Ireland Beer and Cider Market Analysis by Category and Segment, Company and Brand, Price, Packaging and Consumer Insights

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Ireland Beer and Cider Market Overview

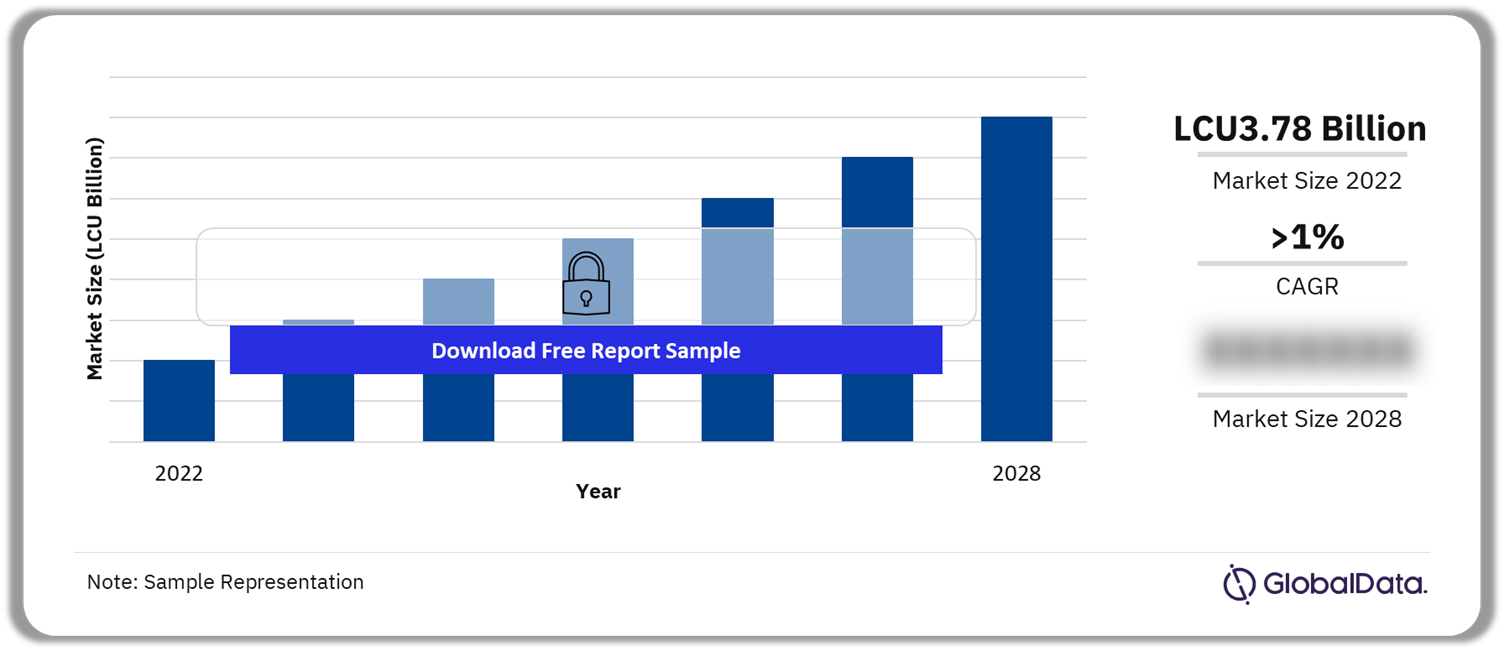

The Ireland beer and cider market size was LCU3.78 billion in 2022 and the market is expected to register a CAGR of more than 1% during 2023-2028. The Ireland beer and cider market research report provides detailed data analysis of the beer and cider sector and includes an introduction, category and segment insights, company and brand insights, channel insights, packaging insights, and appendix sections.

Ireland Beer and Cider Market Outlook, 2022-2028 (LCU Billion)

Buy the Full Report for More Insights into the Ireland Beer and Cider Market Forecast

Growth in the Irish economy in 2022 was robust. The rise in private consumption and growth in investment by multinational companies fueled the country’s economic growth. The rise in tourist arrivals and an increase in the number of social events helped the demand for alcoholic beverages at hotels, restaurants, bars, pubs, and clubs in Ireland. The health & wellness trend has been gaining momentum in Ireland, with more consumers choosing zero-alcohol beer. Beer and cider manufacturers are focusing on reducing their carbon and plastic footprint. For instance, Heineken Ireland announced its initiative to brew beer with recycled carbon dioxide.

| Market Size (2022) | LCU3.78 billion |

| CAGR (2023-2028) | >1% |

| Historical Period | 2018-2022 |

| Forecast Period | 2023-2028 |

| Key Distribution Channels | · On-Premise

· Off-Premise |

| Key Packaging Materials | · Glass

· Metal · PET |

| Key Packaging Types | · Bottle

· Can · Keg |

| Leading Brands | · Guinness

· Heineken · Coors · Bulmers · Carlsberg |

| Leading Companies | · Diageo, Ireland

· Heineken Ireland · C&C Gleeson · C&C · Molson Coors Ireland |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

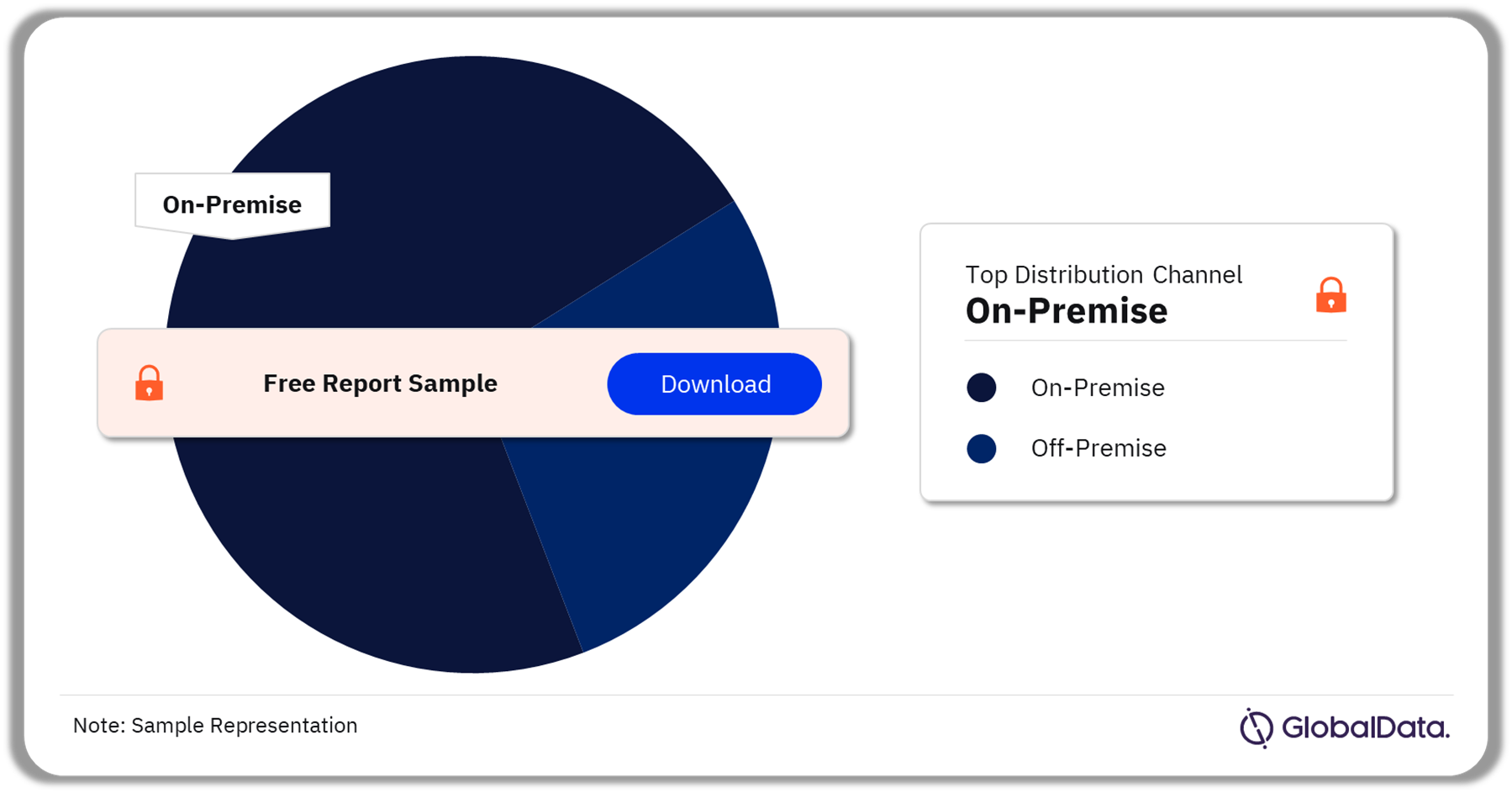

Ireland Beer and Cider Market Segmentation by Distribution Channels

The on-premise channel dominated the market by value in 2022.

The key distribution channels in the Ireland beer and cider market are on-premise and off-premise. In 2022, the on-premise distribution channel dominated the market in terms of value. The segment includes volume sold for “immediate consumption” at the point of purchase including institutions, vending machines, QSR, EDA, and other on-premise channels.

Ireland Beer and Cider Market Analysis by Distribution Channels, 2022 (%)

Buy the Full Report for More Distribution Channel Insights into the Ireland Beer and Cider Market

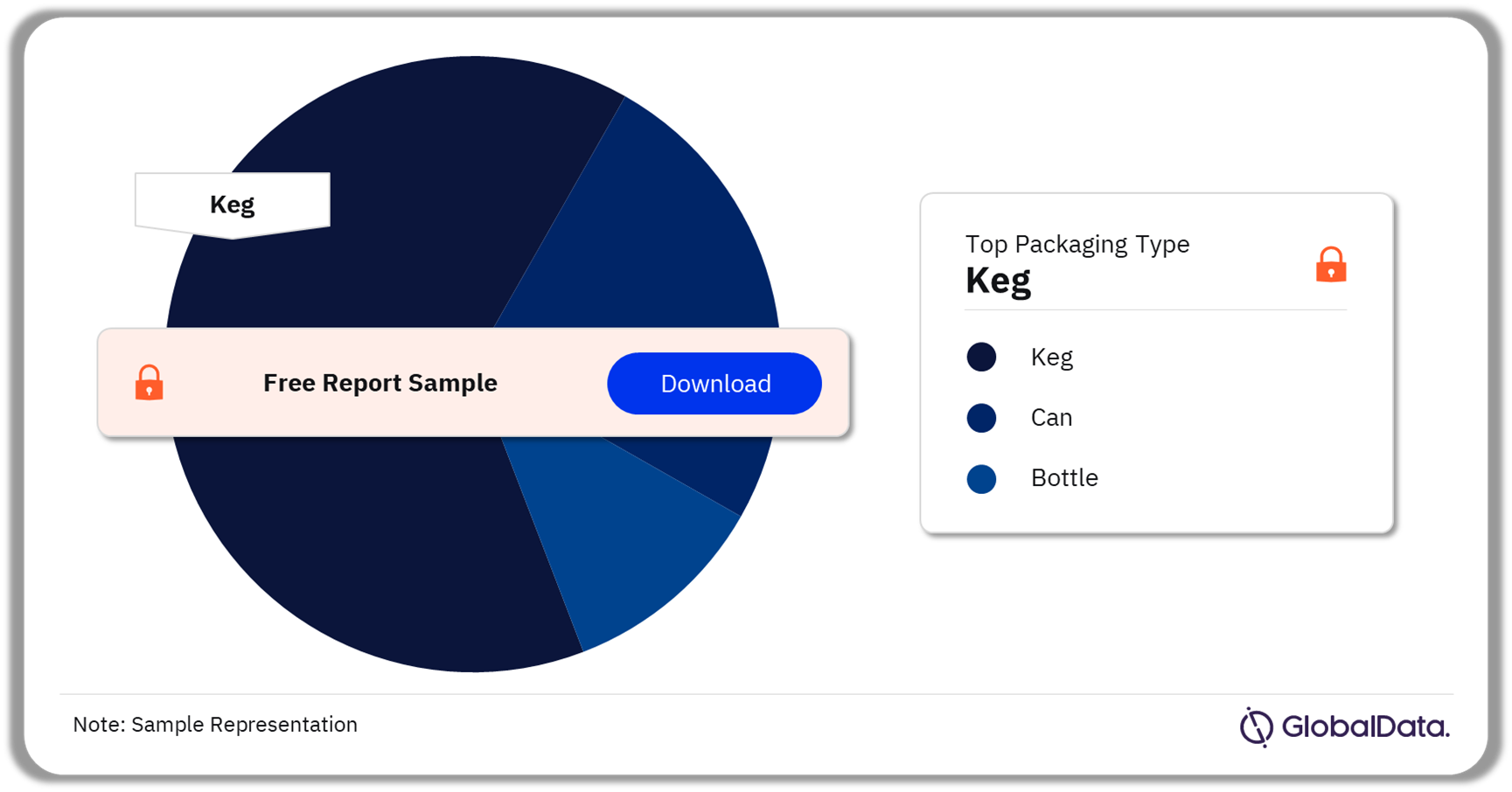

Ireland Beer and Cider Market Segmentation by Packaging

Keg were the most preferred packaging type and metal was the leading packaging material in 2022.

The key packaging types in the Ireland beer and cider market are can, bottle, and keg. The keg packaging type had the major market volume share in 2022. The key packaging materials in the Ireland beer and cider market are metal, PET, and glass. Metal packaging material had the major market volume share in 2022.

Ireland Beer and Cider Market Analysis by Packaging Types, 2022 (%)

Buy the Full Report for More Packaging Type Insights into the Ireland Beer and Cider Market

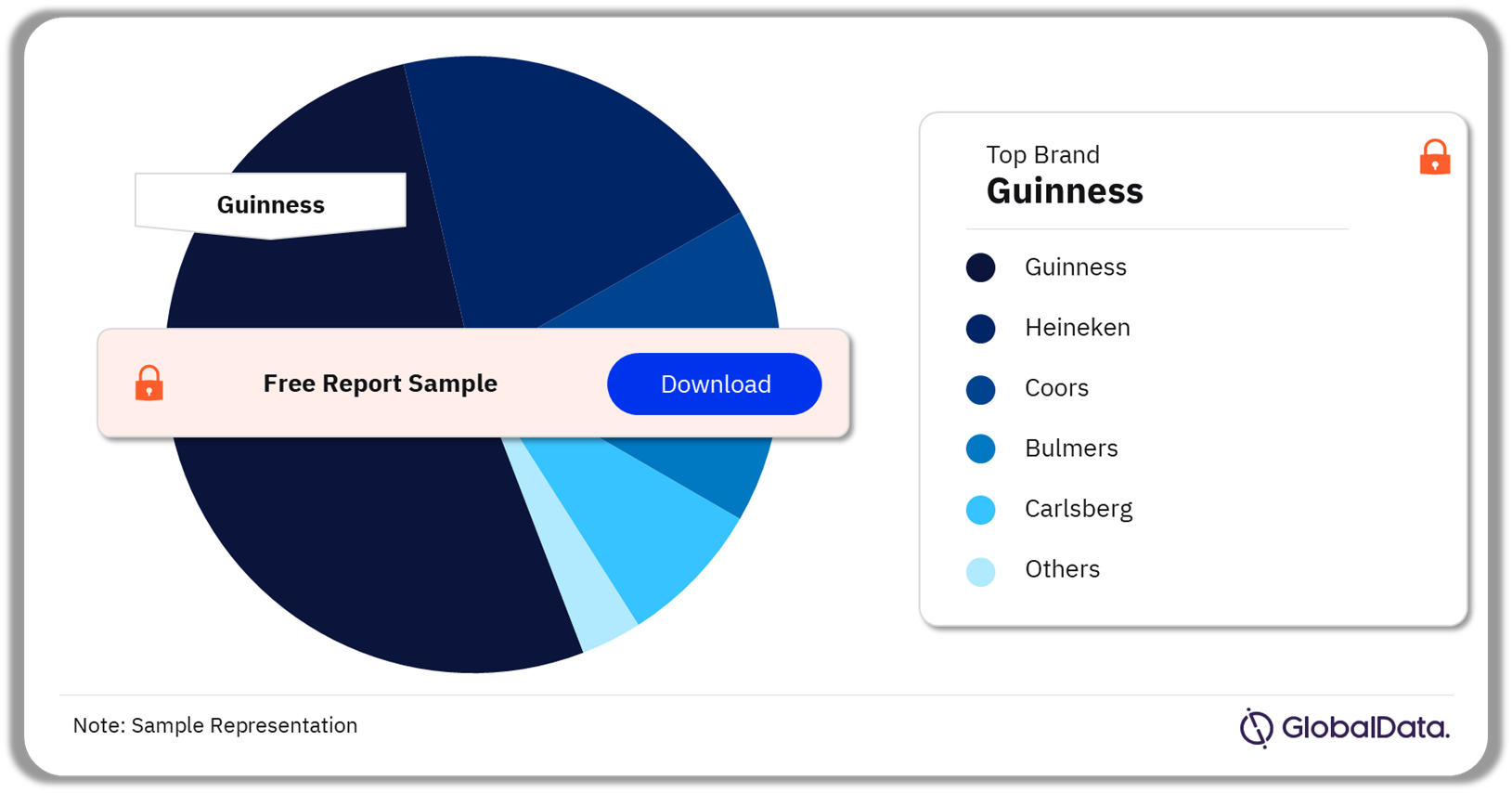

Ireland Beer and Cider Market – Top Brands

Guinness emerged as the most popular brand in terms of value and volume in 2022.

The report offers the market share and growth in terms of volume and value of the top-performing Ireland beer and cider brands. Some of the leading brands in the Ireland beer and cider market are –

- Guinness

- Heineken

- Coors

- Bulmers

- Carlsberg

- Others

Ireland Beer and Cider Market Analysis by Brands, 2022 (%)

Buy the Full Report to Know More About the Leading Ireland Beer and Cider Brands

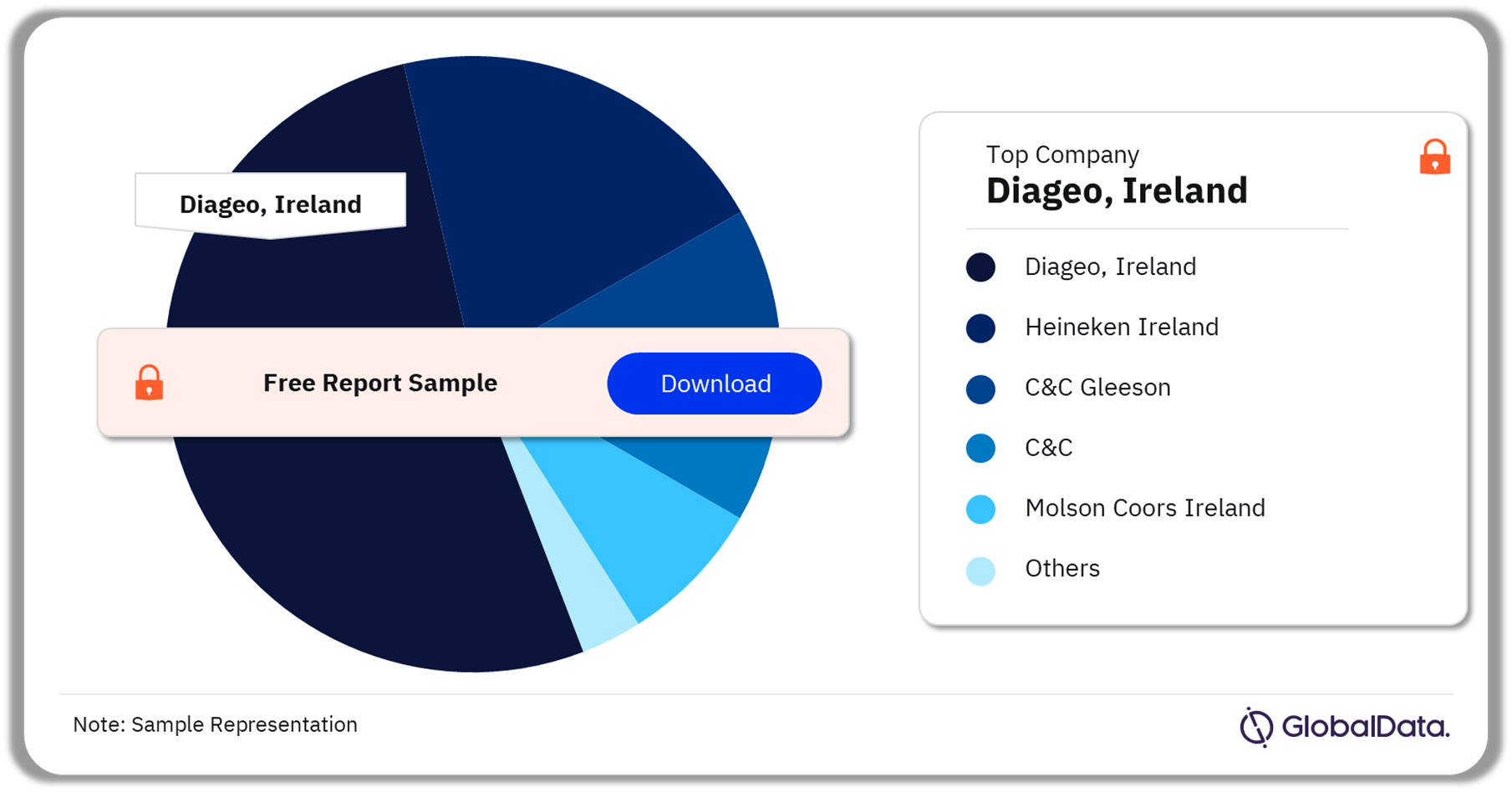

Ireland Beer and Cider Market – Competitive Landscape

Diageo, Ireland with the highest revenue became the market leader in 2022.

The report offers the market share and growth in terms of volume and value of the top-performing Ireland beer and cider companies. Some of the leading companies in the Ireland beer and cider market are –

- Diageo, Ireland

- Heineken Ireland

- C&C Gleeson

- C&C

- Molson Coors Ireland

- Others

Ireland Beer and Cider Market Analysis by Companies, 2022 (%)

Buy the Full Report to Know More About the Leading Ireland Beer and Cider Companies

Segments Covered in the Report

Ireland Beer and Cider Market Distribution Channel Outlook (Value, LCU Billion, 2018-2028)

- On-Premise

- Off-Premise

Ireland Beer and Cider Market Packaging Material Outlook (Value, LCU Billion, 2018-2028)

- Metal

- Glass

- PET

Ireland Beer and Cider Market Packaging Type Outlook (Value, LCU Billion, 2018-2028)

- Can

- Bottle

- Keg

Scope

a) Growing health awareness: The coronavirus (COVID-19) pandemic amplified consumers’ health awareness. Additionally, the government also increased the minimum prices of alcoholic beverages in a bid to discourage consumers from excessive drinking. Consumers’ shift away from alcohol has been evident and is more prominent in Gen-Z consumers. The trend will dent the sector’s volume in the coming years.

b) Reopening of bars and restaurants: With most of the COVID-19 restrictions lifted in 2022, Irish consumers visited on-premise outlets more often in the year. Tourism grew significantly; pushing up the demand for alcoholic beverages at hotels, restaurants, and bars in 2022. The sector’s on-premise volume grew by a significant rate of 30.2% in 2022 as a result.

Reasons to Buy

- Gain an in-depth understanding of the dynamics and structure of the Irish beer and cider industry, from the latest competitive intelligence of both historical and forecast data to enhance your corporate strategic planning.

- Understand volume vs. value data and identify the key growth opportunities across the super-premium, premium, mainstream, and discount segments to best target profitability.

- Analyze domestic and imported beer brand performance to develop a competitive advantage.

- Interrogate the unique granularity of our data to analyze the market on a variety of levels to make well-informed decisions on future threats and growth prospects in the marketplace for your company.

Heineken Ireland

C&C Gleeson

C&C (Ireland)

Molson Coors Ireland

Molson Coors Ireland

Comans Wholesale Ltd

Richmond Marketing

Table of Contents

Frequently asked questions

-

What was the Ireland beer and cider market size in 2022?

The beer and cider market size in Ireland was LCU3.78 billion in 2022.

-

What is the Ireland beer and cider market growth rate?

The beer and cider market in Ireland is expected to register a CAGR of more than 1% during 2023-2028.

-

Which was the leading distribution channel in the Ireland beer and cider market in 2022?

The leading distribution channel by value in the Ireland beer and cider market was on-premise.

-

Which was the leading packaging material in the Ireland beer and cider market in 2022?

The leading packaging material in the Ireland beer and cider market was metal.

-

Which was the leading packaging type in the Ireland beer and cider market in 2022?

The leading packaging type in the Ireland beer and cider market was the keg.

-

Which are the leading brands in the Ireland beer and cider market?

Some of the leading brands in the Ireland beer and cider market are Guinness, Heineken, Coors, Bulmers, Carlsberg, and others.

-

Which are the leading companies in the Ireland beer and cider market?

Some of the leading companies in the Ireland beer and cider market are Diageo, Ireland, Heineken Ireland, C&C Gleeson, C&C, Molson Coors Ireland, and others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.