Europe, Middle East, and Africa (EMEA) Enterprise IT Outlook Bundle

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Europe, Middle East, and Africa Enterprise IT Outlook Bundle

Enterprises in the EMEA will see a significant rise in their information and communication technology spending in the future mostly due to an upswing in demand. This demand may have been built for ICT systems and applications following a conservative spending approach adopted during the COVID-19 crisis and the expected economic recovery. A growing enterprise focus on digitalization in this region, especially through the use of cloud infrastructure, digital services, and disruptive technology solutions is also responsible for an increased budget both in hardware in hardware and cloud computing segments.

As a part of this bundle, you will gain access to in-depth insights available in the following reports:

- Western Europe Enterprise ICT Investment Market Trends by Budget Allocations (Cloud and Digital Transformation), Future Outlook, Key Business Areas and Challenges, 2022

- France Enterprise ICT Investment Market Trends by Budget Allocations (Cloud and Digital Transformation), Future Outlook, Key Business Areas and Challenges, 2022

- United Kingdom (UK) Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services, and Network and Communications

- Germany Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services and Network and Communications

- Saudi Arabia Enterprise ICT Market Analysis and Future Outlook by Segments (Hardware, Software and IT Services)

- Saudi Arabia Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services and Network and Communications

- South Africa ICT Market Size and Forecast (by IT Solution Area, Size Band and Vertical), 2022-2026

Report 1: Western Europe Enterprise ICT Investment Market Trends by Budget Allocations (Cloud and Digital Transformation), Future Outlook, Key Business Areas and Challenges, 2022

Most enterprises in the Western Europe region will see a slight increase in their ICT budget for 2022 compared to 2021. This could be partially attributed to the growing enterprise focus on digitalization in the region, especially through the use of cloud infrastructure, digital services, and disruptive technology solutions. The majority of enterprises in Western Europe will also see an increase in their budget for cloud computing in 2022 compared to 2021. Moreover, most enterprises will see their ICT hardware budget allocations increase slightly across the categories in 2022.

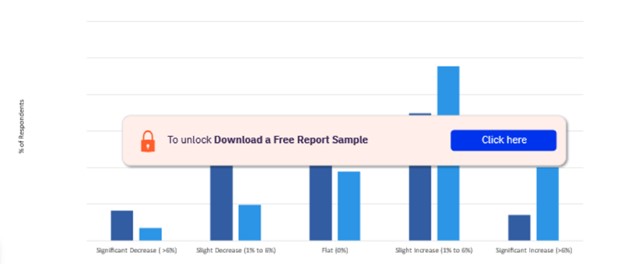

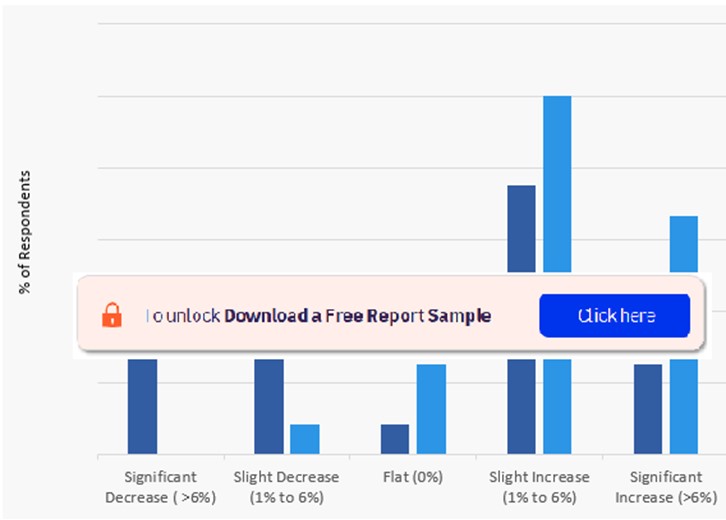

Annual Change in Enterprise ICT Budget Allocation in Western Europe (2021 to 2022 vs. 2020-2021)

To know more about changes in enterprise ICT budget allocation in Western Europe, download a free sample

Report 2: France Enterprise ICT Investment Market Trends by Budget Allocations (Cloud and Digital Transformation), Future Outlook, Key Business Areas and Challenges, 2022

Most enterprises from France have seen slight increases in their enterprises’ ICT budgets for 2022 compared with the previous year. This could be partially attributed to an upswing in demand that may have been built for ICT systems and applications following a conservative spending approach adopted since the onset of the COVID-19 crisis and the expected economic recovery. Furthermore, most enterprises from France have their ICT budget allocations toward cloud computing slightly increased in 2022 compared with 2021. Moreover, enterprises’ ICT hardware budget allocations have increased in total across the hardware categories. However, the majority chose to keep it unchanged for security equipment, desktop PCs/laptops/tablets/printers, and communication devices.

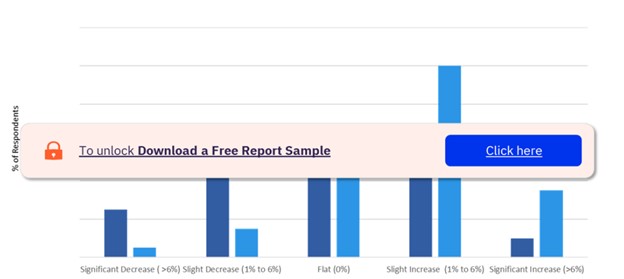

Annual Change in Enterprise ICT Budget Allocation in France (2021 to 2022 vs. 2020-2021)

To know more about changes in enterprise ICT budget allocation in France, download a free sample

Report 3: United Kingdom (UK) Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services, and Network and Communications

The majority of enterprises in the UK will see a slight increase in their enterprises’ ICT budgets for 2022 compared with the previous year. This could be partially attributed to upswing demands that may have been built for ICT systems and applications following a conservative spending approach adopted during the COVID-19 crisis and the expected economic recovery. Moreover, businesses and verticals across the UK are utilizing cloud computing to deploy key applications and data to benefit from the scalability and cost advantage offered by the cloud compared with implementing ICT solutions on-premises.

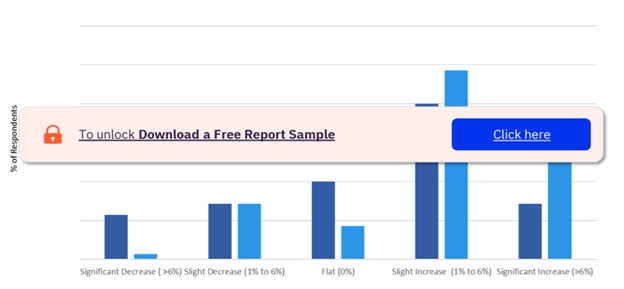

Annual Change in Enterprise ICT Budget Allocation in the UK (2021 to 2022 vs. 2020-2021)

To know more about changes in enterprise ICT budget allocation in the UK, download a free sample

Report 4: Germany Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services and Network and Communications

A majority share of enterprises in Germany will see their ICT budgets increase in 2022 compared to 2021. The continued adoption of remote/hybrid working models could be contributing to this increased ICT spending preference among enterprises especially in enabling technologies like mobility, security, communication, and collaboration solutions. Most of the survey respondents from Germany confirm that their ICT budget allocation towards cloud computing has slightly increased in 2022 compared to 2021. Moreover, enterprise ICT hardware budget allocations across most of the hardware categories are the same in 2022 compared to 2021 except for desktop PCs/laptops/tablets/printers and communication devices.

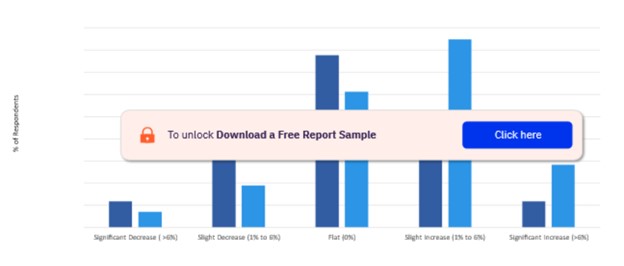

Annual Change in Enterprise ICT Budget Allocation in Germany (2021 to 2022 vs. 2020-2021)

To know more about changes in enterprise ICT budget allocation in Germany, download a free sample

Report 5: Saudi Arabia Enterprise ICT Market Analysis and Future Outlook by Segments (Hardware, Software and IT Services)

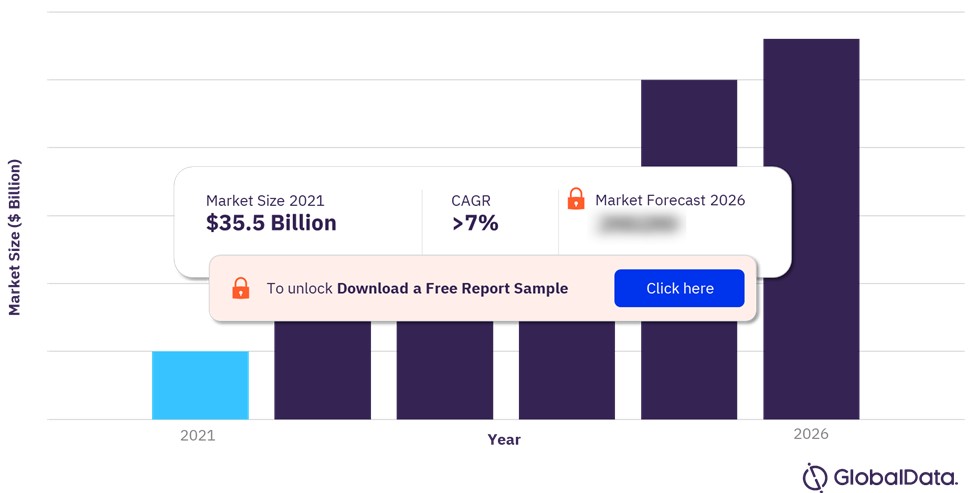

The Saudi Arabia enterprise ICT market revenue was valued at $35.5 billion in 2021. It is expected to increase by a CAGR of more than 7% during 2021-2026. ICT market growth in Saudi will be accelerated due to the large-scale digital transformation strategy adopted by the government of Saudi Arabia under its Vision 2030 program. Given its well-established energy and industrial sector mainly benefiting from its vast oil & gas reserves, and with the country’s efforts towards digital inclusion and promoting a digital economy, Saudi Arabia is turning into a key market for enterprise ICT products and services. In 2020, the government of Saudi Arabia launched National Strategy for Data and Artificial Intelligence aimed at positioning the country among the top 15 nations in AI by 2030. The initiative is focused on accelerating AI usage in five critical sectors, namely healthcare, mobility, education, government, and energy.

Saudi Arabia Total ICT Revenue Opportunity ($billions) 2021-2026

To gain more information on Saudi Arabia enterprise ICT revenue opportunity, download a free sample

Report 6: Saudi Arabia Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services and Network and Communications

Most enterprises in Saudi Arabia will see a slight increase in their enterprise ICT budget for 2022 compared to 2021. This could be partially attributed to the government’s 2030 vision based on promoting digital transformation in the kingdom. The program is supervised via the ‘Digital Transformation Unit’ which offers strategic guidance and expertise in cooperation with the government and private agencies. Most enterprises in Saudi Arabia are expected to see an increase in their budget for cloud computing in 2022. Moreover, most enterprises will see their ICT hardware budget allocations increase slightly across the categories in 2022 compared to 2021.

Annual Change in Enterprise ICT Budget Allocation in Saudi Arabia (2021 to 2022 vs. 2020-2021)

To know more about changes in enterprise ICT budget allocation in Saudi Arabia, download a free sample

Report 7: South Africa ICT Market Size and Forecast (by IT Solution Area, Size Band and Vertical), 2022-2026

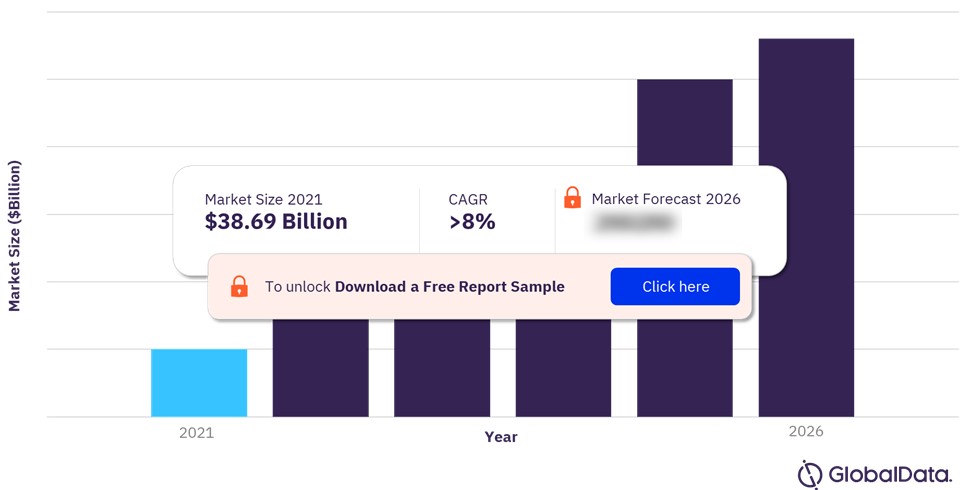

The South Africa ICT market size was valued at $38.69 billion in 2021. The market is expected to grow at a CAGR of more than 8% during 2021-26. In terms of vertical end-use segments, the manufacturing sector was the largest segment in 2021 followed by retail banking. In terms of product/service categories, systems design and integration is the largest segment in the ICT market in South Africa, followed by SaaS.

South Africa ICT Market Outlook

For more information on South Africa ICT market forecast, download a free report sample

Table of Contents

Frequently asked questions

-

Report 1: Western Europe Enterprise ICT Investment Market Trends by Budget Allocations (Cloud and Digital Transformation), Future Outlook, Key Business Areas and Challenges, 2022

-

Why most of the enterprises in Western Europe will see a slight increase in their ICT budgets in 2022 compared to the previous year?

Most enterprises in Western Europe will see a slight increase in their ICT budgets in 2022 compared to the previous year due to the growing enterprise focus on digitalization in the region, especially through the use of cloud infrastructure, digital services, and disruptive technology solutions.

-

Report 2: France Enterprise ICT Investment Market Trends by Budget Allocations (Cloud and Digital Transformation), Future Outlook, Key Business Areas and Challenges, 2022

-

Why did most enterprises from France have seen slight increases in their enterprises’ ICT budgets for 2022 compared with the previous year?

Most enterprises from France have seen slight increases in their enterprises’ ICT budgets for 2022 compared with the previous year due to an upswing in demand that may have been built for ICT systems and applications following a conservative spending approach adopted since the onset of the COVID-19 crisis and the expected economic recovery.

-

Report 3: United Kingdom (UK) Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services, and Network and Communications

-

Why the majority of enterprises in the UK will see a slight increase in their enterprises' ICT budgets for 2022 compared with the previous year?

The majority of enterprises in the UK will see a slight increase in their enterprises’ ICT budgets for 2022 compared with the previous year because of the upswing demands that may have been built for ICT systems and applications following a conservative spending approach adopted during the COVID-19 crisis and the expected economic recovery.

-

Report 4: Germany Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services and Network and Communications

-

Why a majority share of enterprises in Germany will see their ICT budgets increase in 2022 compared to 2021?

A majority share of enterprises in Germany will see their ICT budgets increase in 2022 compared to 2021 due to the upswing in demand that may have been built for ICT systems and applications following a conservative spending approach adopted during the COVID-19 crisis and the expected economic recovery.

-

Report 5: Saudi Arabia Enterprise ICT Market Analysis and Future Outlook by Segments (Hardware, Software and IT Services)

-

What was the Saudi Arabia enterprise ICT market size in 2021?

The Saudi Arabia enterprise ICT market revenue was valued at $35.5 billion in 2021.

-

Report 6: Saudi Arabia Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services and Network and Communications

-

Why most enterprises in Saudi Arabia will see a slight increase in their enterprise ICT budget for 2022 compared to 2021?

Most enterprises in Saudi Arabia will see a slight increase in their enterprise ICT budget for 2022 compared to 2021 due to the government’s 2030 vision based on promoting digital transformation in the kingdom.

-

Report 7: South Africa ICT Market Size and Forecast (by IT Solution Area, Size Band and Vertical), 2022-2026

-

What was the South Africa ICT market size in 2021?

The South Africa ICT market size was valued at $38.69 billion in 2021.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more ICT reports