Fragrances Market Opportunities, Trends, Growth Analysis and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Fragrances Market Overview

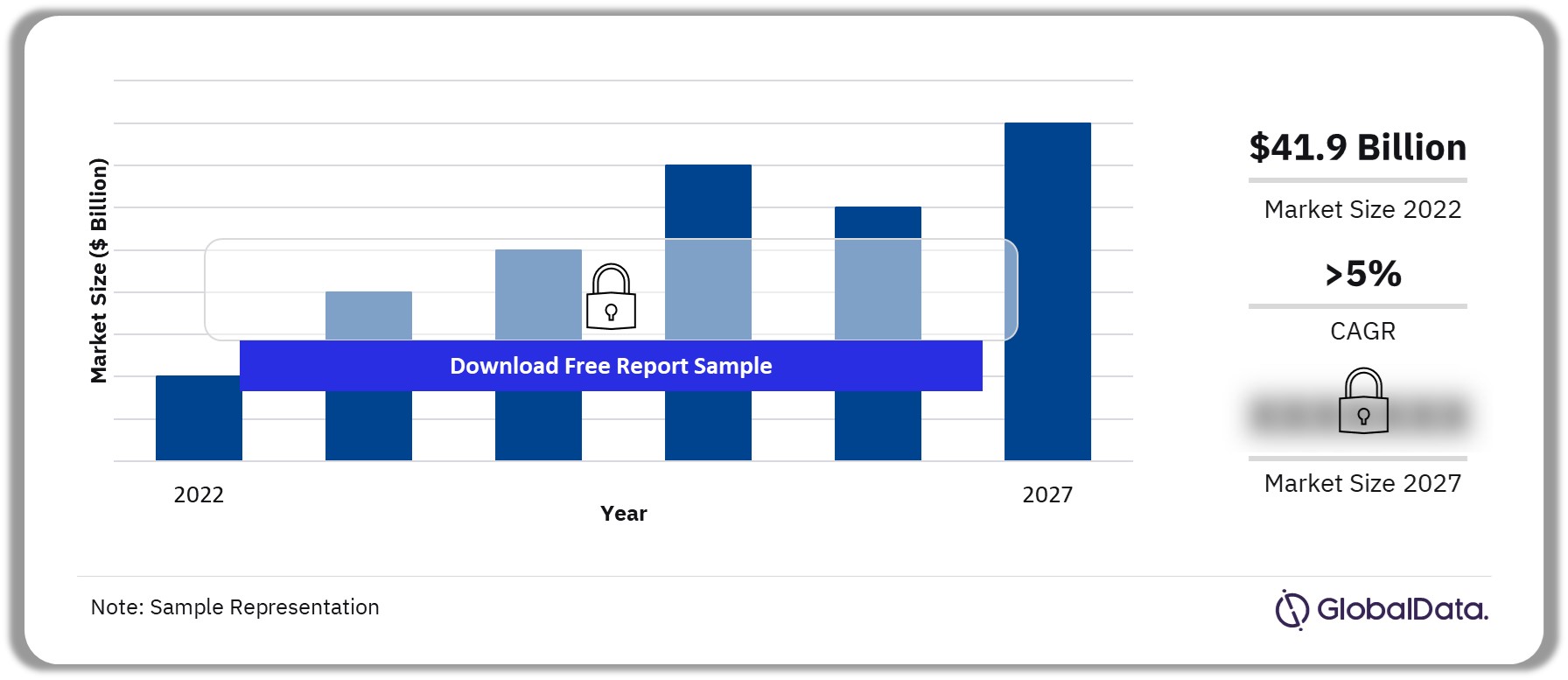

The fragrances market size was valued at $41.9 billion in 2022 and the market is anticipated to grow at a CAGR of more than 5% during 2022-2027. Consumers are increasingly perceiving fragrances as a basic grooming need. This factor will drive the growth of the fragrance market. Moreover, consumers are seeking unique and new fragrances, pushing manufacturers to innovate. Furthermore, the growing awareness of the adverse effects of synthetic ingredients is stimulating demand for natural and clean ingredients included in fragrance products.

Fragrances Market Outlook 2022-2027 ($ Billion)

For more insights on the fragrances market forecasts, download a free sample report

The fragrances market growth analysis report includes an analysis of the sector overview, insights about the high-potential countries, country and regional analysis, competitive landscape, key distribution channels, and selected industry metrics. The report provides an overview of the current fragrances sector scenario, as well as regional overview across five regions including Asia-Pacific, Middle East & Africa, Americas, Western Europe, and Eastern Europe, highlighting industry size, growth drivers, latest developments, and future inhibitors for the regions.

| Market Size (2022) | $41.9 billion |

| CAGR (2022-2027) | >5% |

| Key Categories |

|

| Key Regions |

|

| High-Potential Countries |

|

| Key Distribution Channels |

|

| Key Packaging Material |

|

| Leading Players |

|

| Enquire and Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

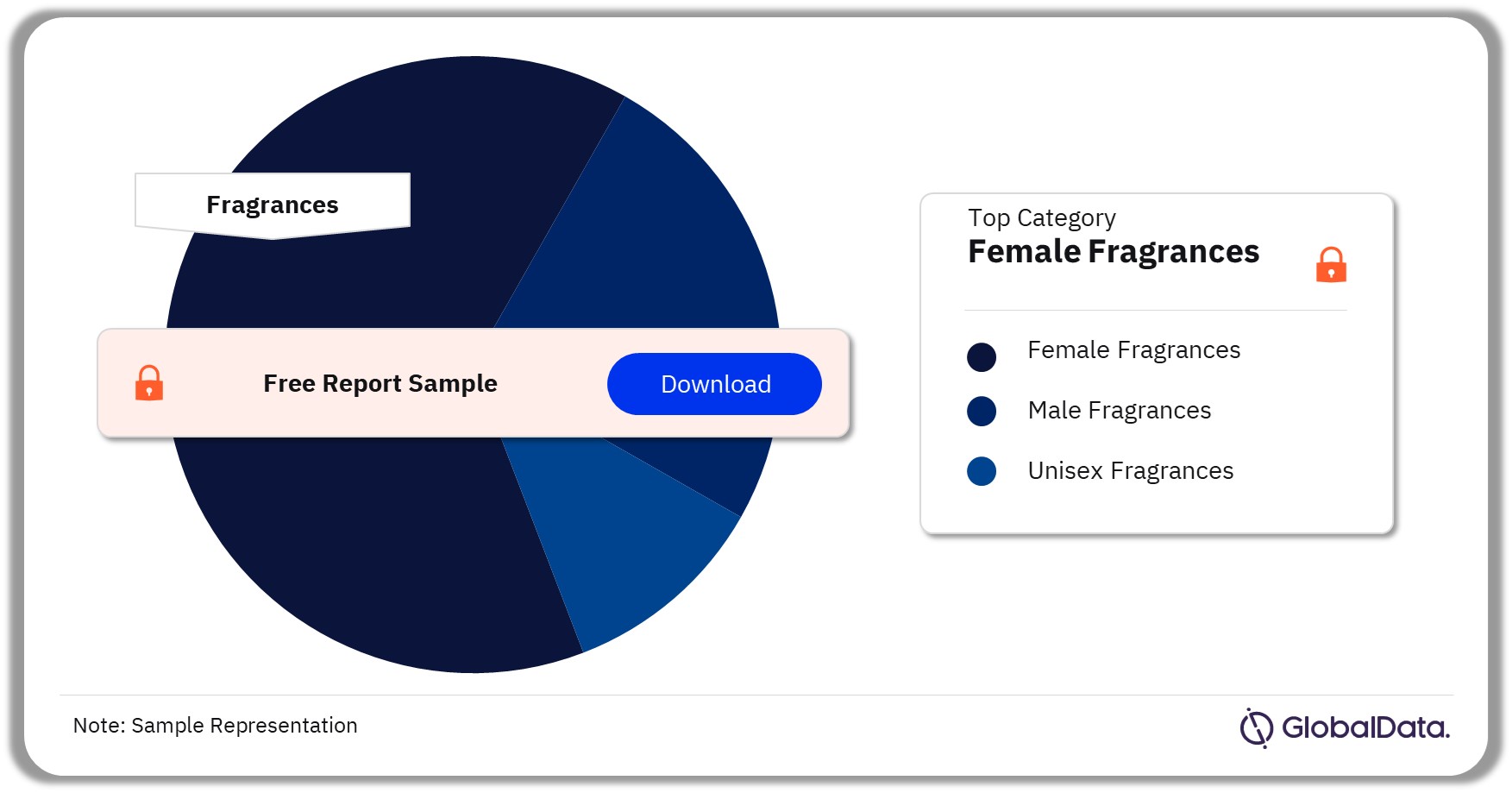

Fragrances Market Segmentation by Category

The key categories in the fragrances market are female fragrances, male fragrances, and unisex fragrances. In 2022, the female fragrances market dominated the market.

Fragrances Market Analysis by Category, 2022 (%)

For more insights on the fragrances market categories, download a free sample

Fragrances Market Segmentation by Regions

The key regions in the fragrances are Asia-Pacific, Western Europe, Eastern Europe, the Americas, and the Middle East & Africa. In 2022, the Americas dominated the fragrances market share. The growing demand for multi-functional products in the region due to busy lifestyles also sustained value sales of the fragrances sector. Growing concerns about the harmful effects of synthetic ingredients have increased the demand for products based on natural ingredients contributing to the growth of the sector.

Fragrances Market Analysis by Region, 2022 (%)

For additional insights on the regional outlook of the fragrances market, download a free sample report

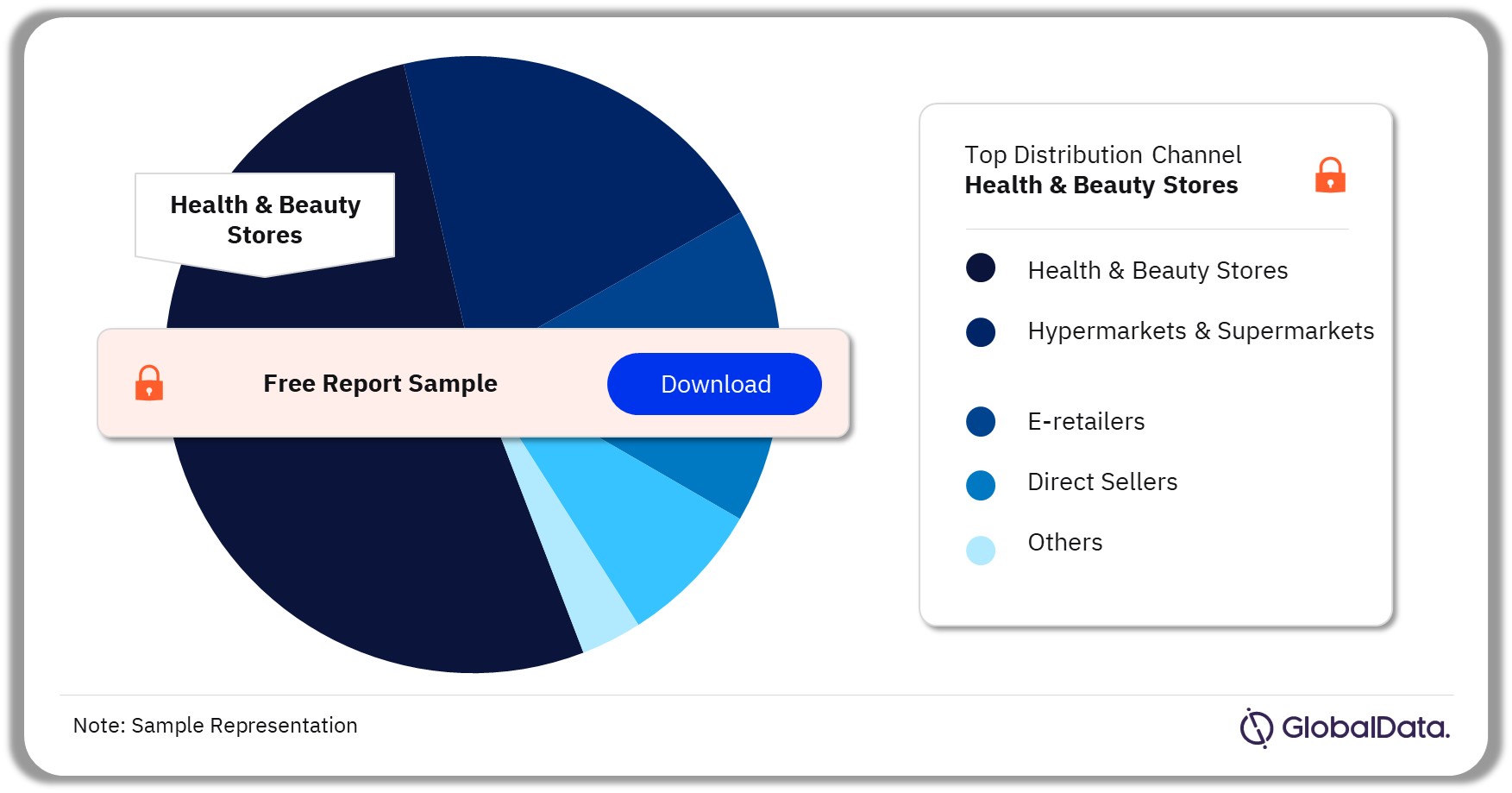

The key distribution channels in the fragrances market are health & beauty stores, hypermarkets & supermarkets, e-retailers, direct resellers, and others. In 2022, the health & beauty stores distribution channels accounted for the largest fragrances market share.

Fragrances Market Analysis by Distribution Channels, 2022 (%)

For more insights on the distribution channels in the fragrances market, download a free sample report

Fragrances Market Segmentation by Packaging Material

The key packaging material in the fragrances market are glass, rigid plastics, and rigid metal. In 2022, the glass packaging material accounted for the largest fragrance market share, followed by rigid plastics.

Fragrances Market Analysis by Packaging Material, 2022 (%)

For more insights on the packaging material in the fragrances market, download a free sample report

Fragrances Market – Competitive Landscape

The leading players in the fragrances market are L’Oréal, Coty, Natura & Co, LMVH Moet Hennessy – Louis Vuitton, Chanel, and Private Labels among others. In 2022, L’Oréal led the fragrances market with key brands including Giorgio Armani, Ralph Lauren, Lancôme, Yves Saint Laurent, and Thierry Mugler among others.

Fragrances Market Analysis by Leading Players, 2022 (%)

For more information on the leading players in the fragrances market, download a free sample

Scope

This report brings together multiple data sources to provide a comprehensive overview of the global fragrances sector. It includes an analysis on the following –

Sector overview: Provides an overview of current sector scenarios in terms of ingredients, manufacturer claims, labeling, and packaging. The analysis also provides a regional overview across five regions-Asia-Pacific, Middle East & Africa, the Americas, Western Europe, and Eastern Europe-highlighting sector size, growth drivers, latest developments, and future challenges for each region. This data includes both on-trade and off-trade data.

Change in consumption: Provides a shift in the consumption of fragrances over 2017–27 at global and regional levels.

High-potential countries: Provides a risk–reward analysis of the top four high-potential countries in each region based on market assessment, economic development, governance indicators, socio-demographic factors, and technological infrastructure.

Country and regional analysis: Provides a deep-dive analysis of 10 high-potential countries covering value growth during 2022–27, key challenges, consumer demographics, and key trends. It also includes regional analysis covering the future outlook for each region. Market size includes both on-trade and off-trade data, while only off-trade data is used in company and brand analysis, distribution analysis, and packaging analysis.

Competitive landscape: Provides an overview of leading brands at a global and regional level, besides analyzing the product profile, country-level presence, market share, and growth of private labels in each region.

Key distribution channels: Provides analysis on the leading distribution channels in the global fragrances sector in 2022. It covers health & beauty stores, direct sellers, parapharmacies/drugstores, “dollar stores”, variety stores & general merchandise retailers, cash & carries and warehouse clubs, convenience stores, department stores, e-retailers, hypermarkets & supermarkets, chemists/pharmacies, and others.

Packaging analysis*: The report provides percentage shares (in 2022) and growth analysis (during 2022–27) for various pack materials, pack types, closures, and primary outer types based on volume sales of fragrance products.

Key Highlights

Consumers today have become extremely selective when purchasing products in the sector, owing to health considerations. New products in the fragrances sector are being launched with a plethora of health claims such as natural origin, vegan, plant-based, no artificial colors, no genetic modification, and no preservatives. The clean labeling trend, which places emphasis on the transparency of fragrances products with reference to the ingredients used, is growing in the fragrances sector. This is becoming increasingly common in new product launches, with labels claiming the use of natural, wholesome, and simple ingredients that are easy to recognize, in order to appeal to consumers.

Reasons to Buy

- Manufacturing and retailers seek latest information on how the market is evolving to formulate their sales and marketing strategies. There is also demand for authentic market data with a high level of detail. This report has been created to provide its readers with up-to-date information and analysis to uncover emerging opportunities for growth within the sector in the region.

- The report provides a detailed analysis of the countries in the region, covering the key challenges, competitive landscape, and demographic analysis, that can help companies gain insight into the country-specific nuances.

- The analysts have also placed a significant emphasis on the key trends that drive consumer choice and the future opportunities that can be explored in the region, which can help companies in revenue expansion.

- To gain competitive intelligence about leading brands in the sector in the region with information about their market share and growth rates.

Coty

Natura & Co

LVMH Moet Hennessy - Louis Vuitton

Chanel

Table of Contents

Table

Figures

Frequently asked questions

-

What was the fragrances market size in 2022?

The fragrances market size in 2022 was $41.9 billion.

-

What will be the fragrances market CAGR during 2022-2027?

The fragrances market will witness a CAGR of more than 5% during 2022-2027.

-

Which category dominated the fragrances market share in 2022?

The female fragrances category accounted for the highest share of the market in 2022.

-

Which distribution channel generated the highest fragrances market revenue in 2022?

The health & beauty stores were the largest distribution channel segment in the fragrances market.

-

Which packaging material generated the highest fragrances market revenue in 2022?

The glass packaging materials were the largest packaging material segment in the fragrances market.

-

Who are the leading players in the fragrances market?

L’Oréal, Coty, Natura & Co, LMVH Moet Hennessy – Louis Vuitton, Chanel, and Private Labels are the leading players in the fragrances market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.