Gold Mining Market Analysis by Reserves, Production, Assets, Demand Drivers and Forecast to 2030

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Empower your strategies with our Global Gold Mining to 2026 report and make more profitable business decisions.

Gold Mining Market Report Overview

The amount of gold produced in 2023 is 121.2moz. Ghana and the US are the key contributors to the growth in global supply in 2023. After a steady improvement from early November 2022, the gold price fell in February due to an improving US dollar and strong US economic data. However, over the course of 2023 economic headwinds are expected to lead to a falling dollar and support gold prices.

The gold mining market research report provides comprehensive coverage of the gold industry including historical and forecast data on gold production by country, production by company, reserves by country, and global gold prices. The report also includes a demand drivers section providing information on factors that are affecting the gold mining industry. It further profiles major gold producers and information on the major active, planned, and exploration projects.

| Forecast Period | 2023-2030 |

| Historical Period | 2011-2022 |

| Key Countries | · Australia

· Russia · South Africa · The US · Peru |

| Active Mines | · Muruntau Mine

· Carlin Mine · Goldstrike Mine · Olimpiada Mine · Shaxi Copper Mine · Grasberg Block Cave Mine · Batu Hijau Mine · Kibali Mine · Boddington Mine · Pueblo Viejo Mine |

| Development Projects | · Sukhoi Log Project

· Mponeng Expansion Project · Donlin Gold Project · KSM (Kerr-Sulphurets-Mitchell) Project · Haiyu Gold Mine · Mallina Gold Project · Tasiast 24k Project · Odyssey Project · Kucing Liar Project · Goldrush Project |

| Exploration Projects | · Vangtat Gold Project

· Potchefstroom Project · Klerksdorp Project · Knife Lake Project · Treaty Creek Project · Mount Cattlin Gold Project · Bendigo North Gold Project · Heruga Project · Talas Copper Gold Project · Anba Property |

| Leading Companies | · Newmont Corp

· Barrick Gold · Agnico-Eagle Mines Ltd · AngloGold Ashanti Ltd · Polyus Gold · Gold Fields Limited · Newcrest Mining Ltd · Kinross Gold Corp · Zijin Mining Group Co Ltd · Freeport-McMoRan |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

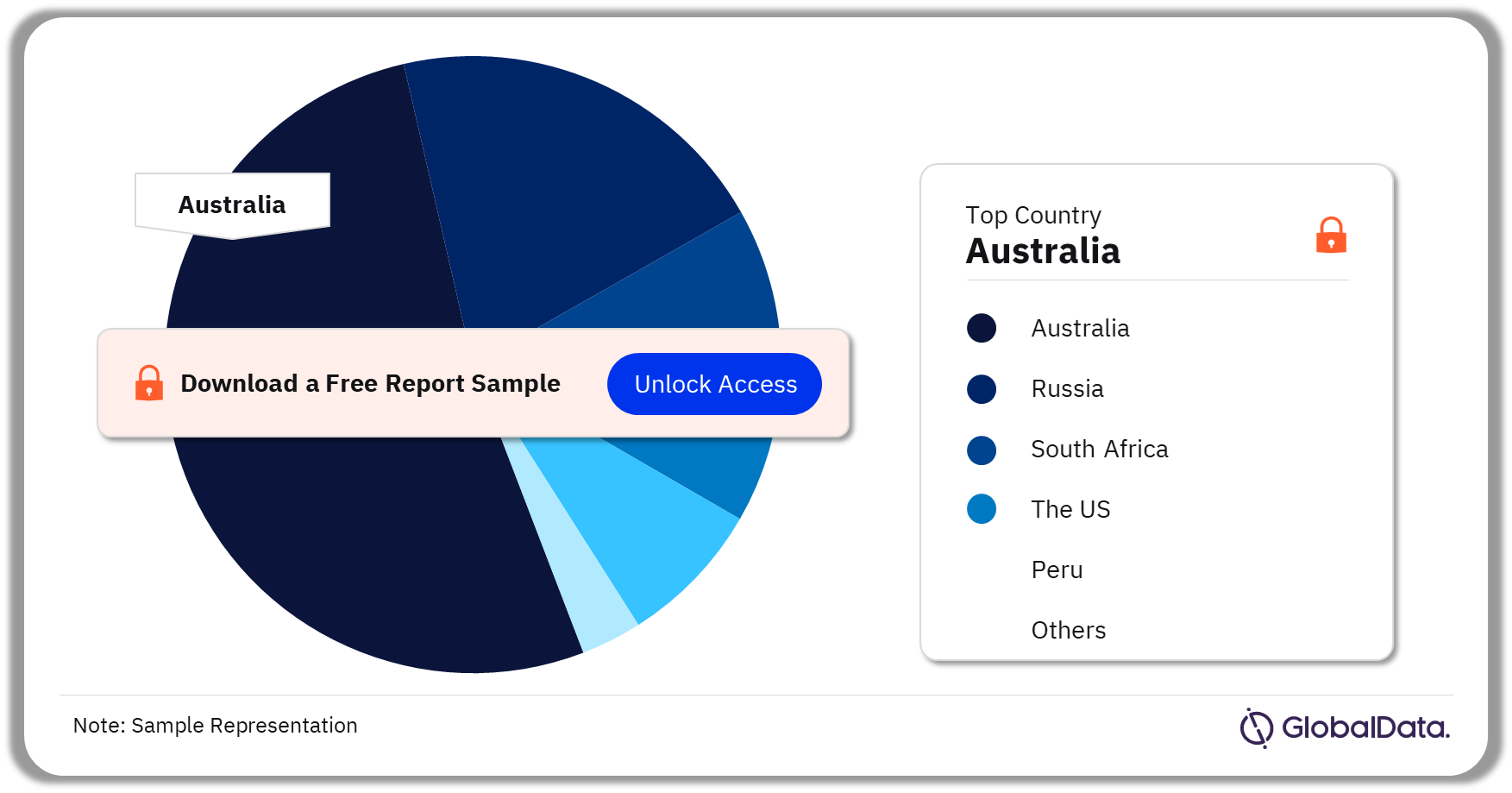

Gold Mining Market Segmentation by Country

Some of the key countries where gold reserves are located are Australia, Russia, South Africa, the US, and Peru. The majority of these are located in Australia, followed by Russia and South Africa. Australia led the gold mining market with the largest number of reserves in 2022 as well.

Gold Mining Market Analysis by Countries, 2023 (%)

For more country insights into the gold mining market, download a free report sample

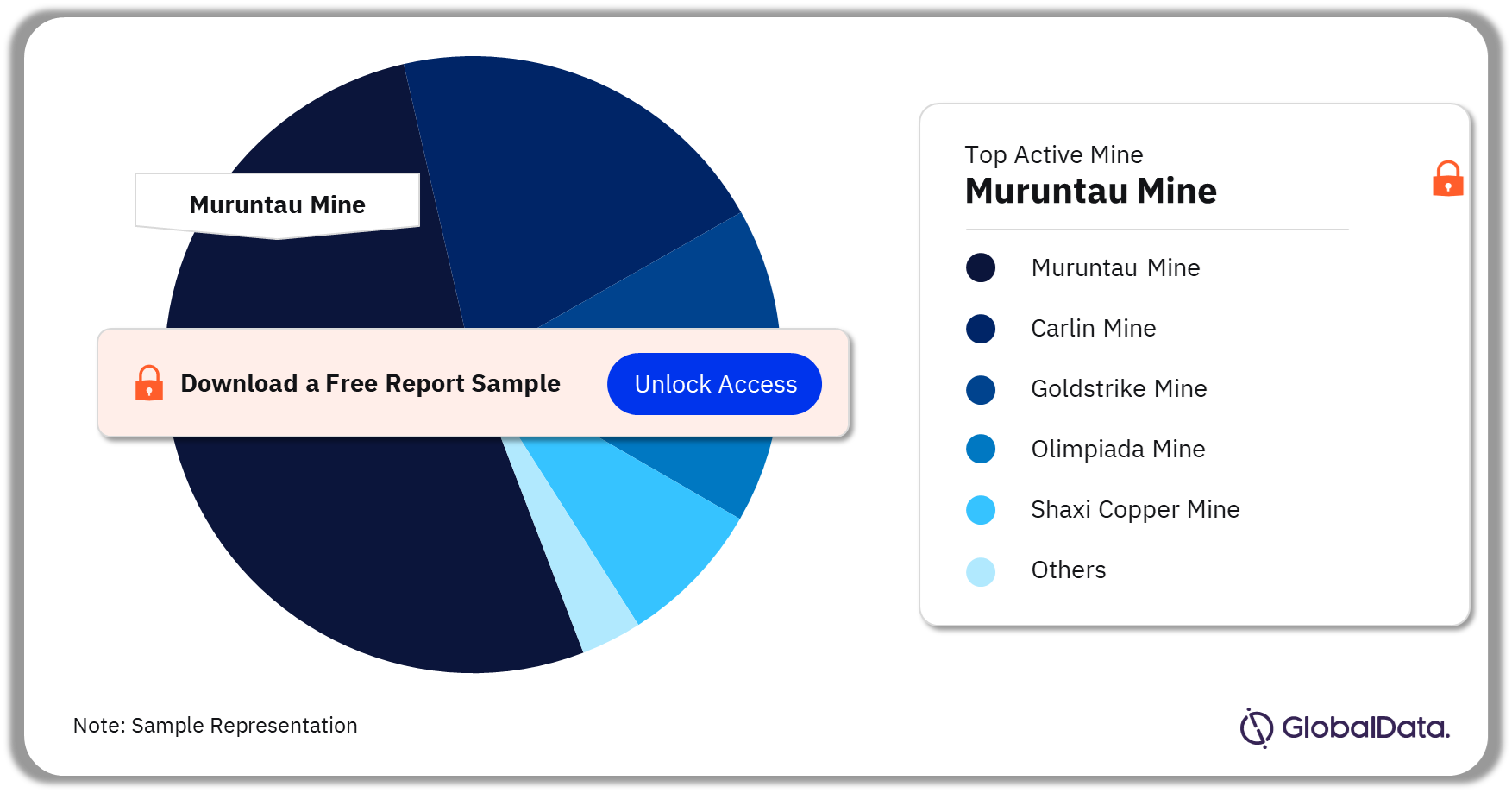

Gold Mining Market - Active Mines

Some of the top active gold mines are Muruntau Mine, Carlin Mine, Goldstrike Mine, Olimpiada Mine, Shaxi Copper Mine, Grasberg Block Cave Mine, Batu Hijau Mine, Kibali Mine, Boddington Mine, and Pueblo Viejo Mine. Muruntau Mine had the highest gold production in 2022.

Gold Mining Market Analysis by Active Mine, 2023 (%)

For more active mine insights into the gold mining market, download a free report sample

Gold Mining Market - Development Projects

Some of the major development projects are Sukhoi Log Project, Mponeng Expansion Project, Donlin Gold Project, KSM (Kerr-Sulphurets-Mitchell) Project, Haiyu Gold Mine, Mallina Gold Project, Tasiast 24k Project, Odyssey Project, Kucing Liar Project, and Goldrush Project. The Sukhoi Log project is a greenfield project in Russia that is jointly owned by Polyus and Rostec Corp. The project is currently undergoing a Bankable Feasibility Studies (BFS) and is expected to start operations in 2027.

Gold Mining Market - Exploration Projects

Some of the major exploration projects are Vangtat Gold Project, Potchefstroom Project, Klerksdorp Project, Knife Lake Project, Treaty Creek Project, Mount Cattlin Gold Project, Bendigo North Gold Project, Heruga Project, Talas Copper Gold Project, and Anba Property. South Africa’s Potchefstroom and Klerksdorp projects, which are wholly owned by Sibanye Stillwater Ltd, are currently in the advanced exploration stage.

Gold Mining Market - Competitive Landscape

The leading companies associated with the gold mining market are Newmont Corp, Barrick Gold, Agnico-Eagle Mines Ltd, AngloGold Ashanti Ltd, Polyus Gold, Gold Fields Limited, Newcrest Mining Ltd, Kinross Gold Corp, Zijin Mining Group Co Ltd, and Freeport-McMoRan. Newmont Corp was the leading gold producer in 2022. Agnico-Eagle Mines Ltd had a considerable increase in production in 2022 compared to 2021.

Leading Gold Mining Companies, 2023

For more company insights into the gold mining market, download a free report sample

Segments Covered in the Report

Gold Mining Market Countries Outlook (Value, MOZ, 2011-2030)

- Australia

- Russia

- South Africa

- The US

- Peru

Scope

- Reserves and Production Data: Access detailed information on reserves, reserves by country, production figures, production by country, and production by company.

- Key Players: Learn about the major players in the industry like Newmont Corp, Barrick Gold, Agnico-Eagle Mines Ltd, AngloGold Ashanti Ltd, Polyus Gold, Gold Fields Limited, Newcrest Mining Ltd, Kinross Gold Corp, Zijin Mining Group Co Ltd, and Freeport-McMoRan.

- Country Insights: Discover leading gold-producing countries such as Australia, Russia, South Africa, the US, and Peru.

- Project landscape: Gain insights into gold explorational and developmental projects, as well as active mines.

Reasons to Buy

- Understand market trends: Gain a comprehensive understanding of gold mining by exploring country-wise market dynamics, identifying key assets, and assessing the competitive landscape.

- Strategic market analysis: Navigate the industry with ease by exploring historical and forecast trends to anticipate market shifts and make forward-looking decisions.

- Forge valuable partnerships: Identify key players in the gold mining market and access exclusive information on key stakeholders such as gold producers, government entities, suppliers, and more.

- Uncover major projects: Dive into a detailed overview of major active, explorational, and developmental mining projects across various regions.

Barrick Gold

Agnico-Eagle Mines Ltd

AngloGold Ashanti Ltd

Polyus Gold

Gold Fields Limited

Newcrest Mining Ltd

Zijin Mining Group Co Ltd

Kinross Gold Corp

Freeport-McMoRan Inc

Table of Contents

Table

Figures

Frequently asked questions

-

Which country has made the largest contribution towards the gold production market in 2023?

Australia is the largest contributor towards gold production in 2023.

-

Which active mine made the largest contribution towards the gold production market in 2022?

Muruntau Mine had the highest gold production in 2022.

-

What are the key active gold mines in the market?

Some of the top active gold mines are Muruntau Mine, Carlin Mine, Goldstrike Mine, Olimpiada Mine, Shaxi Copper Mine, Grasberg Block Cave Mine, Batu Hijau Mine, Kibali Mine, Boddington Mine, and Pueblo Viejo Mine.

-

Who are the leading companies in the gold mining market?

The leading companies associated with the gold mining market are Newmont Corp, Barrick Gold, Agnico-Eagle Mines Ltd, AngloGold Ashanti Ltd, Polyus Gold, Gold Fields Limited, Newcrest Mining Ltd, Kinross Gold Corp, Zijin Mining Group Co Ltd, and Freeport-McMoRan.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.