ESG (Environmental, Social and Governance) 2.0 – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Access and explore in-depth trends and insights in our ‘ESG 2.0. – Thematic Intelligence‘ report:

- The report includes analysis of key trends shaping the ESG theme as the world moves from ESG 1.0 to the ESG 2.0 era. These trends are divided into three categories: Corporate trends, Macroeconomic trends and Regulatory trends.

- It also includes an overview of global ESG-related policy initiatives, including the main policy plans and packages from the EU, the US, and China.

- Also included is analysis of GlobalData’s signals data, including mergers and acquisitions, venture financing, sustainable bonds, hiring, and social media.

- The report incorporates GlobalData’s ESG framework, designed to help companies build trust with society and set them on a path towards a sustainable future.

How is the ‘ESG 2.0.’ report different from other reports in the market?

- Environmental, social, and governance or ESG is moving into a different era, which we call ESG 2.0. Make sure your company is prepared for ESG 2.0 by reading this report.

- In this second phase, there will be a greater focus on the ‘E’ component, with a shift from a voluntary regime to a mandatory one, driven by government mandates rather than consumer pressure.

- A host of new environmental laws are in the pipeline, relating to mandatory reporting, carbon pricing, and carbon import tariffs, as well as more state support and investment in clean energy technologies. Companies unprepared for ESG 2.0 face higher costs and lost sales.

- It is no longer enough to have an ESG strategy focused on reporting and setting targets for some distant future date. Companies now need to show that they are taking action on ESG issues, especially emissions, across their value chain. This report outlines what companies can expect from ESG 2.0.

We recommend this valuable source of information to anyone involved in:

- Technology Leaders and Startups

- Business Development and Market Intelligence

- Investment Analysts and Portfolio Managers

- Professional Services – Investment Banks, PE/VC firms

- M&A/Investment, Management Consultants, and Consulting Firms

Esg 2.0 Theme Analysis Report Overview

Environmental, social, and governance (ESG) is moving into a different era, which we call ESG 2.0. In this second phase, there will be a greater focus on the ‘E’ component, with a shift from a voluntary regime to a mandatory one, driven by government mandates rather than consumer pressure. A host of new environmental laws are in the pipeline, relating to mandatory reporting, carbon pricing, and carbon import tariffs, as well as more state support and investment in clean energy technologies. Companies unprepared for ESG 2.0 face higher costs and lost sales.

Mentions of ESG in Company Filings, 2016-2022

For more insights into the ESG company filings, download a free report sample

Furthermore, it is anticipated that the EU will disrupt the global industry by adding more sectors to its emissions trading system and phasing in the world’s first carbon border tax. This is on top of a host of other ESG reporting and due diligence requirements that will apply to both EU and non-EU businesses. While Europe’s approach to reducing emissions has focused on carbon pricing and new regulations, the US has opted to focus on subsidies for domestic clean industry and technologies.

The ESG thematic intelligence report provides the key trends impacting the growth of the ESG theme over the next 12 to 24 months. It also offers an analysis of M&A, venture financing, hiring, and social media trends.

| Report Pages | 85 |

| Regions Covered | Global |

| Key Trends | · Corporate Trends

· Macroeconomic Trends · Regulatory Trends |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

ESG - Key Trends

The main trends shaping the ESG industry are classified into three categories: corporate trends, macroeconomic trends, and regulatory trends.

- Corporate trends: The key corporate trends impacting the ESG theme are rising greenwashing scandals, greenhushing, increased shareholder pressure, and focus on sustainable finance among others. Recent greenwashing scandals have involved asset management companies, with Goldman Sachs, Deutsche Bank’s asset manager DWS, and BNY Mellon found to have exaggerated their green credentials.

- Macroeconomic trends: The key macroeconomic trends explained in the report are rising interest rates and high inflation, Paris and Glasgow agreements, and a focus on securing access to critical minerals.

- Regulatory trends: The adoption of carbon emissions trading based on an underlying carbon price and the introduction of carbon border taxes regulations by various countries are part of the regulatory trends impacting the ESG theme.

ESG – Signals

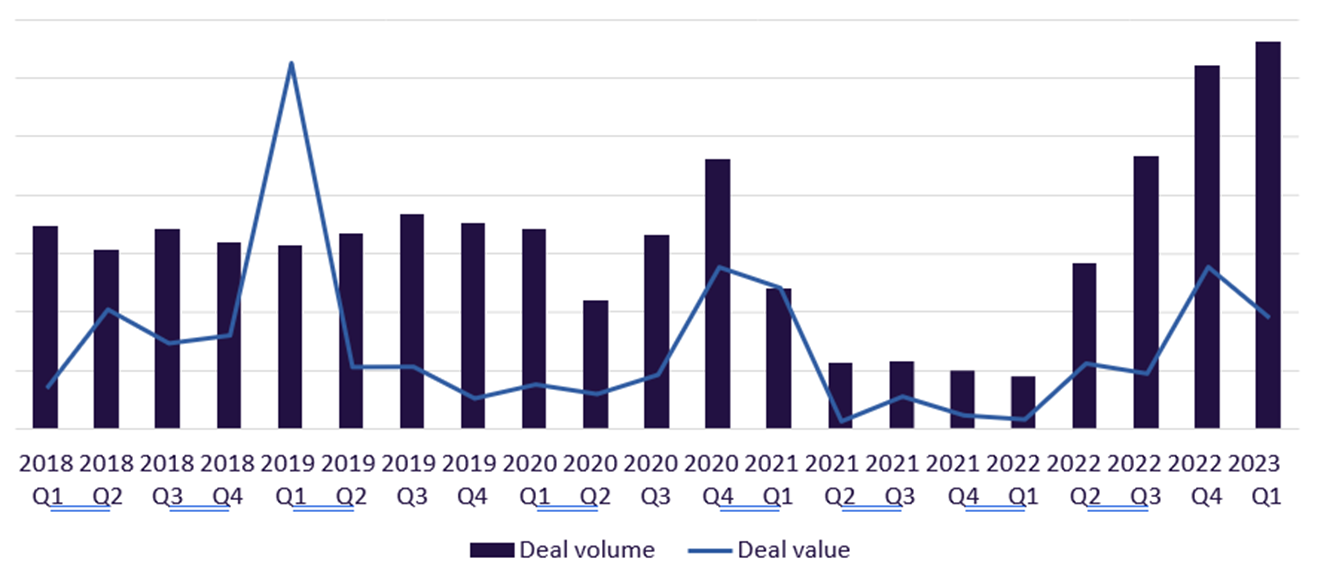

In this section, we use more than 140 million signals generated by our thematic engine to predict how the ESG theme will develop and the likely leaders. These signals are a useful source of competitor intelligence. For instance, ESG-related M&A activity has climbed in both volume and value over 2022 and has continued to rise in the first quarter of 2023. The deal value was more than $84 billion in Q1 2023, the largest quarter for ESG-related M&A deals over the last five years.

The ESG signals analysis also covers:

- Mergers and acquisitions

- Venture financing

- Patent

- Company filings

- Hiring trends

- Social media trends

ESG-Related M&A Deal Volume and Value, 2018-2023 Q1

For more insights into the ESG related deals, download a free report sample

ESG – Global Policy Overview

ESG 2.0 will be driven primarily by government policy rather than voluntary corporate action. Major regions are taking different approaches to the implementation of ESG-related policy. The EU’s approach depends largely on carbon pricing and the development of its ETS. It is also creating many regulations that will impact various EU and non-EU firms. Most of the funding made available by the EU for investments in renewable energy is in the form of loans.

In contrast, the US has taken a spend-and-invest approach. The US regulatory approach is light overall and will probably remain so; there has already been political pushback against mandatory disclosures, so more onerous regulations are likely to be difficult politically. The main US policy is the Inflation Reduction Act (IRA), which provides tax credits for several carbon-reducing technologies such as electric vehicles, batteries, renewables, and nuclear power.

For more insights into the global policy overview, download a free report sample

Key Highlights

- The EU will disrupt the global industry by adding more sectors to its emissions trading system and phasing in the world’s first carbon border tax. This is on top of a host of other ESG reporting and due diligence requirements that will apply to both EU and non-EU businesses.

- The Inflation Reduction Act (IRA), President Biden’s landmark climate policy, is the largest subsidy for clean energy and climate solutions in US history. It will direct $400 billion to develop US-based clean energy and electric vehicle manufacturing, as well as their supply chains. Anti-ESG states are among the biggest beneficiaries of IRA funding, which may make them more amenable to future climate policies.

Reasons to Buy

ESG 2.0 will be less forgiving of poor ESG performers, especially on environmental issues. Under ESG 2.0 –

- Companies that fall behind on decarbonization will pay higher costs and lose sales.

- Companies will be held accountable for ESG performance across their value chain, not just their own operations.

- ESG-related marketing and communications will attract greater scrutiny from regulators and the anti-ESG movement.

- Companies that cannot produce robust ESG data, especially emissions data, will struggle to trade internationally, even if they are not covered by mandatory reporting requirements.

- Companies that cannot provide low-carbon goods and services will miss growth opportunities.

Make sure your company is prepared for ESG 2.0 by reading this report.

Table of Contents

Frequently asked questions

-

What was the size of the ESG-related M&A deal value in Q1 2023?

ESG-related M&A activity has climbed in both volume and value over 2022 and has continued to rise in the first quarter of 2023. The deal value was more than $84 billion in Q1 2023.

-

What are the key corporate trends impacting the ESG theme?

The key corporate trends impacting the ESG theme are rising greenwashing scandals, greenhushing, increased shareholder pressure, and focus on sustainable finance among others.

-

What are the key regulatory trends impacting the ESG theme?

The adoption of carbon emissions trading based on an underlying carbon price and the introduction of carbon border taxes regulations by various countries are part of the regulatory trends impacting the ESG theme.

-

What are the key macroeconomic trends impacting the ESG theme?

The key macroeconomic trends explained in the report are rising interest rates and high inflation, Paris and Glasgow agreements, and a focus on securing access to critical minerals.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Environmental and Waste Management Services reports