Kuwait Power Market Size and Trends by Installed Capacity, Generation, Transmission, Distribution, and Technology, Regulations, Key Players and Forecast, 2022-2035

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Kuwait Power Market Report Overview

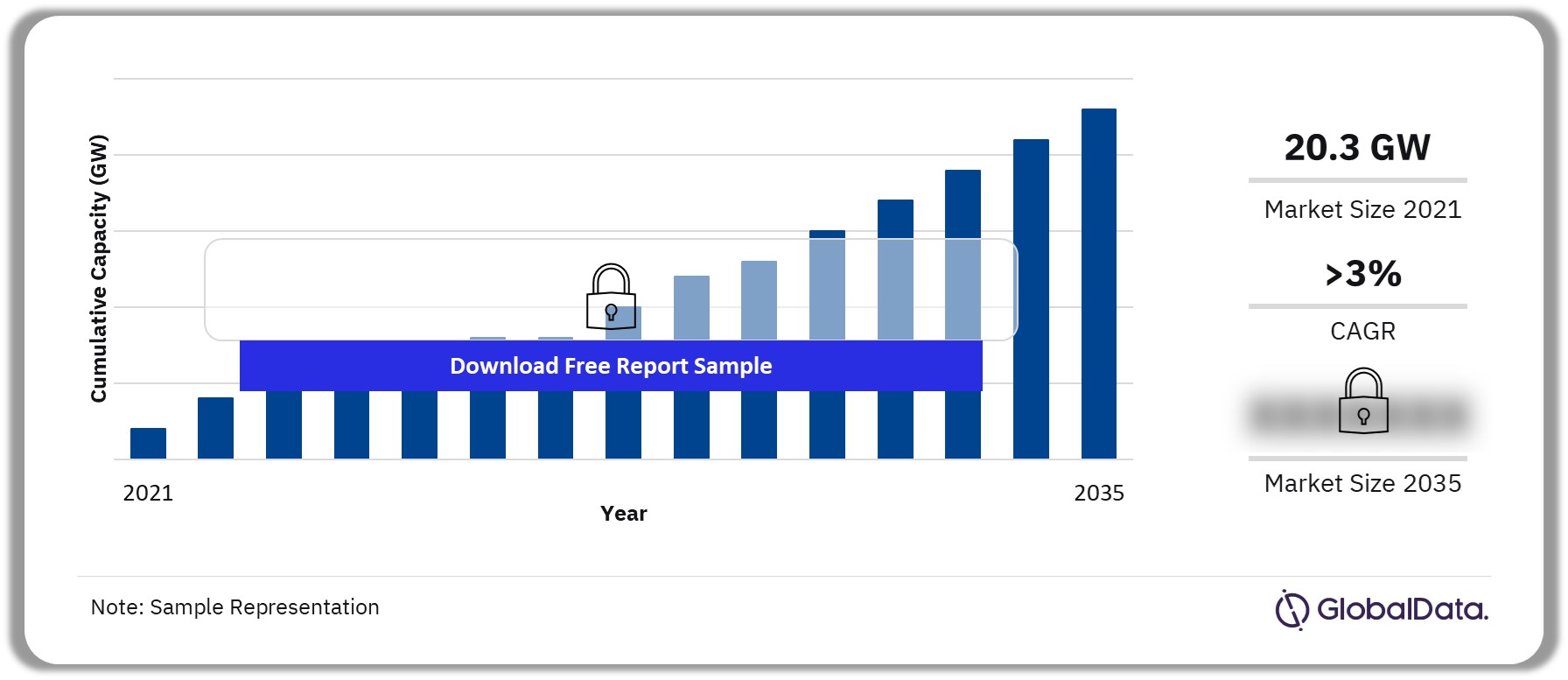

The cumulative installed capacity in the Kuwait power market was 20.3 GW in 2021 and will grow at a CAGR of more than 3% during 2021-2035. In 2021, the residential sector had the dominant share in power consumption across the country.

Kuwait Power Market Outlook 2021-2035 (GW)

Buy the Full Report to Get More Insights into Kuwait’s Power Market

Download a Free Sample Report

The market research report discusses the Kuwait power market structure. It provides historical and forecast numbers for capacity, generation, and consumption up to 2035. The report also analyzes the Kuwait power market’s regulatory structure and competitive landscape.

| Cumulative Installed Capacity (2021) | 20.3 GW |

| CAGR (2021-2035) | >3% |

| Historical Period | 2010-2020 |

| Forecast Period | 2021-2035 |

| Regulatory Scenario (Kuwait’s Power Sector) | · Innovative Renewable Energy Research Program

· Environment Protection Law |

| Major Power Generating Companies | · Ministry of Electricity and Water (MEW)

· Kuwait Authority for Partnership Projects |

| Key Deal Types | Partnership |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Kuwait Power Market Regulators

- The Innovative Renewable Energy Research Program was launched in 2009 and aims to enable the diversification of energy resources, ensuring a sustainable supply of energy and water in the future by providing innovative renewable energy and clean combustion solutions.

- The program includes studies to identify the optimum renewable energy technologies to be installed, tested, and modified to fit local conditions and conducting research and development for producing novel systems to address the future needs of Kuwait.

To Get More Insights into Kuwait’s Power Market Regulators

Download a Free Sample Report

Kuwait Power Market - Competitive Landscape

The major power generating companies in the Kuwait power market are the Ministry of Electricity and Water (MEW) and Kuwait Authority for Partnership Projects. In 2021, the Ministry of Electricity and Water was the leading company in 2021.

Ministry of Electricity and Water (MEW): Ministry of Electricity and Water (MEW) is an electricity and water utility service provider. MEW issues directives and instructions on matters related to energy conservation and rationalization. The ministry offers customer services such as the provision of permits for water and electricity supply connections, chemical works, designing water projects, and online services for payment of electricity and water consumption bills.

Kuwait Power Market Analysis by Companies, 2021 (%)

Buy the Full Report to Get More Insights into Kuwait’s Power Market Companies

Buy the Full Report to Get More Insights into Kuwait’s Power Market Companies

Download a Free Sample Report

Kuwait Power Market by Deal Types

Only 1 partnership deal was recorded in 2021 in Kuwait.

To Get More Insights into the Kuwait Power Market Deal Types

Scope

- Snapshot of the country’s power sector across parameters – macroeconomics, supply security, generation infrastructure, transmission infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential of the power sector

- Statistics for installed capacity, generation, and consumption from 2010 to 2021, and forecast to 2035

- Capacity, generation, and major power plants by technology

- Data on leading active and upcoming power plants

- Information on transmission and distribution infrastructure, and electricity imports and exports

- Policy and regulatory framework governing the market

- Detailed analysis of top market participants, including market share analysis and SWOT analysis

Reasons to Buy

- Identify opportunities and plan strategies by having a strong understanding of the investment opportunities in the country’s power sector

- Identify key factors driving investment opportunities in the country’s power sector

- Facilitate decision-making based on strong historic and forecast data

- Develop strategies based on the latest regulatory events

- Position yourself to gain the maximum advantage of the industry’s growth potential

- Identify key partners and business development avenues

- Identify key strengths and weaknesses of important market participants

- Respond to your competitors’ business structure, strategy, and prospects

Kuwait Authority for Partnership Projects

Sumitomo Corp

Engie SA

A.H. Alsagar & Bros Co

Table of Contents

Table

Figures

Frequently asked questions

-

What was the cumulative installed capacity in the Kuwait power market in 2021?

The cumulative installed capacity in the Kuwait power market was 20.3 GW in 2021.

-

What will the Kuwait power consumption growth rate be during 2021 to 2035?

The power consumption in Kuwait will grow at a CAGR of more than 3% from 2021 to 2035.

-

Which are the major power generating companies in the Kuwait power market?

The major power generating companies in the Kuwait power market are the Ministry of Electricity and Water (MEW) and Kuwait Authority for Partnership Projects.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.