High Performance Computing Market Trends and Analysis by Region, Component, Deployment, Application and Segment Forecast to 2026

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insights from the ‘High Performance Computing’ report can help:

- Understand the current and future state of the market, allowing businesses to make informed decisions about market entry, product development, and investments.

- Identify competitors’ capabilities to stay ahead in the market.

- Identify segments and get an understanding of various stakeholders across different stages of the entire value chain.

- Anticipate changes in demand and adjust the business development strategies.

- Identify potential regions and countries for growth opportunities.

How is our ‘High Performance Computing’ report different from other reports in the market?

- The report presents in-depth market sizing and forecasts at a segment level for more than 20 countries, including historical and forecast analysis for the period 2019-2026 for market assessment.

- The report offers detailed segmentation by:

- Component – Server, Storage, Network, Software, Services, and Cloud

-

- Deployment – On-Premise and Cloud

- Application – Academic, Government, Manufacturing, Bio-Sciences, Financial Services, and Others

- Region – North America, Europe, Asia-Pacific, South & Central America, and Middle East & Africa

- The report covers key market drivers and challenges impacting the high performance computing

- The report covers dashboard analytics for M&A deals, venture financing/private equity deals, job activity, social media analysis, and patent activities.

- The value chain in the report can help identify key companies involved in each stage of the value chain. This helps in understanding the competitive landscape and potential collaboration opportunities.

- Competitive profiling of key companies in the market to provide a deeper understanding of industry competition.

- The report can be a valuable tool for stakeholders to improve their operations, increase customer satisfaction, and maximize profitability by analyzing the latest high performance computing drivers, tracking market growth and demand, and evaluating the existing competition in the market.

We recommend this valuable source of information to:

- Cloud Computing Solutions Providers

- Cloud Service Providers

- Edge Computing Solutions Providers

- Data Center Solution Providers

- Server Providers

- Storage Manufacturers

- Networking Equipment Providers

- HPC Cloud Service Providers

- Investment and VC firms

- Consultants

Get a Snapshot of the High Performance Computing Market, Download a Free Report Sample

High Performance Computing Report Overview

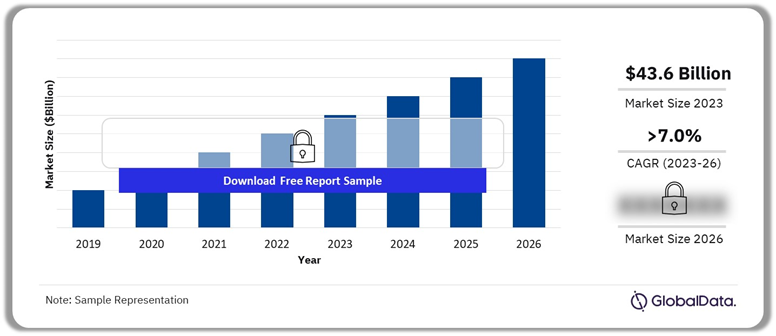

The high performance computing (HPC) market size was valued at $43.6 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of more than 7% over the forecast period. The surge in cloud adoption, coupled with the emergence of HPC as a Service (HPCaaS) and the rise of edge computing, is expected to boost the demand for high-performance computing. Additionally, the continuous evolution of cutting-edge technologies such as machine learning (ML), the Internet of Things (IoT), and AI further augments the need for extensive data processing, making them key drivers of HPC demand in the coming years. These advancements offer scalability, cost-effectiveness, faster processing speeds, and reduced latency, enhancing the overall value proposition of high-performance computing solutions.

AI-enhanced HPC systems are driving advancements across various industries, including healthcare, finance, manufacturing, and more. For example, in healthcare, AI-powered HPC systems can analyze medical imaging data to assist in diagnosing diseases with greater accuracy and speed. In finance, these systems can perform intricate risk assessments and predictive analytics to optimize investment strategies. The synergy between AI and HPC also extends to scientific research, where complex simulations and modeling tasks can benefit from AI-driven optimization and acceleration.

High Performance Computing Market Outlook, 2019-2026 ($Billion)

Buy the Full Report for Additional Insights on the High Performance Computing Market Forecast

High performance edge computing presents a potential solution to overcome the limitations of both local high performance computing data centers and cloud based HPC deployments. Edge computing involves deploying and utilizing computer processing near the data source. The benefits of edge computing include enhanced performance and cost savings achieved by developing, hosting, and powering applications closer to their point of consumption. Industries such as retail, live entertainment, and gaming with low-latency requirements are leveraging HPC at the edge for robust processing power, driving market expansion.

Traditionally, high performance computing systems were confined to local data centers; however, new solutions are emerging, with cloud-based HPC being the most prominent among them. Market trends indicate that the cloud is experiencing rapid growth within the HPC segment, becoming one of the fastest-growing business units. The shift towards cloud-based solutions is driven by the flexibility they offer. Cloud computing can augment in-house infrastructure capacity or enhance a company’s agility, particularly for those operating across multiple sites. The cloud provides a flexible method for overseeing IT infrastructure, facilitating the modernization of enterprise applications, and propelling market growth.

Despite the advantages of cloud computing, certain operations may not be suitable for the cloud environment. Some clients who initially migrated their high performance computing operations to the cloud have later transitioned some or all operations back on-premise due to concerns regarding security, regulations, and latency/performance issues. To maximize the benefits of the cloud while addressing its limitations, vendors are now offering hybrid solutions where HPC operations are distributed between on-premise and cloud environments.

| Market Size (2023) | $43.6 billion |

| CAGR (2023 – 2026) | >7% |

| Forecast Period | 2023-2026 |

| Historic Data | 2019-2021 |

| Report Scope & Coverage | Revenue Forecast, Value Chain, Company Profiles, Market Drivers & Challenges, Technology Trends, COVID-19 Impact Analysis, and PORTER’s |

| Component | Server, Storage, Network, Software, Services, and Cloud |

| Application | Academic, Government, Manufacturing, Bio-Sciences, Financial Services, and Others |

| Deployment | On-Premise and Cloud |

| Region | North America, Europe, Asia-Pacific, South & Central America, and Middle East & Africa |

| Key Countries | US, Canada, UK, Germany, France, Italy, Spain, Netherlands, Switzerland, China, India, Japan, Singapore, South Korea, Australia, Saudi Arabia, UAE, South Africa, Brazil, and Mexico |

| Key Companies | Hewlett Packard Enterprise Co., Lenovo Group Ltd., International Business Machines Corp. (IBM), Dell Technologies Inc., Huawei Investment & Holding Co. Ltd., Fujitsu Ltd., Intel Corp., Advanced Micro Devices Inc., NVIDIA Corp., and STMicroelectronics NV. |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

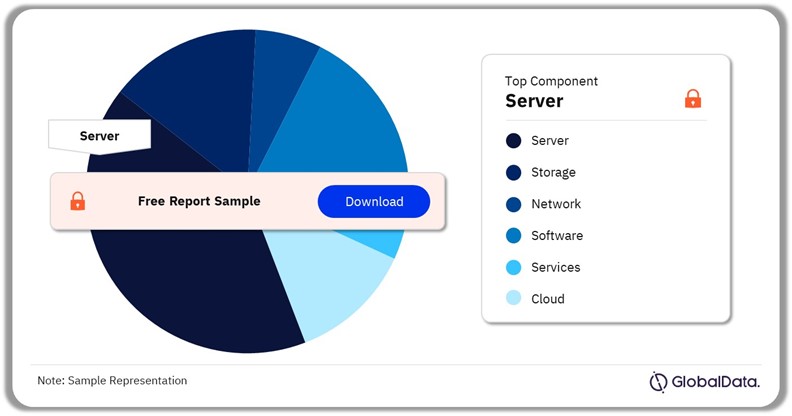

High Performance Computing Market Segmentation by Component

The market is segregated by component into server, storage, network, software, services, and cloud. While cloud and network are important, servers tend to hold the major market share. Servers are expected to dominate the market in 2023 and maintain the leading position over the forecast period. High performance computing servers are extensively used in scientific research for simulations, modeling, and data analysis in fields such as physics, chemistry, biology, and climate science. Researchers require high-performance computing capabilities to tackle complex problems and run simulations that demand significant computational resources.

Organizations are turning to cloud-based HPC solutions to meet their computational needs for tasks such as simulations, data analysis, machine learning, and scientific research. Cloud providers are also investing in specialized hardware and software offerings tailored for high performance computing workloads, further driving the adoption of cloud computing in this domain. As a result, the cloud component is gaining traction within the high performance computing market.

High Performance Computing Market Share by Component, 2023 (%)

Buy the Full Report for More Information on High Performance Computing Market By Component

Moreover, the services component is forecast to experience moderate growth. This sector encompasses maintenance and repair, system engineering, system integration, training, programming, and other related services. The emergence of high performance computing cloud solutions has increased the demand for services, particularly in training and programming. Nevertheless, as prominent companies have already established their cloud services, the services segment is anticipated to exhibit flat growth throughout the forecast period.

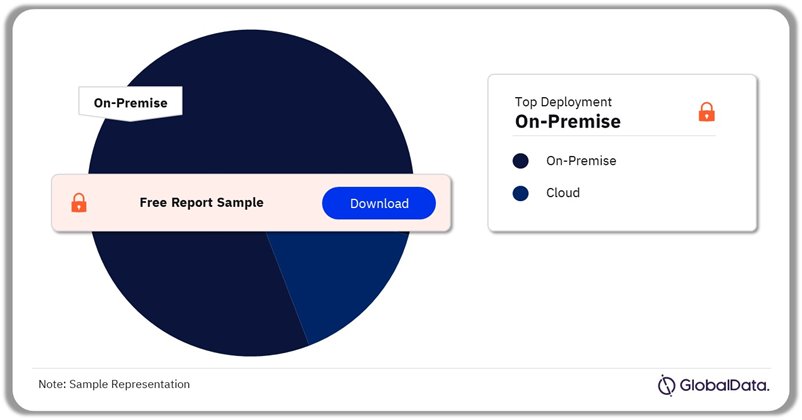

High Performance Computing Market Segmentation by Deployment

High-performance computing can be implemented through two primary methods: on-premises and cloud-based solutions. Traditionally, major market competitors have favored on-premises HPC systems, which offer a sense of familiarity and control. Concerns surrounding data security and privacy when utilizing cloud services have prompted many companies to lean towards on-premises setups. With a growing emphasis on data protection, the demand for on-premises HPC systems is expected to remain robust in the foreseeable future.

In an on-premises HPC deployment, organizations build and manage their own HPC clusters, comprising servers, storage solutions, and related infrastructure. This approach affords direct oversight of hardware, security, and customization options. However, it necessitates substantial initial investments and ongoing maintenance efforts.

High Performance Computing Market Share by Deployment, 2023 (%)

Buy the Full Report for More Information on High Performance Computing Market By Deployment

Furthermore, cloud-based high performance computing systems are anticipated to experience rapid expansion during the forecast period. The cloud offers a more agile framework for managing IT infrastructure, especially in facilitating the modernization of enterprise applications. For instance, Azure provides extensive support for diverse HPC architectures, including computer-aided engineering services, computational fluid dynamics simulations, and 3D video rendering. These solutions are scalable to thousands of compute cores, offering the flexibility to extend existing on-premises clusters.

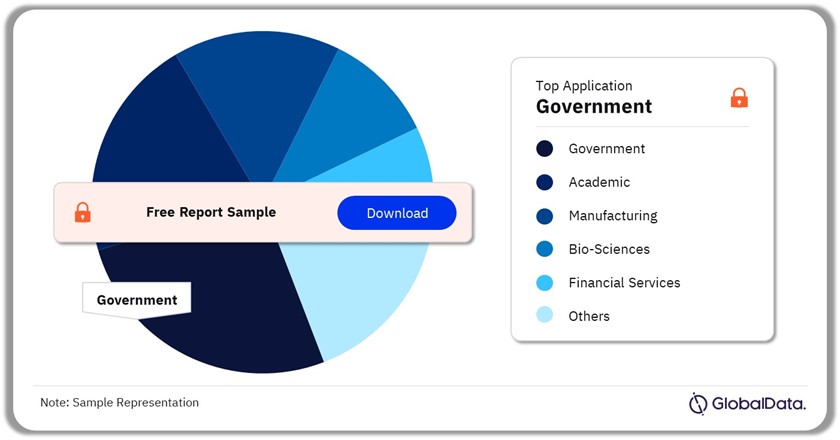

High Performance Computing Market Segmentation by Application

In the high performance computing market, the bio-sciences domain stands out for its significant utilization of HPC solutions, contributing notably to the segment’s robust expansion. This sector encompasses genomics, bioinformatics, pharmaceutical research, drug discovery, and proteomics applications. Research remains a cornerstone of high performance computing application, particularly evident in the medical and biosciences fields. Notably, powerful computing clusters have played a pivotal role during the COVID-19 pandemic, facilitating vital scientific endeavors such as virus understanding and vaccine development.

In addition, high performance computing finds extensive use in the government sector. Governments utilize HPC for tasks such as cryptography, simulating nuclear weapon designs, analyzing intelligence data, and developing defense technologies. HPC helps in creating sophisticated models for strategic planning and predicting potential threats. Furthermore, governments fund a significant portion of scientific research, which often requires heavy computational resources.

High Performance Computing Market Share by Application, 2023 (%)

Buy the Full Report for More Information on High Performance Computing Market By Application

Within the private sector, financial services emerge as prominent consumers of high performance computing capabilities. Investment firms leverage this technology for predictive analysis of stock market trends and high-frequency trading. Additionally, banks utilize HPC to bolster fraud detection measures. Centralized fraud detection systems aggregate data from diverse sources, enabling proactive identification and mitigation of cyber threats while fortifying data privacy. These systems must possess robust anomaly detection capabilities to ensure efficacy.

High Performance Computing Market Analysis by Region

Asia-Pacific held the highest share in 2023, capturing over 30% of the overall market size. China and Japan led the regional market, collectively accounting for over 50% of the regional market in 2023. Some of the leading high performance computing companies come from China, including Huawei, Lenovo, and Inspur. The Chinese government perceives dominance in supercomputing as integral to safeguarding national security.

In North America, early adoption of cutting-edge technology empowers companies to introduce new products to the market swiftly. The US held a significant share of the high performance computing market’s revenue in 2023, leveraging its extensive network of data centers to facilitate seamless integration of HPC solutions. In July 2023, the United States Department of Energy (DOE) introduced a fresh initiative designed to connect industry partners with the high performance computing resources and expertise housed within DOE’s National Laboratories. The main objective was to boost material performance and propel progress in manufacturing methods, paving the way for a more inclusive and sustainable energy future.

High Performance Computing Market Share by Region, 2023 (%)

Buy the Full Report for Regional Insights into the High Performance Computing Market

The high performance computing market in Europe is experiencing consistent growth and garnering greater attention. Leading the regional market are Germany, the UK, and France, together commanding more than 50% of the market share in 2023. These countries are home to top-tier research institutions, universities, and tech firms that are spearheading advancements in HPC across diverse sectors such as academia, government, healthcare, finance, automotive, and aerospace.

High Performance Computing Market – Competitive Landscape

Competition in the high performance computing industry is characterized by the presence of multiple vendors operating across different layers of the value chain. Companies operating in the market have a stronghold in their respective solution offerings. For instance, HPE and Dell Technologies have a strong hold across all the components of an HPC cluster. Companies such as DataDirect Networks, Juniper Networks, and Seagate Technology focus on specific hardware equipment.

M&As play a significant role in shaping the HPC market. In April 2024, ceτi AI, a decentralized AI infrastructure company, announced its acquisition of Canadian firm Big Energy Investments Inc., which specializes in strategic investments in HPC infrastructure. Similarly, in August 2023, atNorth, a provider of colocation and high-performance computing services, expanded its presence in the Nordics by acquiring Gompute, a provider of HPC and data center services.

In the ever-evolving landscape of HPC, strategic partnerships are essential for maintaining a competitive advantage. For instance, in November 2023, Netweb Technologies, an OEM in high-end computing, joined forces with NVIDIA to leverage the potential of high-performance computing and AI. This collaboration aims to address demanding workloads in HPC, data science, large language models, edge computing, enterprise AI, and design and simulation.

Leading Companies in the High Performance Computing Market

- Hewlett Packard Enterprise Co.

- Lenovo Group Ltd.

- International Business Machines Corp. (IBM)

- Dell Technologies Inc.

- Huawei Investment & Holding Co Ltd.

- Fujitsu Ltd.

- Intel Corp.

- Advanced Micro Devices Inc.

- NVIDIA Corp.

- STMicroelectronics NV

Other High Performance Computing Vendors Mentioned

Inspur Software Co. Ltd., Atos SE, NEC Corp., Seagate Technology Holdings Plc, Netapp Inc., Google LLC, Huawei Investment & Holding Co. Ltd., Amazon Web Services Inc., Cisco Systems Inc., Oracle Corp., VMware Inc., Juniper Networks Inc.

Buy the Full Report to Know More About Leading High Performance Computing Companies

High Performance Computing Market Segments and Scope

GlobalData Plc has segmented the high performance computing market report by component, deployment, application, and region:

High Performance Computing (HPC) Component Outlook (Revenue, $Million, 2019-2026)

- Server

- Storage

- Network

- Software

- Services

- Cloud

High Performance Computing (HPC) Deployment Outlook (Revenue, $Million, 2019-2026)

- On-Premise

- Cloud

High Performance Computing (HPC) Application Outlook (Revenue, $Million, 2019-2026)

- Academic

- Government

- Manufacturing

- Bio-Sciences

- Financial Services

- Others

High Performance Computing (HPC) Regional Outlook (Revenue, $Million, 2019-2026)

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Singapore

- Rest of Asia Pacific

- South & Central America

- Brazil

- Mexico

- Rest of South & Central America

- Middle East & Africa

- United Arab Emirates (UAE)

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Scope

This report provides overview and service addressable market for High Performance Computing (HPC).

It identifies the key trends impacting growth of the market over the next 12 to 24 months, split into four categories: technology trends and macroeconomic trends

It includes global market forecasts for the High Performance Computing (HPC) industry and analysis of patents, company filings, and hiring trends.

It contains details of M&A and VF deals in the big data space.

The detailed value chain consists of five main aspects: component, equipment, data center solutions, and end users.

Reasons to Buy

- This market intelligence report offers a thorough, forward-looking analysis of the HPC market, components, application, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in high performance computing market.

- The report also highlights key component segments (Server, Storage, Networking, Software, Services, and Cloud)

- The report also highlights key deployment segments (On-Premise and Cloud)

- The report also highlights key application segments (Academic, Government, Manufacturing, Bio-Sciences, Financial Services, and Others)

- With more than 100 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

- The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in High Performance Computing (HPC)

- The broad perspective of the report coupled with comprehensive, actionable detail will help high performance computing stakeholders, service providers, and other high performance computing players succeed in growing of the high performance computing market globally.

Key Players

Hewlett Packard Enterprise CoLenovo Group Ltd

International Business Machines Corp

Dell Technologies Inc

Huawei Investment & Holding Co Ltd

Fujitsu Ltd

Intel Corp

Advanced Micro Devices Inc

NVIDIA Corp

STMicroelectronics NV

Table of Contents

Table

Figures

Frequently asked questions

-

What was the high performance computing market size in 2023?

The high performance computing market size was valued at $43.6 billion in 2023.

-

What is the high performance computing market growth rate?

The high performance computing market is expected to grow at a CAGR of more than 7% during the forecast period.

-

What are the key high performance computing market drivers?

Increasing adoption of AI, IoT, and machine learning (ML) resulting in the need for computing large volume of data is expected to drive the demand for HPC systems.

-

Which was the leading component in the high performance computing market in 2023?

Server held the largest market share within the high performance computing market’s component segment in 2023.

-

Which was the leading deployment method used in the high performance computing market in 2023?

In 2023, on-premise held the largest market share in terms of deployment method used in the high performance computing market.

-

What was the leading application in the high performance computing market in 2023?

The government sector dominated the high performance computing market in 2023, holding the largest share across applications.

-

Which was the leading regional market in the high performance computing market in 2023?

Asia-Pacific accounted for the largest high performance computing regional market share in 2023.

-

Which are the leading high performance computing companies globally?

The leading high performance computing companies are Hewlett Packard Enterprise Co., Lenovo Group Ltd., International Business Machines Corp., Dell Technologies Inc., Huawei Investment & Holding Co. Ltd., Fujitsu Ltd., Intel Corp., Advanced Micro Devices Inc., NVIDIA Corp., and STMicroelectronics NV, among others.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Technology reports