Drones in Aerospace and Defense – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Explore the following trends and insights from our ‘Drones in Aerospace and Defense’ thematic intelligence report:

- Analyze the emerging technological trends shaping the use of drones in aerospace and defense theme and understand their broader impact on the defense market.

- Get an overview of the various drone programs and projects currently under development to understand the market better. The report will also help assess the diverse range of applications and use cases for this technology in both the civil and military domains.

- Identify investment opportunities for armed forces, suppliers, and institutional investors across the whole drone technology value chain.

- Learn about the range of different drone-related research and development programs currently being undertaken by various military organizations and defense companies.

How is the ‘Drones in Aerospace and Defense’ report unique from other reports in the market?

- Determine potential investment companies based on trend analysis and market projections.

- Understand the market challenges and opportunities surrounding drones in aerospace and defense themes to create smart business goals.

- Understand how spending on drones and related segments will influence the overall market and which spending areas are being prioritized.

- Gain insight into the key players associated with the theme as well as their competitive position within the market.

We recommend this valuable source of information to anyone involved in:

- Counter Drones Technologies Developers/ Drone Manufacturers

- Radar Manufacturers/Radio-Frequency Sensor Manufacturers

- Electro-Optical/Infra-Red Sensor Manufacturers

- Airport Authorities

- Event Organizers

- Private Security Agencies

- Government/Military and Defense Organizations

- VC and Investment Firms

To Get a Snapshot of the Drones in Aerospace and Defense Thematic Report

Drones in Aerospace and Defense Thematic Overview

Unmanned aerial vehicles (UAVs) commonly known as drones, have been a much-used part of advanced militaries’ arsenals for many decades. The US is the pioneer in the development and utilization of unmanned capabilities such as the RQ-2 Pioneer used during Operation Desert Storm or the MQ-9 Reaper used in current conflicts in Syria. In the last few years, other producers have also developed viable, affordable platforms, subsequently increasing the horizontal proliferation of unmanned capabilities. In addition, recent geo-political conflicts have fueled investment in such technologies and have reinvigorated the development of novel military UAVs and research into the dual-use potential of drone technology.

The Drones in Aerospace and Defense thematic intelligence report gives you an in-depth insight into the drone market and the impact it will have on the aerospace and defense sector. It further entails a deep-dive analysis of the industry, including real-life case studies that showcase how the defense sector has responded to the impact of the drone theme on their operations. The report identifies the key market trends and players that will help understand the growth prospects and competitive landscape.

| Report Pages | 88 |

| Regions Covered | Global |

| Value Chains | · Hardware

· Software · Services · End-User |

| Leading Public Companies | · AeroVironment

· AgEagle · Airbus |

| Leading Private Companies | · Acecore Technologies

· Aegis Power · AheadX |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Drones in Aerospace and Defense – Key Trends

The main trends shaping drones in aerospace and defense theme over the next 12 to 24 months are classified into three categories: Technology trends, macroeconomic trends, and regulatory trends.

- Technology trends: A few of the key technology trends impacting the theme are the rising application of artificial intelligence (AI), machine learning, and autonomy; the advent of 3D printing; and investment in 3D digital modeling technologies.

- Macroeconomic trends: A few of the key macroeconomic trends explained in the report are the dominance of China in the drone industry, use of drones during COVID-19, and economic sanctions to inflict financial hardship on targeted entities such as Russia among others.

- Regulatory trends: Canada’s Drone Strategy 2025, the EU’s Drone Strategy 2.0, and Europe’s U-space program are part of the regulatory trends impacting aerospace and defense.

Drones in Aerospace and Defense – Industry Analysis

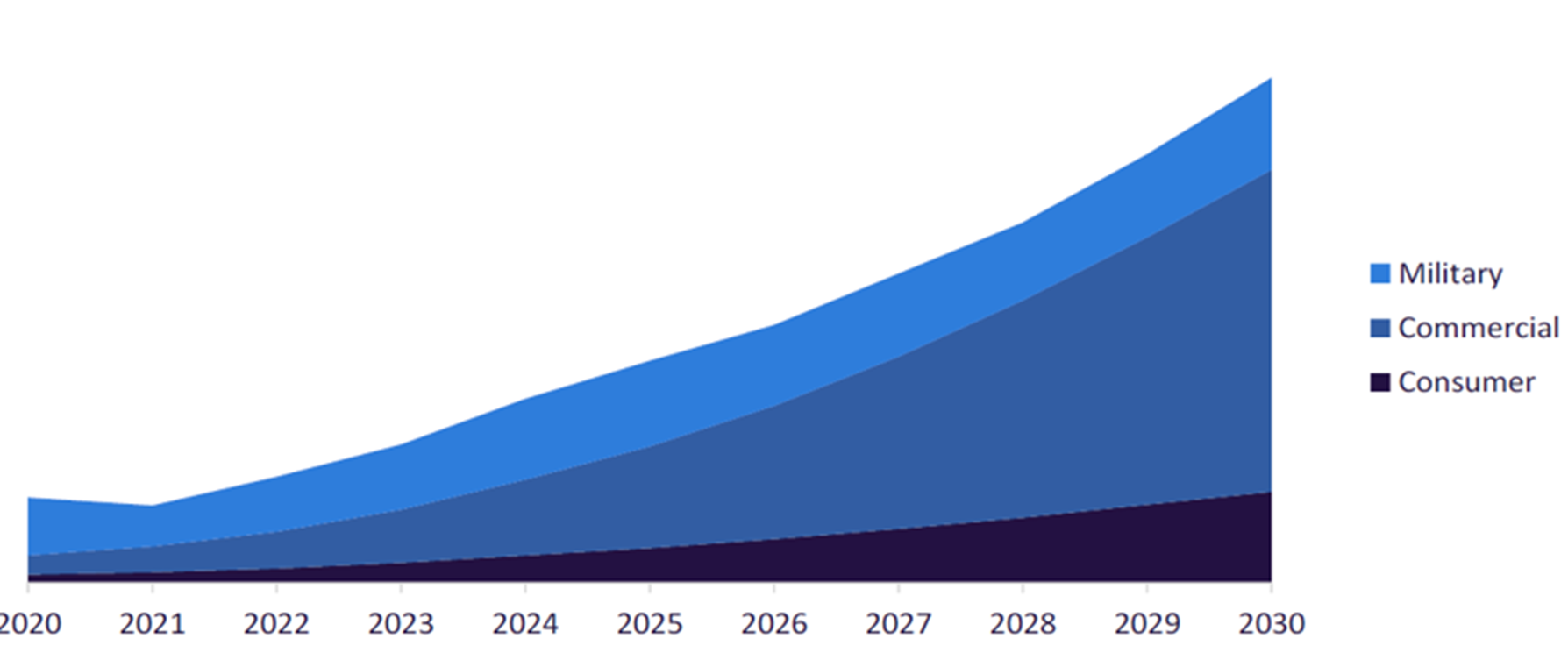

The global drone market was worth $15.2 billion in 2020. The strongest growth will come from commercial drones, which will record a CAGR of more than 32 % between 2020 and 2030. The growth is attributed to the increasing use of commercial drones to deliver essential goods and services, improve safety and efficiency by inspecting critical infrastructure at scale, and connect communities. Apart from commercial drones, the other types of drones are military and consumer drones.

The drones in aerospace and defense industry analysis also covers:

- Mergers and acquisitions

- Mergers and acquisitions

- Patent trends

- Hiring trends

- Case studies

- Timeline

Global Drone Market 2022-2030 ($ Billion)

Buy the Full Report for More Insights into the Drones in the Aerospace and Defense Market Forecast

Drones in Aerospace and Defense - Value Chain Analysis

The drone market broadly comprises hardware, software, services, and end-users.

Software: The software value chain layer includes tools used for control, mapping, data analytics, and security. Drone software optimizes flight and facilitates communication with the operator. Furthermore, with the introduction of AI, drones are becoming smarter and increasingly able to perform specific tasks autonomously. For instance, companies such as Yuneec, UVify, Freefly, and Sentera have used the pioneering PX4 open-source ground control software in their drones for autonomous flight.

Drones Value Chain Analysis

Buy Full Report for More Insights into the Drones Value Chain

Leading Public Companies

A few of the leading listed players associated with this theme:

- AeroVironment

- AgEagle

- Airbus

Leading Private Companies

A few of the leading interesting private companies associated with this theme:

- Acecore Technologies

- Aegis Power

- AheadX

Buy the Full Report for More Insights into the Companies in the Aerospace and Defense Market

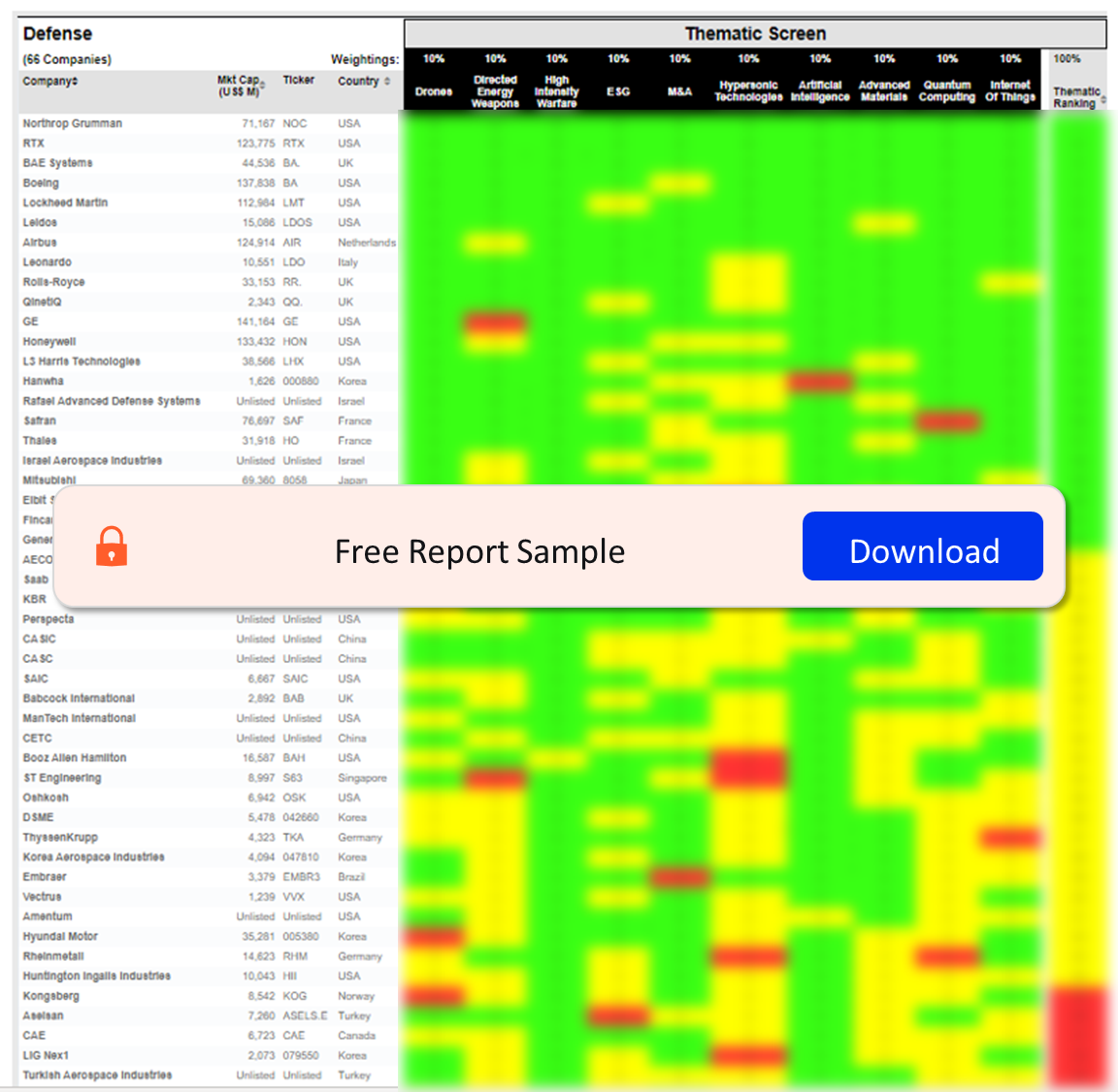

Defense Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our defense sector scorecard has three screens: A thematic screen, a valuation screen, and a risk screen.

- The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

- The valuation screen ranks our universe of companies within a sector based on selected valuation

metrics.

- The risk screen ranks companies within a particular sector based on overall investment risk.

Defense Sector Scorecard – Thematic Screen

Buy the Full Report to know More about Sector Scorecards

DJI

Parrot

Skydio

Yuneec

Emax

Air Hogs

FreeFly

Hubsan

UVify

Walkera

Alphabet (Google)

Aerovironment

AgEagle

Amazon

Aerial MOB

Delair

Drone Volt

DroneDeploy

Kespry

AVIC

Boeing

Airbus

CASC

General Atomics

Lockheed Martin

Northrop Grumman

BAE Systems

Baykar

Elbit Systems

Korea Aerospace Industries

Anduril

Palantir

Kratos Defense

RTX Corp

Turkish Aerospace Industries

Rheinmetall

Table of Contents

Frequently asked questions

-

What was the market size of the global drone market in 2020?

The global drone market was worth $15.2 billion in 2020.

-

What are the components of the drones’ value chain?

The drone market broadly comprises hardware, software, services, and end-users.

-

Which are the leading public companies associated with the aerospace and defense industry?

A few of the leading public companies associated with the theme are AeroVironment, AgEagle, and Airbus.

-

Which are the leading private companies in the aerospace and defense industry?

A few of the leading interesting private companies associated with the theme are Acecore Technologies, Aegis Power, and AheadX.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Aerospace and Defense reports