Digital Payments Market Size, Share, Trends and Analysis by Region, Mode of Payment, Industry and Segment Forecast to 2030

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insight from the ‘Digital Payments’ report can help you:

- Make informed decisions about market entry, technology adoption, and consumer spending patterns

- Identify your competitors’ capabilities to stay ahead in the market

- Identify promising segment analysis (Mode of Payment and Industry), growth trends, regional trends, and markets to expand your regional presence, product portfolio or successful investment

- Anticipate expected changes in demand and adjust your business development strategies

How is our ‘Digital Payments’ report different from other reports in the market?

- The report presents in-depth market sizing and forecast at a segment level for more than 30 countries including historical and forecast analysis by transaction value and volume for the period 2020-2030 for market assessment

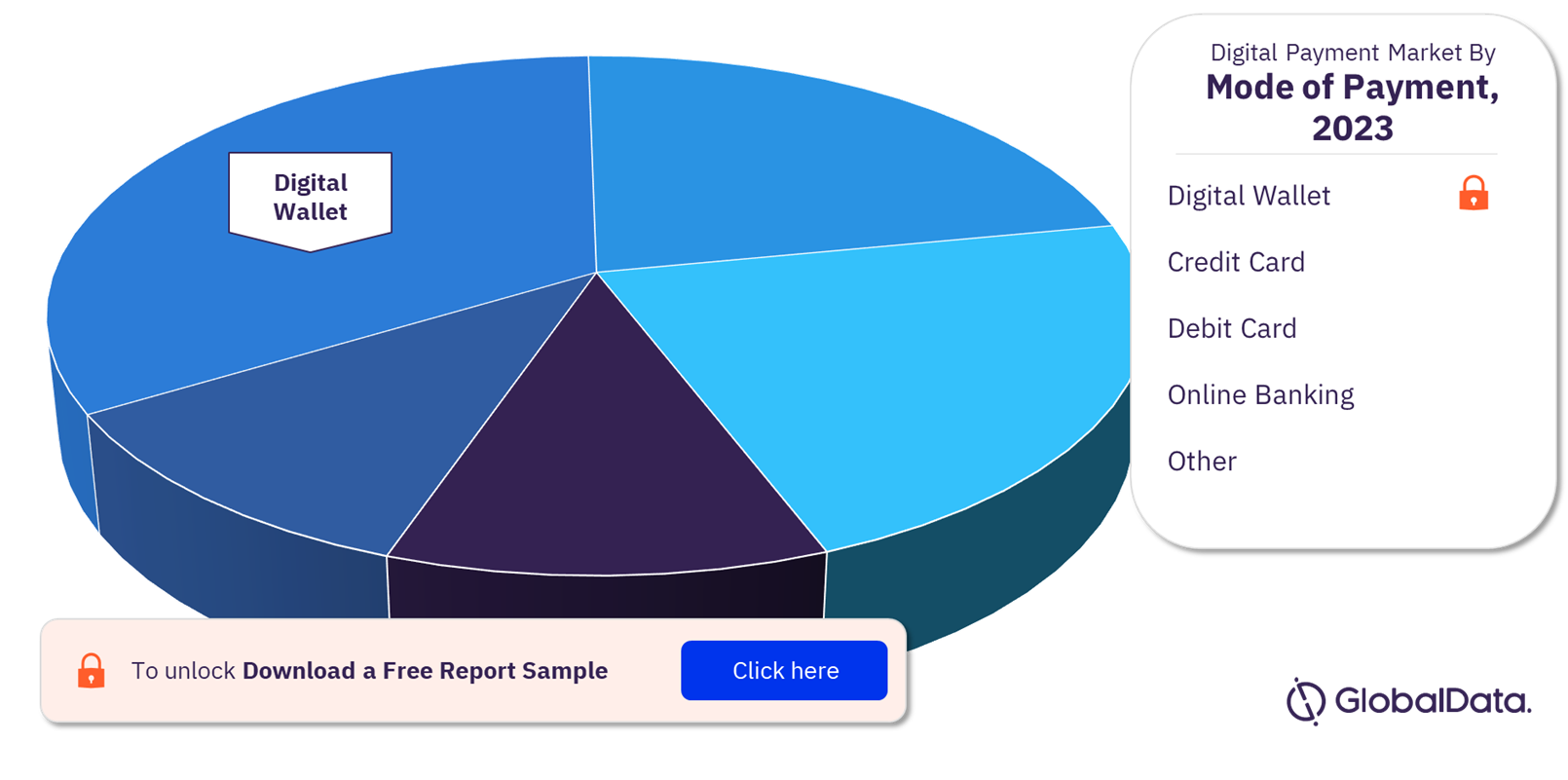

- Detailed segmentation by mode of payment – digital wallet, credit card, debit card, online banking, others

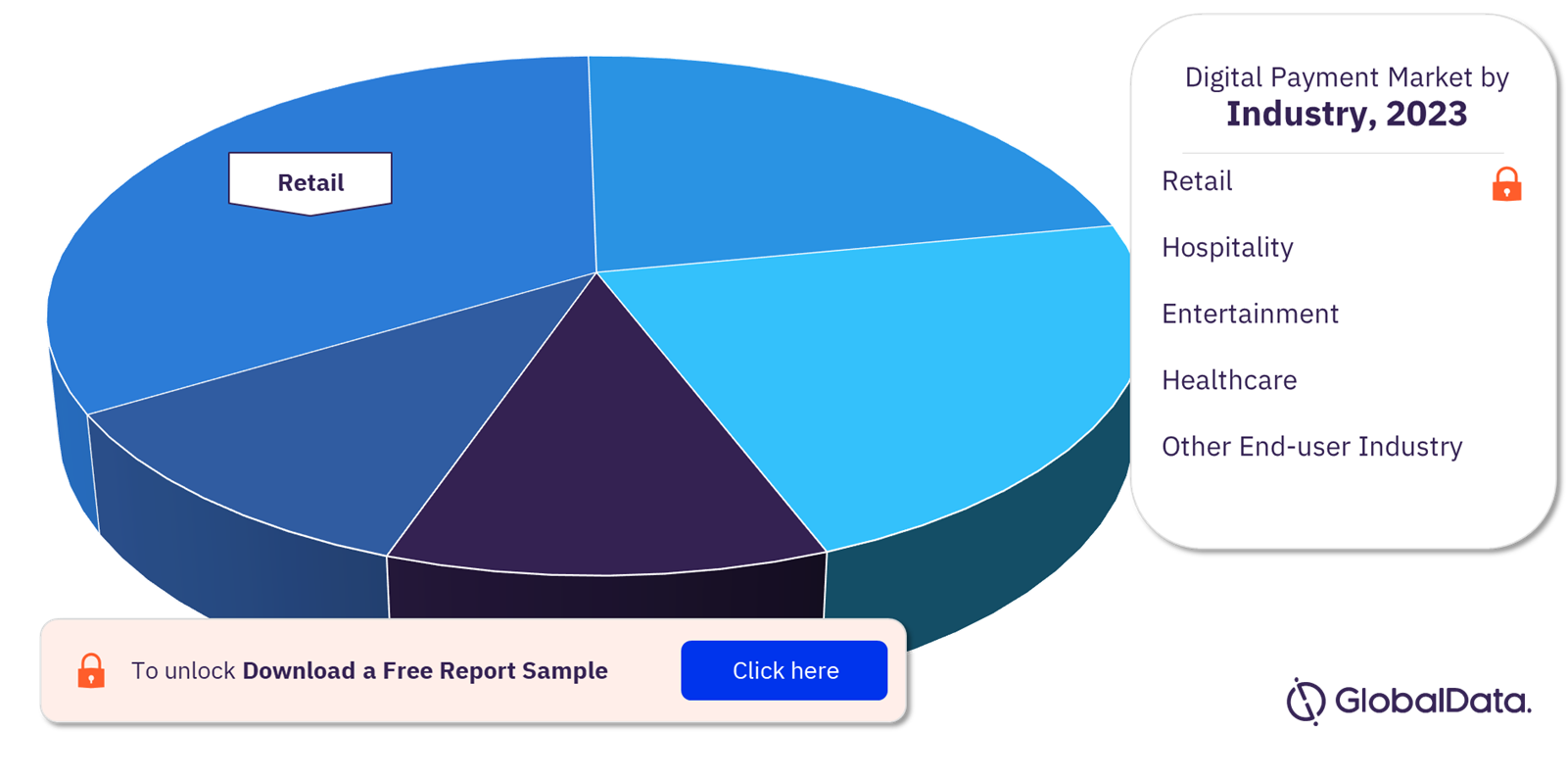

- The report highlights segmentation at industry level – retail, hospitality, entertainment, healthcare, others

- The report offers technological and regulatory trends, along with driving and challenging factors impacting the digital payments market.

- The growth innovation matrix included in the report, divides the market players into four categories i.e., flagbearers, contenders, specialists, and experimenters, which will help value chain participants in understanding how competition is performing based on their revenue growth and their R&D efforts

- The report provides an analysis of M&As, venture financing deals, patent activity, social media, and jobs in the digital payment market.

- Competitive landscape includes list of key emerging companies/technology disruptors/innovators and recent mergers & acquisitions

- Competitive profiling and benchmarking of key players in the market to provide deeper understanding of industry competition

We recommend this valuable source of information to anyone involved in:

- Digital Payments Company

- Fintech Company

- BNPL companies

- Retail Banks

- Ecommerce Companies

- Online Retailers

- Venture Capitalists

- Investment Advisors

- Consultancy Firms

- Management Consultants and Analysts

To Get a Snapshot of the Digital Payments Market Report, Download a Free Report Sample

Digital Payments Market Overview

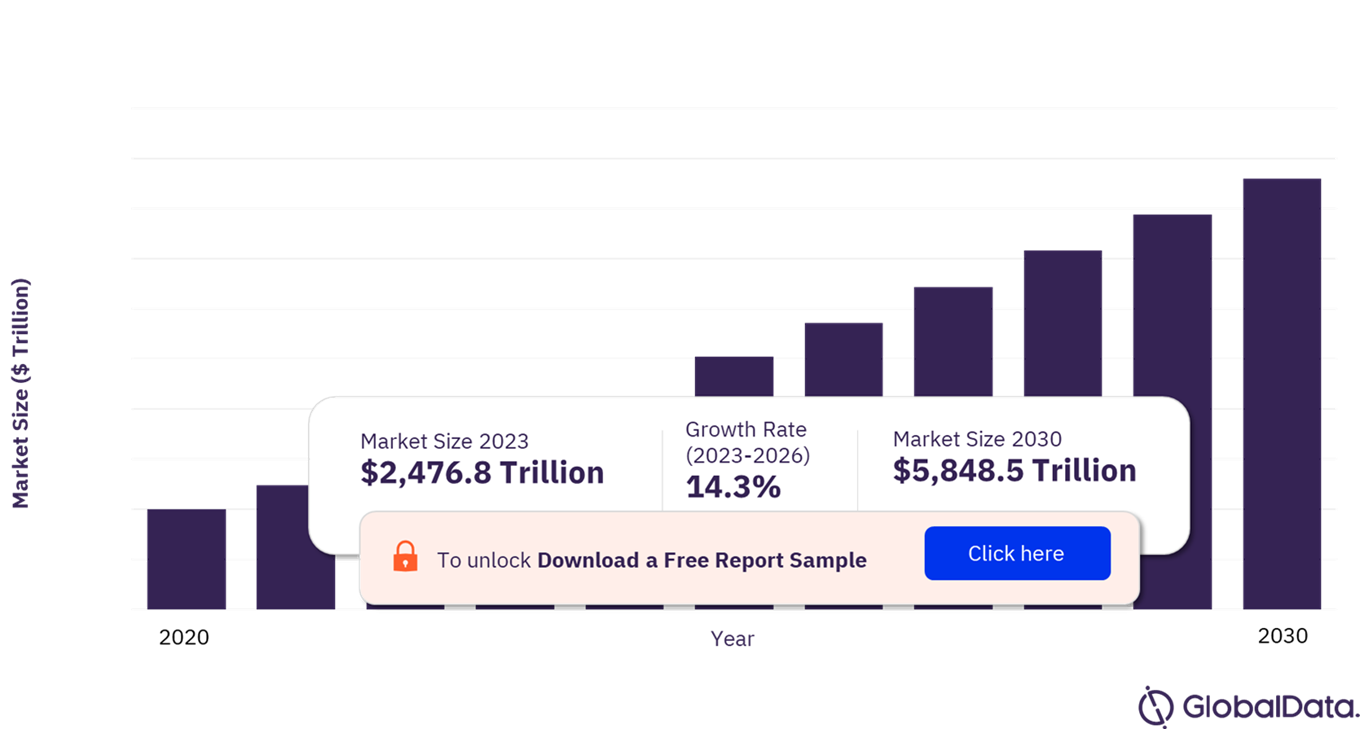

The digital payments market size will be valued at $2,476.8 trillion in 2023 and is expected to grow at a CAGR of 14.3% over the forecast period. The rise in the adoption of digital payments is expected to be propelled by a high level of convenience offered as they allow users to make transactions quickly and easily. In addition, they eliminate the need for physical cash or checks, which can be inconvenient and time-consuming to handle.

Digital Payments Market Outlook, 2020-2030 ($ Trillion)

View Sample Report for Additional Insights on Digital Payments Market Forecast, Download a Free Report Sample

Governments globally have been advocating and endorsing digital payments for several reasons, such as improving financial inclusion, minimizing cash usage, enhancing transparency, and promoting economic progress. For example, the Digital India campaign by the Government of India is aimed at transforming the country into a digital economy. One of the key components of this campaign is the promotion of digital payments through initiatives such as BHIM (Bharat Interface for Money), which is a mobile app based on UPI (Unified Payments Interface) that lets users make payments directly from their bank accounts.

The market faces significant challenges from lack of infrastructure and security concerns which are expected to impact growth over the forecast period. Digital payments require a reliable and fast internet connection, which is often lacking in many parts of the world. This makes it difficult for people in rural or remote areas to access digital payment platforms. Digital payments are also vulnerable to fraud, including identity theft, account takeover, and phishing attacks. Cybercriminals can steal user credentials, use malware to intercept transactions, or set up fake websites or apps to trick users into providing their personal and financial information.

| Market Size by Transaction Value in 2023 | $2,476.8 trillion |

| Market Size by Transaction Value in 2030 | $5,848.5 trillion |

| CAGR (2023-2030) | 14.3% |

| Forecast Period | 2023-2030 |

| Historic Data | 2020-2022 |

| Report Scope & Coverage | Revenue Forecast, Competitive Index, Company Landscape, Growth Trends |

| Mode of Payment | Digital Wallet, Credit Card, Debit Card, Online Banking, Others |

| Industry | Retail, Hospitality, Entertainment, Healthcare, Others |

| Region Coverage | North America, Europe, Asia Pacific, South & Central America, Middle East & Africa |

| Country Coverage | US, Canada, UK, France, Germany, Russia, Italy, Netherlands, Belgium, Spain, Ireland, Denmark, Finland, Poland, Sweden, China, India, Japan, South Korea, Australia, Indonesia, Singapore, Malaysia, Saudi Arabia, South Africa, Turkey, Mexico, Brazil, Colombia, Argentina, Peru |

| Key Companies | Alibaba Group Holding Ltd, American Express Co, Apple Inc, Google LLC, Mastercard Inc, PayPal Holdings Inc, Visa Inc, Discover Financial Services, ACI Worldwide Inc, Amazon.com Inc, Fiserv Inc, One97 Communications Ltd., Samsung Electronics Co Ltd, Fidelity National Information Services Inc, and The Western Union Co. |

Digital Payments Market Segmentation by Mode of Payment

Digital payments market by mode of payment, includes digital wallets, credit cards, debit cards, online banking, and others. Digital wallets are commonly used for digital payments. They offer a convenient and secure way to make transactions online or through mobile devices and store payment information. They also provide an efficient and streamlined transaction process for digital payments by storing consumers’ debit and credit cards.

Currently, digital wallets are directly linked to cards, but they pose an indirect threat to card payments as they can be linked to users’ accounts, enabling A2A and P2P transfers through real-time payment (RTP) rails or even blockchain systems for back-end processing. This has the potential to make payment transactions more efficient and cost-effective for merchants, as they would have reduced transaction fees to pay compared to card scheme providers.

Digital Payments Market Share by Mode of Payment, 2023 (%)

Fetch Sample PDF for Segment-Specific Revenues and Shares, Download a Free Report Sample

Digital payments made through credit cards have gained significant popularity as a growing number of individuals opt to make purchases online or via mobile devices. Credit cards provide numerous advantages for digital payments, such as convenience, security, and the ability to earn reward points or cashback on purchases. Credit card companies employ several security measures to safeguard against fraudulent and unauthorized transactions, with many now offering supplementary security features such as two-factor authentication, fraud alerts, and real-time transaction monitoring. Although digital payments through credit cards are convenient, there are typically associated fees such as annual fees, foreign transaction fees, or balance transfer fees.

Digital Payments Market Segmentation by Industry

Traditionally, online payments referred specifically to ecommerce, being the buying and selling of goods and services over the internet. But as internet technologies have become more pervasive and portable, more and more types of payment are moving online. Now digital payments are used in most of the industries as a primary mode of payment.

In the pursuit of maximizing revenue-generating transactions, the payments industry has traditionally been advocating for cashless societies. Efforts by governments to discourage the use of cash, such as in Italy and India where the objective is to reduce the size of the black economy and increase tax revenues from electronic payments, are supported by the payments industry. The COVID-19 pandemic has accelerated this trend, with governments and companies worldwide promoting and launching mobile payment services.

Digital Payments Market Share by Industry, 2023 (%)

Digital Payments Market Outlook Report with Detailed Segment Analysis is Available with GlobalData Now! Download a Free Report Sample

The use of digital payments in the healthcare sector is increasing to streamline payment processes, reduce administrative expenses, and improve patient satisfaction. Several healthcare providers now offer online payment portals, enabling patients to pay their bills electronically using credit or debit cards, or other digital payment options. Additionally, patients can access their billing statements, payment history, and insurance information through the online portal. With the emergence of mobile payment apps such as Apple Pay, Google Pay, or Samsung Pay, patients can now make healthcare payments through their smartphones or other mobile devices. Such apps allow patients to securely store their payment details and make payments efficiently and quickly.

Many hotels and other hospitality businesses offer online booking and payment systems, allowing customers to carry out bookings and make payments digitally. This proves to be more convenient for customers and helps businesses to reduce administrative costs. Contactless payment methods such as Near Field Communication (NFC) or Quick Response (QR) codes are becoming more popular in the hospitality industry, allowing customers to make payments without physically touching a payment terminal. This helps to reduce the risk of transmitting viruses or other pathogens and are more convenient for customers.

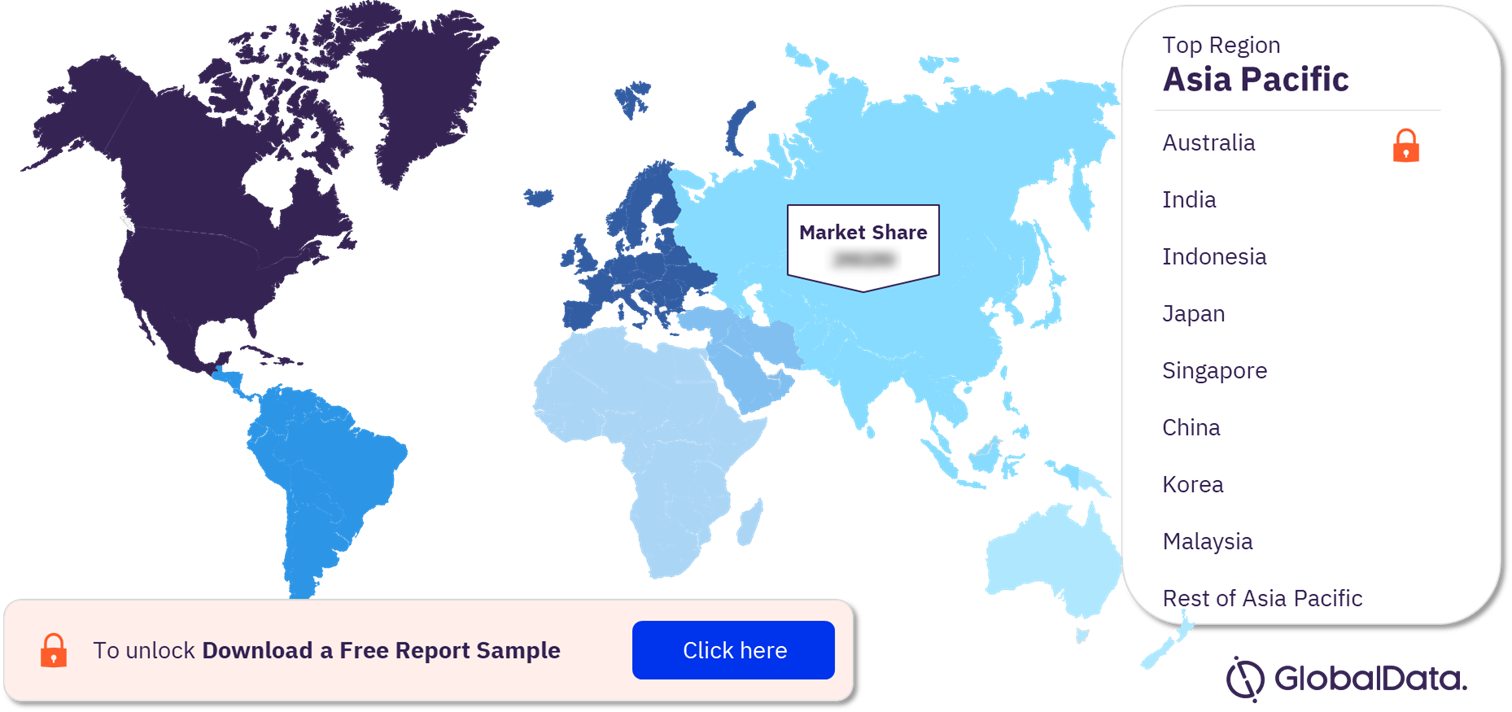

Digital Payments Market Analysis by Region

The Asia Pacific digital payment market by transaction value and volume was the highest in 2023, capturing over 50% of the overall market. The regional demand by value of transactions was led by China and UK collectively accounting for over 50% of the digital payments market in 2023. The regional demand by volume of transactions was led by China and US collectively accounting for over 40% of the digital payments market in 2023.

Asia Pacific is projected to retain the largest share by 2030 accounting for a major share of the global digital payments market by transaction value and volume, with a forecasted growth rate exceeding 15% from 2023 to 2030. Governments in the Asia Pacific region have been promoting digital payments in order to increase financial inclusion, reduce the use of cash, and drive economic growth. The government of India has introduced several policies and initiatives, such as the Unified Payments Interface (UPI) and the Bharat Interface for Money (BHIM) app, to make digital payments more accessible and convenient.

Asia-Pacific Digital Payments Market Share by Country, 2023 (%)

View Sample Report for Additional Digital Payments Market Insights, Download a Free Report Sample

Digital payments have become increasingly popular in Europe, with many countries adopting digital payment technologies. For example, the European Union launched the Single Euro Payments Area Instant Credit Transfer (SCT Inst) scheme, which allows for instant payments across participating countries. The EU’s revised Payment Services Directive (PSD2) has introduced the open banking regulations that require banks to share customer data with third-party providers to facilitate innovative payment services and improve financial inclusion. Europe is seeing significant growth in digital payments, driven by a range of factors such as changing consumer behavior, technological innovation, and regulatory developments.

Digital Payments Market – Competitive Landscape

Starting from 2019, there have been two main trends in the online payments industry. Firstly, established payment providers and processors have been consolidating, while dominant players have been acquiring new technology providers. This consolidation began with the merger between Fiserv and First Data in 2019, followed by FIS acquiring Worldpay and Global Payments acquiring TSYS in the same year. In 2020, Ingenico Group was acquired by Worldline. These significant transactions were primarily driven by the acquirers’ desire to broaden the range of services they offer to consumers, in response to the increasing adoption of alternative payment methods. These acquirers aim to provide comprehensive solutions that cater to all the requirements of both merchants and consumers.

The leading companies that specialize in digital payments are Alibaba Group Holding Ltd, American Express Co, Apple Inc, Google LLC, Mastercard Inc, PayPal Holdings Inc, Visa Inc, Discover Financial Services, ACI Worldwide Inc, Amazon.com Inc, Fiserv Inc, One97 Communications Ltd., Samsung Electronics Co Ltd, Fidelity National Information Services Inc, and The Western Union Co.

Leading Players in the Digital Payments Market

- Alibaba Group Holding Ltd.

- American Express Co.

- Apple Inc.

- Google LLC

- Mastercard Inc.

- PayPal Holdings Inc.

- Visa Inc.

- Discover Financial Services

- ACI Worldwide Inc.

- com Inc.

- Fiserv Inc.

- One97 Communications Ltd.

- Samsung Electronics Co Ltd

- Fidelity National Information Services Inc.

- The Western Union Co.

Other Digital Payments Market Vendors Mentioned

Adyen, Affirm, Afterpay, Bud, China UnionPay, Danske, G+D, Global Payments, JPMorgan Chase, Jumio, Klarna, Monzo, MoneyGram, M-PESA, Plaid, Revolut, Ripple, RuPay, Square, Stripe, Tencent, Tink, TrueLayer, Trulioo, Wise, and Veridium

To Know More About Leading Digital Payments Market Players, Download a Free Report Sample

Digital Payments Market Segments and Scope

GlobalData Plc has segmented the digital payments market report by mode of payment, industry, and region:

Digital Payments Market Mode of Payment Outlook (Transaction Value and Volume, $ Trillion, 2020-2030)

- Digital wallet

- Credit Card

- Debit Card

- Online banking

- Other

Digital Payments Market Industry Outlook (Transaction Value and Volume, $ Trillion, 2020-2030)

- Retail

- Hospitality

- Entertainment

- Healthcare

- Other End-user Industry

Digital Payments Market Regional Outlook (Transaction Value and Volume, $ Trillion, 2020-2030)

- North America

- US

- Canada

- Asia-pacific

- Australia

- India

- Indonesia

- Japan

- Singapore

- China

- Korea

- Malaysia

- Rest of Asia Pacific

- Europe

- Russia

- Belgium

- Germany

- Italy

- Spain

- Ireland

- Denmark

- Finland

- Netherlands

- Poland

- Sweden

- France

- UK

- Rest of Europe

- South and Central America

- Mexico

- Brazil

- Colombia

- Argentina

- Peru

- Rest of South and Central America

- Middle East and Africa

- South Africa

- Turkey

- Saudi Arabia

- Rest of Middle East and Africa

Key Players

Alibaba Group Holding Ltd.American Express Co.

Apple Inc.

Google LLC

Mastercard Inc.

PayPal Holdings Inc.

Visa Inc.

Discover Financial Services

ACI Worldwide Inc.

Amazon.com Inc.

Fiserv Inc.

One97 Communications Ltd.

Samsung Electronics Co Ltd

Fidelity National Information Services Inc.

The Western Union Co.

Table of Contents

Figures

Frequently asked questions

-

What will be the digital payment market size in 2023?

The digital payment market size globally by transaction value will be $2,476.8 trillion in 2023.

-

What is the digital payment market growth rate?

The digital payment market is expected to grow at a CAGR of 14.3% over the forecast period (2023-2030).

-

What are the key digital payment market drivers?

Convenience and security offered by digital payments along with the globalization of ecommerce are some of the major factors driving the digital payment market growth.

-

What are the key digital payment market segments?

Mode of Payment: Digital Wallet, Credit Card, Debit Card, Online Banking, Others

End-use Industry: Retail, Hospitality, Entertainment, Healthcare, Others

-

Which are the leading digital payment companies globally?

The leading digital payment companies are Alibaba Group Holding Ltd, American Express Co, Apple Inc, Google LLC, Mastercard Inc, PayPal Holdings Inc, Visa Inc, Discover Financial Services, ACI Worldwide Inc, Amazon.com Inc, Fiserv Inc, One97 Communications Ltd., Samsung Electronics Co Ltd, Fidelity National Information Services Inc, and The Western Union Co.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports