Iran Cards and Payments – Opportunities and Risks to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Iran Cards and Payments Market Report Overview

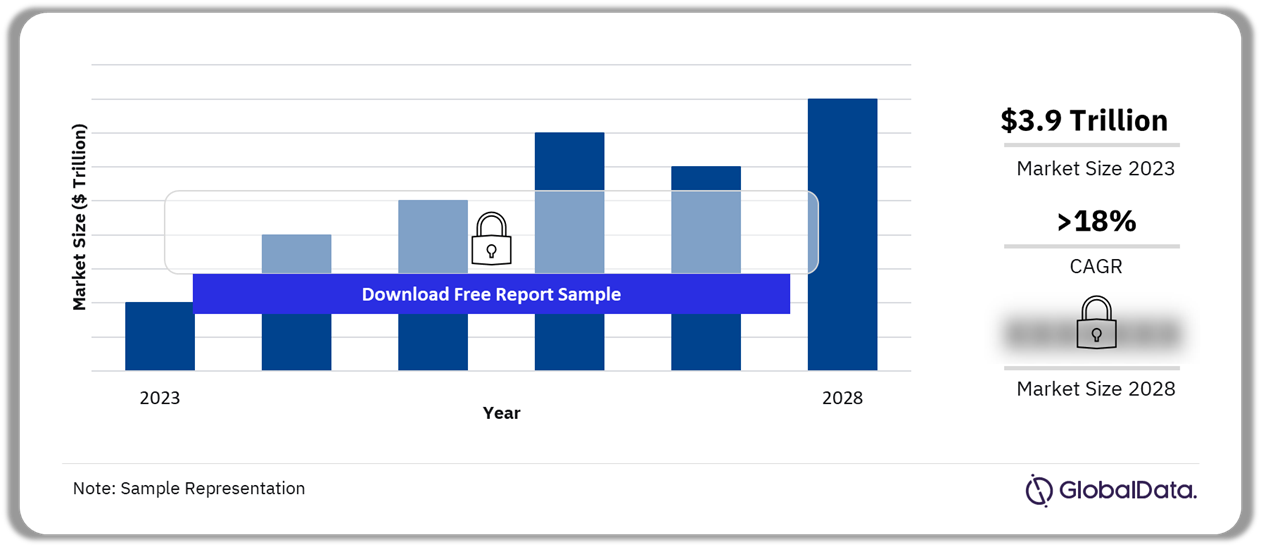

The annual value of card transactions in the Iran cards and payments market was $3.9 trillion in 2023. The value will grow at a CAGR of more than 18% during 2024-2028 owing to the improvements to the country’s payments infrastructure and an increase in the number of retailers accepting payment cards.

Iran Card Transactions Outlook, 2023-2028 ($ Trillion)

Buy the Full Report for More Information on the Iran Cards and Payments Market Forecast Download a Free Sample Report

The Iran cards and payments market research report provides a detailed analysis of market trends influencing the industry. It provides transaction values and volumes for several payment instruments for the review period. In addition, the Iran cards and payments market analysis offers information on the country’s competitive landscape, including market shares of issuers and schemes. The report also entails regulatory policy details and provides extensive coverage of any recent changes in the regulatory structure.

| Annual Card Transactions Value (2023) | $3.9 Trillion |

| CAGR (2024-2028) | >18% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Payment Instruments | · Cards

· Credit Transfers · Cheques |

| Key Segments | · Card-Based Payments

· Alternative Payments |

| Leading Players | · Bank Melli Iran

· Bank Mellat · Tejarat Bank · Phone Pay · Hamrah Card |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Iran Cards and Payments Market Dynamics

In 2023, the payment card transaction volume recorded significant growth in Iran. The country’s payment card market penetration rate per individual is higher than those of its neighboring countries such as Israel, Kuwait, the UAE, Bahrain, Saudi Arabia, Lebanon, and Oman. The high penetration rate in Iran can be attributed to the country’s large banked population, as well as the implementation of various government initiatives to encourage electronic payments.

Although US sanctions have isolated Iran from the global payment system, electronic payments are likely to grow in the country. The adoption of new technologies and the availability of various alternative payment solutions will further propel the payments market growth. Furthermore, the launch of the digital rial will also facilitate the uptake of electronic payments.

Buy the Full Report to Get Additional Iran Cards and Payments Market Dynamics

Iran Cards and Payments Market Segmentation by Payment Instruments

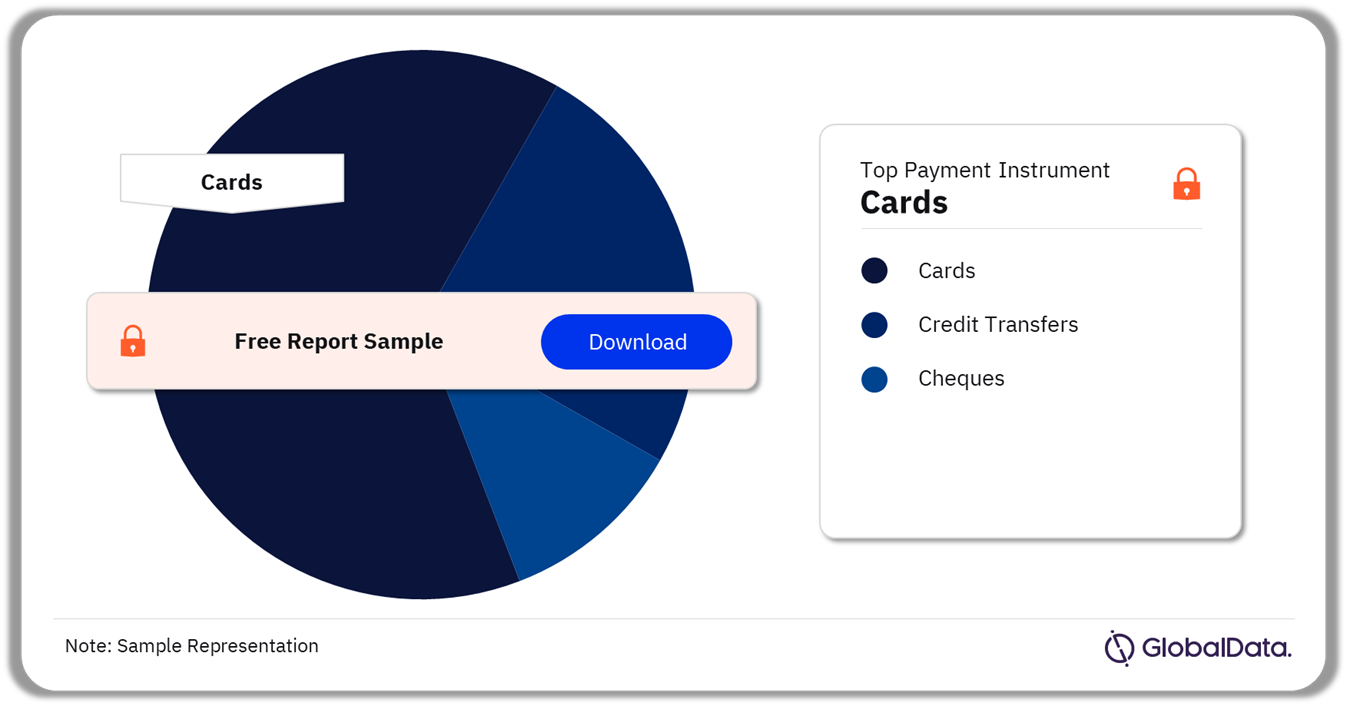

Cards had the highest transaction volume in the Iran payments space in 2023

The key payment instruments in the Iran cards and payments market are cards, credit transfers, and cheques. The growth of payment cards can be attributed to Iran’s highly banked population, in addition to government initiatives to promote electronic payments and growing awareness of the benefits of payment cards. All interbank transactions are settled via Shetab, which processes electronic transactions made at ATMs and POS terminals, as well as via landlines, the internet, kiosks, and PIN pads.

Iran Cards and Payments Market Analysis by Payment Instruments (Volume Terms), 2023 (%)

Buy the Full Report for More Payment Instrument Insights into the Iran Cards and Payments Market

Iran Cards and Payments Market Segments

Debit cards dominated the payment card market in 2023

The key segments in the Iran cards and payments market are card-based payments and alternative payments.

Card-Based Payments: The payment card market registered significant growth over 2019-2023 owing to Iran’s large banked population and infrastructure improvements. The growth in the number of retailers accepting cards and a general consumer shift toward card-based payments also propelled the card market growth.

Buy the Full Report for More Market Segment Insights into the Iran Cards and Payments Market

Iran Cards and Payments Market - Competitive Landscape

A few of the leading players in the Iran cards and payments market are Bank Melli Iran, Bank Mellat, Tejarat Bank, Phone Pay, and Hamrah Card among others.

Hamrah Card: Hamrah Card is a payment solution offered by domestic payment firm eFarda. The solution can be used to make card-to-card fund transfers, QR code-based payments, smartphone top-ups, utility bill payments, and charitable donations. Users can store their payment card details by scanning the front of the card with the app, or by entering the information manually. Payments are charged to the linked payment card.

Iran Cards and Payments Market Analysis by Players, 2023

Buy the Full Report to Know More about the Players in the Iran Cards and Payments Market Download a Free Sample Report

Buy the Full Report to Know More about the Players in the Iran Cards and Payments Market Download a Free Sample Report

Iran Cards and Payments Market – Latest Developments

- In April 2021, the central bank lifted the prohibition on business debit cards. Banks are now allowed to offer debit cards along with business accounts for companies and legal entities, after verifying relevant documents such as articles of association.

- In January 2024, Iran Zamin Bank launched the Amber mobile app, enabling users to make contactless in-store payments using NFC-enabled smartphones. Once customers add their payment card details to the app, they can complete payments by placing their smartphones close to contactless-enabled POS terminals.

Segments Covered in the Report

Iran Cards and Payments Instruments Outlook (Value, $ Trillion, 2019-2028)

- Cards

- Credit Transfers

- Cheques

Iran Cards and Payments Market Segments Outlook (Value, $ Trillion, 2019-2028)

- Card-Based Payments

- Alternative Payments

Scope

The report provides:

- Current and forecast values for each market in the Iran cards and payments industry, including debit and credit cards.

- Detailed insights into payment instruments including cards, credit transfers, and cheques. It also includes an overview of the country’s key alternative payment instruments.

- E-commerce market analysis.

- Analysis of various market drivers and regulations governing the Iran cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit and credit cards.

- Comprehensive analysis of consumer attitudes and buying preferences for cards.

- AN overview of the competitive landscape of the Iran cards and payments industry.

Reasons to Buy

- Make strategic business decisions, using top-level historical and forecast market data, related to the Iran cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Iran cards and payments industry.

- Assess the competitive dynamics in the Iran cards and payments industry.

- Gain insights into marketing strategies used for various card types in Iran.

- Gain insights into key regulations governing the Iran cards and payments industry.

Bank Saderat Iran

Bank Mellat

Bank Sepah

Tejarat Bank

Bank Keshavarzi

Bank Maskan

Post Bank of Iran

Parsian Bank

Refah Bank

TT Bank

TAT Bank

Qarzol-Hasane Mehr Iran Bank

Ansar Bank

Pasargad Bank

EN Bank

Sina Bank

Saman Bank

Sarmayeh Bank

Table of Contents

Frequently asked questions

-

What was the annual value of card transactions in the Iran cards and payments market in 2023?

The annual value of card transactions in the Iran cards and payments market was $3.9 trillion in 2023.

-

What will the Iran cards market growth rate be during the forecast period?

Iran’s annual card market value will grow at a CAGR of more than 18% during 2024-2028.

-

Which was the leading payment instrument in the Iran cards and payments market in 2023?

Cards was the leading payment instrument in terms of transaction volume in the Iran cards and payments market in 2023.

-

Which are the leading players in the Iran cards and payments market?

A few of the leading players in the Iran cards and payments market are Bank Melli Iran, Bank Mellat, Tejarat Bank, Phone Pay, and Hamrah Card among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports