Crude Oil Refinery Maintenance Review by Region and Operator, 2023 Update

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Crude Oil Refinery Maintenance Review Report Overview

Asia had the highest refining capacity under maintenance in 2023. The crude oil refinery maintenance review report provides a count of the maintenance by region in 2023, including a detailed coverage of the Petroleum Administration for Defense Districts (PADD). The report also discusses the key operators in the crude oil refinery maintenance market.

| Key Regions | · Asia

· Europe · Africa · South America · Middle East · North America · Oceania · Former Soviet Union · Caribbean |

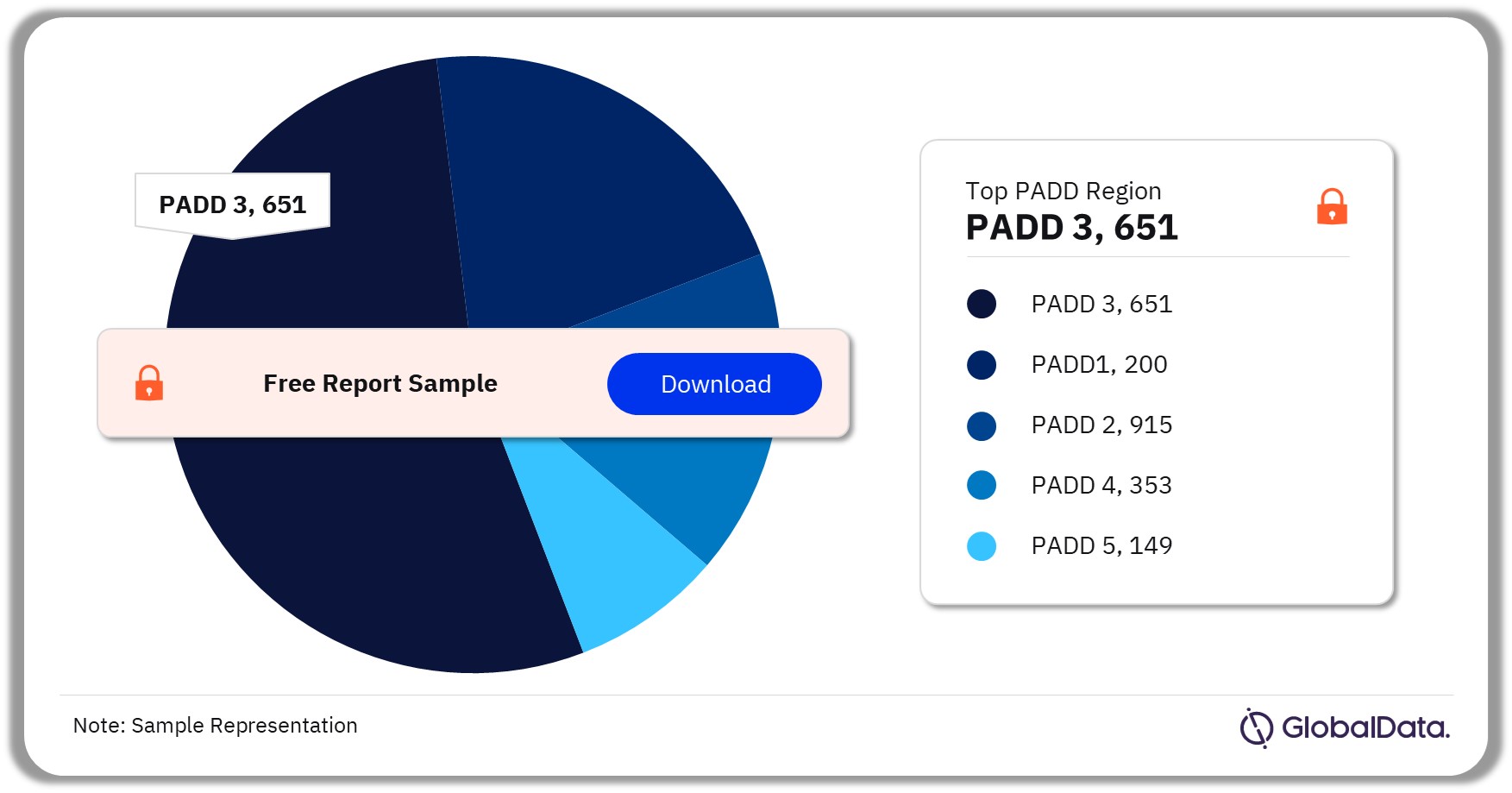

| Key PADD Regions | · PADD1, 200

· PADD 2, 915 · PADD 3, 651 · PADD 4, 353 · PADD 5, 149 |

| Key Operators | · Petroleos de Venezuela

· CITGO Petroleum · ExxonMobil Fuels · Kuwait Integrated Petroleum Industries · CITGO Petroleum |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Crude Oil Refinery Maintenance Segmentation by Regions

The key regions with crude oil refinery maintenance are Asia, Europe, Africa, South America, the Middle East, North America, Oceania, the Former Soviet Union, and the Caribbean. Asia had the highest refining capacity under both planned and unplanned maintenance in 2023. It is followed by North America and Europe.

The report also analyzes:

- Global Coking Capacity under Maintenance by Region, 2023 vis-à-vis 2022

- Global Fluid Catalytic Cracking (FCC) Capacity under Maintenance by Region, 2023 vis-à-vis 2022

- Global Hydrocracker Capacity under Maintenance by Region, 2023 vis-à-vis 2022

- Global Hydrotreater Capacity under Maintenance by Region, 2023 vis-à-vis 2022

- Global Reformer Capacity under Maintenance by Region, 2023 vis-à-vis 2022

Crude Oil Refinery Maintenance Analysis by Regions, 2023(%)

Buy the Full Report for More Region Insights into Crude Oil Refinery Maintenance

Download a Free Report Sample

Crude Oil Refinery Maintenance Segmentation by Petroleum Administration for Defense Districts (PADD) Regions

The key PADD regions with crude oil refinery maintenance are PADD1, 200; PADD 2, 915; PADD 3, 651; PADD 4, 353; and PADD 5, 149. Among the PADD regions in the US, the PADD3 region had the highest refining capacity under maintenance, including both planned and unplanned projects in 2023.

The report also analyzes:

- Coking Capacity under Maintenance by PADD Regions in the US, 2023 vis-à-vis 2022

- FCC Capacity under Maintenance by PADD Regions in the US, 2023 vis-à-vis 2022

- Hydrocracker Capacity under Maintenance by PADD Regions in the US, 2023 vis-à-vis 2022

- Hydrotreater Capacity under Maintenance by PADD Regions in the US, 2023 vis-à-vis 2022

- Reformer Capacity under Maintenance by PADD Regions in the US, 2023 vis-à-vis 2022

Crude Oil Refinery Maintenance Analysis by PADD Regions, 2023(%)

Buy the Full Report for More Region Insights into Crude Oil Refinery Maintenance

Download a Free Report Sample

Crude Oil Refinery Maintenance by Key Operators

The primary operators associated with crude oil refinery maintenance are Petroleos de Venezuela, CITGO Petroleum, ExxonMobil Fuels, Kuwait Integrated Petroleum Industries, and CITGO Petroleum. Petroleos de Venezuela had the highest refining capacity under planned maintenance in 2023, followed by CITGO Petroleum.

Crude Oil Refinery Maintenance Analysis by Operators, 2023 (%)

Buy the Full Report for More Operator Insights into Crude Oil Refinery Maintenance

Download a Free Report Sample

Segments Covered in the Report

Crude Oil Refinery Maintenance Regional Outlook (2023)

- Asia

- Europe

- Africa

- South America

- Middle East

- North America

- Oceania

- Former Soviet Union

- Caribbean

Crude Oil Refinery Maintenance PADD Regions Outlook (2023)

- PADD1, 200

- PADD 2, 915

- PADD 3, 651

- PADD 4, 353

- PADD 5, 149

Scope

The report provides:

- Analysis of capacity under maintenance for crude distillation, coking, fluid catalytic cracking, hydrocracker, hydrotreater, and reformer units globally for 2023.

- Comparison of select refinery units under maintenance (planned, unplanned, and both) by major regions for 2023 and 2022.

- Comparison of select refinery units under maintenance (planned, unplanned, and both) by PADD regions in the US for both years.

- Comparison of select refinery units under maintenance (planned, unplanned, and both) by operators for both years.

Reasons to Buy

- Mark major refinery units (crude distillation, coking, fluid catalytic cracking, hydrocracker, hydrotreater, and reformer) under maintenance globally for 2023 and 2022.

- Obtain information on region-wise maintenance globally for 2023 in comparison with 2022.

- Identify and compare PADD regions and operators with the highest maintenance in 2023 and 2022.

- Make decisions on the basis of strong refinery maintenance data.

- Assess your competitor’s refinery maintenance.

Table of Contents

Table

Figures

Frequently asked questions

-

Which was the leading PADD region in crude oil refinery maintenance in 2023?

Among the PADD regions in the US, the PADD3 region had the highest refining capacity under maintenance including both planned and unplanned projects in 2023.

-

Which was the region with the leading number of crude oil refinery maintenance in 2023?

Asia was the leading region globally with the highest number of crude oil refinery maintenance in 2023.

-

Which are the key operators associated with crude oil refinery maintenance?

The operators mainly associated with crude oil refinery maintenance are Petroleos de Venezuela, CITGO Petroleum, ExxonMobil Fuels, Kuwait Integrated Petroleum Industries, and CITGO Petroleum.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.