India Wealth Management – Market Sizing and Opportunities to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

India Wealth Management Market Report Overview

India’s affluent segment (including the HNW and mass affluent population) has experienced robust growth in the recent years. The India Wealth Management market research report analyzes India’s wealth and retail savings and investments markets including the overall affluent market size. The report also provides an analysis of the factors driving liquid asset growth, including a breakdown, and forecast of total retail savings and investments split by equities, mutual funds, deposits, and bonds.

India Wealth Management Market Dynamics

With the economy witnessing a strong recovery from the pandemic, there was a broad-based revival of investor risk appetite, coupled with modestly higher stock market valuations that tilted the portfolio away from deposits in 2022. Mass affluent investors allocated more than half of their wealth to risk-on assets such as equities, mutual funds, and ETFs. However, despite a year-on-year decline in deposit allocations, savings accounts continued to hold the largest share in the mass affluent portfolio as interest rate hikes and liquidity concerns drove demand.

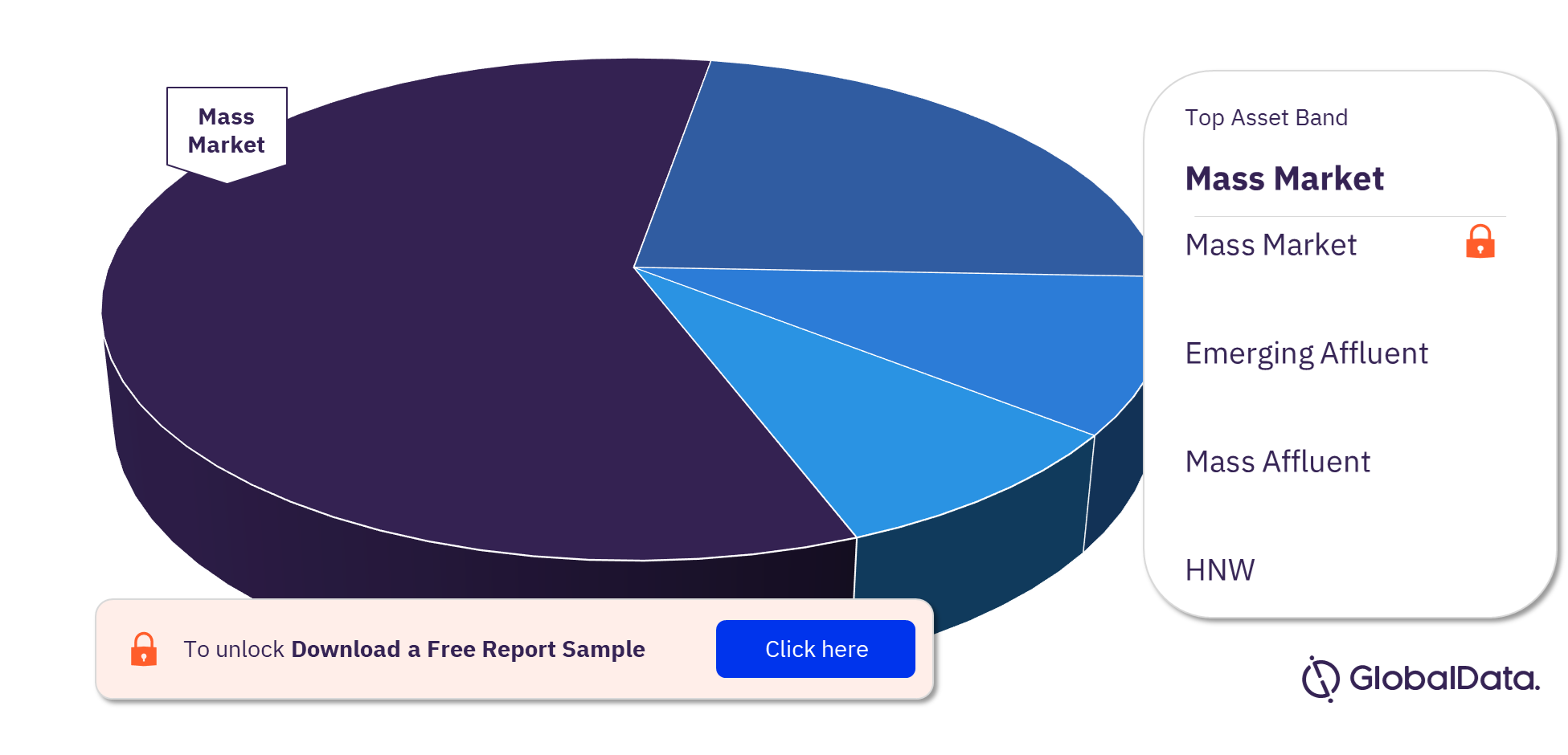

India Wealth Management Market Segmentation by Asset Bands

The India wealth management market is segmented into asset bands such as mass market, emerging affluent, mass affluent, and HNW. In 2022, the Indian economy faced new challenges due to rising inflation, interest rate hikes, the Russia–Ukraine war, the uncertain global economic environment, as well as a third wave of COVID-19 infections. Despite this, investor sentiment remained positive thanks to strong domestic consumption and growth in exports. The affluent segment registered an estimated growth of more than 7% in 2022, while the HNW segment also rose. Growth was particularly pronounced in higher wealth bands.

India Wealth Management Market Analysis by Asset Bands, 2022 (%)

For more asset bands insights into the India wealth management market, download a free report sample

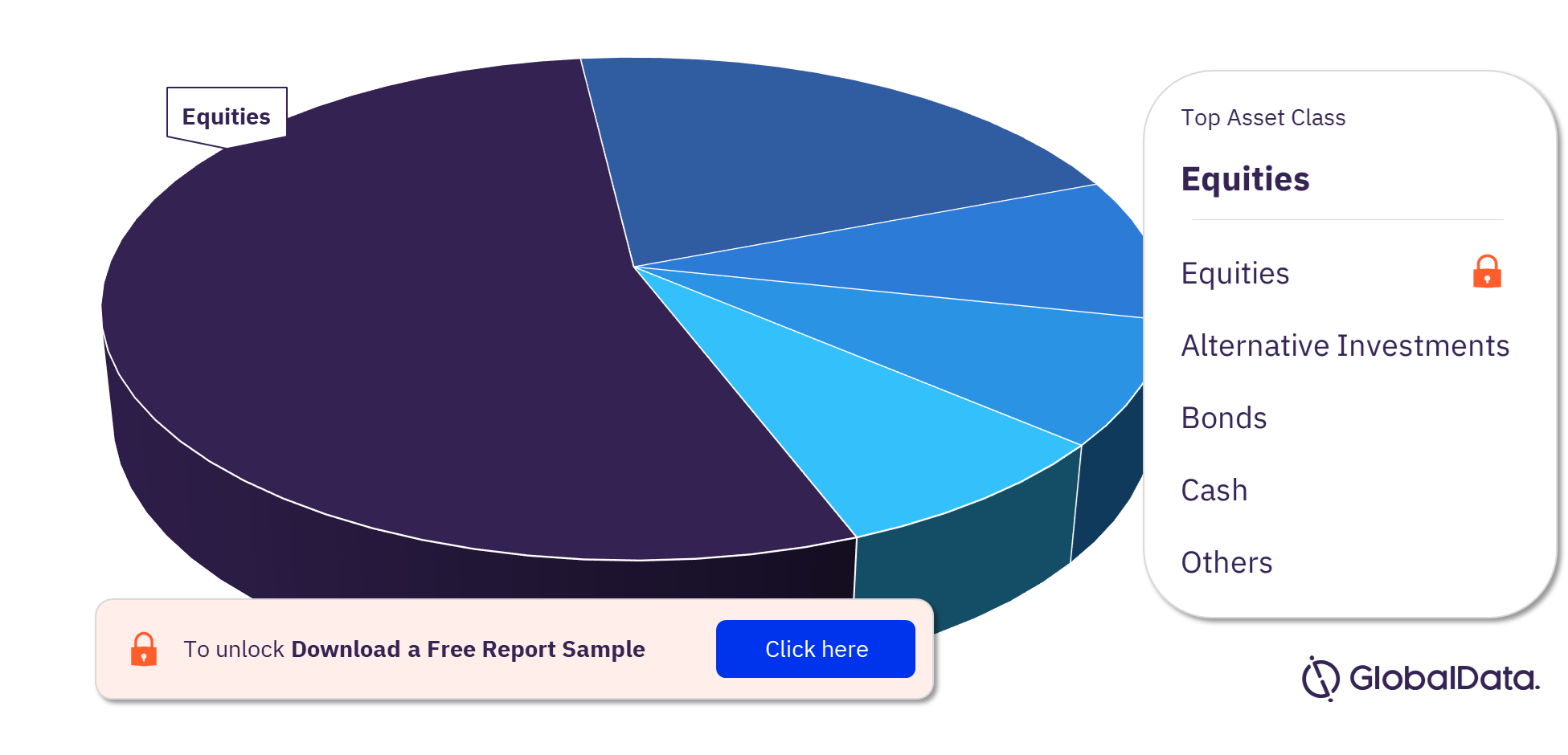

India Wealth Management Market Segmentation by HNW Asset Allocation Classes

The key HNW asset allocation classes in the India wealth management market are alternative investments, bonds, cash, commodities, equities, and property. Equities continue to be the most-preferred asset class for HNW investors. HNW investors in India also allocate a sizable proportion of their wealth to cash and near-cash products. Apart from the traditional preference for this asset class, investors waiting for opportunities to arise represent another important influence. HNW demand for cash is expected to increase further in 2023, amid growing geopolitical uncertainties and rising interest rates. Foreign currency deposits form the largest allocation in HNW investors’ cash and near-cash portfolios.

India Wealth Management Market Analysis by HNW Asset Allocation Classes, 2022 (%)

For more asset allocation classes insights into the India wealth management market, download a free report sample

India Wealth Management Market - Competitive Landscape

Some of the leading players in the India wealth management market are Reserve Bank of India, Securities and Exchange Board of India (SEBI), HDFC Money, Scripbox, HDFC Bank, ICICI Bank, Association of Mutual Funds in India (AMFI), Groww, Fisdom, and FundsIndia.

India Wealth Management Market Overview

| Key Asset Bands | Mass Market, Emerging Affluent, Mass Affluent, and HNW |

| Key HNW Asset Allocation Classes | Alternative Investments, Bonds, Cash, Commodities, Equities, and Property |

| Leading Players | Reserve Bank of India, Securities and Exchange Board of India (SEBI), HDFC Money, Scripbox, HDFC Bank, ICICI Bank, Association of Mutual Funds in India (AMFI), Groww, Fisdom, and FundsIndia |

Key Highlights

- Affluent individuals accounted for just 0.69% of India’s total adult population in 2022 but collectively held 90.3% of total onshore liquid assets.

- Advisory mandates lead the Indian HNW market.

- Deposits remain the most popular investment avenue for Indian investors, indicating their preference for safe investment asset classes.

Reasons to Buy

- Make strategic decisions using top-level historic and forecast data on India’s wealth industry.

- Identify the most promising client segment by analyzing the penetration of affluent individuals.

- Receive detailed insights into retail liquid asset holdings in India.

- Understand the changing market and competitive dynamics by learning about new competitors and recent deals in the wealth space.

- See an overview of key digital disruptors in the country’s wealth market.

Securities and Exchange Board of India (SEBI)

HDFC Money

Scripbox

HDFC Bank

ICICI Bank

Association of Mutual Funds in India (AMFI)

Groww

Fisdom

FundsIndia

Punjab National Bank (PNB)

UTI Asset Management Company

Credent Asset Management Services Private Limited

Essel Finance Advisors & Managers

Vijya Fintech

Incofin

Mufin Green Finance

Table of Contents

Frequently asked questions

-

What are the key asset bands in the India wealth management market?

The key asset bands in the India wealth management market are mass affluent, emerging affluent, mass market, and HNW.

-

What are the key HNW asset allocation classes in the Indian wealth management market?

The key HNW asset allocation classes in the Indian wealth management market are alternative investments, bonds, cash, commodities, equities, and property.

-

Which is the most-preferred asset class for HNW investors?

Equities continue to be the most-preferred asset class for HNW investors.

-

Who are the key players in the India wealth management market?

The key players in the India wealth management market are Reserve Bank of India, Securities and Exchange Board of India (SEBI), HDFC Money, Scripbox, HDFC Bank, ICICI Bank, Association of Mutual Funds in India (AMFI), Groww, Fisdom, and FundsIndia.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Wealth Management reports