Mexico Defense Market Size and Trends, Budget Allocation, Regulations, Key Acquisitions, Competitive Landscape and Forecast, 2022-2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

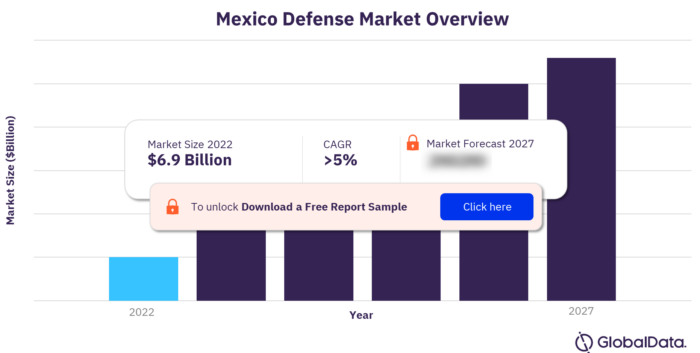

Mexico defense budget is $6.9 billion in 2022. The market is expected to achieve a CAGR of more than 5% during 2023-27. The Mexico defense market research report provides the market size forecast and the projected growth rate for the next five years. The report covers industry analysis including the key market drivers, emerging technology trends, and major challenges faced by market participants. It also offers insights regarding key factors and government programs that are expected to influence the demand for military platforms over the forecast period.

For more Mexico defense market insights, download a free report sample

Mexico Defense Market Drivers

A network of illegal activities, ranging across extensive cartel operations, trafficking, and illegal immigration, runs through Mexico. These threats were the focus of the Merida Initiative, and despite AMLO’s decreasingly militarized approach, ongoing spending in the defense and security sectors will be required.

The increase in drug trafficking and associated violence has compelled the Mexican government to focus on the modernization of its armed forces. The Mexican Air Force initiated “Plan 2030” to better equip the country’s defense forces to combat drug cartels and other related groups.

Military Doctrines and Defense Strategies in Mexico

The Mexican Armed Forces comprise the Secretary of National Defense (SEDENA), which is responsible for the air force and army, and the Secretariat of the Navy (SEMAR). SEDENA’s military doctrine revolves around the protection of the independence and sovereignty of Mexico and guaranteeing the internal stability and security of the state. SEDENA is also responsible for protecting civilians in times of public need or disaster. SEMAR’s doctrine largely reflects that of SEDENA but has a greater focus on upholding security by maintaining the rule of law in marine areas.

One of Mexico’s primary military strategies revolves around countering illegal drug trafficking and the associated cartel presence. This involves trying to reduce violence, intercepting cartel operations, and destroying drugs and plantations.

Both SEDENA and SEMAR forces attempt to regulate Mexico’s borders and prevent illegal movements across them. This includes manning border stations, patrolling land borders and marine border areas, and carrying out surveillance missions.

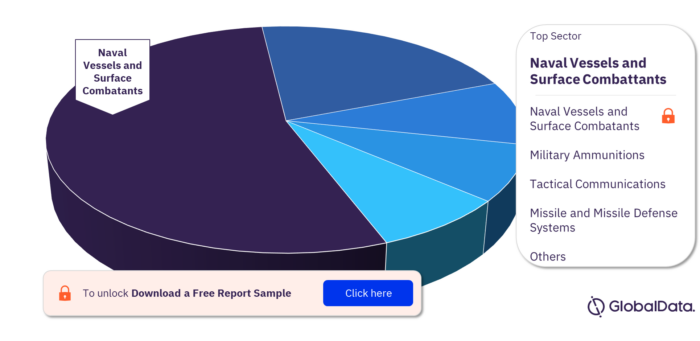

Key Sectors in the Mexico Defense Market

Naval vessels and surface combatants, military ammunitions, and tactical communications are the most attractive sectors in the market. Other prominent sectors include missile and missile defense systems, military radar, underwater warfare systems, EOIR systems, artillery, military simulation and training, electronic warfare systems, INS GNSS, and body armor and personal protection.

Mexico Defense Market Outlook, by Sectors

For more sector insights, download a free report sample

Key Companies in the Mexico Defense Market

Some of the key companies in the Mexico defense market are America Movil SAB DE CV, Maquinaria IGSA Group, Ciateq AC, Honeywell Aerospace de México, S.A. de C.V., SDM Composites, Aernnova Aerospace SA, Air France Industries KLM Engineering and Maintenance, Airbus SE, Aircraft Industries AS, and Arotech Corp.

Mexico Defense Market Report Overview

| Market Size (2022) | $6.9 billion |

| CAGR (2023-2027) | >5% |

| Forecast Period | 2023-2027 |

| Key Sectors | Naval Vessels and Surface Combatants, Military Ammunitions, Tactical Communications, Missile and Missile Defense Systems, Military Radar, Underwater Warfare Systems, EOIR Systems, Artillery, Military Simulation and Training, Electronic Warfare Systems, INS GNSS, and Body Armor and Personal Protection |

| Key Companies | America Movil SAB DE CV, Maquinaria IGSA Group, Ciateq AC, Honeywell Aerospace de México, S.A. de C.V., SDM Composites, Aernnova Aerospace SA, Air France Industries KLM Engineering and Maintenance, Airbus SE, Aircraft Industries AS, and Arotech Corp |

Scope

This report provides:

- Detailed analysis of the Mexican 2022 defense budget broken down into market size and market share. This is coupled with an examination of key current and future acquisitions.

- Explanation of the procurement policy and process. This is coupled with an analysis of the Mexican military doctrine and strategy to provide a comprehensive overview of Mexican military regulation.

- Examination of political alliances and perceived security threats to Mexico. They help to explain trends in spending and modernization.

- Analysis of prevalent trends in the country’s imports and exports over the last five years.

- Analysis of the competitive landscape of Mexico’s defense industry.

Reasons to Buy

- Determine prospective investment areas based on a detailed trend analysis of the Mexican defense market over the next five years.

- Gain an in-depth understanding of the underlying factors driving demand for different defense and internal security segments in the Mexican market and identify the opportunities offered.

- Strengthen your understanding of the market in terms of demand drivers, market trends, and the latest technological developments, among others.

- Identify the major threats that are driving the Mexican defense market providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channel resources by focusing on the ongoing programs that are being undertaken by the Mexican government.

- Make correct business decisions based on an in-depth analysis of the competitive landscape consisting of detailed profiles of the top defense equipment providers in the country. The company profiles also include information about the key products, alliances, recent contracts awarded, and financial analysis, wherever available.

Raytheon Technologies

BAE Systems

America Movil SAB DE CV

Maquinaria IGSA Group

Ciateq AC

Honeywell Aerospace de México S.A. de C.V.

SDM Composites

Table of Contents

Table

Figures

Frequently asked questions

-

What is the Mexico defense budget in 2022?

The defense budget of Mexico is $6.9 billion in 2022.

-

What is the Mexico defense market growth rate?

The Mexico defense market is expected to achieve a CAGR of more than 5% during 2023-27.

-

What are the key sectors in the Mexico defense market?

The key sectors in the Mexico defense market are naval vessels and surface combatants, military ammunitions, tactical communications, missile and missile defense systems, military radar, underwater warfare systems, EOIR systems, artillery, military simulation and training, electronic warfare systems, INS GNSS, and body armor and personal protection.

-

Which are the key companies in the Mexico defense market?

Some of the key companies in the Mexico defense market are America Movil SAB DE CV, Maquinaria IGSA Group, Ciateq AC, Honeywell Aerospace de México, S.A. de C.V., SDM Composites, Aernnova Aerospace SA, Air France Industries KLM Engineering and Maintenance, Airbus SE, Aircraft Industries AS, and Arotech Corp

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Aerospace and Defense reports