Healthcare Expenditure and Pharmaceutical Sales by Region, Patent Expiries and New Technologies – Overview of 2022 and Outlook for 2023

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insight from the ‘Healthcare and Pharmaceutical Market’ report can help you:

- Identify the broader macroeconomic environment and industry-specific trends that will impact the outlook of the global pharmaceutical sector.

- Analyze how technology developments, patent expirations, M&A, and healthcare policy reforms are impacting the outlook of the pharmaceutical industry.

- Identify key drivers across patent expirations, new technologies and M&A.

How is the ‘Healthcare and Pharmaceutical Market’ report different from other reports in the market?

- The report offers a global 10-year outlook for healthcare spending & pharmaceutical sales alongside an analysis of key drivers and trends that are impacting the forecasts.

- It highlights the new technologies including developments in rare disease/orphan drugs, cell/gene therapies (regenerative medicines), and other high-cost/high-budget impact areas.

- The report provides strategic planners, competitive intelligence professionals, and key stakeholders in the pharmaceutical industry with a clear view of the opportunities and risks over the foreseeable future.

- It provides critical insights for both developing and emerging markets that pharma professionals can use to help dictate their strategy for country planning and investments.

We recommend this valuable source of information to anyone involved in:

- Pharma Manufacturers (innovative, biotech, generics, biosimilars, rare/orphan disease)

- Distributors, Pharmacies, Parallel Trade Organizations

- Clinical research Organizations (CROs)

- Financial Institutions (investors in pharma/biotech, pricing consultancies)

- Managers, Directors, and VPs

To Get a Snapshot of the Healthcare and Pharmaceutical Sales Report, Download a Free Report Sample

Healthcare Expenditure and Pharmaceutical Sales Report Overview

The total global healthcare spending is projected to grow to $10.2 trillion and pharmaceutical sales is projected to grow to $1.5 trillion in 2023. The pharmaceutical sales are driven by new product entries and continued spending on COVID-19 vaccines and therapeutics. The Healthcare Expenditure and Pharmaceutical sales research report provides an executive summary of healthcare expenditure and pharmaceutical sales forecasts from its Q1 2023 forecast cycle.

Healthcare and Pharmaceutical Market by Countries

GlobalData examines the trends in healthcare spending and pharma sales for five key groups of markets which are the US, the top five European markets (France, Germany, Italy, Spain, and the UK), Japan, BRIC MT (Brazil, Russia, India, China, Mexico, and Turkey), and the secondary emerging markets (Colombia, Indonesia, Malaysia, Nigeria, the Philippines, Poland, Saudi Arabia, South Africa, Thailand, and Vietnam).

The US: Omnibus spending bill in December attempts to improve access to healthcare before a new Congress is formed. The US lawmakers have proposed an FY 2023 omnibus spending bill that contains several major healthcare policies: partial relief from Medicare payment cuts, a new Medicaid redetermination deadline, an extension to telehealth flexibilities and rural hospital programs, a boost to mental health funding, and reforms to the FDA accelerated approval pathway.

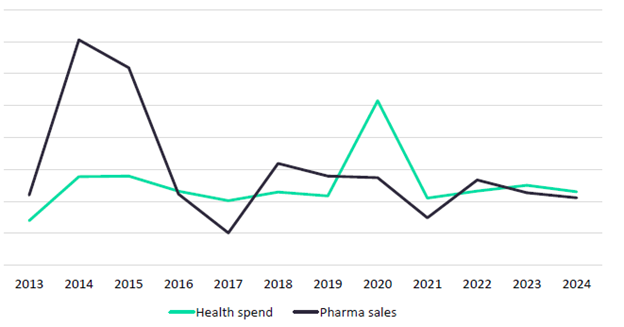

US Growth in Health Spend and Pharma Sales, 2013-2024

For more country insights into the healthcare and pharmaceutical sales, download a free report sample

Japan: Japan’s Cabinet Office passed a new economic stimulus package to address the recent rise in inflation. It includes financial support for domestic API manufacturing and vaccine development. Subsequently, in December, the government approved a record national budget plan for fiscal year (FY) 2023 which had a budget allocated for social security. Out of the social security budget, an amount is allocated for healthcare spending, including funding for national healthcare insurance, special measures to ensure stable drug supply, and special projects to expand public healthcare distribution.

The UK: In November, the Chancellor of the Exchequer Jeremy Hunt vowed to increase combined spending on the National Health Service (NHS) and social care in cash terms by the financial year 2024/25. However, the funding may be insufficient to atone for underinvestment in infrastructure and workforce shortages. The government plans to adopt the Vaccine Taskforce style approach used during the pandemic to target four key areas which are cancer, obesity, mental health, and addiction.

Healthcare and Pharmaceutical Market - Patent Expiries

In terms of number of drugs losing exclusivity in 2023, the highest impact by far will be felt in the infectious disease and metabolic disorders therapeutic areas. In terms of revenue of the affected originator product, the most significant patent expiry in 2023 was for an anti-inflammatory drug in the US in January 2023. Market penetration of biosimilar versions of Humira in the US is likely to be relatively fast, considering that the FDA granted approval with ‘interchangeability’ status to a biosimilar version in October 2021.

Healthcare and Pharmaceutical Market – Top Mergers and Acquisitions

In line with the trend seen in 2022, oncology and Central Nervous System (CNS) are likely to remain popular drivers for M&A activity, along with personalized medicine. Additionally, the pandemic and the war in Ukraine will cast a long shadow on pharma M&A activity for some time to come. This may lead to more deals designed to safeguard supply chains in case of sustained global market turbulence. Some M&A deals will also be driven by ESG considerations. A final driver will be protectionist policies that may encourage companies to acquire local partners in a bit to secure access to reimbursement and favorable pricing in countries that give priority to locally produced medicines. Some of the top M&A deals of 2022 are the acquisition of Biohaven by Pfizer in May and the acquisition of Global Blood Therapeutics (GBT) by Pfizer in October.

For additional healthcare and pharmaceutical sales insight, download a free report sample

Healthcare Expenditure and Pharmaceutical Sales Report Overview

| Healthcare Expenditure (2023) | $10.2 trillion |

| Pharmaceutical Sales (2023) | $1.5 trillion |

| Analysis Period | 2013-2023 |

| Forecast Year | 2024 |

| Top Markets | The US, The Top Five European Markets (France, Germany, Italy, Spain, and the UK), Japan, BRIC MT (Brazil, Russia, India, China, Mexico, and Turkey), and The Secondary Emerging Markets (Colombia, Indonesia, Malaysia, Nigeria, the Philippines, Poland, Saudi Arabia, South Africa, Thailand, and Vietnam) |

Healthcare Expenditure and Pharmaceutical Sales Top Markets Outlook (Value, %, 2013-2024)

- The US

- France

- Germany

- Italy

- Spain

- The UK

- Japan

- Brazil

- Russia

- India

- China

- Mexico

- Turkey

- Colombia

- Indonesia

- Malaysia

- Nigeria

- The Philippines

- Poland

- Saudi Arabia

- South Africa

- Thailand

- Vietnam

Scope

- The forecasts summarized here include healthcare spending, pharmaceutical sales, and several other indicators across 70 markets.

- In this executive summary, GlobalData examines the trends in healthcare spending and pharma sales for five key groups of markets: the US, the top five European markets (France, Germany, Italy, Spain, and the UK), Japan, BRIC-MT (Brazil, Russia, India, China, Mexico, and Turkey), and the secondary emerging markets (Colombia, Indonesia, Malaysia, Nigeria, the Philippines, Poland, Saudi Arabia, South Africa, Thailand, and Vietnam).

Key Highlights

The Covid-19 pandemic, the Russia-Ukraine war, rising domestic debts, higher inflation, and tighter monetary

policy have converged to weaken the global economy. Going forward, we see additional risks emanating from

geopolitical tensions in Asia and the Middle East, which could plunge the global economy into a deeper

recession.

• Global economic growth is projected to stay at 1.7% in 2023.

• Global healthcare spending is projected to grow 5.1% to $10.2 trillion in 2023, and 5.2% in 2024.

• Global pharmaceutical sales are projected to grow 4.2% to $1.5 trillion in 2023 and 4.3% in 2024, driven by

new product entries, and continued spending on COVID-19 vaccines and therapeutics.

Reasons to Buy

This report will enhance your decision-making capability by allowing you to:

- Develop business strategies by understanding the trends shaping and driving the healthcare market

- Drive revenues by understanding the key trends, reimbursement and regulatory policies, pharmaceutical market segments, and companies likely to impact the healthcare market in the future

- Formulate effective sales and marketing strategies by understanding the competitive landscape and analyzing competitors’ performance

- Organize your sales and marketing efforts by identifying the market categories and segments that present the most opportunities for consolidation, investment, and strategic partnership

Key Players

Table of Contents

Frequently asked questions

-

What is the expected healthcare spending in 2023?

The total healthcare spending is projected to grow to $10.2 trillion in 2023.

-

What is the expected pharmaceutical sales in 2023?

The total pharmaceutical sales is projected to grow to $1.5 trillion in 2023.

-

Which are the key countries in the healthcare spending and pharma sales market?

The healthcare spending and pharma sales discussed are for five key groups of markets which are the US, the top five European markets (France, Germany, Italy, Spain, and the UK), Japan, BRIC MT (Brazil, Russia, India, China, Mexico, and Turkey), and the secondary emerging markets (Colombia, Indonesia, Malaysia, Nigeria, the Philippines, Poland, Saudi Arabia, South Africa, Thailand, and Vietnam).

-

Which therapeutic area will have the highest impact of losing exclusivity in 2023?

In terms of the number of drugs losing exclusivity in 2023, the highest impact by far will be felt in the infectious disease and metabolic disorders therapeutic areas.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Pharmaceuticals reports