Hong Kong (China SAR) Cards and Payments – Opportunities and Risks to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Hong Kong (China SAR) Cards and Payments Market Report Overview

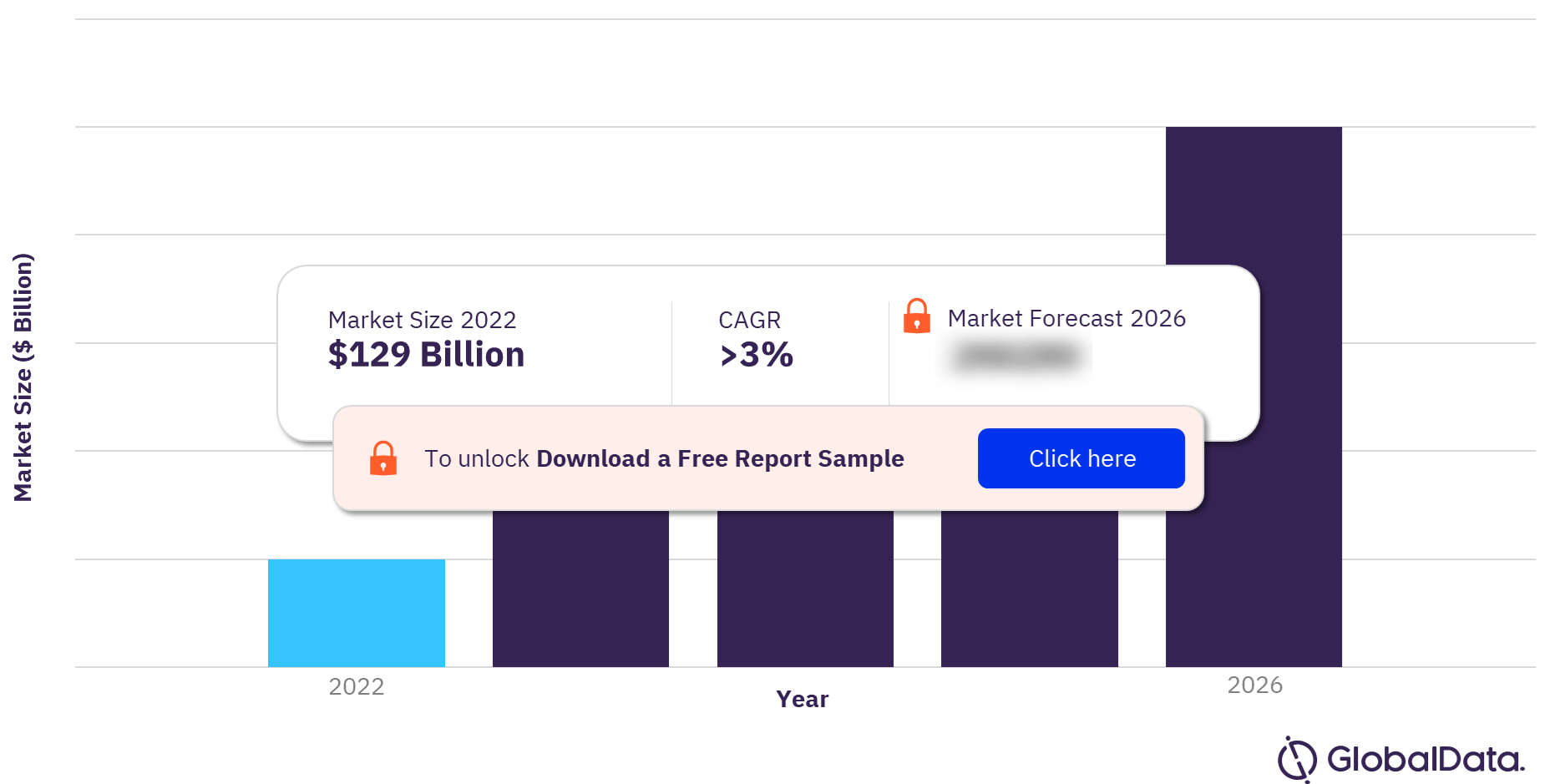

The Hong Kong cards and payments market size was valued at $129 billion in 2022 and is expected to achieve a CAGR of more than 3% during 2022-2026. The Hong Kong (China SAR) payment card market is mature despite a strong inclination towards cash. This is due to consistent efforts to promote electronic payment methods, such as waiving minimum balance fees on bank accounts, launching digital-only banks, and developing and expanding payment acceptance infrastructure.

The Hong Kong (China SAR) cards and payments market research report provides a detailed analysis of market trends in the Hong Kong cards and payments industry. The report provides values and volumes for several key performance indicators in the industry, including cash, cards, direct debits, credit transfers, and cheques during the review period. It also analyzes various payment card markets operating in the industry and provides detailed information on the number of cards in circulation, transaction values, and volumes during the review period and over the forecast period. Moreover, it offers information on the country’s competitive landscape, including market shares of issuers and schemes.

Hong Kong Cards and Payments Market Outlook, 2022-2026 ($ Billion)

To gain more information on the Hong Kong cards and payments market forecast, download a free report sample

Hong Kong Cards and Payments Market Dynamics

The government and regulatory authorities have taken steps to boost the use of cashless payment methods. In September 2018, the Hong Kong Monetary Authority (HKMA) launched Common QR Code standards to promote the use of a standard QR code for retail payments, thereby eliminating the need for merchants to display multiple QR codes at the POS. The Hong Kong QR mobile app can be used by consumers to make payments at all retailers accepting the Common QR Code. As of February 2023, 13 payment service providers had signed up for the initiative.

Additionally, digital-only banks are driving competition in the banking space, thus helping to boost debit card holding. Similarly, contactless card holding is high in Hong Kong, especially option for transport payments.

Furthermore, companies are taking steps to boost electronic payment acceptance among SMEs. For instance, HKT Merchant Services waived transaction fees for SMEs, social enterprises, and non-governmental organizations with an HKT smartPOS terminal. The promotion ran from March 1, 2022, to March 31, 2023.

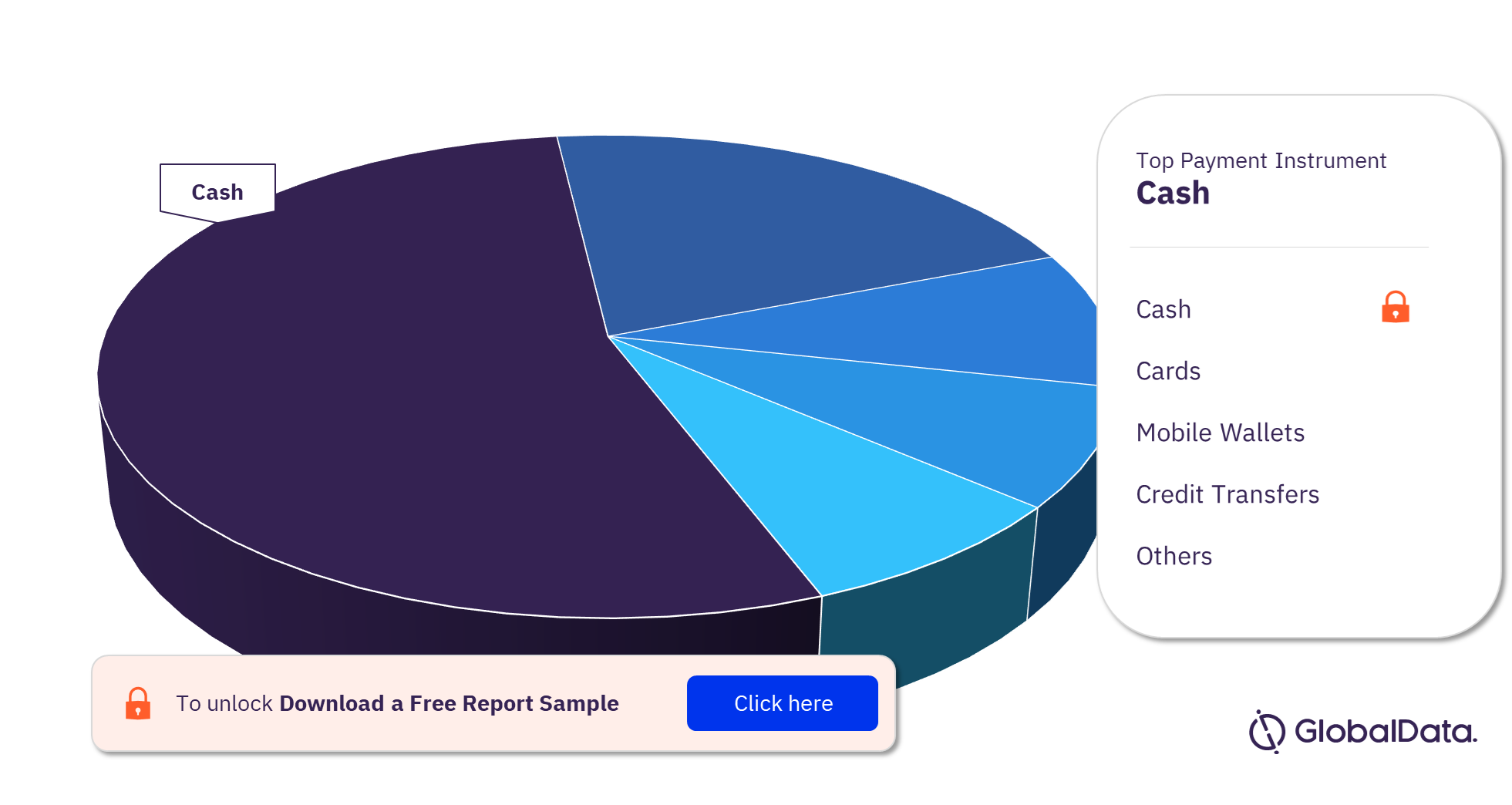

Hong Kong Cards and Payments Market Segmentation by Payment Instruments

The key payment instruments in the Hong Kong cards and payments market are cash, cards, mobile wallets, credit transfers, direct debits, and cheques. In 2022, cash was the major payment instrument due to its extensive usage in Hong Kong, especially for day-to-day, low-value transactions. However, with the increase in electronic payments, cash transaction volume and value reduced during 2018–22e. This trend is expected to continue over the forecast period.

Hong Kong Cards and Payments Market Analysis by Payment Instruments, 2022 (%)

For more payment instrument insights into the Hong Kong cards and payments market, download a free report sample

Hong Kong Cards and Payments Market Segments

The key segments in the Hong Kong cards and payments market are card-based payments, e-commerce payments, in-store payments, buy now pay later, mobile payments, P2P payments, bill payments, and alternative payments.

Hong Kong Cards and Payments Market - Competitive Landscape

Some of the leading players in the Hong Kong cards and payments market are HSBC, Standard Chartered, Bank of China, Citibank, Bank of East Asia, DBS, Aeon Credit Service, China Construction Bank, Bank of Communication, and EPS.

Hong Kong Cards and Payments Market Report Overview

| Market Size (2022) | $129 billion |

| CAGR | >3% |

| Forecast Period | 2022-2026 |

| Historical Period | 2018-2021 |

| Key Payment Instruments | Cash, Cards, Mobile Wallets, Credit Transfers, Direct Debits, and Cheques |

| Key Segments | Card-Based Payments, E-Commerce Payments, In-Store Payments, Buy Now Pay Later, Mobile Payments, P2P Payments, Bill Payments, and Alternative Payments |

| Leading Players | HSBC, Standard Chartered, Bank of China, Citibank, Bank of East Asia, DBS, Aeon Credit Service, China Construction Bank, Bank of Communication, and EPS |

Segments Covered in the Report

Hong Kong Cards and Payments Instruments Outlook (Value, $ Billion, 2018-2026)

- Cash

- Direct Debits

- Mobile Wallets

- Cards

- Credit Transfers

- Cheques

Hong Kong Cards and Payments Market Segments Outlook (Value, $ Billion, 2018-2026)

- Card-Based Payments

- E-Commerce Payments

- In-Store Payments

- Buy Now Pay Later

- Mobile Payments

- P2P Payments

- Bill Payments

- Alternative Payments

Scope

This report provides:

- Current and forecast values for each market in Hong Kong cards and payments industry, including debit, credit, and charge cards.

- Detailed insights into payment instruments including cash, cards, mobile wallets, credit transfers, direct debits, and cheques. It also includes an overview of the country’s key alternative payment instruments.

- E-commerce market analysis.

- Analysis of various market drivers and regulations governing the Hong Kong cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit, credit, and charge cards.

- Comprehensive analysis of consumer attitudes and buying preferences for cards.

- The competitive landscape of Hong Kong’s cards and payments industry.

Reasons to Buy

- Make strategic business decisions, using top-level historic and forecast market data, related to the Hong Kong cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Hong Kong cards and payments industry.

- Assess the competitive dynamics in the Hong Kong cards and payments industry.

- Gain insights into marketing strategies used for various card types in Hong Kong.

- Gain insights into key regulations governing the Hong Kong cards and payments industry.

Standard Chartered

Bank of China

Citibank

Bank of East Asia

DBS

Aeon Credit Service

China Construction Bank

Bank of Communication

EPS

Hang Seng Bank

Global Payments

Fiserv

Wirecard

Mastercard

Visa

China UnionPay

Mastercard

American Express.

Table of Contents

Frequently asked questions

-

What was the Hong Kong cards and payments market size in 2022?

The cards and payments market size in Hong Kong was valued at $129 billion in 2022.

-

What is the Hong Kong cards and payments market growth rate?

The cards and payments market in Hong Kong is expected to achieve a CAGR of more than 3% during 2022-2026.

-

What are the key payment instruments in the Hong Kong cards and payments market?

The key payment instruments in the Hong Kong cards and payments market are cash, cards, mobile wallets, credit transfers, direct debits, and cheques.

-

What are the key segments in the Hong Kong cards and payments market?

The key segments in the Hong Kong cards and payments market are card-based payments, e-commerce payments, in-store payments, buy now pay later, mobile payments, P2P payments, bill payments, and alternative payments.

-

Who are the leading players in the Hong Kong cards and payments market?

Some of the leading players in the Hong Kong cards and payments market are HSBC, Standard Chartered, Bank of China, Citibank, Bank of East Asia, DBS, Aeon Credit Service, China Construction Bank, Bank of Communication, and EPS.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports