Digital Oilfield Market Size, Share, Trends, and Analysis by Product, End-Use, Region and Segment Forecast to 2030

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insights from the ‘Digital Oilfield’ report can help:

- In evaluating market size based on product, end-use, and regional markets

- Detailed mapping of the entire value chain and its associated stages

- Country-level insights with breakdown provided for key market segments

- Potential revenue growth opportunities in product and end-use segments supported by concise qualitative commentary

- Foresee possible changing dynamics of the sector and align business strategies to capitalize on them

- List of key upcoming projects and company market ranking by key oil & gas operators

How is our ‘Digital Oilfield’ report different from other reports in the market?

- The report captures the prominent trends of the digital oilfield market space through forward-looking analysis based on product, end-use, and regions.

- Detailed segmentation by product – Hardware, Software, and Data Storage

- Detailed segmentation by end-use – Onshore and Offshore

- With more than 90+ charts, the report is designed for an executive-level audience, boasting presentation quality.

- The study offers easily digestible market content with intelligence for decision-makers and executives.

- The key market participants operating within this market and their respective profiles are laid out with dedicated sections on company overview, financials, business segments, products & services, SWOT analysis, strategic initiatives, and key employees.

- The competitive landscape is thoroughly investigated while accounting for recent developments from key market vendors and their impact on the overall sector.

We recommend this valuable source of information to:

- Oil & Gas Producers

- Oilfield Service Providers

- Oilfield Equipment Manufacturers

- Automation Technology Providers

- Midstream & Downstream Producers

- Technology Leaders and Startups

- Business Development and Market Intelligence

- Investment Analysts and Portfolio Managers

- Professional Services – Investment Banks, PE/VC firms

- M&A/Investment, Management Consultants, and Consulting Firms

Get a Snapshot of the Digital Oilfield Market

Digital Oilfield Market Report Overview

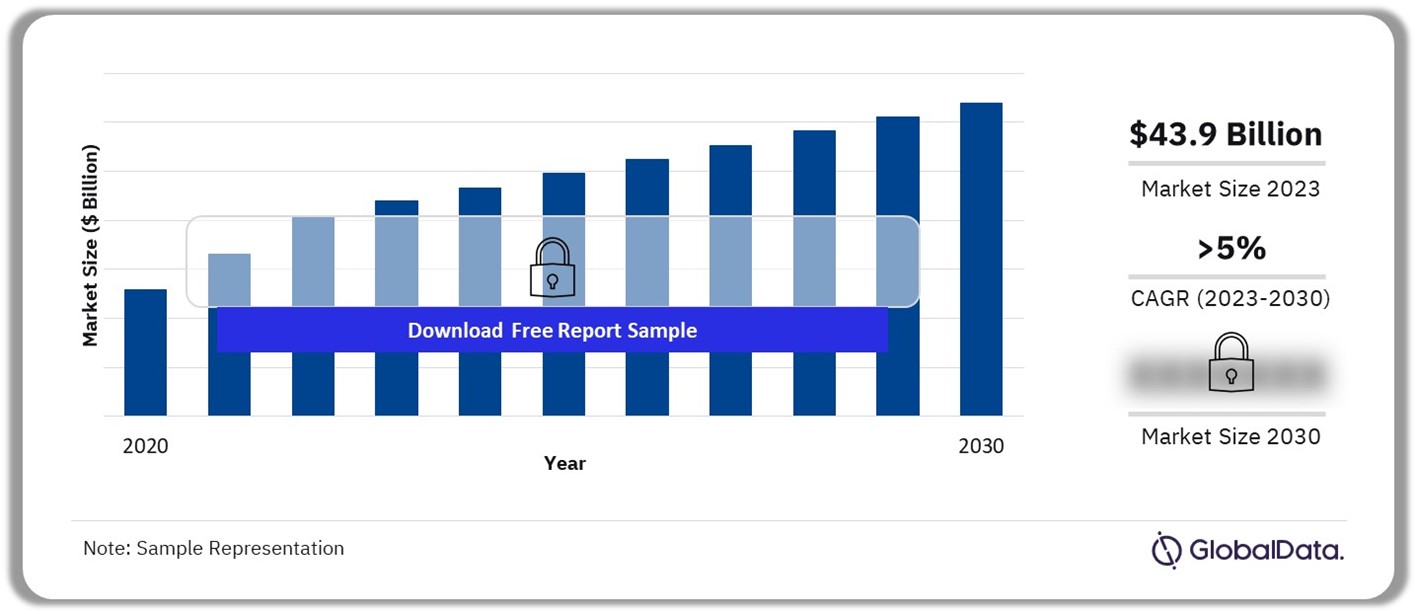

The digital oilfield market size revenue was valued at $43.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of more than 5% over the forecast period. Rapid advancements in digital technologies such as IoT, Big Data analytics, artificial intelligence (AI), machine learning (ML), and cloud computing are enabling the transformation of traditional oilfields into digital oilfields. These technologies enhance operational efficiency, optimize production processes, and enable real-time monitoring and decision-making which are key factors fueling growth over the forecast period.

The upstream oil & gas sector is a capital-intensive business and is often required to upgrade and maintain machinery to maximize the output levels. The role of sensors and connected devices is increasingly critical in enhancing the overall performance of machinery deployed on-site. They help achieve a greater degree of automation in oil & gas workflow and facilitate remote monitoring and predictive analytics to improve asset uptime. This trend of adopting technology to optimize production levels is anticipated to aid the industry growth of digital oilfields over the coming years.

Digital Oilfield Market Outlook, 2020-2030 ($Billion)

Buy the Full Report for Additional Insights on the Digital Oilfield Market Forecast

The demand for oil & gas picked up significantly in the post-pandemic era, leading to a rise in commodity prices in 2022. However, this price increment was neutralized to some extent in 2023 backed by a steady supply of oil & gas from major producing countries. The growth in commodity prices drove the investments in the upstream sector pushing the operators to adopt methods of digital transformation. For instance, in July 2023, SLB (Schlumberger Ltd.) won a five-year contract from Petrobras to deploy the enterprise wide Delfi platform.

The deployment of digital technologies from the stages of exploration to production operations has greatly reduced the economic cost and downtime for the operators, resulting in efficient operations. These technological advancements are further assisting the operators in achieving their net-zero targets via the implementation of emission monitoring systems.

Despite the ongoing drive to boost the implementation of digital technologies in the oil & gas sector, the practical approach to this innovation still lacks traction owing to several factors. One of the key factors restraining the growth is the limited availability of skilled personnel. The aging workforce and high training cost of existing manpower remain a key challenge. Hence, it is of vital interest to close the gap between the number of skilled resources required and those available.

| Market Size (2023) | $43.9 billion |

| CAGR (2023-2030) | >5% |

| Forecast Period | 2023-2030 |

| Historic Data | 2020-2022 |

| Report Scope & Coverage | Industry Overview, Revenue Forecast, Regional Analysis, Competitive Landscape, Company Profiles, Growth Trends |

| Product Segment | Hardware, Software, and Data Storage |

| End-Use Segment | Onshore, Offshore |

| Regions | North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa |

| Countries | US, Canada, Mexico, UK, Norway, Russia, Rest of Europe, China, India, Indonesia, Rest of Asia Pacific, Brazil, Argentina, Rest of Central & South America, Iraq, Saudi Arabia, UAE, Algeria, Rest of Middle East & Africa |

| Key Companies | SLB, Weatherford, Baker Hughes Co., Halliburton, NOV Inc., ABB Ltd., Emerson Electric Co., Rockwell Automation Inc., Siemens AG, Honeywell International Inc., Kongsberg Gruppen ASA, Pason Systems Inc. |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

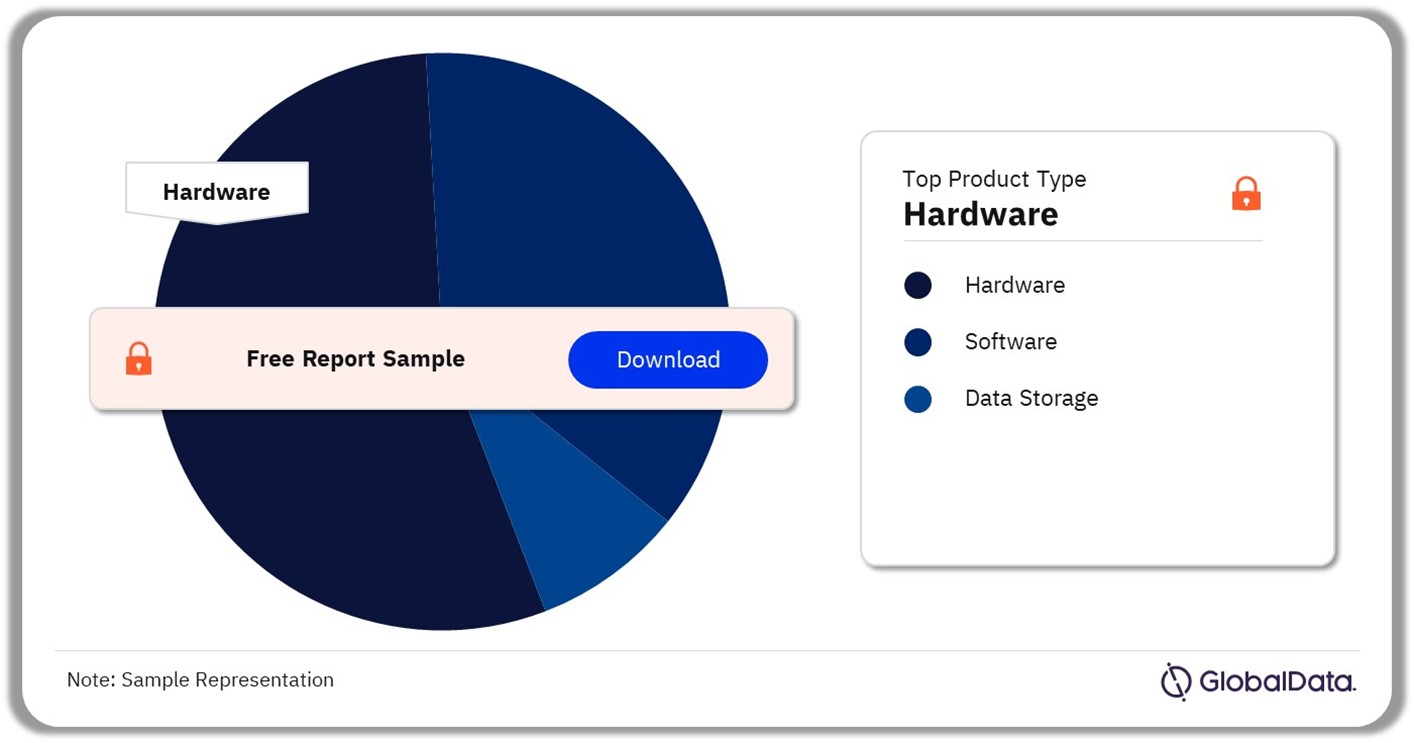

Digital Oilfield Market Segmentation by Product

The hardware product segment is projected to dominate the revenue share, accounting for nearly 55% of the market in 2023. Hardware provides support for data generation, connectivity, and data presentation, among other things. It relays information to data centers using switches, servers, routers, and storage systems, among many more, which are primarily used to monitor and process information.

Digitalized transformation, which includes remote intelligence, real-time monitoring, and extraction of insights from data, drives the industry hardware to evolve through the application of enhanced edge computing. The hardware product segment which is responsible for the surveillance and communication of data transfer in both onshore and offshore fields covers different systems and components including smart wells, distributed control systems, safety devices, wireless sensors, and others.

The software product segment is the second largest category and is primarily used to provide automation operations, which directly improves the profitability of the production process. Schlumberger, Weatherford, Halliburton, and Baker Hughes, among others, are the major players that provide software solutions to the oil and gas industry. These vendors deploy cloud-based solutions for analysis and decision-making. For instance, in 2023, Schlumberger along with AWS and Shell signed a multi-year three-way contract to offer digital workflow on a cloud-based platform. This collaboration aims to deliver cost-efficient and high-performance subsea digital solutions for Shell using OSDU Data Platform standards.

Digital Oilfield Market Share by Product Type, 2023 (%)

Buy the Full Report for More Information on Digital Oilfield Market Products

Data storage product segment forms an important part in the oil and gas industry as there is large amount of complex and confidential data that needs to be managed and secured with advanced technologies. Technology companies have expertise in cloud computing, big data, and AI, and companies such as Microsoft, Amazon, IBM, and Oracle are some of the leading enablers for data storage in digital oilfields.

Digital Oilfield Market Segmentation by End-Use

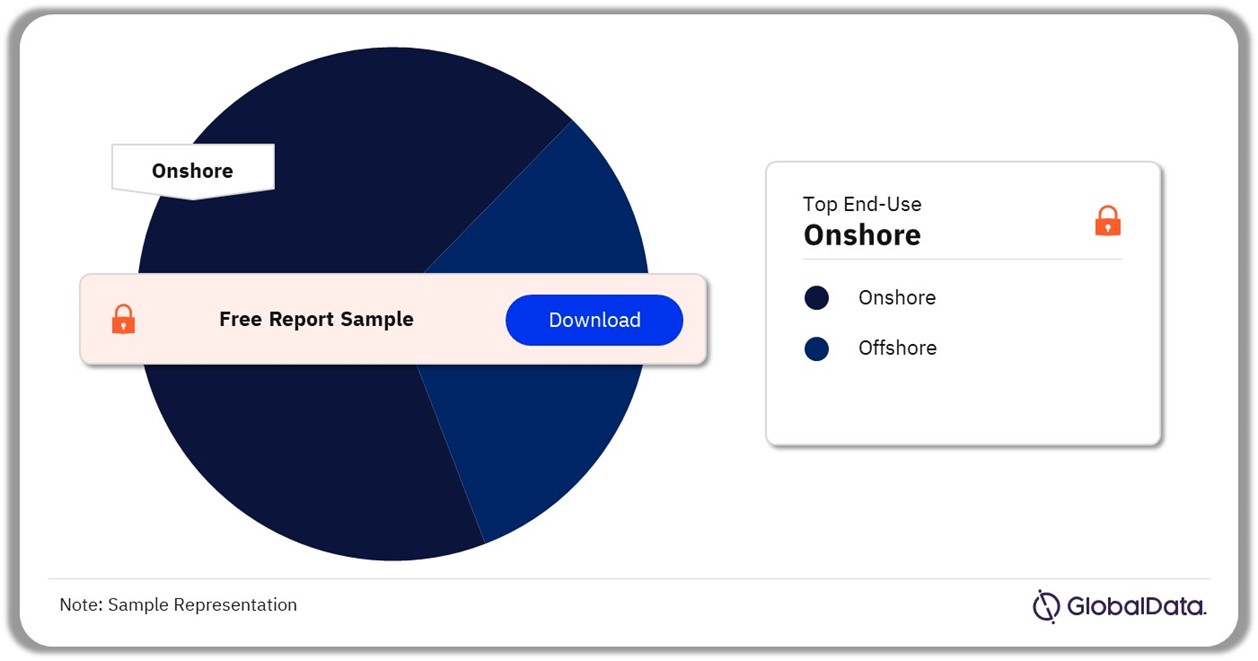

The onshore end-use segment is predicted to remain a dominant category over the predicted timelines. The implementation of digital technologies in the onshore sector observed a steady growth in the post-pandemic era mostly fueled by the rising need to expand the production output levels. In addition, the number of onshore reserves of oil & gas reserves is much higher as compared to its counterpart, pushing the overall revenue share for the onshore end-use segment in 2023.

Currently, the primary focus of industry vendors in the oil and gas industry is on improving remote operations by deploying sensors to relay information from wide-ranging equipment and infrastructure to onshore command centers. This has led to the rising deployment of digital services particularly in the onshore fields of North America and the Middle East & Africa region. To capitalize on this trend, Honeywell International in July 2023 launched a safety and security tool to safeguard and automate operations from the wellhead to the command center.

Digital Oilfield Market Share by End-Use, 2023 (%)

Buy the Full Report for More Information on Digital Oilfield Market End-Use

The offshore end-use segment is predicted to remain the fastest growing category, registering a compounded annual growth rate of 6.1% over the forecast period. This growth is primarily attributed to the rising demand for offshore electrification in an attempt to curb carbon dioxide emissions. For instance, in March 2022, ABB was awarded the part-project to electrify the Oseberg oil and gas offshore field in Norway. Increasing interest from offshore operators to electrify and automate the existing assets is predicted to aid segmental growth over the coming years.

Digital Oilfield Market Analysis by Region

North America accounted for the second-largest market share and is expected to showcase the fastest growth rate over the predicted timeline owing to increasing awareness regarding the benefits of digital technologies to optimize operations in mature economies such as the US. The US dominated the digital oilfield sector in the North America region in 2023, accounting for over 74% of the regional share and the trend is expected to prevail over the forecast period.

Middle East & Africa emerged as the largest regional market in 2023, owing to the increasing number of investments in the oil & gas industry, coupled with rising technology adoption by the key oil & gas companies in the region. The industry participants are emphasizing enhancing their oil production and exploring previously untapped resources. Saudi Arabia dominated the digital oilfield market in the Middle East & Africa in 2023, accounting for over 33% of the regional share.

The presence of growing economies including China, Indonesia, and India with significant oil & gas demand is expected to boost the avenues for the digital oilfield industry in the Asia Pacific. Several regional vendors are forming collaborations with international players to uplift digital innovation. For instance, PTTEP in Thailand Collaborated with Halliburton in August 2023 for the development of a digital transformation solution for the energy sector of Thailand, Vietnam, and Malaysia. Similar activities have been observed in Oceania, which is further expected to gain momentum over the forecast period.

Digital Oilfield Market Share by Region, 2023 (%)

Buy the Full Report for Regional Insights into the Digital Oilfield Market

Europe remains the third-largest regional market and is expected to grow at a compounded annual growth rate of 5.2% over the forecast period. The regional dynamics indicate high digital technology penetration in the offshore fields of Norway. Norway is one of the largest exporters of oil in the region with approximately 95 active offshore fields. The country is swiftly moving towards a renewable form of energy and thus, the prospects for digital oilfields have reduced in the past few years.

The smallest regional share was captured by the Central & South America region in 2023. The regional dynamics are dominated by Brazil with a share of more than 47% in 2023. The development of new offshore platforms in Brazil is predicted to generate new avenues for development, particularly for digital transformation technologies. For instance, in September 2023, Petrobras announced that it planned to deploy 11 new production offshore platforms in Brazil. The company further envisions to invest over $64 billion in exploration and production activities.

Digital Oilfield Market – Competitive Landscape

The key players in the digital oilfield industry have a presence throughout the value chain, which helps position them at the forefront. The companies are categorized based on five key segments: devices and equipment; connectivity; data analytics; visualization tools; and oilfield services.

The digital oilfield sector is highly competitive in nature with an increasing number of market participants offering diverse solutions ranging from cloud-based asset management solutions to EPC contracts. In addition, the market vendors are forming joint partnerships to develop new digital solutions for the oil & gas sector.

The recent trends in the industry suggest further penetration of digital oilfield technology at an upstream level of the value chain to enhance the profit margins while reducing costs and increasing safety for the workers. According to the Association for Supply Chain Management (ASCM), Chevron is leveraging the digital twin technology for predictive maintenance purposes in its oilfields. The company is expected to use sensor-based systems for its high-value field equipment to enable cost savings and reduce breakdown incidents. The increased adoption within the upstream sector of oil and gas is projected to greatly influence the deployment as well as penetration of digital oilfield technologies over the forecast period.

Leading Companies in the Digital Oilfield Market

- SLB

- Weatherford

- Baker Hughes Co.

- Halliburton

- NOV Inc.

- ABB Ltd.

- Emerson Electric Co.

- Rockwell Automation Inc.

- Siemens AG

- Honeywell International Inc.

- Kongsberg Gruppen ASA

- Pason Systems Inc.

Other Digital Oilfield Market Vendors Mentioned

Oceaneering International, Inc., Subsea7, Schneider Electric, eDrilling, Quorum Business Solutions, Inc., Oleumtech, Petrolink, Katalyst Data Management, and IBM, among others.

Buy the Full Report to Know More About Leading Digital Oilfield Companies

Digital Oilfield Market Segments

GlobalData Plc has segmented the digital oilfield market report by product, end-use, and region:

Digital Oilfield Market Product Outlook (Revenue, $Million, 2020-2030)

- Hardware

- Software

- Data Storage

Digital Oilfield Market End-Use Outlook (Revenue, $Million, 2020-2030)

- Onshore

- Offshore

Digital Oilfield Market Regional Outlook (Revenue, $Million, 2020-2030)

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Norway

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Indonesia

- Rest of Asia Pacific

- Central & South America

- Brazil

- Argentina

- Rest of Central & South America

- Middle East & Africa

- Iraq

- Saudi Arabia

- UAE

- Algeria

- Rest of Middle East & Africa

Scope

The market intelligence report provides an in-depth analysis of the following –

• Digital oilfield market outlook: analysis as well as historical figures and forecasts of revenue opportunities from the product, end-use, and regional segments.

• The competitive landscape: an examination of the positioning of leading players in the digital oilfield market.

• Company snapshots: analysis of the market position of leading service providers in the digital oilfield market.

• Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

Key Highlights

According to GlobalData estimates, the global digital oilfield market will grow from $43.9 billion in 2023 to $63.8 billion in 2026 at a CAGR of 5.5%. One of the most detrimental factors positively aiding the market growth is the rising demand for oil & gas across the globe.

Reasons to Buy

• This market intelligence report offers a thorough, forward-looking analysis of the global digital oilfield market by product, end-use, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

• Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in digital oilfield markets.

• The report also highlights key product segments (Hardware, Software, Data Storage)

• The report also highlights key end-use segments (Onshore, Offshore)

• With more than 90 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

• The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in digital oilfield markets.

• The broad perspective of the report coupled with comprehensive, actionable detail will help oil & gas sector stakeholders, service providers, and other digital oilfield players succeed in growing the digital oilfield market globally.

Key Players

SLBWeatherford

Baker Hughes Co.

Halliburton

NOV Inc.

ABB Ltd.

Emerson Electric Co.

Rockwell Automation Inc.

Siemens AG

Honeywell International Inc.

Kongsberg Gruppen ASA

Pason Systems Inc.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the digital oilfield market size in 2023?

The digital oilfield market size was valued at $43.9 billion in 2023.

-

What is the digital oilfield market growth rate?

The digital oilfield market is expected to grow at a CAGR of more than 5% during the forecast period.

-

What is the key digital oilfield market driver?

The digital oilfield market growth is primarily driven by increasing momentum for technological adoption, emphasis on reduction of carbon footprint, increasing focus on enhancing productivity, and shift towards Industry 4.0.

-

Which was the leading product segment in the digital oilfield market in 2023?

The hardware product group accounted for the largest digital oilfield market share in 2023.

-

Which are the leading digital oilfield companies globally?

The leading digital oilfield companies are SLB, Weatherford, Baker Hughes Co., Halliburton, NOV Inc., ABB Ltd., Emerson Electric Co., Rockwell Automation Inc., Siemens AG, Honeywell International Inc., Kongsberg Gruppen ASA, and Pason Systems Inc.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.