Life Insurance Sector Scorecard – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Life Insurance Sector Scorecard Thematic Intelligence Report Overview

Wellbeing and AI are the standout themes for life insurance. By utilizing AI technology, insurers can improve interactions with customers and cut down on admin time significantly, while longer-term possibilities are much more transformative.

AI offers a wide range of possibilities within the life sector including triage, diagnosis, and even basic drug prescription services, as we have seen in China. The ability to spot patterns from vast amounts of data can enable insurers to identify conditions as well. AI will work closely with another key technology theme, the medical Internet of Things (IoT). The more personal health data insurers can collect, the more they will be able to identify issues and promote healthier lifestyles, which will reduce risk.

The life insurance sector scorecard thematic intelligence report provides a top-down, comprehensive outlook for key players in the payments sector over the coming years. It is based on the key themes set to transform their market landscape. It also identifies 10 key themes that are driving changes and disruption in the payments industry.

| Report Pages | 17 |

| Top Themes | · Artificial Intelligence

· Cybersecurity · Innovation · IoT · Big Data |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Life Insurance Theme Map

Some of the biggest themes that are impacting the life insurance sector are artificial intelligence, cybersecurity, innovation, IoT, and Big Data among others. Our theme map for the life insurance industry highlights the big themes driving share prices and is the result of a series of interviews with senior industry executives and investors, reflecting an up-to-date view of the issues that keep them awake at night. Our theme maps cover not only disruptive tech themes but also macroeconomic and regulatory themes.

Life Insurance Sector Theme Map 2023

Buy the Full Report to Unlock the Biggest Themes Driving Growth in The Life Insurance Industry, Download a Free Report Sample

Artificial Intelligence: There is a huge amount of hype around the AI theme across all industries at present, especially in insurance. It can be essential within life insurance due to the vast amount of personal data that needs to be processed, stored, and analyzed. Driving insights from this data can be essential in improving consumer behavior and reducing risk. Usage across the industry will range from more human-like chatbots and interactive services to back-end applications. Generative AI will accelerate the industry’s usage of the technology significantly and insurers who establish themselves as leaders will be able to provide a much better product to customers. Utilizing AI to improve diagnosis will be the area to watch within AI in life insurance.

Buy the Full Report to Know More About Other Top Themes Disrupting the Life Insurance Industry, Download a Free Report Sample

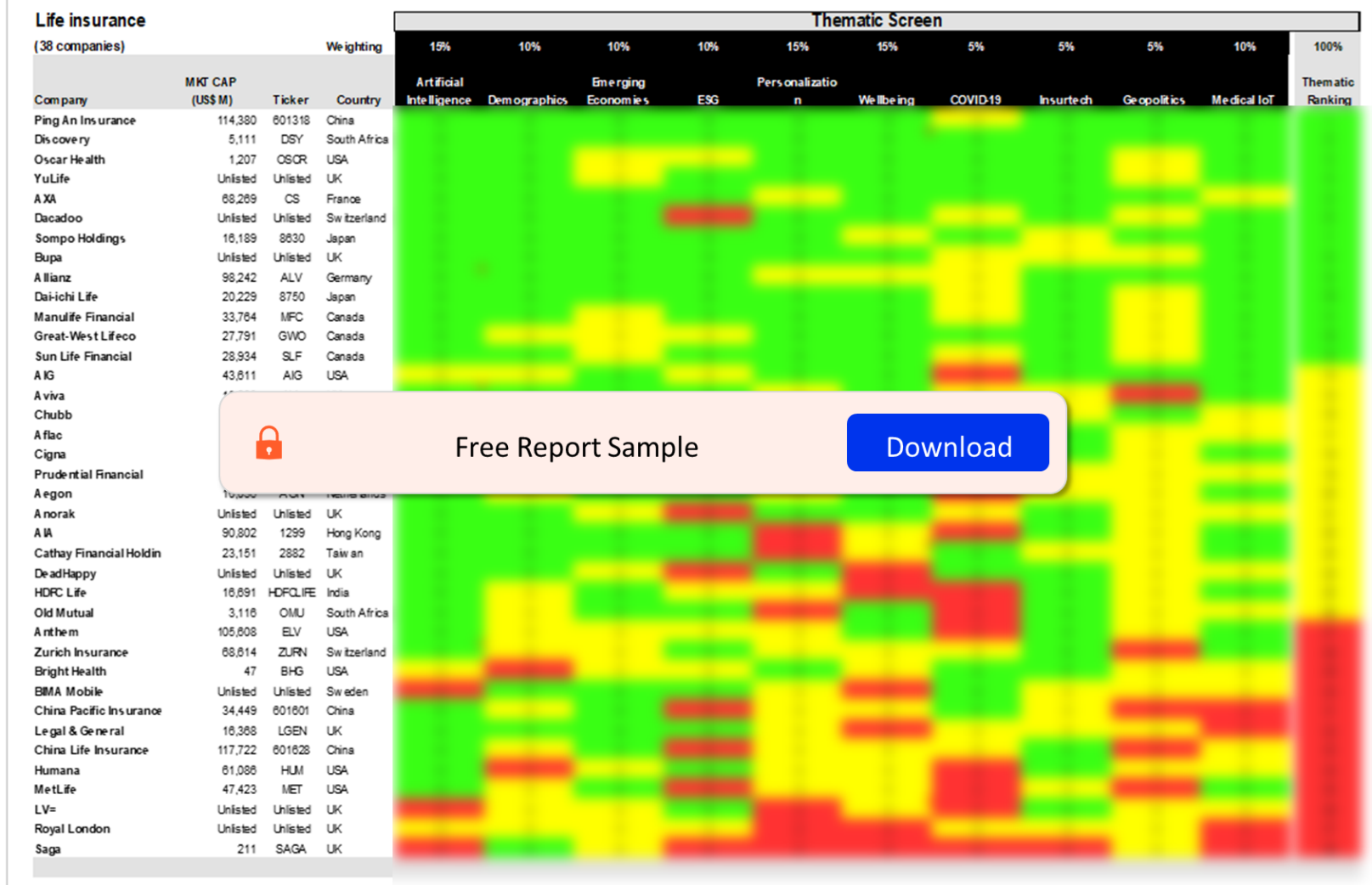

Life Insurance Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecards have three screens: a thematic screen, a valuation screen, and a risk screen. The life insurance sector scorecard has three screens:

- The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- The risk screen ranks companies within a particular sector based on overall investment risk.

Life Insurance Sector Scorecard – Thematic Screen

Buy the Full Report to Know More About the Life Insurance Sector Scorecard, Download a Free Report Sample

Scope

• There has been a great deal of buzz around AI since the emergence of generative AI at the start of 2023, and it is now the leading technology theme. By utilizing AI technology, insurers can improve interactions with customers and cut down on admin time significantly, while longer-term possibilities are much more transformative.

• AI offers a wide range of possibilities within the life sector including triage, diagnosis, and even basic drug prescription services, as we have seen in China. The ability to spot patterns from vast amounts of data can enable insurers to identify conditions as well.

• ESG is the key long-term theme across the insurance industry as a whole. It is not specific to life insurers, but insurers will need to make sure they stay on top of ESG targets and establish themselves as leaders. It is ranked slightly lower in this scorecard than in general insurance because life insurers do not face the same claims costs from increasing severe weather events.

Key Highlights

- ESG is the key long-term theme across the insurance industry as a whole. It is not specific to life insurers, but insurers will need to make sure they stay on top of ESG targets and establish themselves as leaders. It is ranked slightly lower in this scorecard than in general insurance because life insurers do not face the same claims costs from increasing severe weather events.

Reasons to Buy

- Benchmark yourself against the rest of the market.

- Discover market leaders across 10 essential themes to life insurance.

- Discover what the 10 key themes are and understand why we believe them to be so crucial

Ageas

AIA

Allianz

Allstate

Anorak

Aviva

Axa

Chubb

Covea

Hiscox

Insurance Australia Group

PICC

Ping An

Progressive

Prudential

Root Insurance

RSA

Suncorp

Tokio Marine

Zurich

Sompo Holdings

VIG

Discovery

Bupa

Manulife Financial

Cigna

Yulife

Dacadoo

Royal London

Saga

LV=

Dai-Ichi Life

Dead Happy

Table of Contents

Frequently asked questions

-

What are the biggest themes impacting the life insurance sector?

Some of the biggest themes that are impacting the life insurance sector are artificial intelligence, cybersecurity, innovation, IoT, and Big Data among others.

-

Why should insurers utilize AI technology?

By utilizing AI technology, insurers can improve interactions with customers and cut down on admin time significantly.

-

What are the uses of AI in the life sector?

AI offers a wide range of possibilities within the life sector including triage, diagnosis, and even basic drug prescription services, as we have seen in China.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Life Insurance reports