Life Insurance Market Size and Trend Analysis by Region, Competitive Landscape, Opportunities and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Life Insurance Market Report Overview

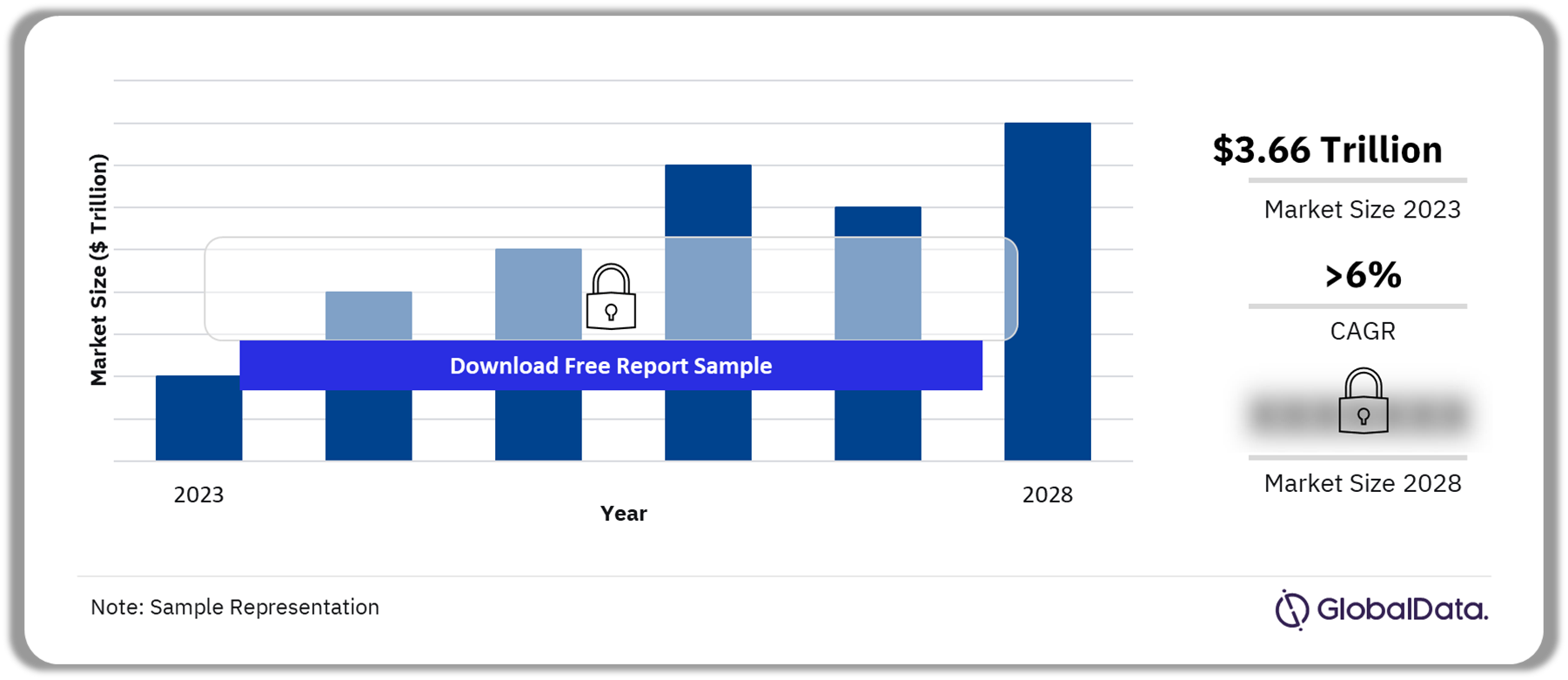

The estimated written premium of the life insurance market was $3.66 trillion in 2023 and will achieve a CAGR of more than 6% during 2024-2028. Positive regulatory developments, innovation, and rising inflation rates across the world will support the growth of the life insurance market in the coming years.

The life insurance market research report provides in-depth market analysis, information, insights, and a detailed outlook of the life insurance segment. It also provides values for key performance indicators such as written premiums and claims during the review period and forecast period.

Life Insurance Market Outlook, 2023-2028 ($ Trillion)

Buy Full Report to Gain More Information about the Life Insurance Market Forecast

The life insurance market report also gives a comprehensive overview of the global and regional life insurance industry, key lines of business, key trends, drivers, challenges, regulatory overview, and developments in the industry.

The report includes an insight into key technological developments impacting the global life insurance industry. It further evaluates the competitive landscape in the country, which entails an overview and comparative analysis of leading companies and top insurance markets’ premium and profitability trends for every region.

| Market Size (2023) | $3.66 trillion |

| CAGR (2024-2028) | >6% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Regions | · Asia-Pacific

· Europe · Middle East and Africa · North America · South and Central America |

| Key Lines of Business | · Whole Life

· General Annuity · Pension · Term Life · Endowment |

| Key Distribution Channels | · Direct from Insurers

· Insurance Brokers · Financial Advisors · Banks · Online Aggregators |

| Leading Companies | · Legal & General

· China Life · Ping An · Prudential Financial · MetLife |

| Enquire &Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Life Insurance Market Trends

ESG, inclusive insurance, personalization, and insurtech are the recurring trends in the life insurance market.

ESG will continue to be a central part of any leading business strategy over the coming years. For instance, Colombia’s government is focused on developing a green bond market that helps the country meet its ESG goals. The market will help channel private sector capital towards environmental priorities.

The advancement of AI and data analytics are helping insurers offer policies catering to individual needs. These personalized policies can be bought and managed online. For example, in India, HDFC Life’s InstA platform uses advanced analytics and machine learning to offer customized products and services based on customer behaviors and preferences.

Life Insurance Market Segmentation by Regions

North America had the leading life insurance market in 2023

The key regions in the life insurance industry are Asia-Pacific, Europe, the Middle East and Africa, North America, and South and Central America. The US, Canada, and Mexico are the main countries responsible for the growth of the life insurance market in North America.

The growing prominence of alternative investment managers within life insurance, regulatory and accounting changes, and volatile macroeconomic conditions are driving product strategy alterations, competitive landscape changes, and greater M&A activity.

Life Insurance Market Analysis by Regions, 2023 (%)

Buy the Full Report for more Regional Insights into the Life Insurance Market

Life Insurance Market Segmentation by Lines of Business

General annuity was the leading life insurance line of business in 2023

A few of the key lines of business in the life insurance industry are whole life, general annuity, pension, term life, and endowment. Mature life insurance markets (such as the European market) remained dominated by capital-intensive savings insurance products during 2019-2023.

The aging global population will support pension demand over 2024-2028. Pension growth will also benefit from conducive regulatory policies in many countries.

Life Insurance Market Analysis by Lines of Business, 2023 (%)

Buy the Full Report for more Lines of Business Insights into the Life Insurance Market

Life Insurance Market Segmentation by Distribution Channels

A few of the key distribution channels in the life insurance industry are direct from insurers, banks, insurance brokers, online aggregators, and financial advisors. Direct from insurers was the preferred channel for buying life insurance across most Asia-Pacific markets, except the Philippines, Taiwan (Province of China), Singapore, Hong Kong (China SAR), and Thailand. Notably, the direct channel was particularly dominant in Japan.

Life Insurance Market Analysis by Distribution Channels, 2023 (%)

Buy the Full Report for more Distribution Channel Insights into the Life Insurance Market

Life Insurance Market - Competitive Landscape

Legal & General was the leading life insurer in 2022

A few of the leading life insurance companies are:

- Legal & General

- China Life

- Ping An

- Prudential Financial

- MetLife

Life Insurance Market Analysis by Insurers, 2022 (%)

Buy the Full Report to Know More about the Insurers in the Life Insurance Market

Life Insurance Market – Latest Developments

- In August 2023, IRDAI issued a circular permitting modifications to life insurer products that have been withdrawn from sale. This provides additional options and benefits to policyholders while ensuring their existing benefits are not adversely affected.

- In October 2023, the Brazilian Securities and Exchange Commission announced a new resolution related to the Ecological Transformation Plan, requiring companies to prepare and disclose annual reports on ESG voluntarily.

Segments Covered in the Report

Life Insurance Regional Outlook (Value, $ Trillion, 2019-2028)

- Asia-Pacific

- Europe

- Middle East and Africa

- North America

- South and Central America

Life Insurance Lines of Business Outlook (Value, $ Trillion, 2019-2028)

- Whole Life

- General Annuity

- Pension

- Term Life

- Endowment

Life Insurance Distribution Channel Outlook (Value, $ Trillion, 2019-2028)

- Direct from Insurers

- Insurance Brokers

- Financial Advisors

- Banks

- Online Aggregators

Scope

This report provides:

- A comprehensive analysis of the global life insurance industry.

- Historical values for the global and regional life insurance industry for the report’s review period and projected figures for the forecast period.

- Detailed analysis of the regional life insurance industry and market forecasts to 2027.

- Key market trends in the global life insurance industry.

- Provides rankings, premiums, and market share of top global and regional life insurers and analyzes the competitive landscape.

Key Highlights

- Key insights and dynamics of the life insurance industry.

- Insights on key market trends in the life insurance industry.

- Insights on key growth and profitability challenges in the life insurance industry.

- Comparative analysis of leading life insurance providers.

- In-depth analysis of regional markets.

- Insight on the future growth trend and market outlook.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to the global and regional life insurance industry.

- In-depth market analysis, information, and insights into the global life insurance industry.

- In-depth analysis of the competitive landscape and top 20 regional markets.

- Understand the key dynamics, trends, and growth opportunities in the global and regional life insurance industry.

- Identify key regulatory developments impacting market growth.

- Identify growth opportunities in key regional markets.

China Life

Ping An

Prudential Financial

MetLife

LIC

Generali

Nippon Life

Dai-ichi Life

MassMutual

New York Life

Aviva

AIA

CNP Assurances

AXA

Manulife

Allianz

Apollo Global

Aegon

Meiji Yasuda

Table of Contents

Frequently asked questions

-

What was the life insurance market written premium in 2023?

The estimated written premium of the life insurance market was $3.66 trillion in 2023.

-

What will the growth rate of the life insurance market during the forecast period?

The life insurance market will achieve a CAGR of more than 6% during 2024-2028.

-

Which was the leading region in the life insurance market in 2023?

North America had the leading life insurance market in 2023.

-

Which line of business held the largest share of the life insurance market in the base year?

General annuity was the leading life insurance line of business in 2023.

-

Who are the key insurers operating in the life insurance market?

A few of the leading life insurance companies are Legal & General, China Life, Ping An, Prudential Financial, and MetLife.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Life Insurance reports