Liability Insurance Market Trends and Analysis by Region, Line of Business, Competitive Landscape and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Liability Insurance Market Report Overview

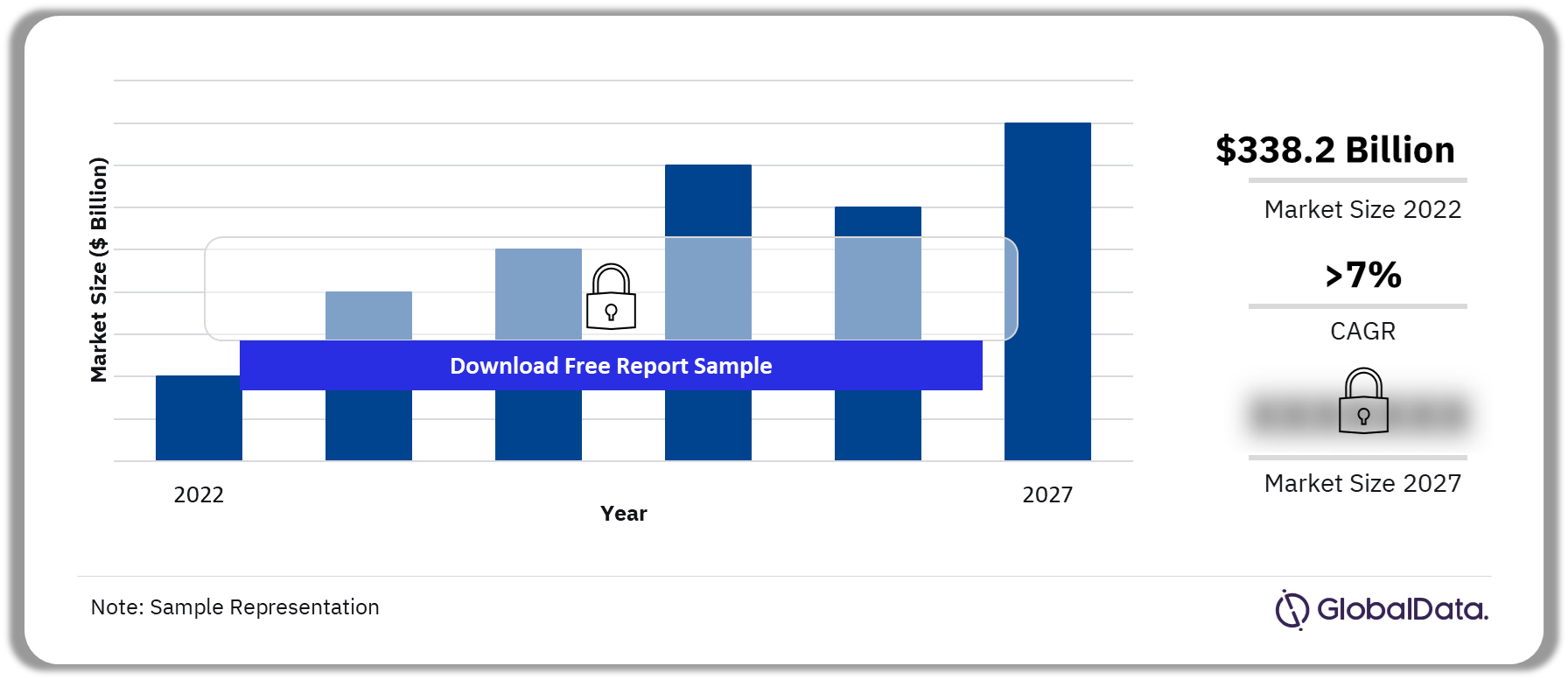

The written premium of liability insurance was $338.2 billion in 2022. The market is expected to achieve a CAGR of more than 7% during 2023-2027. The Liability insurance market research report provides in-depth market analysis, information, and insights into the global and regional liability insurance industry. It provides a detailed outlook as well as values for key performance indicators such as written premium and claims during the review period and forecast period.

Liability Insurance Market Outlook, 2022-2027 ($ Billion)

Buy Full Report for More Insights into the Liability Insurance Market Forecast

The report gives a comprehensive overview of the global and regional liability insurance industry, key lines of business, key trends, drivers, challenges, regulatory overview, developments in the industry, and insights into key technological developments impacting the market. The report provides a detailed analysis of the competitive landscape, overview, and comparative analysis of leading companies and top insurance markets’ premium and profitability trends for every region. It also gives insurers access to information on liability insurance dynamics in the country.

| Market Size (2022) | $338.2 billion |

| CAGR (2023-2027) | >7% |

| Forecast Period | 2023-2027 |

| Historical Period | 2018-2022 |

| Key Lines of Business | · Workers’ Compensation, Industrial Accident, and Employers’ Liability

· Third-Party Liability · Professional or Management Liability · Environmental or Hazardous Material Risk · Other Liability |

| Key Regions | · Asia-Pacific

· Europe · Middle East and Africa · North America · South and Central America |

| Leading Insurers | · Chubb

· Berkshire Hathaway · Travelers · Liberty Mutual · Hartford Financial |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Liability Insurance Market Trends

- Embedded insurance, product development, and new regulations to strengthen cyber insurance frameworks are some of the trends impacting the liability insurance market.

- Embedded insurance is most popular within the travel insurance market and is also present within gadget insurance.

- In 2022, the Strengthening American Cybersecurity Act was passed in the US. It requires federal agencies and critical infrastructure operators to report cyberattacks and ransomware payments.

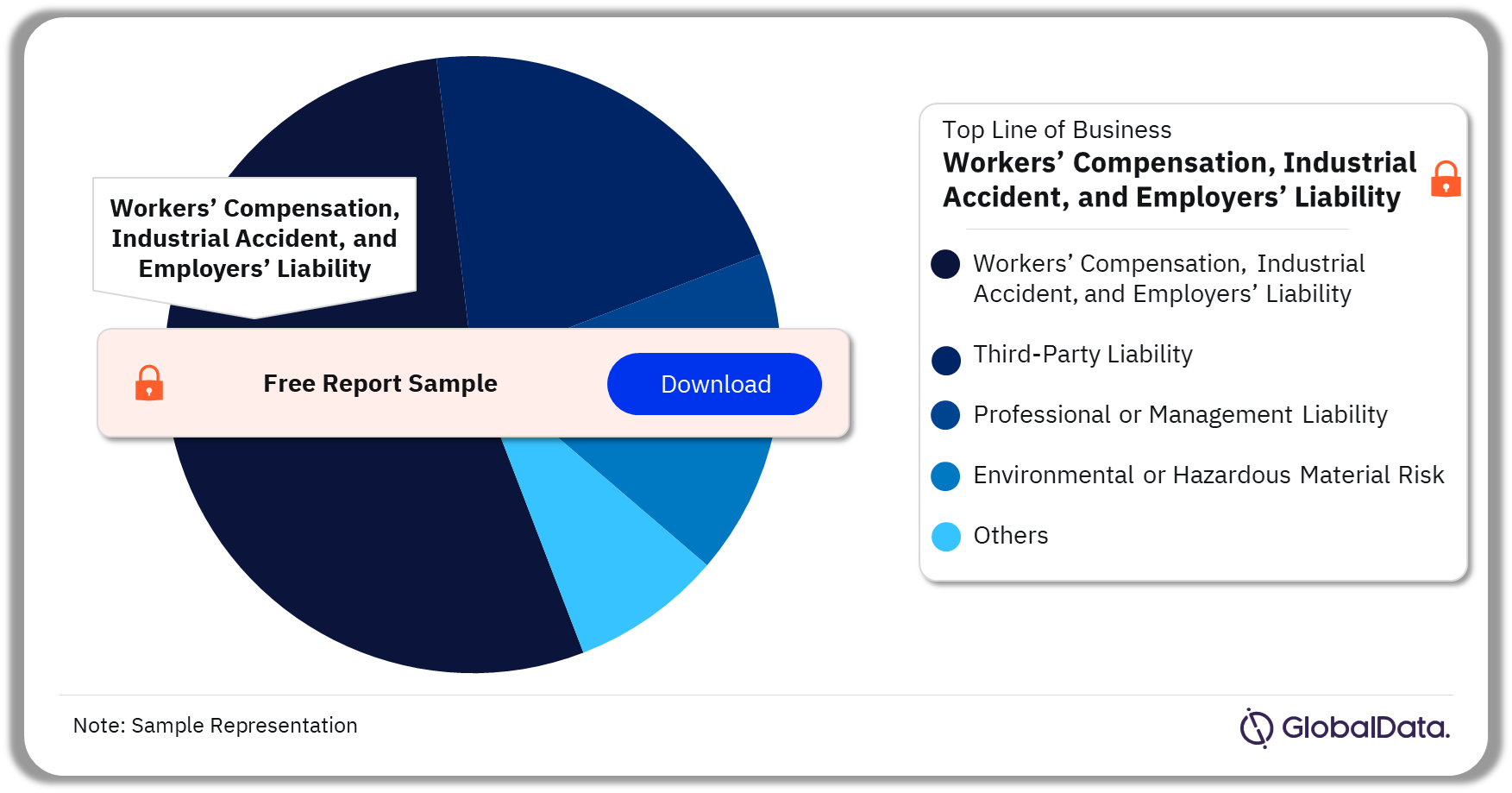

Liability Insurance Market Segmentation by Lines of Business

Workers’ compensation, industrial accident, and employers’ liability was the leading liability insurance LOB in 2022.

The lines of business included in the liability insurance market are workers’ compensation, industrial accident, and employers’ liability, third-party liability, professional or management liability, environmental or hazardous material risk, and other liability.

Workers’ compensation, industrial accident, and employers’ liability is the leading liability insurance LOB. Aging workforces, medical inflation, telemedicine, and workplace safety are the key themes in this line of business. Furthermore, professional and management liability insurance growth is expected to pick up pace in 2023 due to stringent underwriting practices in this LOB.

Liability Insurance Market Analysis by Lines of Business, 2022 (%)

Buy Full Report for More Line of Business Insights into the Liability Insurance Market

Liability Insurance Market Segmentation by Regions

North America is the leading region in the liability insurance market.

The key regions where liability insurance is available are Asia-Pacific, Europe, the Middle East and Africa, North America, and South and Central America. North America, the leading regional market is expected to dictate global liability growth trends over the forecast period. Developments in digitalization, relative stability in underwriting practices, and new market entries resulted in improved market conditions for cyber insurance in the region. Additionally, Marijuana legalization, the opioid crisis, mental health and well-being, and remote working are the focus areas for workers’ compensation insurers in the US in 2023.

Liability Insurance Market Analysis by Regions, 2022 (%)

Buy Full Report for More Region Insights into the Liability Insurance Market

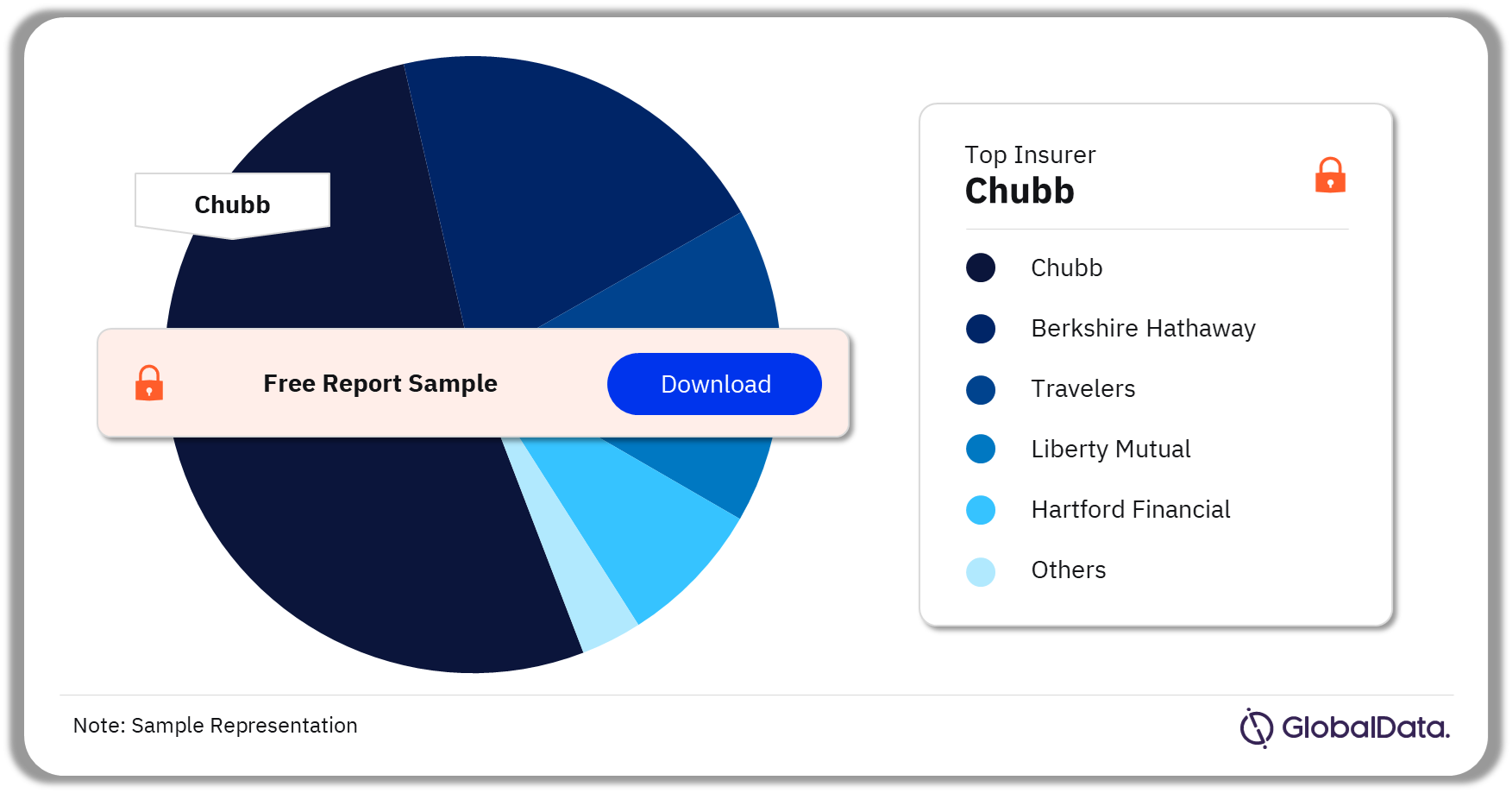

Liability Insurance Market – Competitive Landscape

Chubb had the highest market share in 2022.

Some of the key insurers in the liability insurance market are:

- Chubb

- Berkshire Hathaway

- Travelers

- Liberty Mutual

- Hartford Financial

In September 2022, Chubb introduced a range of flexible management liability propositions under the ForeFront Portfolio for private, not-for-profit, and healthcare organizations. In June of the same year, insurtech firm JA Assure and Chubb announced the launch of the Haxsafe cyber insurance platform in Hong Kong (China SAR), Singapore, and Malaysia. It is designed to provide pre-loss risk mitigation and incident response services.

Liability Insurance Market Analysis by Insurers, 2022 (%)

Buy Full Report for More Insurer Insights into the Liability Insurance Market

Liability Insurance Market – Latest Developments

- In April 2023, the Dubai International Financial Centre (DIFC) proposed amendments to the Data Protection Regulations 2020 framework in areas covering personal data breach obligations and usage and collection of personal data for marketing and communications.

- In June 2023, Chubb launched a cyber central quoting platform for brokers and agents that simplifies the quoting process and provides cyber, technology errors and omissions, and miscellaneous professional liability coverages.

Segments Covered in the Report

Liability Insurance Lines of Business Outlook (Value, $ Billion, 2018-2027)

- Workers’ Compensation, Industrial Accident, and Employers’ Liability

- Third-Party Liability

- Professional or Management Liability

- Environmental or Hazardous Material Risk

- Other Liability

Liability Insurance Regional Outlook (Value, $ Billion, 2018-2027)

- Asia-Pacific

- Europe

- Middle East and Africa

- North America

- South and Central America

Scope

This report provides:

- A comprehensive analysis of the global liability Insurance industry.

- It provides historical values for the global and regional liability insurance industry for the report’s review period and projected figures for the forecast period.

- It offers a detailed analysis of the regional liability insurance industry and market forecasts to 2027.

- It provides key market trends in the global liability insurance industry.

- It provides rankings, premiums, and market share of top global and regional liability insurers and analyzes the competitive landscape.

Key Highlights

- Key insights and dynamics of the liability insurance industry.

- Insights on key market trends in the liability insurance industry.

- Insights on key growth and profitability challenges in the liability insurance industry.

- Comparative analysis of leading liability insurance providers.

- In-depth analysis of regional markets.

- Insight on the future growth trend and market outlook.

Reasons to Buy

- Make strategic business decisions using in-depth historical and forecast market data related to the global and regional liability insurance industry.

- In-depth market analysis, information, and insights into the global liability insurance industry.

- In-depth analysis of the competitive landscape and top 20 regional markets.

- Understand the key dynamics, trends, and growth opportunities in the global and regional liability insurance industry.

- Identify key regulatory developments impacting market growth.

- Identify growth opportunities in key regional markets.

Berkshire Hathaway

Travelers

Liberty Mutual

Hartford Financial

AIG

AXA

AmTrust

American Financial

Nationwide Mutual

Tokio Marine

Arch Capital

Everest Re

Starr Group

Grupo Sancor Seguros

Groupo Sura

Provincia Seguros

Experta Aseguradora de Riesgos del Trabajo

Positiva Compania De Seguros

Galeno Seguros

Instituto Nacional de Seguros

Banco de Seguros del Estado

Federacion Patronal Seguros

Swiss Medical Art

Grupo Bolivar

Riesgos Profesionales Colmena

Zurich Insurance

Fairfax Financial

La Previsora SA Compania De Seguros

Markel

Assurant

San Cristobal Sociedad Mutual De Seguros Generales

Grupo Asegurador La Segunda

Provinzial Rheinland

Harel Group

Ayalon Insurance

Phoenix Holdings

Menora Mivtachim Group

Clal Insurance Enterprises Holdings

Shlomo Eliahu Holdings

Holmarcom Group

Elezra Holdings

Sanlam Group

Wafa Assurance

Groupama Holding

Bituach Haklai Central Cooperative Society

Assurances Et Reassurances Du Congo

Munich Re

Shlomo Insurance

Mutuelle Agricole Marocaine d'Assurances

GA Insurance Kenya

W.R. Berkley

CNA Financial

R+V Versicherung

Unipol Gruppo

Helvetia Holding

VHV Group

Versicherungskammer Bayern

Gothaer Versicherungsbank VVaG

Tryg

Schweizerische Mobiliar Versicherungsgesellschaft

Fosun International Holdings

NN Group

Sampo

Vereniging Achmea

Mapfre

Fubon Insurance

Sompo

Lotte Non-Life Insurance

HDI (Talanx)

Generali

PICC

Ping An

China Pacific Insurance

NongHyup Property & Casualty

Samsung Fire & Marine

Hyundai Marine & Fire

KB Insurance

DB Insurance

Meritz Fire and Marine

Hanwha Life

Sunshine Insurance

MS&AD

Allianz

Table of Contents

Frequently asked questions

-

What was the liability insurance market written premium in 2022?

The written premium of liability insurance was $338.2 billion in 2022.

-

What is the growth rate of the liability insurance market?

The liability insurance market is expected to achieve a CAGR of more than 7% during 2023-2027.

-

Which line of business dominated the liability insurance market in 2022?

Workers’ compensation, industrial accident, and employers’ liability was the leading liability insurance line of business in 2022.

-

Which was the leading region in the liability insurance market in 2022?

North America was the leading region in the liability insurance market.

-

Who are the major insurers operating in the liability insurance market?

Some of the key insurers in the liability insurance market are Chubb, Berkshire Hathaway, Travelers, Liberty Mutual, and Hartford Financial.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Liability reports