Digital Transformation in Banking – Thematic Research

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Every sector is going digital. Due to the pandemic, consumer behavior began to outpace the channel capabilities of slow-moving incumbent banks, reinvigorating providers around digital transformation imperatives. However, there are clear tensions between tactical time-to-market priorities and the longer-term tech changes required to emancipate providers from legacy.

Institutions that focus on knowing their customer – not just from a regulatory perspective, but in terms of financial impact, behaviors, and prospects – will be best placed to succeed under conditions of expedited change. This will require the operational agility to recalibrate customer personas, risk models, and channel propositions.

The digital transformation in banking sector research report will help you to understand key technology, macroeconomic and political, and regulatory trends characterizing digital transformation efforts at incumbent banks.

Digital transformation in Banking: Key Trends

The key trends that are associated with the digital transformation theme can be classified into three categories: technology trends, macroeconomic & political trends, and regulatory trends.

- Technology trends – Some of the key technology trends impacting the digital transformation theme include a renewed focus on core system modernization to improve agility and time to market, a zero-scratch redesign of core decision-making processes to realize breakthrough cost reduction, and others.

- Macroeconomic & political trends – The key macroeconomic & political trends that will shape the digital transformation theme are heightened political and economic support for digital transformation, and declining private investment for new entrants creating a buyer’s market.

- Regulatory trends – Some of the key regulatory trends impacting the digital transformation theme include Tensions between the need for regulations to move more slowly and more quickly, Increased regulatory risk around expedited digitization, and others.

Digital transformation in Banking – Industry Analysis

In 2017, online was significantly more popular for a greater range of tasks than mobile is in 2020. Meanwhile, telephone banking, once a forgotten channel amid digitization, has made gains as branch usage has reduced. The preference for telephone banking has notably increased for more complex queries such as making a complaint or querying transactions, but it has risen for all other tasks too.

The digital transformation in the banking industry analysis also covers:

- Mergers and acquisitions

- Timeline

Digital transformation in Banking - Value Chain Analysis

GlobalData’s digital transformation value chain consists of core banking/legacy systems (transaction processing), digital banking platforms (front-end channels), API management/strategy (middleware), money management/data infrastructure, and niche fintech partners.

Middleware: APIs have become the great enablers of digital transformation. Rather than optimize business structures, processes, and technologies for anyone’s one-to-one partnership, public APIs enable banks to optimize for all possible partnerships. This brings economies of scale and scope to partnering.

Niche fintech partners: Partnerships have been critical to expanding access to new products and processes at pace. In a COVID context, one recent example is Tully, providing a free-to-consumer digital outsourcing service that registers consumer applications, validates eligibility for payment relief, and shares that information with relevant partners in the network.

Leading Global Banks Associated with the Digital transformation Theme

Some of the leading retail banks associated with the digital transformation theme are DBS, BBVA, and JPMorgan Chase.

Leading Credit Unions/Building Societies Associated with the Digital transformation Theme

Some of the leading credit unions/building societies making their mark within the digital transformation theme are USAA and Navy Federal.

Banking Sector Scorecard

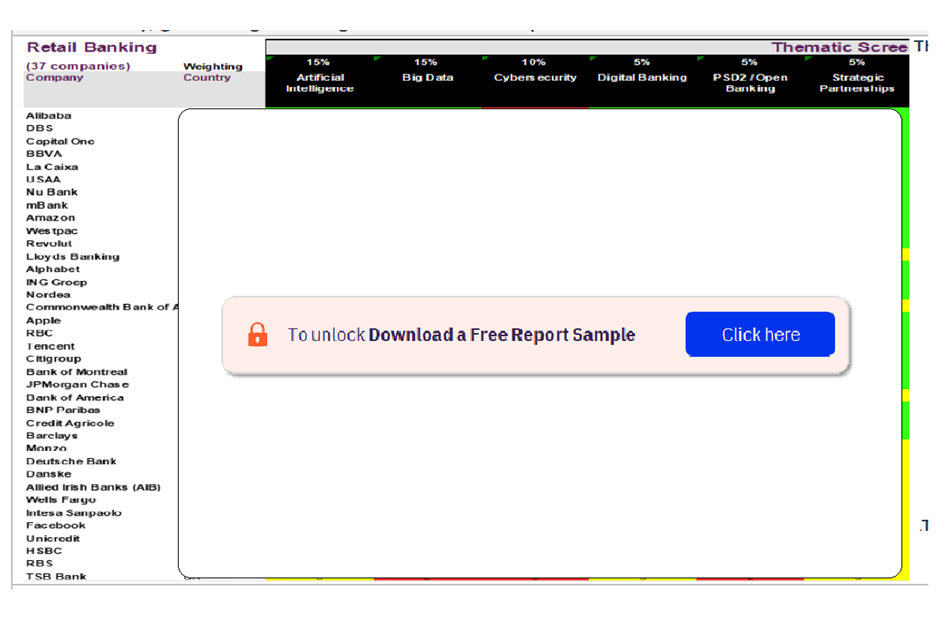

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecards have three screens: a thematic screen, a valuation screen, and a risk screen. The banking sector scorecard has two screens:

- The thematic screen tells us who are the overall leaders in the 10 themes that matter most, based on our thematic engine.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

Banking Sector Scorecard – Thematic Screen

To know more about the sector scorecards, download a free report sample

Digital transformation in Banking Market Overview

| Report Pages | 42 |

| Regions Covered | Global |

| Key Trends | Technology Trends, Macroeconomic & Political Trends, and Regulatory Trends |

| Value Chains | Core Banking/Legacy Systems (Transaction Processing), Digital Banking Platforms (Front-End Channels), API Management/Strategy (Middleware), Money Management/Data Infrastructure, and Niche Fintech Partners |

| Key Global Banks | DBS, BBVA, and JPMorgan Chase |

| Key Credit Unions/Building Societies | USAA and Navy Federal |

Scope

- Banks’ channel migration efforts have not met expectations. Many commentators expected mobile to quickly displace all other channels, with attendant risks that consumer behavior could outpace banks’ channel capabilities. But this situation has not transpired.

- Banks that view digital transformation as building new capabilities – around cloud, API, big data, etc. – tend to score better in terms of customer satisfaction, cost reduction, and operational agility than those that have merely digitized existing analog processes.

- Leading institutions have prioritized core decision-making processes. Credit-related activities typically cut across front-office, risk management, and back-office procedures; integrating these actions into one straight-through process offers the biggest efficiency gains.

Reasons to Buy

- Understand key technology, macroeconomic and political, and regulatory trends characterizing digital transformation efforts at incumbent banks.

- Access the latest consumer survey data on evolving channel behaviors, provider preferences, and product holdings.

- Identify leading digital transformation efforts based on cost/income and customer satisfaction metrics.

- Access firm-level/case study insight on successful digital transformation efforts by incumbents.

Apple

Alphabet

Tinkoff Bank

AIB

Capital One

WeBank

Mbnk

Monzo

NatWest

RBS

Danske Bank

DBS

TSB

BBVA

Citibank

mBank

Revolut

Credit Agricole

Barclays

La Caixa

CBA

UniCredit

HSBC

Nordea

Intesa San Paulo

USAA

BNP Paribas

Deutsche Bank

ING

NU Bank

Bank of America

BMO

RBC

JPMorgan Chase

Lloyds

Temenos

Finastra

Table of Contents

Frequently asked questions

-

What key technology trends are shaping the digital transformation theme in the banking industry?

Some of the key technology trends impacting the digital transformation theme include a renewed focus on core system modernization to improve agility and time to market, Zero-scratch redesign of core decision-making processes to realize breakthrough cost reduction, and others.

-

What key macroeconomic & political trends are shaping the digital transformation theme in the banking industry?

The key macroeconomic & political trends that will shape the digital transformation theme are heightened political and economic support for digital transformation, and declining private investment for new entrants creating a buyer’s market.

-

What key regulatory trends are shaping the digital transformation theme in the banking industry?

Some of the key regulatory trends impacting the digital transformation theme include Tensions between the need for regulations to move more slowly and more quickly, Increased regulatory risk around expedited digitization, and others.

-

What are the components of the digital transformation value chain?

GlobalData’s digital transformation value chain consists of core banking/legacy systems (transaction processing), digital banking platforms (front-end channels), API management/strategy (middleware), money management/data infrastructure, and niche fintech partners.

-

Which global banks are associated with the digital transformation theme?

Some of the leading banks associated with the digital transformation theme are DBS, BBVA, and JPMorgan Chase.

-

Which leading credit unions/building societies are associated with the digital transformation theme?

Some of the leading credit unions/building societies making their mark within the digital transformation theme are USAA and Navy Federal.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports