ESG (Environmental, Social and Governance) in Wealth Management – Thematic Research

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

ESG in Wealth Management Market Report Overview

Global sustainable fund assets have almost tripled in the past few years, rising to $2.8 trillion at the end of the first quarter of 2022. Environmental, social, and governance (ESG) is no longer just a buzzword but has a major impact on the broader financial services industry, and the wealth management sector in particular. As per S&P, from an investment standpoint, ESG sees “market participants consider in their decision-making the ways in which environmental, social, and governance risks and opportunities can have material impacts on companies’ performance.

| Market Size (Q1 2022) | $2.8 Trillion |

| Key Countries | Australia, New Zealand, Asia ex-Japan, US, Europe, Canada, and Japan |

| Key Players | J.P. Morgan and OpenInvest, Vanguard and Just Invest, BlackRock and Aperio, and Perpetual and Trillium |

The ESG in wealth management research report provides an overview of the key trends impacting ESG performance in wealth management. It discusses GlobalData’s ESG framework and ESG action feedback loop, alongside ESG-related survey results, an ESG timeline, and the size of the ESG market and understands HNW demand patterns across countries. It will also help you to understand what your competitors are doing in the ESG space via different case studies.

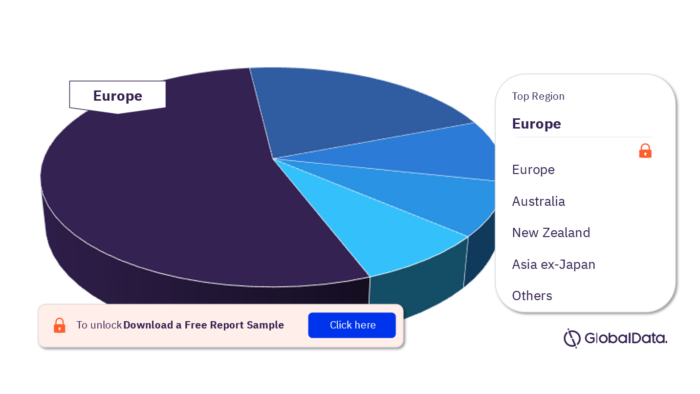

Key Regions in Global Sustainable Fund Market

Australia, New Zealand, Asia ex-Japan, the US, Europe, Canada, and Japan are the key countries in the global sustainable fund market. Europe leads the way in sustainability, but strong demand across the board should drive product development globally.

Global Sustainable Fund, by Regions

For more regional insights, download a free report sample

Key Players in the Global Sustainable Fund Market

J.P. Morgan and OpenInvest, Vanguard and Just Invest, BlackRock and Aperio, and Perpetual and Trillium are some of the key players in the global sustainable fund market. Many vendors have been expanding their ESG capabilities via acquisitions.

J.P. Morgan and OpenInvest: In June 2021, J.P. Morgan announced the acquisition of OpenInvest, an ESG investment platform that helps advisors and retail users create portfolios that more accurately reflect investors’ ESG values.

Perpetual and Trillium: In July 2020, Perpetual finalized the acquisition of specialist ESG investment firm Trillium.

For more insights on the impact of ESG on various industry sectors, download a free report sample

Scope

- 82% of wealth managers expect the proportion of financial client assets allocated to ESG investments to increase over the next 12 months.

- HNW investors opt for ESG investments for a multitude of reasons. However, return on investment considerations are the number one driver.

- Younger generations are more open to ESG investments. Using the UK as an example, 75% of consumers in their 20s regard sustainable investing as “very important” or “somewhat important.

- HNW investors expect a sophisticated ESG proposition. Globally, 73% of wealth managers agree that HNW investors expect ESG products that apply positive as opposed to negative screening strategies.

Reasons to Buy

- Learn about the size of the ESG market and understand HNW demand patterns across countries.

- Understand how HNW investors’ and retail investors’ attitudes towards ESG differ.

- Learn about product preferences in the ESG space.

- Learn about current compliance issues and the growing relevance of greenwashing, as well as the impact these factors will have on wealth managers.

- Understand what your competitors are doing in the ESG space via different case studies

TrueWealth

DBS

UBS

Goldman Sachs

Marcus

Wealthfront

Table of Contents

Frequently asked questions

-

What is the size of the global sustainable fund market?

Global sustainable fund assets rose to $2.8 trillion at the end of the first quarter of 2022.

-

Which are the key countries in the global sustainable fund market impacted by the ESG theme?

Australia, New Zealand, Asia ex-Japan, the US, Europe, Canada, and Japan are the key countries in the global sustainable fund market.

-

Which are the key players in the global sustainable fund market impacted by the ESG theme?

J.P. Morgan and OpenInvest, Vanguard and Just Invest, BlackRock and Aperio, and Perpetual and Trillium are some of the key players in the global sustainable fund market impacted by the ESG theme.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Wealth Management reports