Iraq Oil and Gas Exploration and Production Market Volumes and Forecast by Terrain, Assets and Major Companies

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Iraq Oil and Gas Exploration and Production Market Report Overview

Iraq is the second-largest crude oil producer in the Organization of Petroleum Exporting Countries (OPEC). The country holds a proven oil reserves of 148 billion barrels, making it the fifth-largest holder of crude oil in the world. All of Iraq’s crude oil production comes from onshore fields, with oilfields in the southern province, Al Basrah, which accounts for approximately 70% of the country’s total petroleum production. Most of Iraq’s gas resources are associated with oil.

The Iraq oil and gas E&P market research report provides an oil and gas production outlook by assets, terrain, and major companies. The report offers key details of active and upcoming oil and gas assets in the country. Furthermore, the detailed report covers crucial information about the recently licensed block details and other latest discoveries. In addition, insights regarding the latest mergers & and acquisitions related to the Iraq oil and gas E&P sector are also provided in this report.

| Forecast Period | 2023-2028 |

| Historical Period | 2019-2022 |

| Key Terrains (Crude Oil and Condensate Production) | · Onshore |

| Key Assets (Gross Crude Oil and Condensate

Production) |

· Rumaila

· West Qurna-1 · West Qurna-2 · Zubair · Halfaya |

| Key Assets

(Marketed Natural Gas Production) |

· Khor Mor and Chemchemal

· Topkhana · Garraf · Nasiriya · Ajeel |

| Leading Companies (Crude Oil and Condensate Production) | · Ministry of Oil, Iraq

· Dhi Qar Oil Co · KAR Group · China National Petroleum Corp · TotalEnergies SE |

| Leading Companies (Marketed Natural Gas Production) | · Ministry of Oil, Iraq

· Dhi Qar Oil Co · Crescent Group Holdings Ltd · Dana Gas · Repsol SA |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Iraq Oil and Gas E&P Market by Terrains

The only terrains in Iraq’s oil and gas E&P market are onshore terrains.

Buy the Full Report for more Terrain-Wise Insights into the Iraq Oil and Gas E&P Market

Download a Free Sample Report

Iraq Oil and Gas E&P Market Segmentation by Crude Oil and Condensate Production Assets

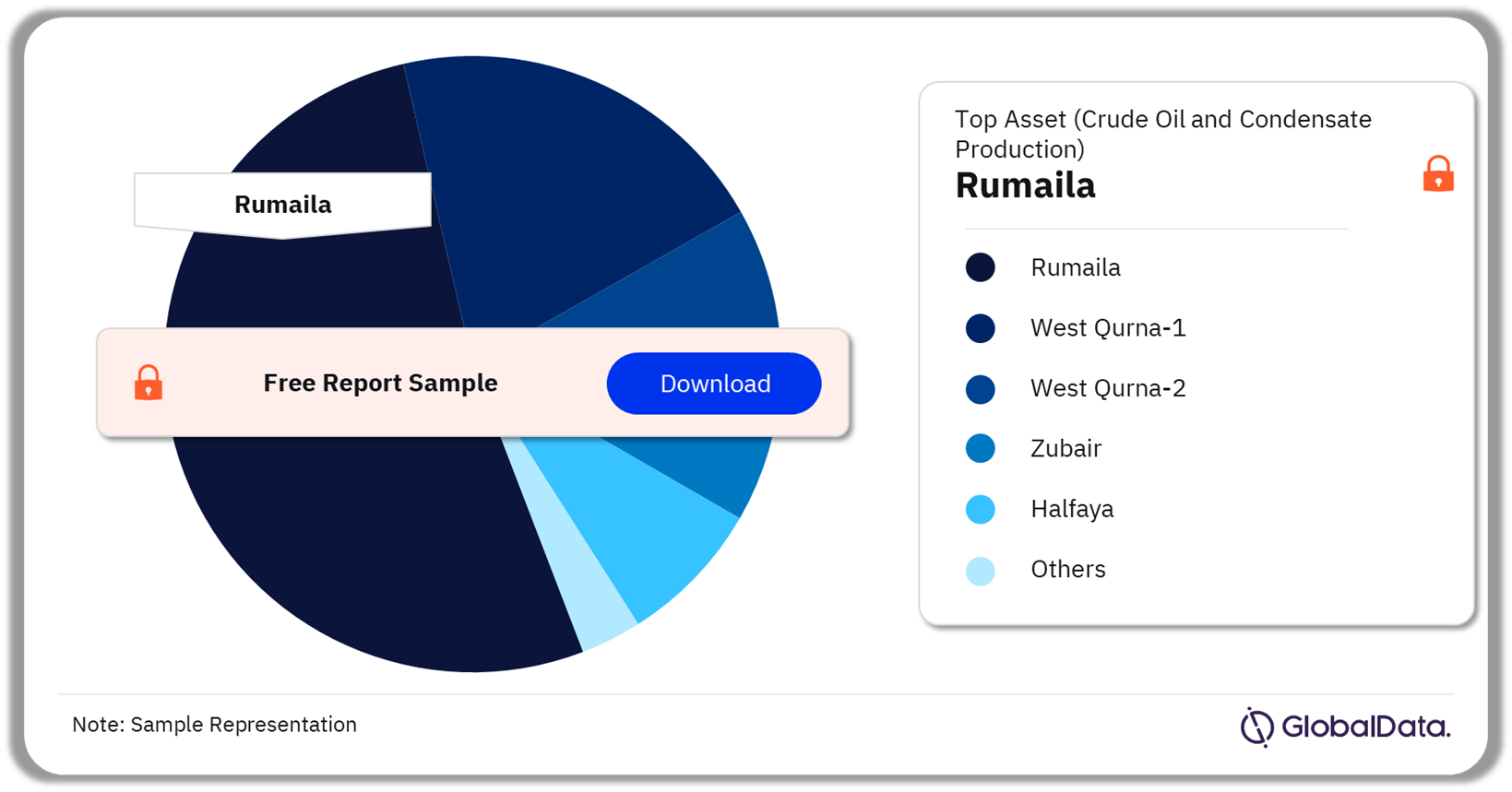

The key crude oil and condensate production assets in Iraq’s oil and gas E&P market are Rumaila, West Qurna-1, West Qurna-2, Zubair, and Halfaya among others. In 2022, Rumaila was the leading crude oil and condensate production asset.

Iraq Oil and Gas E&P Market Analysis by Crude Oil and Condensate Production Assets, 2022 (%)

Buy the Full Report for More Insights into Crude Oil and Condensate Production Assets of the Iraq oil and Gas E&P Market, Download A Free Report Sample

Iraq Oil and Gas E&P Market Segmentation by Marketed Natural Gas Production Assets

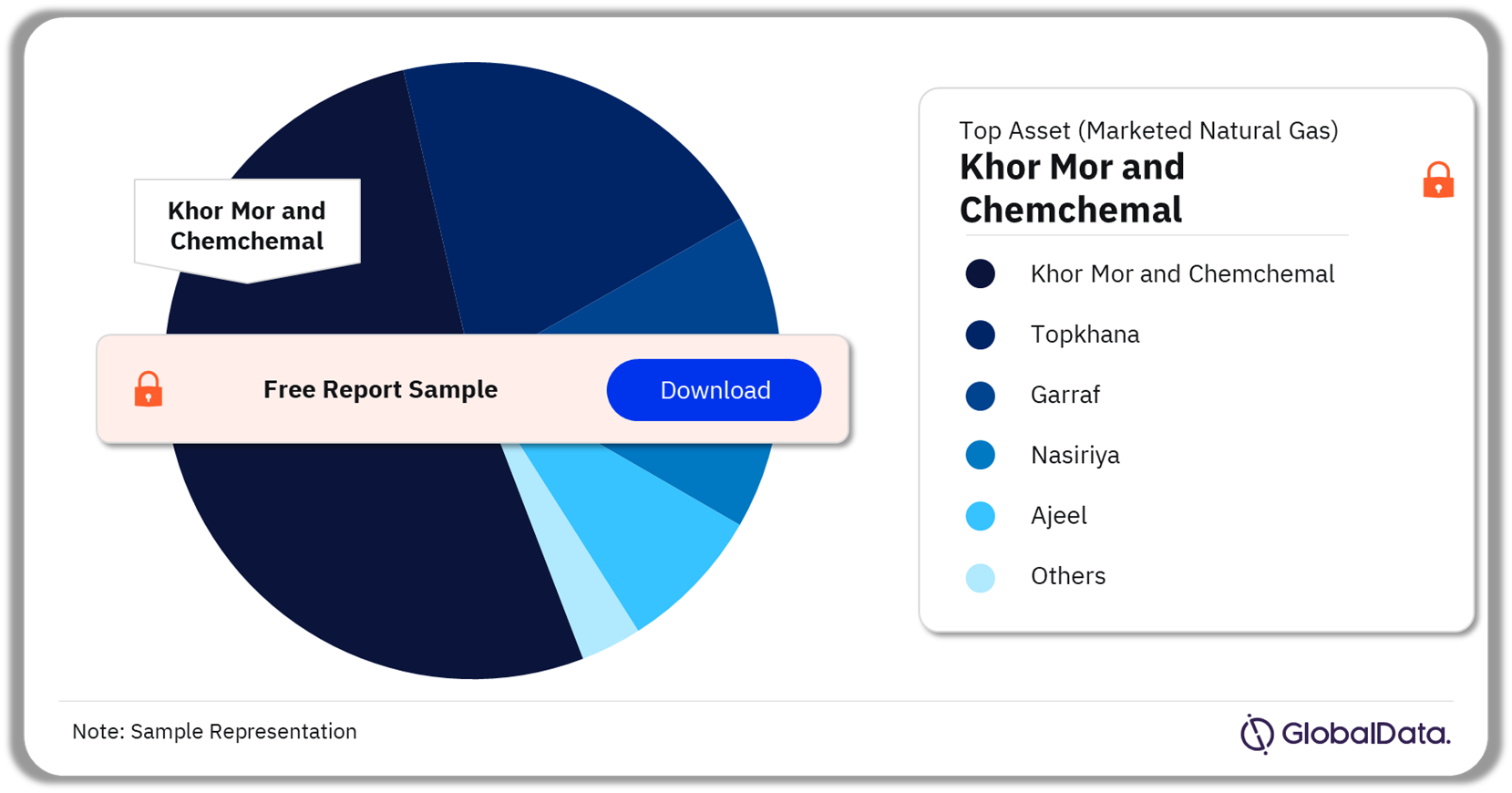

The key marketed natural gas production assets in Iraq’s oil and gas E&P market are Khor Mor and Chemchemal, Topkhana, Garraf, Nasiriya, and Ajeel among others. In 2022, Khor Mor and Chemchemal was the leading marketed natural gas production asset.

Iraq Oil and Gas E&P Market Analysis by Marketed Natural Gas Production Assets 2022 (%)

Buy the Full Report for More Insights into Marketed Natural Gas Production Assets of the Iraq Oil and Gas E&P Market, Download A Free Report Sample

Iraq Oil & Gas Exploration and Production Market - Competitive Landscape

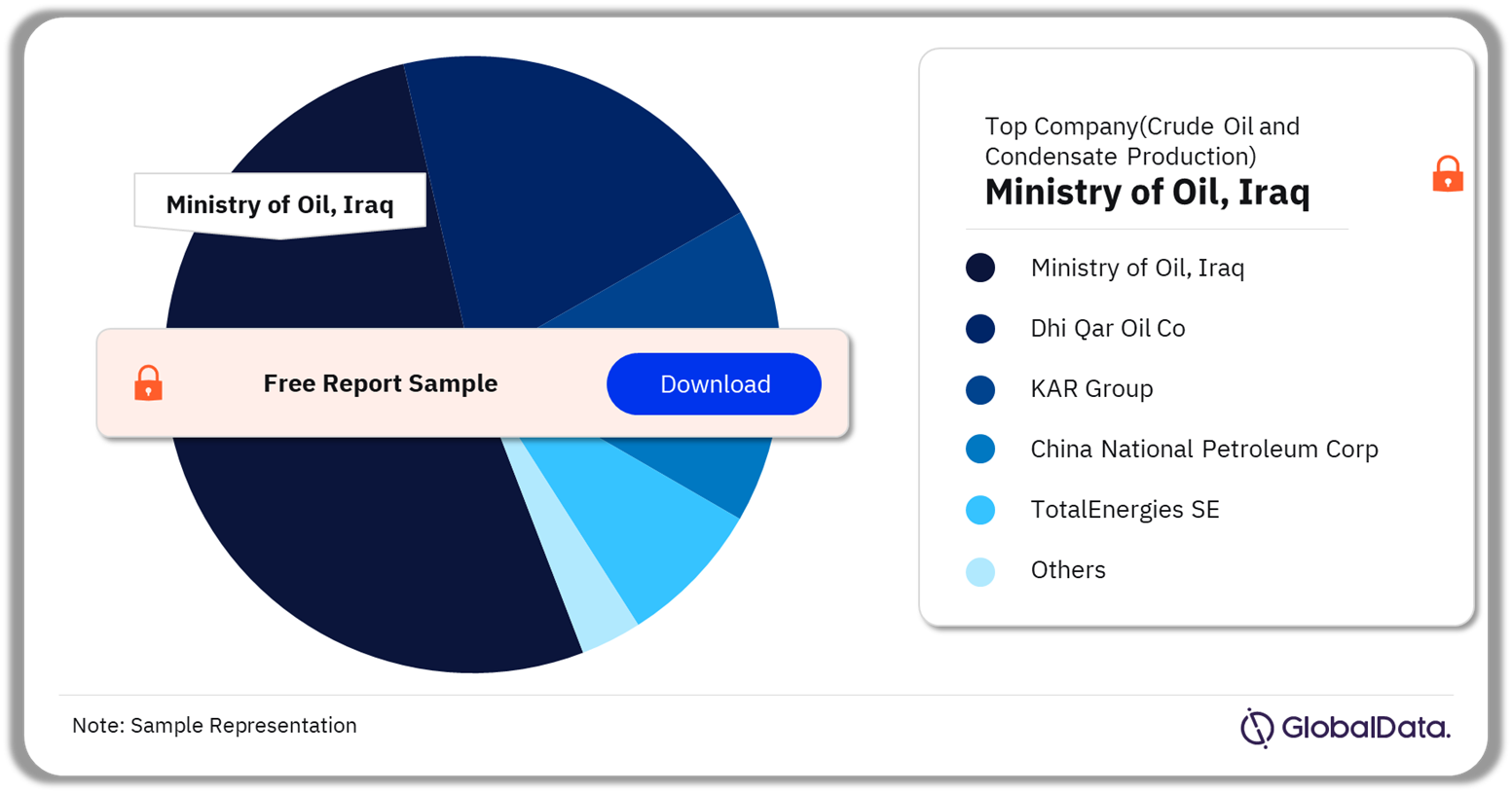

Leading Crude Oil & Condensate Production Companies: The leading crude oil & condensate production companies in the Iraq oil and gas E&P market are Ministry of Oil, Iraq; Dhi Qar Oil Co; KAR Group; China National Petroleum Corp; and TotalEnergies SE among others. Ministry of Oil, Iraq, was the leading company with the highest net entitlement crude oil and condensate production, in 2022.

Leading Marketed Natural Gas Production Companies: The leading marketed natural gas production companies in the Iraq oil and gas E&P market are Ministry of Oil, Iraq; Dhi Qar Oil Co; Crescent Group Holdings Ltd; Dana Gas; and Repsol SA among others. Ministry of Oil, Iraq, was the leading company with the highest net entitlement natural gas production, in 2022.

Iraq Oil and Gas E&P Analysis by Crude Oil & Condensate Production Companies, 2022 (%)

Buy the Full Report to Learn More About Leading Companies in Iraq’s Oil and Gas Exploration and Production Market

Download A Free Report Sample

Segments Covered in the Report

Iraq Oil and Gas E&P Market Terrains Outlook (2019-2028)

- Onshore

- Others

Scope

Iraq’s oil and gas production outlook by assets terrain, and major companies

Key details of active and upcoming oil and gas assets in the country

Recently licensed blocks details, and latest discoveries

Latest mergers and acquisitions related to the E&P sector in the country

Reasons to Buy

- Gain a strong understanding of Iraq’s E&P sector.

- Aids in decision-making based on strong historical and outlook of oil and gas production data, licensed blocks details, and discoveries.

- Assess competitors’ production outlook and licensed block details in the country.

- Analyze the latest M&A landscape related to the country’s E&P sector.

Table of Contents

Table

Figures

Frequently asked questions

-

Which terrains dominated the oil and gas E&P in Iraq during 2022?

In 2022, onshore terrains dominated the oil and gas E&P in Iraq.

-

Which crude oil and condensate production asset accounted for the largest Iraq oil and gas E&P market share in 2022?

In 2022, Rumaila was the leading crude oil and condensate production asset in the Iraq oil and gas E&P market.

-

Which natural gas production asset accounted for the largest Iraq oil and gas E&P market share?

In 2022, Khor Mor and Chemchemal was the leading natural gas production market asset in the Iraq oil and gas E&P market.

-

Which are the major crude oil & condensate production companies operating in the Iraq oil and gas E&P market?

The leading crude oil & condensate production companies in the Iraq oil and gas E&P market are Ministry of Oil, Iraq; Dhi Qar Oil Co; KAR Group; China National Petroleum Corp; and TotalEnergies SE among others.

-

Which are the major marketed natural gas production companies operating in the Iraq oil and gas E&P market?

The leading marketed natural gas production companies in the Iraq oil and gas E&P market are Ministry of Oil, Iraq; Dhi Qar Oil Co; Crescent Group Holdings Ltd; Dana Gas; and Repsol SA among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.