In-Vitro Diagnostics (IVD) Market Size, Share and Trends Analysis by Region, Product and Segment Forecast to 2033

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insights from the ‘In Vitro Diagnostics’ report can help in:

- Gaining a valuable understanding of the current and future state of the market and allow businesses to make informed decisions about market entry, product development, and investments.

- Identifying competitors’ capabilities to stay ahead in the market.

- Finding segments and getting an understanding of various stakeholders.

- Anticipating changes in demand and adjust business development strategies.

- Identifying potential regions and countries for growth opportunities.

How is our ‘In Vitro Diagnostics’ report different from other reports in the market?

- The report presents in-depth market sizing and forecasts at a segment level for more than 25 countries, including historical and forecast analysis for 2021-2033 for market assessment.

- Detailed segmentation by:

-

- Product – COVID-19 Tests, Cholesterol Tests, Colorectal Cancer Screening Tests, Hepatitis B Tests, Hepatitis C Tests, Clinical Chemistry Analyzers, Hematology Tests, Human Immunodeficiency Virus (HIV) Tests, Immunochemistry Analyzers, Diabetes Assays, and Others

- Region – North America, Europe, Asia-Pacific, South & Central America, and Middle East & Africa

- The report covers the key market drivers and challenges impacting the IVD market.

- The competitive landscape includes an overview and company share analysis by segment in the IVD market that will help the stakeholders in the ongoing process of identifying, researching, and evaluating competitors, to gain insight to form their business strategies.

- Competitive profiling and benchmarking of key companies in the market to provide a deeper understanding of industry competition.

We recommend this valuable source of information to:

- Companies offering IVD Solutions

- Consulting & Professional Services Firms

- Researchers and Academicians

- Venture Capital/Equity Firms

- IVD Manufacturers

Buy the Full Report to Get a Snapshot of the IVD Market, Download a Free Report Sample

In Vitro Diagnostics Market Report Overview

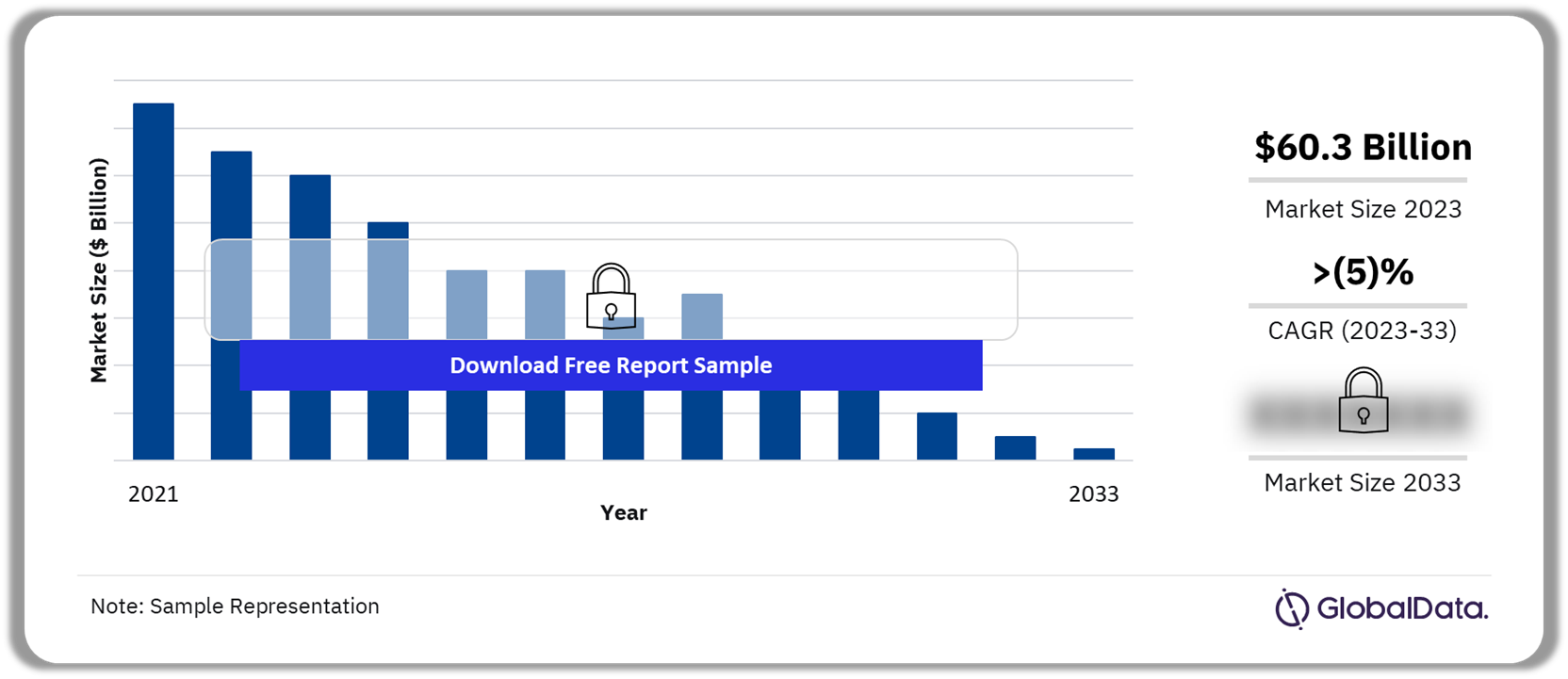

The In Vitro Diagnostics (IVD) market was valued at $60.3 billion in 2023. The market is projected to experience a negative CAGR of more than (5)% during the forecast period. This decline in growth can primarily attributed to the exceptional surge in demand during the COVID-19 pandemic. The IVD market includes business sectors engaged in the manufacturing, distribution, sale, and provision of services related to in vitro diagnostic (IVD) equipment and technologies. This sector is vital within the healthcare industry, covering a diverse array of tests and diagnostic tools specifically designed for analyzing samples external to the human body. These diagnostic solutions are crucial for disease detection, monitoring, and the advancement of personalized medicine.

The IVD market holds considerable significance in the healthcare industry by actively contributing to disease diagnosis, treatment monitoring, and overall patient health management. Early disease detection, a cornerstone for successful treatment and recovery, is a pivotal aspect of IVD. The IVD technologies include a diverse range of tests that analyze biological samples such as urine, blood, and tissues (external to the human body). These tests excel in identifying the presence of diseases and health conditions, often detecting them even before symptoms emerge.

In Vitro Diagnostics Market Outlook, 2021 – 2033 ($Billion)

Buy the Full Report for Additional Insights on the IVD Market Forecast

Download a Free Report Sample

IVD testing plays a vital role in advancing patient-centered, personalized medicine. It enables healthcare providers to customize treatments for individual patients by considering their distinct genetic characteristics and disease profiles. Genetic testing, a subset of IVD, can uncover precise genetic mutations that impact how a patient responds to medications. Armed with this information, clinicians can prescribe the most suitable drugs and dosages, reducing adverse reactions and optimizing therapeutic results. The emergence of personalized medicine, facilitated by IVD, is a groundbreaking advancement poised to revolutionize healthcare, providing more efficient and targeted treatment approaches.

| Market Size in 2023 | $60.3 billion |

| CAGR (2023 to 2033) | > (5)% |

| Forecast Period | 2023-2033 |

| Historic Data | 2021 & 2022 |

| Report Scope & Coverage | Industry overview, market dynamics, regulatory landscape, reimbursement scenario, revenue forecast, regional analysis, competitive landscape, company profiles |

| Product | COVID-19 tests, cholesterol tests, colorectal cancer screening tests, hepatitis B tests, hepatitis C tests, clinical chemistry analyzers, hematology tests, human immunodeficiency virus tests, immunochemistry analyzers, diabetes assays, and others |

| Regional Segment | North America, Europe, Asia-Pacific, Central & South America, and Middle East & Africa |

| Key Companies | Danaher Corp, Abbott Laboratories, F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories Inc, and Thermo Fisher Scientific Inc |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

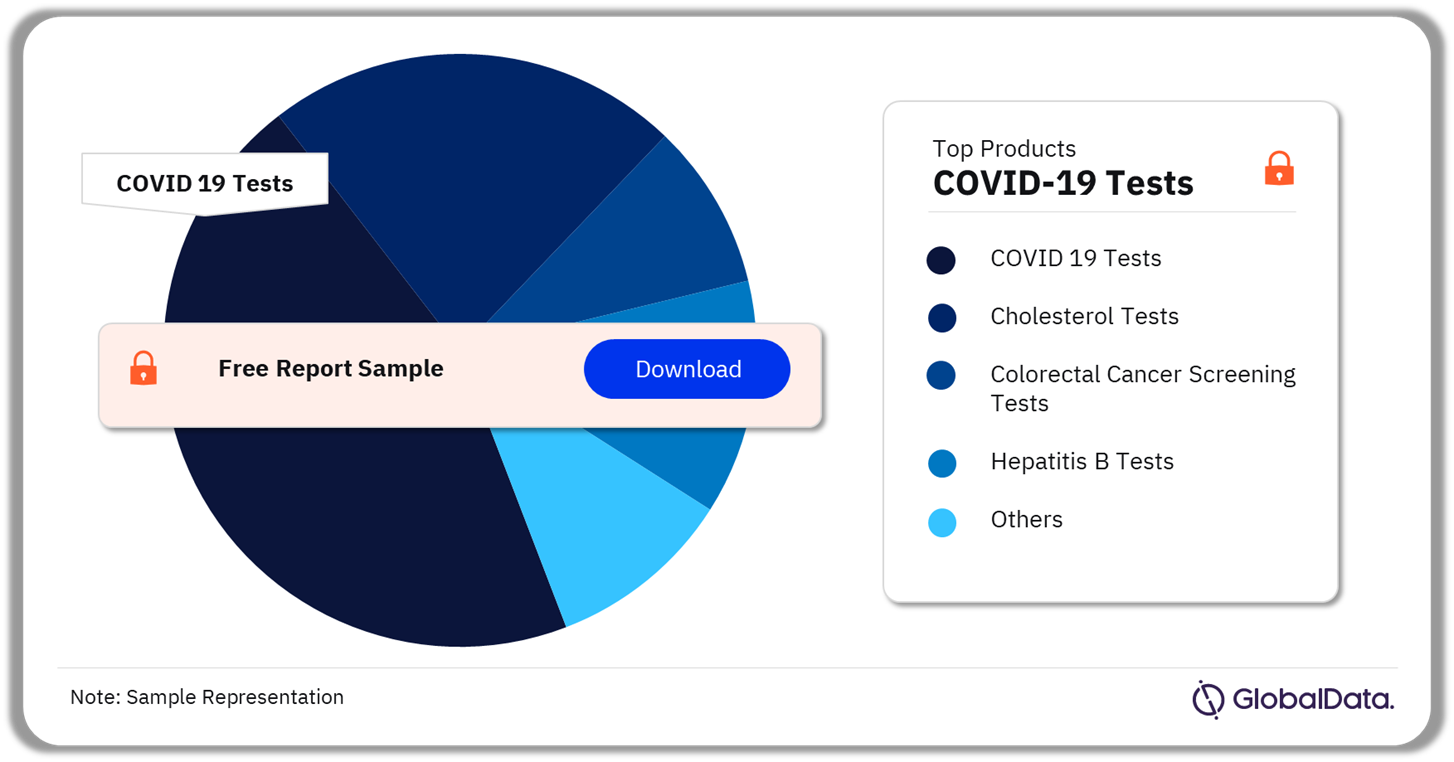

In Vitro Diagnostics Market Segmentation by Product

The IVD market by product is segmented into COVID-19 tests, cholesterol tests, colorectal cancer screening tests, clinical chemistry analyzers, hematology tests, human immunodeficiency virus tests, hepatitis B tests, hepatitis C tests, immunochemistry analyzers, diabetes assays, and others. The colorectal cancer screening tests segment is anticipated to experience the most rapid growth among product segments, with a CAGR of over 6% during the forecast period.

The colorectal cancer screening tests hold significant importance in the landscape of in vitro diagnostics. Colorectal cancer, commonly referred to as bowel cancer, ranks among the most widespread and life-threatening malignancies globally. The significance of early detection and intervention cannot be overstated, highlighting the pivotal role played by the colorectal cancer screening segment in the growth of the IVD market.

In Vitro Diagnostics Market Analysis by Product, 2023 (%)

Buy the Full Report for More Product-Wise Information in the In Vitro Diagnostics Market

Download a Free Report Sample

A notable colorectal cancer screening test is the fecal occult blood test. This straightforward and non-invasive test identifies minute traces of blood in the stool, serving as an early indicator of colorectal cancer or pre-cancerous polyps. fecal occult blood test proves to be a cost-effective and efficient means of screening large populations for potential colorectal cancer risk. Their widespread use has substantially reduced mortality rates by pinpointing cases at an early and treatable stage.

In 2023, the clinical chemistry analyzers segment secured the second-highest growth in revenue share in terms of segmentation by product. In modern healthcare, the clinical chemistry analyzers segment within the IVD market holds tremendous importance. Its significance extends to disease prevention, early detection, and the management of chronic conditions. As continuous technological advancements and the incorporation of digital technologies persist, clinical chemistry analyzers are evolving to become increasingly efficient, cost-effective, and indispensable tools for healthcare providers.

In Vitro Diagnostics Market Analysis by Region

In 2023, Asia-Pacific emerged as the market leader with the highest revenue share and is expected to register a negative CAGR of more than (12)% during the forecast period. This region encompasses a diverse range of healthcare systems, ranging from well-established ones in countries such as Japan and Singapore, to emerging healthcare markets such as India and Taiwan.

Several major players in the IVD industry have a strong presence in Japan, contributing to the country’s significance in this sector. Roche Diagnostics, for instance, has a substantial market share in Japan, with a wide range of diagnostic products and a strong focus on research and development. Abbott Laboratories is another global giant that has established a strong foothold in Japan by offering a diverse portfolio of IVD solutions.

In Vitro Diagnostics (IVD) Market Analysis by Region, 2023 (%)

Buy the Full Report for Regional Insights into the IVD Market

Download a Free Report Sample

Europe secures the second position in the IVD market in terms of revenue share in 2023. The European IVD market is marked by its diversity, rapid growth, and a dedicated focus on harnessing advanced technologies to enhance healthcare outcomes. The future of the IVD market in Europe looks promising. The region’s strong focus on research and development, coupled with governments’ support and a commitment to quality, is likely to continue to drive innovation in the sector. The demand for personalized medicine, which relies on precise diagnostics, is expected to grow, offering new opportunities for IVD companies.

The European IVD market presents a varied landscape, with numerous countries actively contributing to its growth and innovation. Each country brings a unique perspective and expertise to the field, such as Germany’s technological prowess, France’s research emphasis, the UK’s innovation in point-of-care testing, and the precision diagnostics of the Netherlands. This collaborative effort across Europe ensures the continuous evolution of the IVD market, offering cutting-edge solutions to support healthcare systems and enhance patient outcomes both within the continent and globally.

In the recent years, the IVD market in Germany has witnessed substantial growth. Benefiting from a well-established healthcare infrastructure and a strong research and development sector, Germany has been a frontrunner in diagnostic technology. Notably, key companies including Siemens Healthineers and Roche Diagnostics, both based in Germany, are renowned for their state-of-the-art diagnostic solutions. Ranging from clinical chemistry analyzers to molecular diagnostics, these solutions are extensively utilized within the country and exported globally.

In Vitro Diagnostics (IVD) Market – Competitive Landscape

The IVD market on a global scale is marked by intense competition, featuring numerous key companies providing a range of IVD products and services. In this dynamic landscape, companies continually adjust to evolving dynamics, influenced by the swift progress of technology, the introduction of innovative IVD products, and a growing focus on precise diagnostic techniques.

At the forefront of the IVD market are major players such as Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific, and BD (Becton, Dickinson, and Company). These companies have established themselves as industry leaders through decades of experience and a comprehensive portfolio of diagnostic solutions. Their wide range of products includes clinical chemistry analyzers, immunoassay systems, molecular diagnostic platforms, and more. These established players have the resources and expertise to provide a holistic suite of diagnostic solutions, making them significant contributors to the IVD market.

The IVD market, however, is not solely dominated by the larger companies. Emerging players are increasingly making their presence felt by offering innovative solutions and targeting niche segments within the market. These companies often focus on specialized areas, such as advanced molecular testing or digital diagnostics. For instance, in the field of molecular diagnostics, companies such as Qiagen and Bio-Rad Laboratories have made significant advancements, providing innovative solutions for genetic and molecular testing.

Vendors are consistently innovating to elevate automation and efficiency in diagnostic procedures. Beckman Coulter, for example, provides automated clinical chemistry analyzers and immunoassay systems designed to streamline laboratory workflows. This not only mitigates the risk of errors but also enhances accuracy in diagnostic processes.

Leading Companies in the In Vitro Diagnostics (IVD) Market

- Hoffmann-La Roche Ltd

- Hologic Inc

- Abbott Laboratories

- Siemens AG

- Exact Sciences Corp

- bioMerieux SA

- Quidelortho Corp

- Sysmex Corp

- Bio-Rad Laboratories Inc

- Thermo Fisher Scientific Inc

- Beckman Coulter Inc

Leading IVD Market Players

Buy the Full Report to Get Additional Insights on the Leading IVD Market Players,

Download a Free Sample Report

Other In Vitro Diagnostics (IVD) Market Vendors Mentioned

Qiagen NV, H.U. Group Holdings Inc, and Omega Diagnostics Group Plc

In Vitro Diagnostics (IVD) Market Segments and Scope

GlobalData Plc has segmented the in vitro diagnostics (IVD) market report by product and region:

In Vitro Diagnostics (IVD) Product Outlook (Revenue, $ Million 2021-2033)

- COVID-19 Tests

- Cholesterol Tests

- Clinical Chemistry Analyzers

- Colorectal Cancer Screening Tests

- Hepatitis B Tests

- Hepatitis C Tests

- Hematology Tests

- Human Immunodeficiency Virus (HIV) Tests

- Immunochemistry Analyzers

- Diabetes Assays

- Others

In Vitro Diagnostics (IVD) Regional Outlook (Revenue, $ Million, 2021-2033)

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- Netherlands

- Switzerland

- UK

- Russia

- Austria

- Belgium

- Czech Republic

- Denmark

- Greece

- Finland

- Hungary

- Ireland

- Norway

- Poland

- Portugal

- Sweden

- Turkey

- Asia-Pacific

- China

- India

- Japan

- Australia

- New Zealand

- South Korea

- Taiwan

- Central & South America

- Brazil

- Chile

- Argentina

- Middle East & Africa

- United Arab Emirates

- Saudi Arabia

- South Africa

- Israel

- Egypt

Scope

• This report provides overview and service addressable market for global in vitro diagnostics (IVD) market

• It identifies the key drivers and restraints impacting growth of the IVD market over the next 12 to 24 months.

• It includes global market forecasts for the IVD market and reimbursement scenario, and regulatory trends.

•It covers detailed segmentation by product – COVID-19 Tests, Cholesterol Tests, Colorectal Cancer Screening Tests, Hepatitis B Tests, Hepatitis C Tests, Clinical Chemistry Analyzers, Hematology Tests, Human Immunodeficiency Virus (HIV) Tests, Immunochemistry Analyzers, Diabetes Assays, and Others, along with regional segmentation.

Key Highlights

The global in Vitro Diagnostics (IVD) market will be valued at $60.3 billion in 2023 and is expected to decline temporarly at a compound annual growth rate (CAGR) of -5.3% over the forecast period. The in vitro diagnostics market’s future is bright, with technology, patient-centric care, and preventive healthcare at the forefront. This industry will continue to play a crucial role in improving healthcare outcomes and advancing medical science. IVD refers to medical tests conducted on samples such as blood, urine, or tissues outside the human body to diagnose various diseases and conditions. AI and machine learning will become integral to IVD, automating image analysis and expediting diagnosis, thereby improving workflow efficiency.

Reasons to Buy

• This market intelligence report offers a thorough, forward-looking analysis of the global in vitro diagnostics (IVD) market by product, regional segments in a concise format to help executives build proactive and profitable growth strategies.

• Accompanying GlobalData’s Forecast products, the report examines the drivers, challenges, and regulatory trend analysis in the IVD market.

• Detailed segmentation by product – COVID-19 Tests, Cholesterol Tests, Colorectal Cancer Screening Tests, Hepatitis B Tests, Hepatitis C Tests, Clinical Chemistry Analyzers, Hematology Tests, Human Immunodeficiency Virus (HIV) Tests, Immunochemistry Analyzers, Diabetes Assays, and Others, along with vertical and regional segmentation.

• The report includes 100+ charts and tables providing in-depth analysis of the market size, forecast, and supporting factors which are tailor-made for an executive-level audience, with enhanced presentation quality.

• The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in IVD markets.

• The competitive section of the report helps in identifying the flagbearers, experimenters, contenders, and specialists based on their growth and innovation performance in the IVD industry which will help stakeholders analyze competition penetration.

• The broad perspective of the report, coupled with comprehensive, actionable detail, will help IVD vendors and other companies succeed in the growing IVD market globally.

Key Players

F. Hoffmann-La Roche LtdHologic Inc

Abbott Laboratories

Siemens AG

Exact Sciences Corp

bioMerieux SA

Quidelortho Corp

Sysmex Corp

Bio-Rad Laboratories Inc

Thermo Fisher Scientific Inc

Beckman Coulter Inc

Table of Contents

Table

Figures

Frequently asked questions

-

What was the IVD market size in 2023?

The IVD market was valued at $60.3 billion in 2023.

-

What is the expected IVD market growth rate during the forecast period?

The market is projected to experience a negative CAGR of more than (5)% during the forecast period..

-

What is the key IVD market driver?

In the rapidly evolving landscape of IVD, one of the most prominent market drivers is advancement in molecular diagnostics.

-

Which was the leading product segment of the in vitro diagnostics market in 2023?

The COVID-19 tests was the leading product segment of the in vitro diagnostics market in 2023.

-

Which was the dominant regional segment of the in vitro diagnostics market in 2023?

Asia-Pacific was the dominant regional segment of the in vitro diagnostics market in 2023.

-

Which are the leading IVD companies globally?

The leading IVD companies are Danaher Corp, F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories Inc, Abbott Laboratories, and Thermo Fisher Scientific Inc.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more In Vitro Diagnostics reports