Macau Insurance Industry – Key Trends and Opportunities to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Macau Insurance Market Report Overview

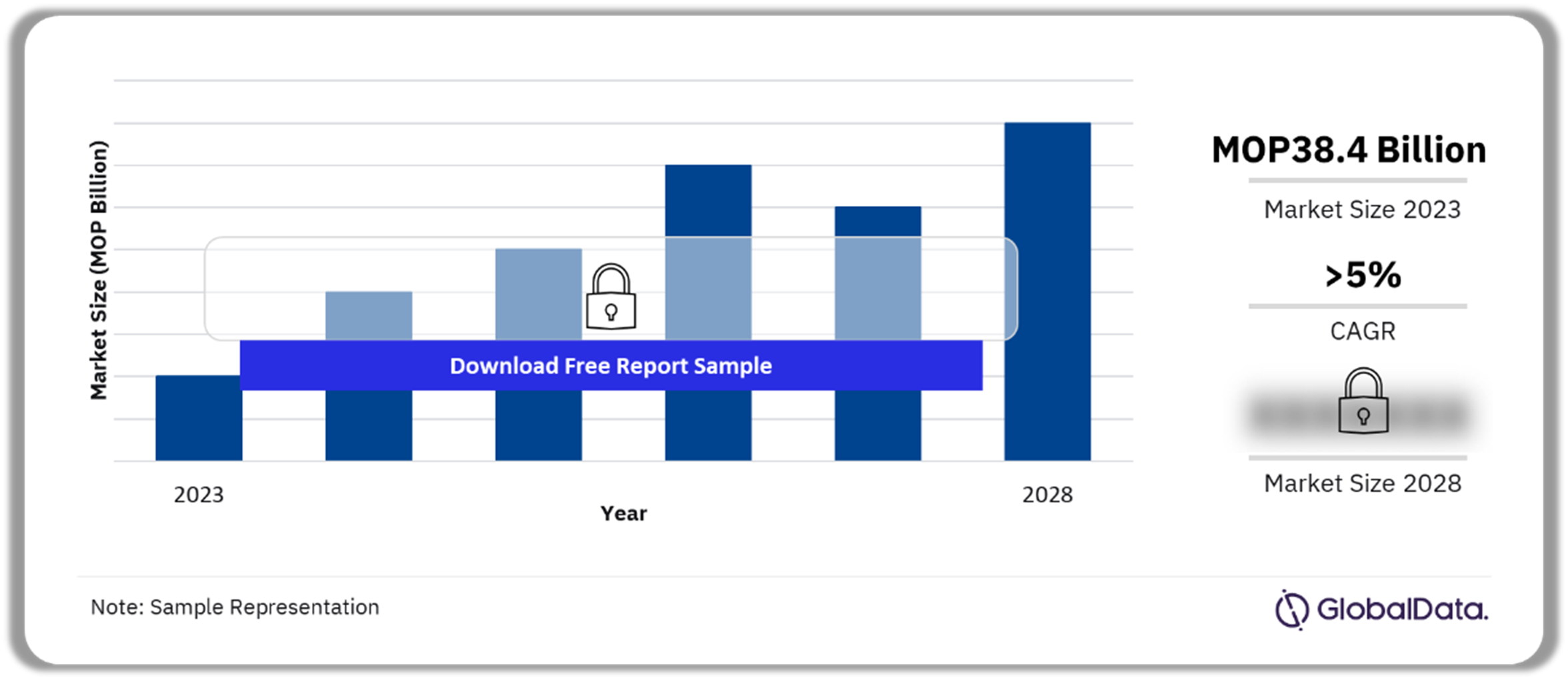

The gross written premium of the Macau insurance market was MOP38.4 billion ($4.9 billion) in 2023. The market is expected to achieve a CAGR of more than 5% during 2024-2028. The Macau insurance market research report provides in-depth market analysis, information, and insights into the Macau insurance industry. It provides a detailed outlook by product category as well as values for key performance indicators such as gross written premium, penetration, premium accepted and ceded, profitability ratios, and premium by line of business, during the review and forecast periods.

Macau Insurance Market Outlook, 2023-2028 (MOP Billion)

Buy the Full Report for More Insights into the Macau Insurance Market Forecast

Download a Free Report Sample

The Macau insurance market report also analyzes distribution channels operating in the segment and gives a comprehensive overview of the Macau’s economy and demographics. It further evaluates the competitive landscape, which entails information on segment dynamics, competitive advantages, and profiles of insurers operating in the country. The report also includes details of insurance regulations and recent changes in the regulatory structure.

| Market Size (2023) | MOP38.4 billion ($4.9 billion) |

| CAGR (2024-2028) | >5% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Segments | · Life Insurance

· General Insurance |

| Key Companies | · AIA International

· China Life Overseas · YF Life International · China Taiping Life · AXA China Region |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Macau Insurance Market Trends

The key trends impacting the Macau insurance market are the developments in the Greater Bay Area (GBA) and the surge in popularity of insurtech and parametric insurance. Macau’s insurance industry (along with other financial sectors) is experiencing growth due to increased integration across the Greater Bay Area. The interconnectivity of Hong Kong (China SAR), Macau, and China is also fostering the development of cross-border healthcare via the Insurance Connect initiative. Insurance Connect allows Macanese insurers to establish service centers across the Greater Bay Area. Recent developments include a partnership between AXA Hong Kong and Macau and Hong Kong-based healthcare provider UMP Healthcare in late 2023. Through this partnership, AXA will provide premium health insurance in the Greater Bay Area and Mainland China via the UMP network.

Furthermore, Insurers in Macau are implementing digitalization initiatives within their value chains. This trend is expected to gain further traction over the coming years. Insurance companies are integrating technology to cater to the evolving business needs and requirements of consumers. For instance, YF Life’s AI Customer Assistant Chatbot software answers general inquiries from users and provides information about the insurer’s products and services through simple interactions. Similarly, FWD Life offers a chatbot that assists with customer queries and policy purchases. Meanwhile, China Taiping HK and Luen Fung Hang offer smartphone apps that provide policy information, purchases, claims, and customer service.

Buy the Full Report for More Insights on the Macau Insurance Market Trends,

Download a Free Report Sample

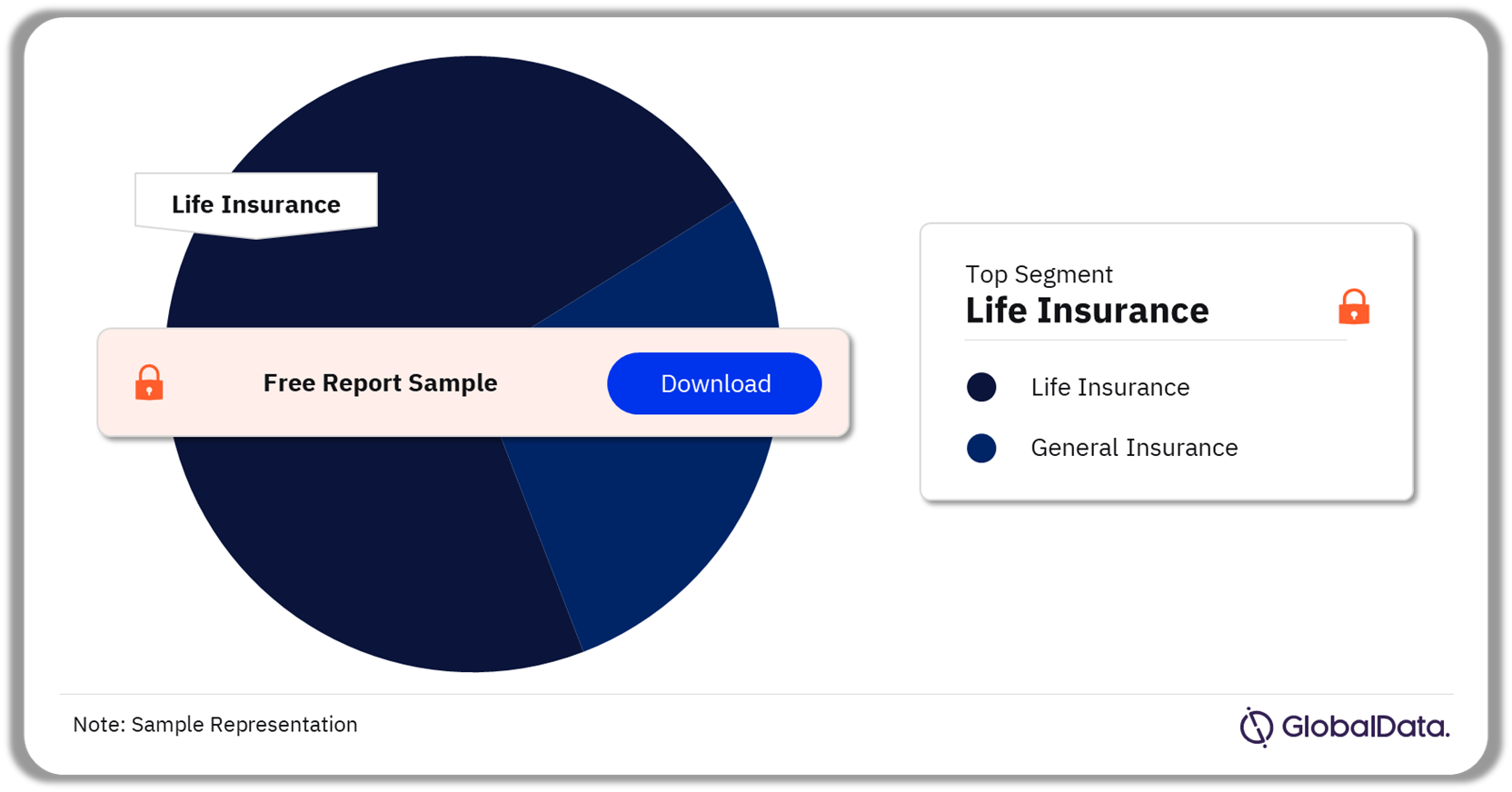

Macau Insurance Market by Segments

The key segments in the Macau insurance market are life insurance and general insurance. The life insurance segment dominated the Macau insurance market in 2023. The segment is expected to record a considerable CAGR during the forecast period, mainly supported by economic growth and demographic trends. Chinese residents are a prominent consumer segment for Macanese life insurers, as life insurance products available in Macau offer higher returns compared to policies offered in China. As a result, insurers such as HSBC Life and Manulife have increased their investments in Mandarin-trained agents and expanded their operations in Macau in 2023.

The key lines of business in the Macau life insurance market are whole life, general annuity, universal life, endowment, term life, and life PA&H among others. Whole life insurance was the leading line of business for the Macau life insurance segment in 2023, followed by endowment. Macau’s population demographics are shifting, with a notable increase in the elderly population and a decline in births, creating an aging society with a higher dependency ratio. This will have a notable impact on the life insurance sector, as it highlights the need for more tailored and diverse policies catering to healthcare, retirement, and long-term care needs.

Macau Insurance Market Analysis by Segments, 2023 (%)

Buy the Full Report for More Segment Insights into the Macau Insurance Market

Download a Free Report Sample

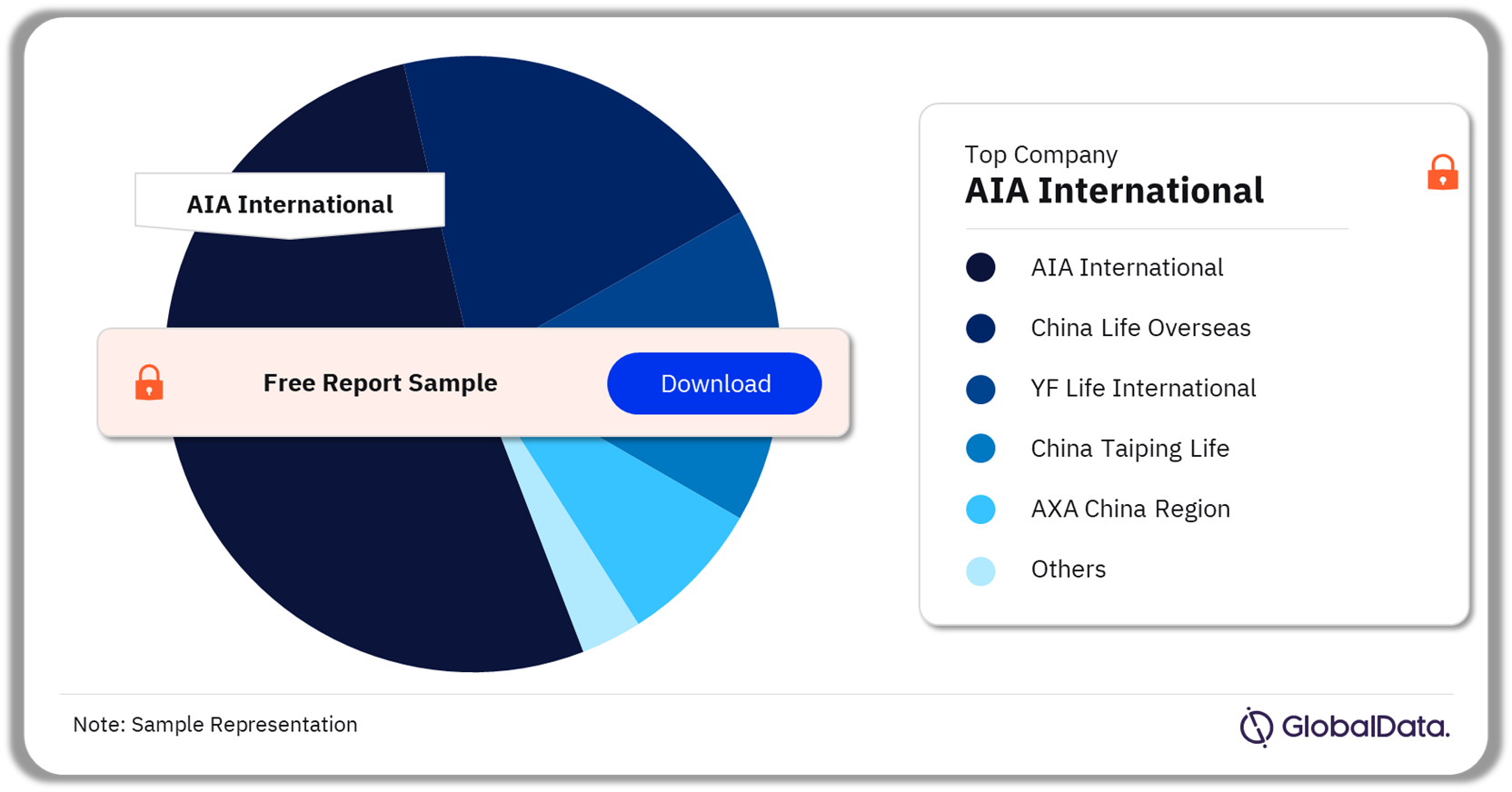

Macau Insurance Market – Competitive Landscape

In 2022, AIA International accounted for the highest market share in the Macau life insurance market

A few of the key companies in the Macau insurance market are:

- AIA International

- China Life Overseas

- YF Life International

- China Taiping Life

- AXA China Region

AIA International is a subsidiary of AIA Group, which is headquartered in Hong Kong (China SAR). The insurer markets and sells its products and services through a network of employees, partners, and agents. It also provides employee benefits, credit life, and pension services to corporate clients.

Macau Life Insurance Market Analysis by Companies, 2022(%)

Buy the Full Report for More Company Insights into the Macau Insurance Market, Download a Free Report Sample

Macau Insurance Market – Latest Developments

- The Monetary Authority of Macau’s Macau Vehicle Circulation in Guangdong Province scheme is set to come into effect by the end of 2024, enabling an estimated 450,000 private car owners in Hong Kong (China SAR) to travel to Guangdong province.

- In August 2023, HSBC established the HSBC Life Insurance Planning Centre in Macau. The center caters to customers from Macau and the Greater Bay Area region, offering protection products and wealth management solutions.

- In October 2023, AXA Hong Kong and Macau announced the development of customized parametric insurance products covering unexpected weather events.

Macau Insurance Market Segments Outlook (Value, MOP Billion, 2019-2028)

- Life Insurance

- General Insurance

Scope

This report provides a comprehensive analysis of the Macau insurance industry through the following:

- Historical values for the Macau insurance industry for the review period, 2019-2023, and projected figures for the forecast period, 2024-2028.

- A detailed analysis of the key categories in the Macau insurance industry and market forecasts up to 2028.

- Insights on key regulations affecting the market.

- Analysis of distribution channels operating in the segment, an overview of the Macau economy and demographics, and detailed information on the competitive landscape in the country.

- Profiles of the top life insurance companies in Macau and outlines the key regulations affecting them.

Key Highlights

- Key insights and dynamics of Macau insurance industry.

- A comprehensive overview of Macau economy, government initiatives, and investment opportunities.

- Macau insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

- Macau insurance industry’s market structure gives details of lines of business.

- Macau’s reinsurance business’s market structure gives details of premium ceded along with cession rates.

Reasons to Buy

- Make strategic business decisions using in-depth historical and forecast market data related to the Macau insurance industry, and each category within it.

- Understand the demand-side dynamics, key market trends, and growth opportunities in the Macau insurance industry.

- Assess the competitive dynamics in the Macau insurance industry.

- Identify growth opportunities and market dynamics in key product categories.

AXA China

China Life

FWD Life

YF Life

Manulife

China Taiping Life

China Taiping

Table of Contents

Frequently asked questions

-

What was the Macau insurance market gross written premium in 2023?

The gross written premium of the Macau insurance market was MOP38.4 billion ($4.9 billion) in 2023.

-

What will the growth rate of the Macau insurance market be during the forecast period?

The insurance market in Macau is expected to achieve a CAGR of more than 5% during 2024-2028.

-

Which segment dominated the Macau insurance market in 2023?

The life insurance segment dominated the Macau insurance market in 2023.

-

Which are the major companies operating in the Macau life insurance market?

The key companies in the Macau life insurance market are AIA International, China Life Overseas, YF Life International, China Taiping Life, and AXA China Region among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports