Electric Vehicles (EV) Market Analysis by Region, Product Type, End-Use Type and Forecast to 2031

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insights from the ‘Electric Vehicles’ report can help:

- Gain a valuable understanding of the current and future state of the market, allowing businesses to make informed decisions about market entry, product development, and investments.

- Identify competitors’ capabilities to stay ahead in the market.

- Identify segments and get an understanding of various stakeholders across different stages of the entire value chain.

- Anticipate changes in demand and adjust the business development strategies.

- Identify potential regions and countries for growth opportunities.

How is our ‘Electric Vehicles’ report different from other reports in the market?

- The report presents in-depth market sizing and forecasts at a segment level for more than 20 countries, including historical and forecast analysis for the period 2021-2031 for market assessment.

- Detailed segmentation by:

- Product – BEV, FHEV, MHEV (48V), PHEV, EREV, FCEV, and PFCEV

- End-Use – Personal and Commercial

- Region – Americas, Europe, Asia Pacific, and the Rest of the World

- The report covers key market drivers and challenges impacting the EV market.

- The report covers Mergers & Acquisitions (M&A), Venture Finance, Patent Analytics, and Social Media activities dashboards.

- The competitive landscape includes competitive positioning of key companies and company share analysis in the EV market that will help the stakeholders in the ongoing process of identifying, researching, and evaluating competitors, to gain insights to form their business strategies.

- Competitive profiling and benchmarking of key companies in the market to provide a deeper understanding of industry competition.

- The report can be a valuable tool for stakeholders to improve their operations, increase customer satisfaction, and maximize profitability by analyzing the latest EV trends, tracking market growth and demand, and evaluating the existing competition in the market.

We recommend this valuable source of information to:

- EV Vendors

- Consulting & Professional Products Firms

- Venture Capital/Equity Firms

Get a Snapshot of the Electric Vehicles (EV) Market, Download a Free Report Sample

Electric Vehicles Market Report Overview

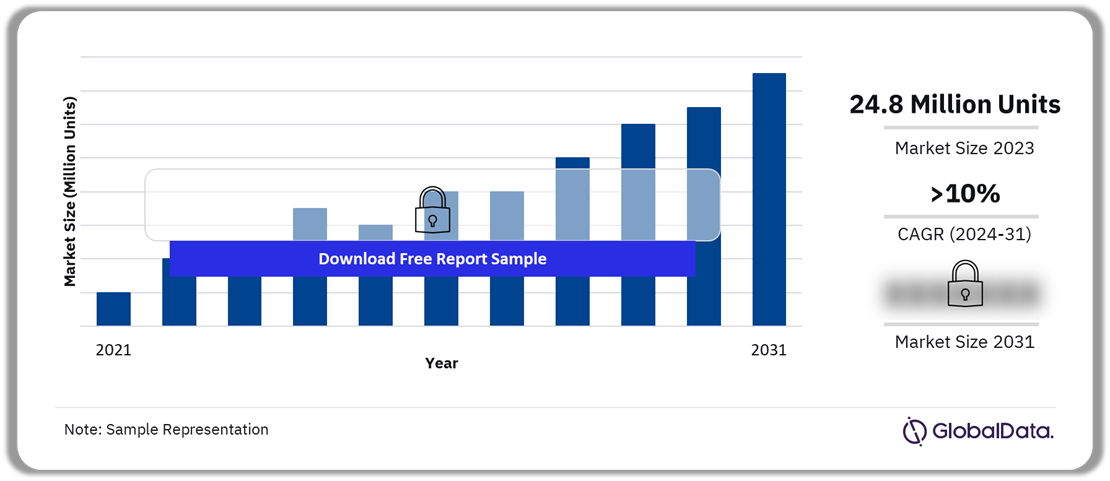

The electric vehicles (EV) market volume was 24.8 million units in 2023 and is expected to grow at a compound annual growth rate (CAGR) of more than 10% over the forecast period. Rising environmental concerns and consumer preferences for clean mobility coupled with supportive government policies to promote the usage of eco-friendly transportation are expected to significantly boost the adoption of EVs. Technological innovations, particularly in battery technology are significantly driving the automotive industry, spurring innovation, attracting investment, and gaining consumer confidence in the flourishing electric vehicles market.

Progress in battery technology is anticipated to positively influence the electric vehicles market. Following lithium-ion batteries, solid-state batteries emerge as a promising option due to their lightweight nature and improved battery safety. Additionally, alternative battery technologies such as aluminum-graphite, lithium-sulfur, and redox-flow are under investigation for potential integration into electric vehicles. The battery manufacturers are employing artificial intelligence (AI) and machine learning to analyze driving patterns, environmental conditions, and battery performance to augment the size and capacity of battery packs for specific use cases.

Electric Vehicles Market Outlook, 2021-2031 (Million Units)

Buy the Full Report for Additional Insights on the Electric Vehicles (EV) Market Forecast

Changing consumer preferences are fueling the increased demand for sustainable transportation. Modern consumers are exhibiting a high degree of environmental consciousness and are increasingly choosing goods and services that reflect their values. This has resulted in a heightened interest in EVs as consumers endeavor to reduce their carbon footprint and contribute to a more environmentally friendly future.

Governments worldwide are implementing policies to boost the pace of domestic EV production, aiming to attract both local and foreign automotive companies. This includes providing incentives for setting up manufacturing facilities, tax incentives for land used to set up manufacturing facilities, and exemption from electricity and stamp duties. Furthermore, the governments have been offering subsidies and incentives on the retail price to potential buyers, thereby reducing the initial upfront cost and attracting consumers across all income groups to opt for EVs.

Despite experiencing impressive expansion in recent years, the EV industry is witnessing numerous constraints that could hinder its growth potential. Constraints include limited charging stations, high procurement costs, range concerns, and a limited supply of chips. Inadequate charging infrastructure lowers the convenience of EV adoption for consumers. Moreover, high initial costs and battery range anxieties deter consumer acceptance. The global shortage of semiconductor chips has posed significant challenges for the EV industry, impacting production, pricing, and supply chains. Resolving these constraints is vital for expediting the industry growth and widespread adoption of EVs.

| Market Size (2023) | 24.8 million units |

| CAGR (2024 to 2031) | >10% |

| Forecast Period | 2024-2031 |

| Historic Data | 2021-2023 |

| Report Scope & Coverage | Volume Forecast, Competitive Landscape, Company Profiling, Growth Trends |

| Product | BEV, FHEV, MHEV (48V), PHEV, EREV, FCEV, and PFCEV |

| End-Use | Personal and Commercial |

| Regions | Americas, Europe, Asia Pacific, Rest of World |

| Countries | China, Japan, India, South Korea, Australia, Thailand, Indonesia, Malaysia, Philippines, Germany, UK, France, Italy, Spain, US, Canada, Brazil, Mexico, and Argentina |

| Key Companies | Toyota Motor Corp., BYD Auto Co. Ltd., Tesla Inc., Volkswagen AG, Hyundai Motor Co., Geely Automobile Holdings Ltd., Mercedes-Benz Group AG, Stellantis N.V., Bayerische Motoren Werke AG (BMW), SAIC Motor Corp. Ltd., and SAIC Motor Corp. Ltd. |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

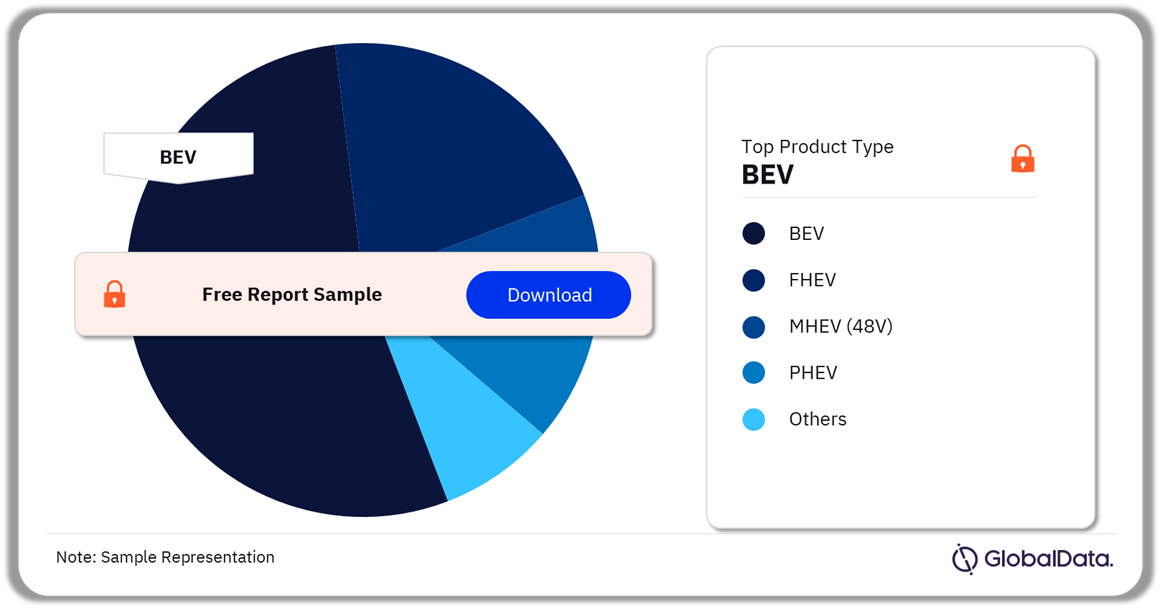

Electric Vehicles (EV) Market Segmentation by Product Type

The market is segregated by product into BEV, FHEV, MHEV (48V), PHEV, EREV, FCEV, and PFCEV segments. The BEV segment, which holds the largest market share is projected to capture more than 60% of the market by 2031. BEVs emit zero tailpipe emissions, rendering them a cleaner and more environmentally sustainable option than traditional internal combustion engine vehicles. To bolster their adoption, governments worldwide are implementing more stringent emissions regulations and providing incentives, accelerating the growth of BEVs.

As concerns about climate change and air pollution increase, governments worldwide are progressively enacting bans on sales of new internal combustion engine (ICE) vehicles. These bans, designed to mitigate greenhouse gas emissions and enhance air quality, are compelling automakers to expedite their shift towards electric mobility, propelling the demand for non-emission transportation options, such as BEV.

Electric Vehicles (EV) Market Share by Product Type, 2023 (%)

Buy the Full Report for More Information on Electric Vehicles (EV) Market by Product Type

Innovations in battery technology are aiding the growth of the BEV segment. Advancements in battery technology have resulted in longer driving ranges, faster charging times, and reduced costs, making BEVs more convenient and attractive to consumers. With ongoing advancements in battery technology, BEVs are progressively rivaling traditional vehicles in terms of both performance and affordability.

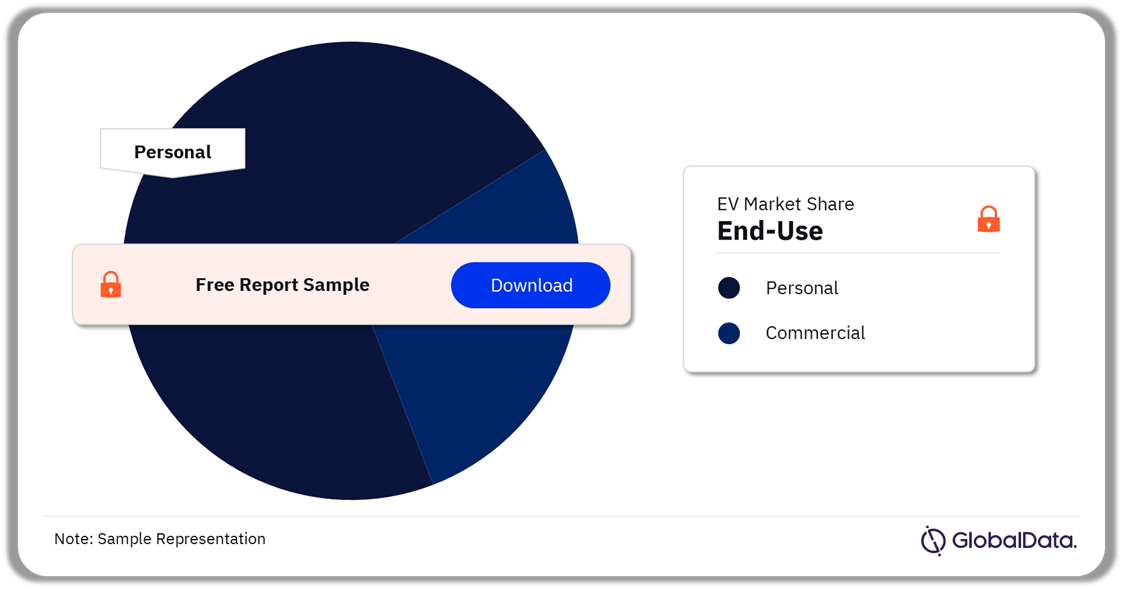

Electric Vehicles (EV) Market Segmentation by End-Use Type

Electric Vehicles are primarily offered in two end-use types, personal and commercial. The personal vehicle segment currently dominates the market, holding over 95% of the market share. Consumers are increasingly exhibiting awareness regarding the deteriorating air quality, particularly in urban areas, due to the emissions from ICE vehicles. Consequently, consumers are seeking greener transportation alternatives such as personal EVs.

Governments and local authorities are pivotal in encouraging the adoption of personal EVs among urban consumers. Numerous cities are enacting policies to stimulate EV adoption, including offering subsidies and tax incentives and establishing dedicated EV infrastructure. These initiatives not only reduce the cost of ownership but also improve the overall convenience of owning and operating an EV in urban regions.

Electric Vehicles (EV) Market Share by End-Use Type, 2023 (%)

Buy the Full Report for More Information on Electric Vehicles (EV) Market End-Use Types

Automotive companies are expanding their EV product portfolio to include compact cars, sedans, SUVs, and vans, catering to a large base of consumers with varying preferences and requirements. This diversifying portfolio enables consumers to choose an EV that fits their lifestyle, budget, and driving needs, increasing the market potential for personal EVs.

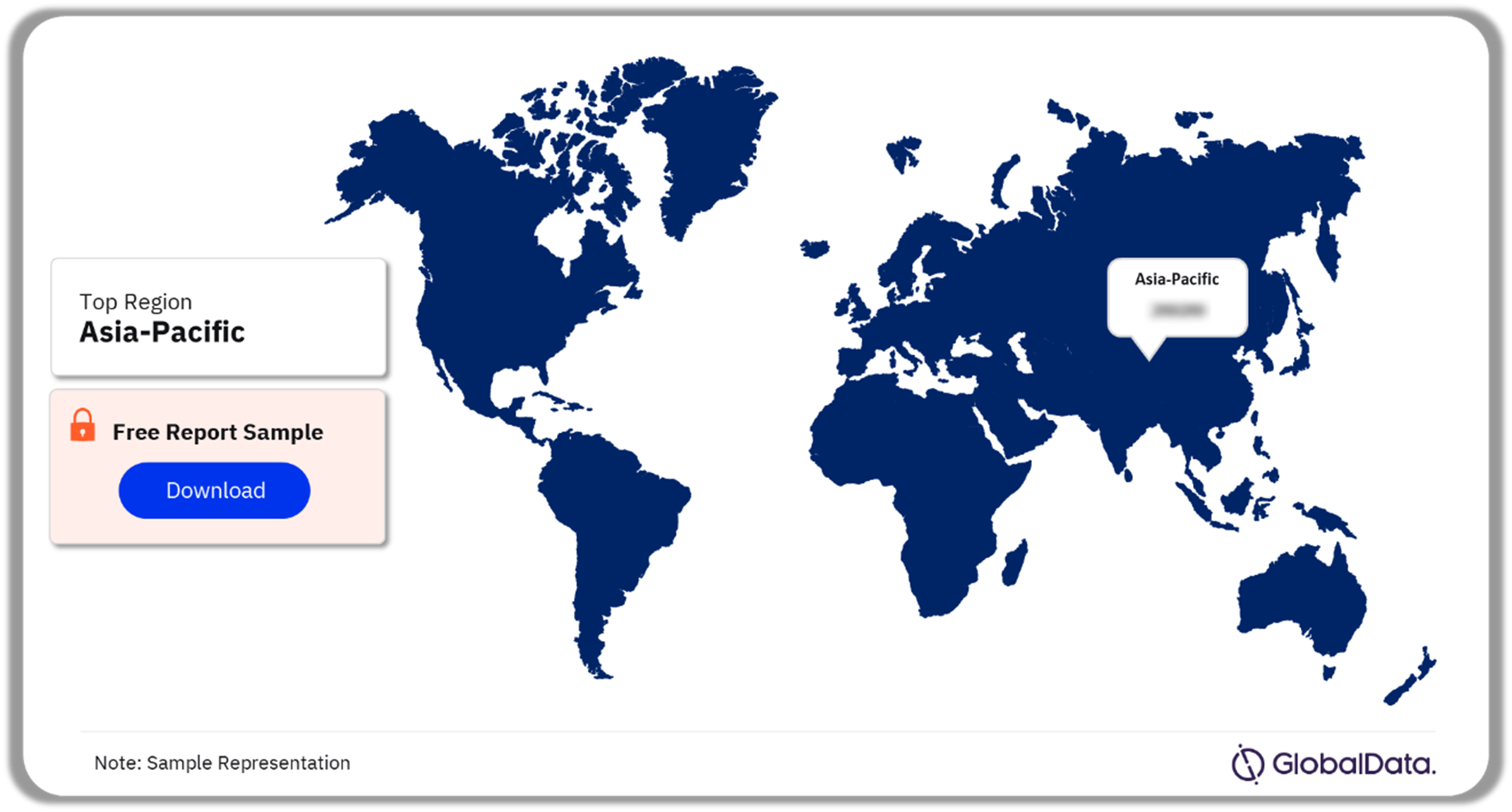

Electric Vehicles (EV) Market Analysis by Region

Asia Pacific’s EV market volume sales were the highest in 2023, capturing over 50% of the overall market size. China led the regional market, accounting for over 75% of the EV market in 2023. The dominance of the Chinese EV industry can be attributed to its strategic combination of investments, infrastructure development, and technological capabilities. Moreover, in June 2023, the Chinese government extended its tax exemption policy on new electric vehicles from its original expiration date in 2023 to 2027. This extension is aimed at boosting domestic sales and enhancing the appeal of foreign investment opportunities in the electric vehicles market.

The key economies in the region, such as China, Japan, South Korea, and India, have established ambitious goals to decrease carbon emissions. This commitment has resulted in the implementation of supportive policies and funding to accelerate the adoption of electric transportation in the region, contributing to the overall market growth momentum.

Electric Vehicles (EV) Market Share by Region, 2023 (%)

Buy the Full Report for Regional Insights into the Electric Vehicles (EV) Market

The region is home to some of the world’s most renowned automotive companies, such as BYD Auto, Toyota Group, Hyundai Motors, and Geely Group. These companies manufacture locally and provide EVs to consumers at an affordable price. Furthermore, they also benefit from a profound understanding of local customer preferences, which is evident in the design of their vehicles, tailored to meet these preferences.

Electric Vehicles (EV) Market – Competitive Landscape

EV is an emerging industry and is currently led by automotive giants, including Toyota Motor Corp., BYD Auto Co. Ltd., and Tesla Inc., which combinedly accounted for over 32% of the market share in 2023. The competitive landscape of the electric vehicles market is being shaped by a combination of industry trends, including product innovation, battery technology advancements, and collaboration, which have contributed to fueling the competition. In April 2024, Tesla Inc. announced to introduction of a new voice-activated gear selector in their new electric cars. The company has also planned to form a joint venture with Reliance Industries to set up an EV manufacturing unit in India.

As the industry is recording staggering growth, the competitive landscape is becoming increasingly complex, with both established automakers and new entrants competing for market share. Consequently, numerous venture capital firms are making substantial investments in startups that boast cutting-edge expertise. In March 2024, IM Motors, a Chinese automaker primarily providing advanced technology solutions for navigation systems inside automotive vehicles, raised $1.1 billion. This funding will support the development of next-generation smart EV models and entry into international markets.

The merger and acquisition (M&A) activities in the electric mobility sector remain vibrant, with companies vying for dominance. With the rapid expansion of the market, there might be an increase in strategic maneuvers, partnerships, and consolidation. With the ongoing competition to meet dynamic consumer demands, M&A engagements will continue to influence the industry’s trajectory. For instance, in November 2023, Stellantis N.V. acquired a 21% stake in Zhejiang Zero Run Technology Co., Ltd. (Leapmotor), a Chinese electric automotive manufacturer, at a deal value of $1.6 billion.

Leading Companies in the Electric Vehicles (EV) Market

- Toyota Motor Corp.

- BYD Auto Co. Ltd.

- Tesla Inc.

- Volkswagen AG

- Hyundai Motor Co.

- Geely Automobile Holdings Ltd.

- Mercedes-Benz Group AG

- Stellantis N.V.

- Bayerische Motoren Werke AG (BMW)

- SAIC Motor Corp. Ltd.

Other Electric Vehicles (EV) Market Vendors Mentioned

Renault-Nissan-Mitsubishi, Changan Automobile Group, Great Wall Motor, Chery Group, Brilliance Auto, Dongfeng Motor, FAW Group, BAIC Group, Suzuki Group, Mazda Motors, and General Motors Group among others.

Electric Vehicles (EV) Market Segments

GlobalData Plc has segmented the EV market report by product, end-use, and region:

Electric Vehicles Market Product Outlook (Volume, Million Units, 2021-2031)

- BEV

- FHEV

- MHEV (48V)

- PHEV

- MHEV

- EREV

- FCEV

- PFCEV

Electric Vehicles Market End-Use Outlook (Volume, Million Units, 2021-2031)

- Personal

- Commercial

Electric Vehicles Market Regional Outlook (Volume, Million Units, 2021-2031)

- Americas

- US

- Canada

- Mexico

- Brazil

- Argentina

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- Thailand

- Malaysia

- Indonesia

- Philippines

- Rest of World

Scope

This report provides overview and addressable market for electric vehicles.

It identifies the key drivers and challenges impacting growth of the market over the next 12 to 24 months.

It includes global market forecasts for the electric vehicles industry and analysis of M&A, venture financing, patent analytics, and social media activities.

The detailed value chain consists of four main aspects: batteries, semiconductors, auto components, assembly and charging.

Key Highlights

The electric vehicles market recorded a volume sales of 24.8 million units in 2023 and is expected to grow at a CAGR of 10.9% during the forecast period (2022-2030). An electric vehicle is a vehicle that uses an electric motor for propulsion instead of a combustion engine. The EV industry is undergoing rapid growth and innovation, driven by technological advancements, government policies, and consumer demand. With continued investment in infrastructure and technology, the EV industry is poised to play a significant role in the transition to a more sustainable transportation future.

Reasons to Buy

This market intelligence report offers a thorough, forward-looking analysis of the electric vehicles market and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in global electric vehicle markets.

The report also highlights key propulsion type segments (Battery electric vehicle (BEV), Fuel cell electric vehicle (FCEV), Full hybrid electric vehicle (FHEV), Plug-in hybrid electric vehicle (PHEV), Extended range electric vehicle (EREV), Mild hybrid electric vehicle (MHEV)), end user type segments (personal vehicles and commercial vehicles)

With more than 50 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players that enable executives to quickly get up to speed with the current and emerging trends in electric vehicle markets.

The broad perspective of the report, coupled with comprehensive, actionable detail, will help electric vehicle vendors, service providers, and other players succeed in the growing electric vehicles market globally.

Key Players

Toyota Motor Corp.BYD Auto Co. Ltd.

Tesla Inc.

Volkswagen AG

Hyundai Motor Co.

Geely Automobile Holdings Ltd.

Mercedes-Benz Group AG

Stellantis N.V.

Bayerische Motoren Werke AG (BMW)

SAIC Motor Corp. Ltd.

Table of Contents

Table

Figures

Frequently asked questions

-

Which is the key segment by end-use type in the EV market?

Personal vehicle is the key segment by end-use type in the EV market.

-

Which is the key region in the EV market?

Asia Pacific is the key region in the EV market.

-

Which are the leading Electric Vehicles (EV) companies globally?

The leading EV companies are Toyota Motor Corp., BYD Auto Co. Ltd., Tesla Inc., Volkswagen AG, Hyundai Motor Co., Geely Automobile Holdings Ltd., Mercedes-Benz Group AG, Stellantis N.V., Bayerische Motoren Werke AG (BMW), SAIC Motor Corp. Ltd., and SAIC Motor Corp. Ltd.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Electrified Vehicles reports