Lithium Mining Market Analysis by Reserves, Production, Assets, Demand Drivers and Forecast to 2030

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Empower your strategies with our Global Lithium Mining to 2030 report and make more profitable business decisions.

Lithium Mining Market Report Overview

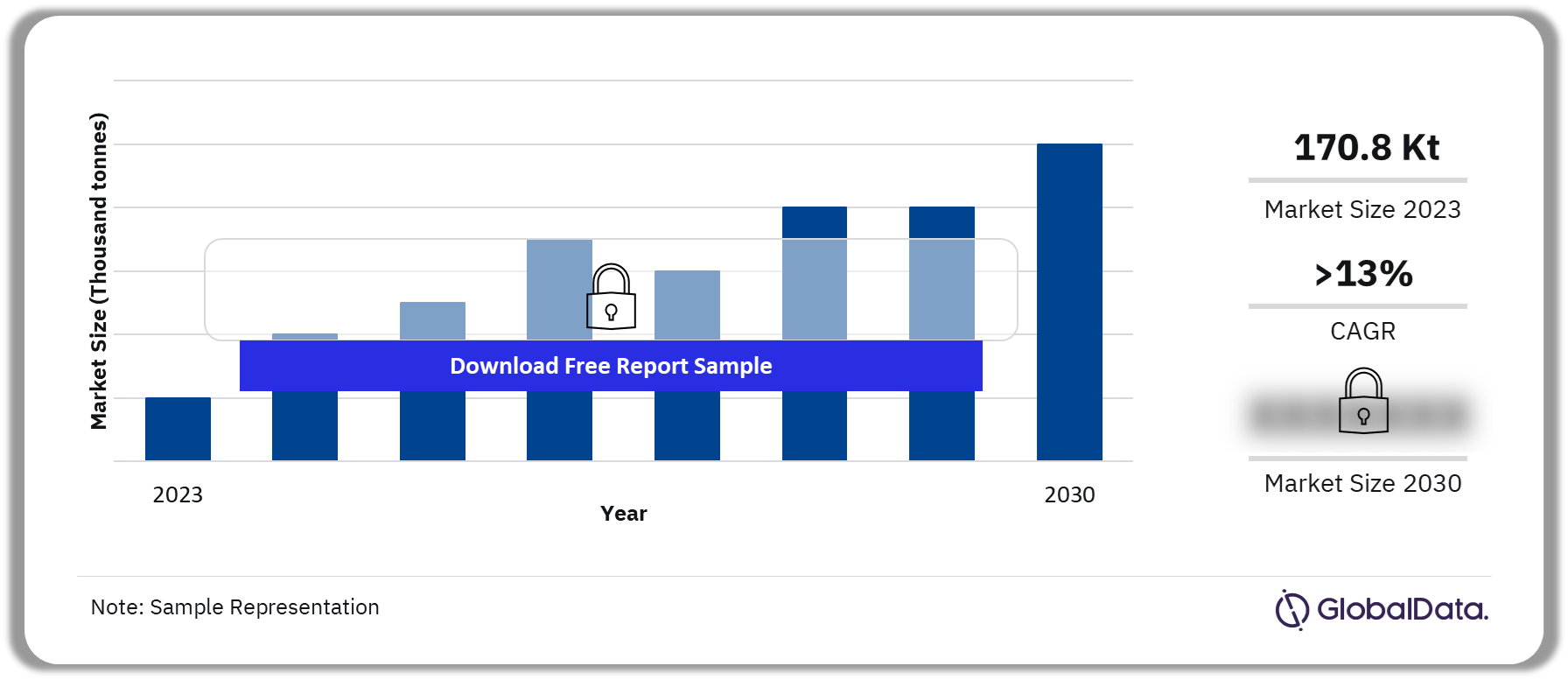

The lithium production increased for the third year in a row to 170.8 thousand tonnes (kt) in 2023 with Australia, Argentina, Zimbabwe, and Brazil being the key contributors. The lithium production is expected to grow marginally at a CAGR of more than 13% over the forecast period.

Currently, brines and hard-rock deposits are the dominant sources of lithium worldwide, of which the former accounts for 66% of the total.

Lithium Mining Market Outlook, 2023 – 2030 (Kt)

Buy the Full Report for More Insights into the Global Lithium Market Forecast, Download A Free Report Sample

The lithium mining market research report provides detailed historical and forecast period data on the global lithium industry. It provides a complete view of the lithium reserves globally, with a breakdown of key lithium mining countries and the prevailing lithium prices in those countries. It also analyzes the competitive business landscape, highlighting company profiles of a few of the major market participants. Furthermore, the report sheds light on the major active mines, as well as upcoming development and exploration projects by region.

| Forecast Period | 2023-2030 |

| Historical Period | 2011-2022 |

| Key Countries | · Chile

· Australia · Argentina · China · US · Canada · Zimbabwe · Brazil |

| Active Mines | · Greenbushes Lithium Operations

· Salar de Atacama Mine · Mount Marion Lithium Project · Salar de Atacama Mine (Albemarle Corporation) · Pilgangoora Project |

| Development Projects | · Kathleen Valley project

· Salar de Centenario Ratones Project · Goulamina Lithium Project · Thacker Pass Lithium Mine · Mt Holland Lithium Project · Barreiro Mine (Grota Do Cirilo Project Phase 2) |

| Exploration Projects | · TLC Project

· Burro Creek East Project · Leaky Bore Project · Kamativi Lithium Project · Alberta-1 Project · Buldania Lithium Project |

| Leading Companies | · Sociedad Quimica y Minera de Chile SA (SQM)

· Albemarle · Pilbara Minerals · Mineral Resources Ltd · Alkem · Livent |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

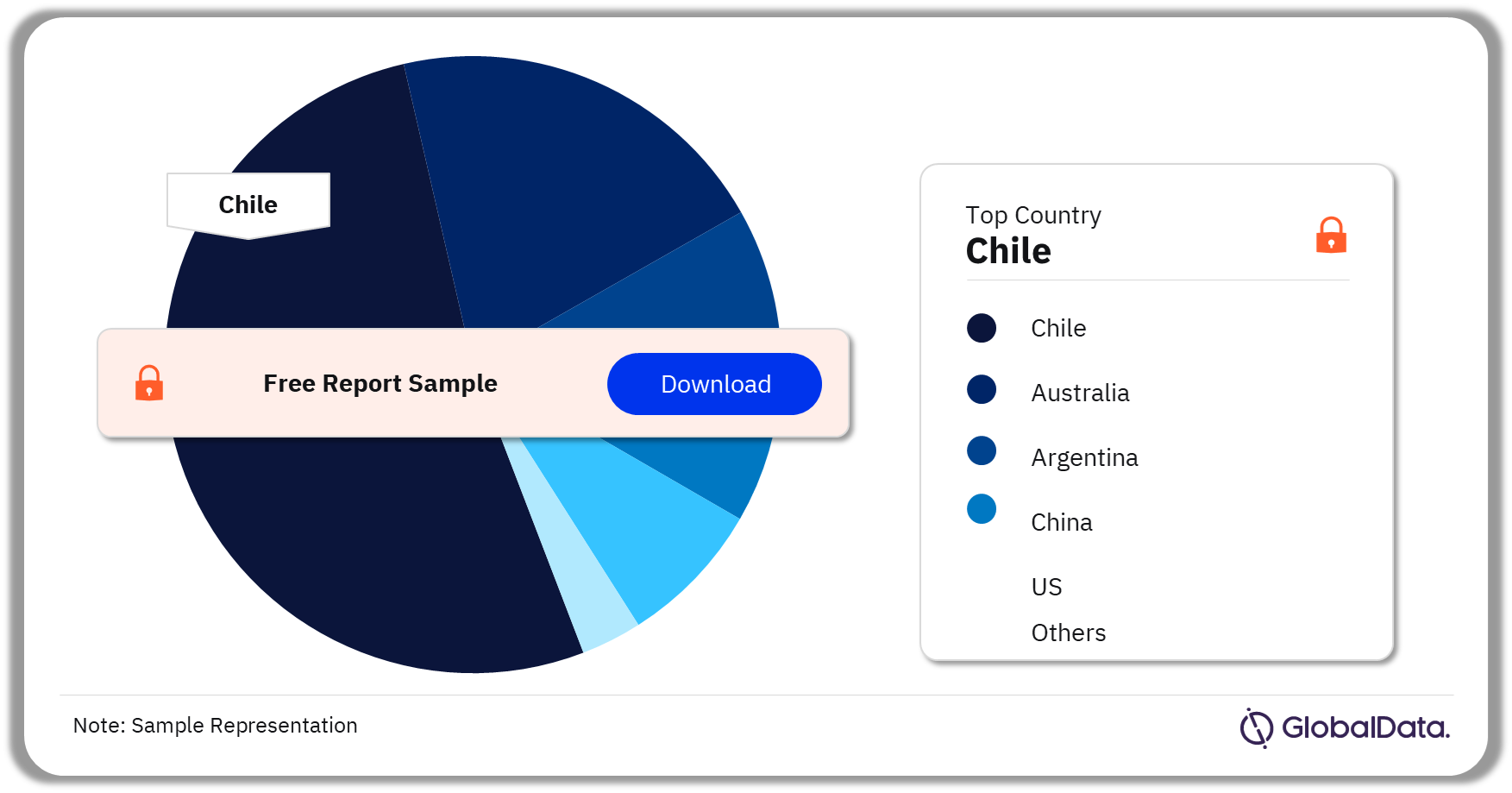

Lithium Mining Market Segmentation by Country

According to the US Geological Survey (USGS), global lithium reserves totaled 26.0 million tonnes (Mt) as of January 2023. Chile, Australia, Argentina, China, and the US were the top five countries, accounting for a collective 21.2 Mt of lithium reserves. These were followed by Canada, Zimbabwe, Brazil, and Portugal. In Chile, most of the country’s lithium reserves are found in the Salar Flat of Atacama, which contains the world’s richest deposits of lithium.

Lithium Mining Market Analysis by Countries, 2023 (%)

Buy the Full Report for More Country Insights into The Lithium Mining Market, Download a Free Report Sample

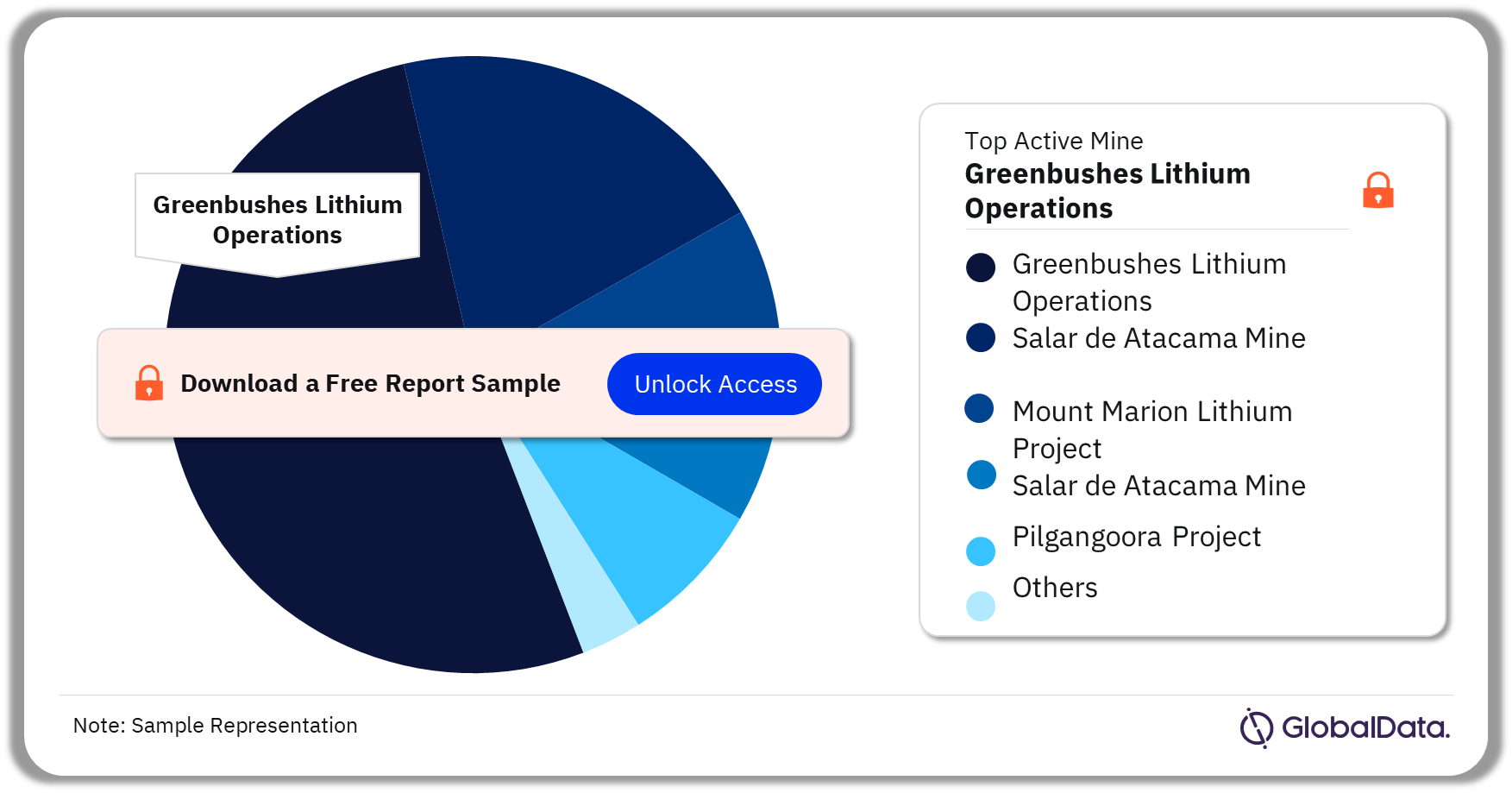

Lithium Mining Market - Active Mines

A few of the major active lithium mines are Greenbushes Lithium Operations, Salar de Atacama, Mine, Mount Marion Lithium Project, Salar de Atacama Mine (Albemarle Corporation), and Pilgangoora Project among others. Greenbushes, a tantalum, and lithium mine in Western Australia, is the world’s largest hard rock lithium deposit, jointly owned by Albemarle Corp., Tianqi Lithium Corp., and IGO Ltd.

Lithium Mining Market Analysis by Active Mine, 2022 (%)

Buy the Full Report for More Insights on Active Mines in the Lithium Mining Market, Download a Free Report Sample

Lithium Mining Market - Development Projects

A few of the major lithium mining projects that are in the development phase include the Kathleen Valley project, the Salar de Centenario Ratones project, the Goulamina Lithium project, the Thacker Pass Lithium mine, Mt Holland Lithium project, and Barreiro Mine (Grota Do Cirilo Project Phase 2) among others.

Kathleen Valley Project: Liontown Resources Ltd owns the Kathleen Valley project, a greenfield project currently undergoing construction works. It has an annual lithium production capacity of up to 760kt and a mine life of up to 23 years. It is set to commence operations in mid-2024.

Buy the Full Report for More Insights on Development Projects in The Lithium Mining Market, Download a Free Report Sample

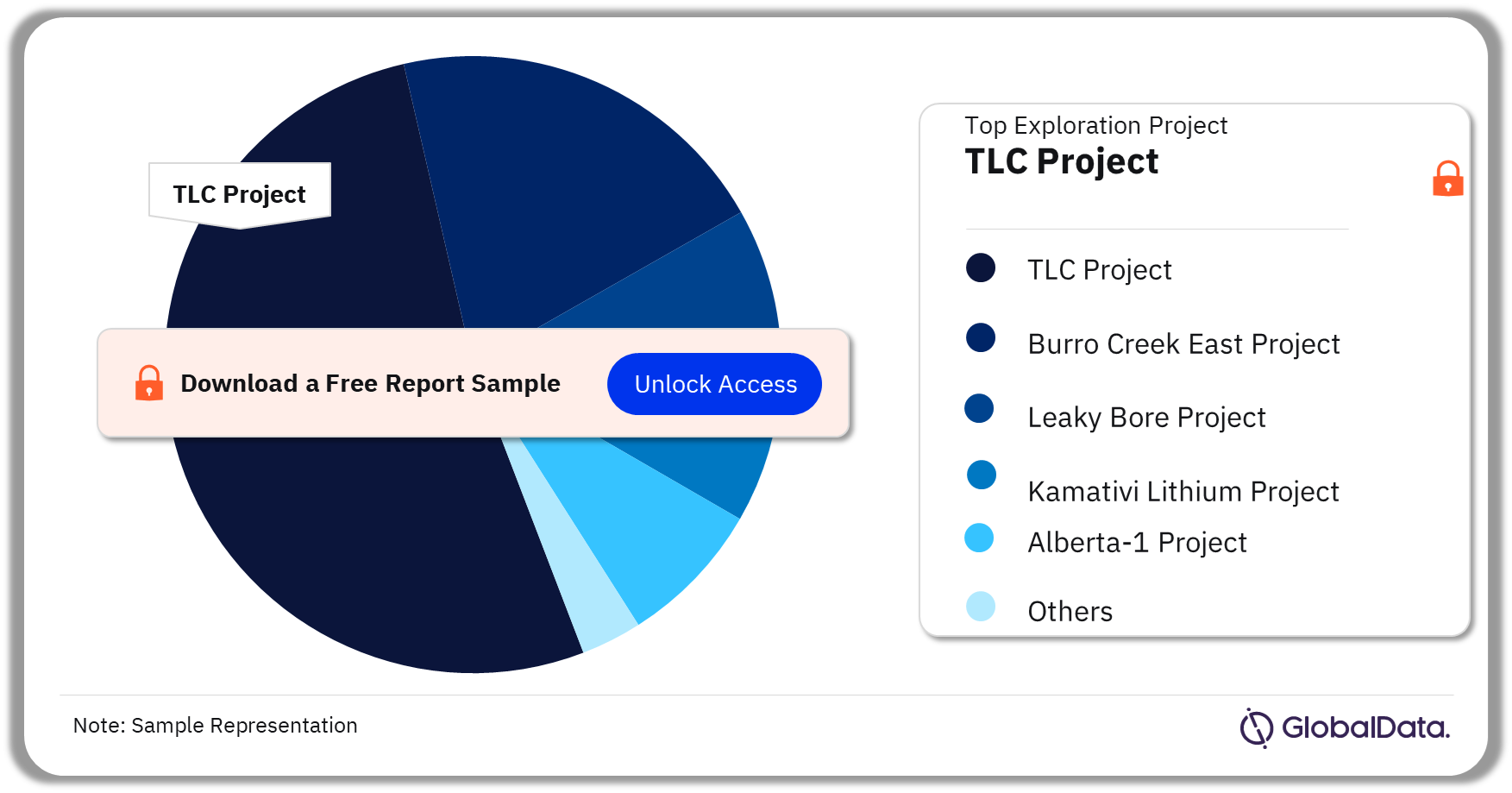

Lithium Mining Market - Exploration Projects

A few of the major lithium exploration projects are the TLC Project, Burro Creek East Project, Leaky Bore Project, Kamativi Lithium Project, Alberta-1 Project, and Buldania Lithium Project among others. TLC Project has 1,469 Mt of lithium reserves. The mine was commissioned for operations in 2020.

Lithium Mining Market Analysis by Exploration Projects

Buy Full Report for More Insights on Exploration Projects in The Lithium Mining Market, Download a Free Report Sample

Lithium Mining Market - Competitive Landscape

Sociedad Quimica y Minera de Chile SA (SQM), Albemarle, Pilbara Minerals, Mineral Resources Ltd, Alkem, and Livent are among the key lithium-producing companies in the world.

Leading Lithium Mining Companies, 2022 (%)

Buy the Full Report for More Insights on Companies in The Lithium Mining Market, Download a Free Report Sample

Segments Covered in the Report

Lithium Mining Market Countries Outlook (Value, 2011-2030)

- Chile

- Australia

- Argentina

- China

- US

- Canada

- Zimbabwe

- Brazil

Scope

- Reserves and Production Data: Access detailed information on reserves, reserves by country, production figures, production by country, and production by company.

- Key Players: Learn about the major players in the industry like Sociedad Quimica y Minera de Chile SA (SQM), Albemarle, Pilbara Minerals, Mineral Resources Ltd, Allkem, and Livent.

- Country Insights: Discover leading lithium-producing countries such as Chile, Australia, Argentina, China, US, Canada, Zimbabwe, Brazil.

- Project landscape: Gain insights into lithium explorational and developmental projects, as well as active mines.

Reasons to Buy

- Understand market trends: Gain a comprehensive understanding of lithium mining by exploring country-wise market dynamics, identifying key assets, and assessing the competitive landscape.

- Strategic market analysis: Navigate the industry with ease by exploring historical and forecast trends to anticipate market shifts and make forward-looking decisions.

- Forge valuable partnerships: Identify key players in the lithium mining market and access exclusive information on key stakeholders such as lithium producers, government entities, suppliers, and more.

- Uncover major projects: Dive into a detailed overview of major active, explorational, and developmental mining projects across various regions.

Albemarle

Pilbara Minerals

Mineral Resources Ltd

Allkem

Livent

Table of Contents

Table

Figures

Frequently asked questions

-

Which country had the largest lithium reserves in 2023?

Chile had the largest lithium reserves in 2023 and it was the world’s second largest producer.

-

Which are the major active lithium mines in the market?

A few of the major active lithium mines are Greenbushes Lithium Operations, Salar de Atacama, Mine, Mount Marion Lithium Project, Salar de Atacama Mine (Albemarle Corporation), and Pilgangoora Project among others.

-

Which are the major development projects in the lithium mining market?

A few of the major lithium mining projects that are in the development phase include the Kathleen Valley project, the Salar de Centenario Ratones project, the Goulamina Lithium project, the Thacker Pass Lithium mine, Mt Holland Lithium project, and Barreiro Mine (Grota Do Cirilo Project Phase 2) among others.

-

Which are the major exploration projects in the lithium mining market?

A few of the major lithium exploration projects are the TLC Project, Burro Creek East Project, Leaky Bore Project, Kamativi Lithium Project, Alberta-1 Project, and Buldania Lithium Project among others.

-

Which are the leading companies in the Lithium mining market?

A few of the leading lithium-producing companies are Sociedad Quimica y Minera de Chile SA (SQM), Albemarle, Pilbara Minerals, Mineral Resources Ltd, Alkem, and Livent among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.