making payments through sanctioned banks. Along with ongoing economic pressures, a lack of new capacity additions will have an impact on Russia’s diamond production over the forecast period. Additionally,

major discoveries in Russia, Botswana and South Africa has resulted in an increase in global reserves in the recent years.

However, with ongoing economic uncertainty in the US, such as inflation, and rising COVID cases in China, demand for polished diamonds in 2023 is expected to be lower than in 2022.

Buy the Full Report for More Insights on the Diamond Mining Market Drivers, Download A Free Sample Report

Diamond Mining Market Segmentation by Countries

The leading countries in the diamond mining market in terms of production are Russia, Botswana, Canada, DRC, South Africa, Angola, and Others. Russia was the leading producer of diamond in 2022. Russia, Botswana, Canada, and the DRC are the world’s largest diamond producers, , together accounting for more than 77% of total diamond production in 2022.

Diamond Mining Market Analysis by Countries, 2022 (%)

Buy the Full Report for More Country Insights Into The Diamond Mining Market, Download A Free Report Sample

Diamond Mining Market – Key Assets

Active Mines – Some of the key active diamond mines are Jwaneng Mine, Gahcho Kue Project, Venetia Mine, Udachny Mine, and Cullinan Mine among others.

Development Projects – Some of the key diamond development projects are Jay Project, Venetia Underground Project, Karowe Expansion Project, Mazaruni River Project, and Luele Project among others.

Exploration Projects – Some of the key diamond exploration projects are Lomonosov Pipe Project, Kennady North Project, WO Property, IGE Tshikapa Project, Tonguma Project, and Bunder Project among others.

Buy the Full Report for More Asset Insights into the Diamond Mining Market, Download A Free Report Sample

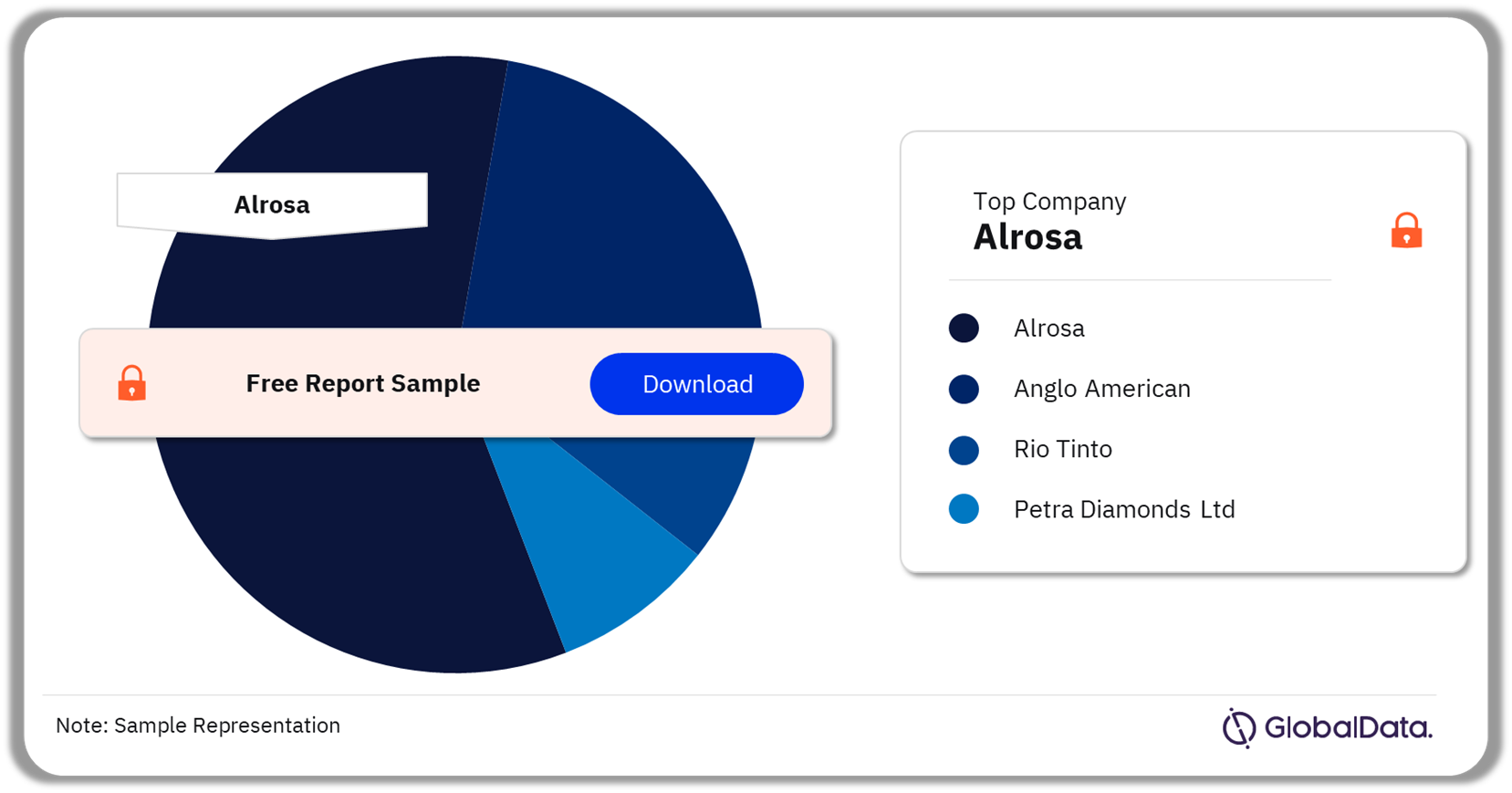

Diamond Mining Market – Competitive Landscape

Some of the leading diamond producing companies are Alrosa, Anglo American, Rio Tinto and Petra Diamonds Ltd among others. In 2022, Alrosa dominated the diamond mining market share, followed by Anglo American, Rio Tinto and Petra Diamonds Ltd respectively in terms of production.

Diamond Mining Market Analysis by Companies, 2022 (%)

Buy the Full Report for More Insight On The Key Companies In Diamond Mining Market, Download A Free Sample Report

Key Segments Covered in this Report

Diamond Mining Market Country Outlook (Volume, Million Tonnes, 2016-2026)

- Russia

- Botswana

- Canada

- DRC

- South Africa

- Angola

- Others

Scope

- Reserves and Production Data: Access detailed information on reserves, reserves by country, production figures, production by country, and production by company.

- Key Players: Learn about the major players in the industry like Alrosa, Anglo American, Rio Tinto and Petra Diamonds Ltd.

- Country Insights: Discover leading diamond-producing countries such as Russia, Botswana, Canada, DRC, South Africa, and Angola.

- Project landscape: Gain insights into diamond explorational and developmental projects, as well as active mines.

Reasons to Buy

- Understand market trends: Gain a comprehensive understanding of diamond mining by exploring country-wise market dynamics, identifying key assets, and assessing the competitive landscape.

- Strategic market analysis: Navigate the industry with ease by exploring historical and forecast trends to anticipate market shifts and make forward-looking decisions.

- Forge valuable partnerships: Identify key players in the diamond mining market and access exclusive information on key stakeholders such as diamond producers, government entities, suppliers, and more.

- Uncover major projects: Dive into a detailed overview of major active, explorational, and developmental mining projects across various regions.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Diamond mining market size in 2022?

The diamond mining market production was estimated at 117.5 million carats (Mct) in 2022.

-

Which are the leading countries in terms of Diamond production?

The leading countries in terms of diamond production are Russia, Botswana, Canada, DRC, South Africa, Angola, and Others.

-

Which is the leading country in Diamond mining market?

Russia led the diamond mining market share in terms of production during 2022.

-

Which companies are the leading producers in the Diamond mining market?

Some of the leading diamond producers are Alrosa, Anglo American, Rio Tinto and Petra Diamonds Ltd.

-

Which producer held the largest Diamond mining market share in 2022?

Alrosa held the largest diamond mining market share in 2022.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.