Morocco Cards and Payments – Opportunities and Risks to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Morocco Cards and Payments Market Report Overview

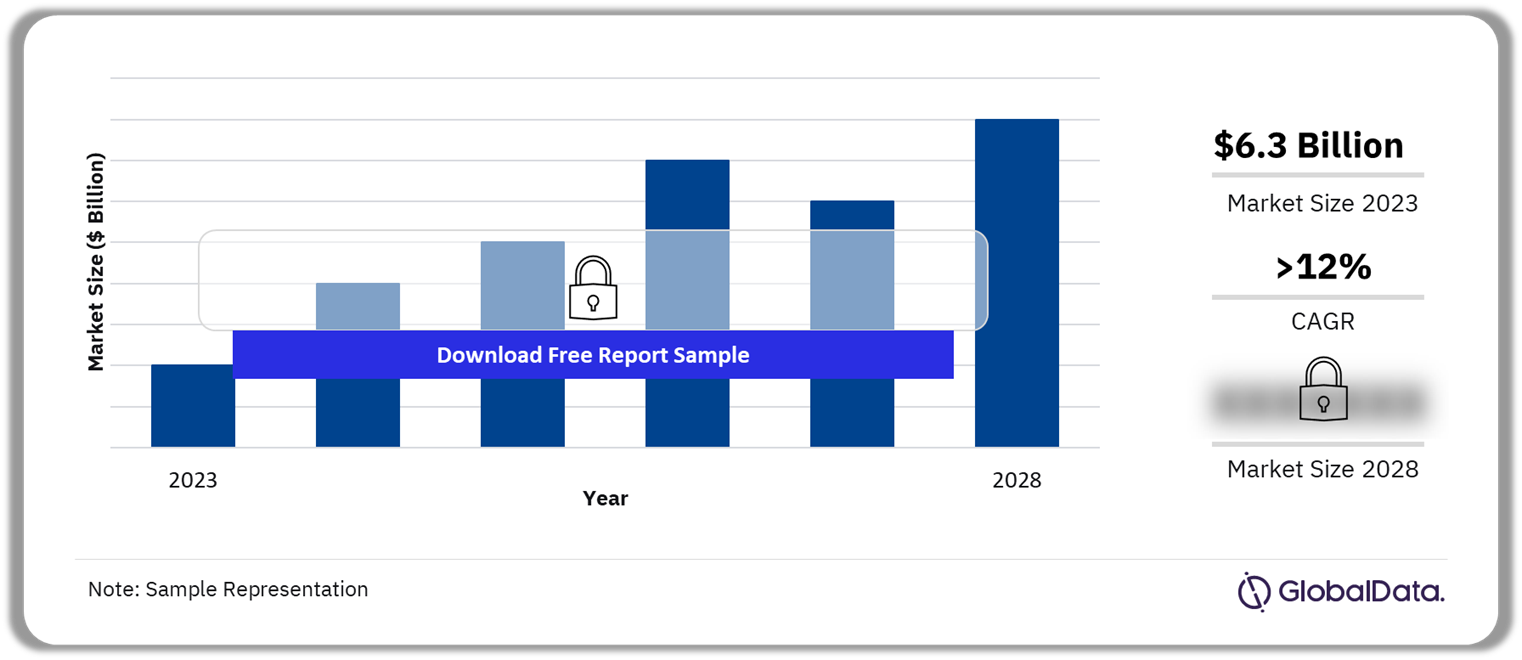

The annual value of card transactions in the Morocco cards and payments market was $6.3 billion in 2023 and will grow at a CAGR of more than 12% during 2024-2028. Cash remains a strong preference for Moroccan consumers. However, the government and banks are striving to increase awareness levels to encourage electronic payments.

Morocco Card Transactions Outlook, 2023-2028 ($ Billion)

Buy the Full Report for More Information on the Morocco Cards and Payments Market Forecast Download a Free Sample Report

The Morocco cards and payments market research report provides a detailed analysis of market trends influencing the industry. It provides transaction values and volumes for several payment instruments for the review period. In addition, the Morocco cards and payments market analysis offers information on the country’s competitive landscape, including market shares of issuers and schemes. The report also entails regulatory policy details and provides extensive coverage of any recent changes in the regulatory structure.

| Annual Card Transactions Value (2023) | $6.3 billion |

| CAGR (2024-2028) | >12% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Payment Instruments | · Cards

· Credit Transfers · Direct Debits · Checks |

| Key Segments | · Card-Based Payments

· E-commerce Payments · Alternative Payments |

| Leading Players | · Banque Populaire

· Attijariwafa Bank · Bank of Africa · Credit Agricole |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Morocco Cards and Payments Market Dynamics

Payment cards are at a nascent stage of development in Morocco. The low uptake of payment cards is due to the country’s high dependence on cash and the limited acceptance of payment cards by merchants. The government has launched financial inclusion initiatives such as introducing instant bank transfers, running financial education programs, and offering basic bank accounts to individuals. As a result, the banked population witnessed a significant increase in 2023. Additionally, with merchants gradually starting to accept payment cards, their share in terms of transaction value and volume increased over 2019–23e. Going forward, a growing e-commerce market, the availability of digital-only banks, the launch of alternative payment solutions, and the rising preference for mobile point-of-sale (POS) solutions are expected to drive electronic payments.

Buy the Full Report to Get Additional Morocco Cards and Payments Market Dynamics

Morocco Cards and Payments Market Segmentation by Payment Instruments

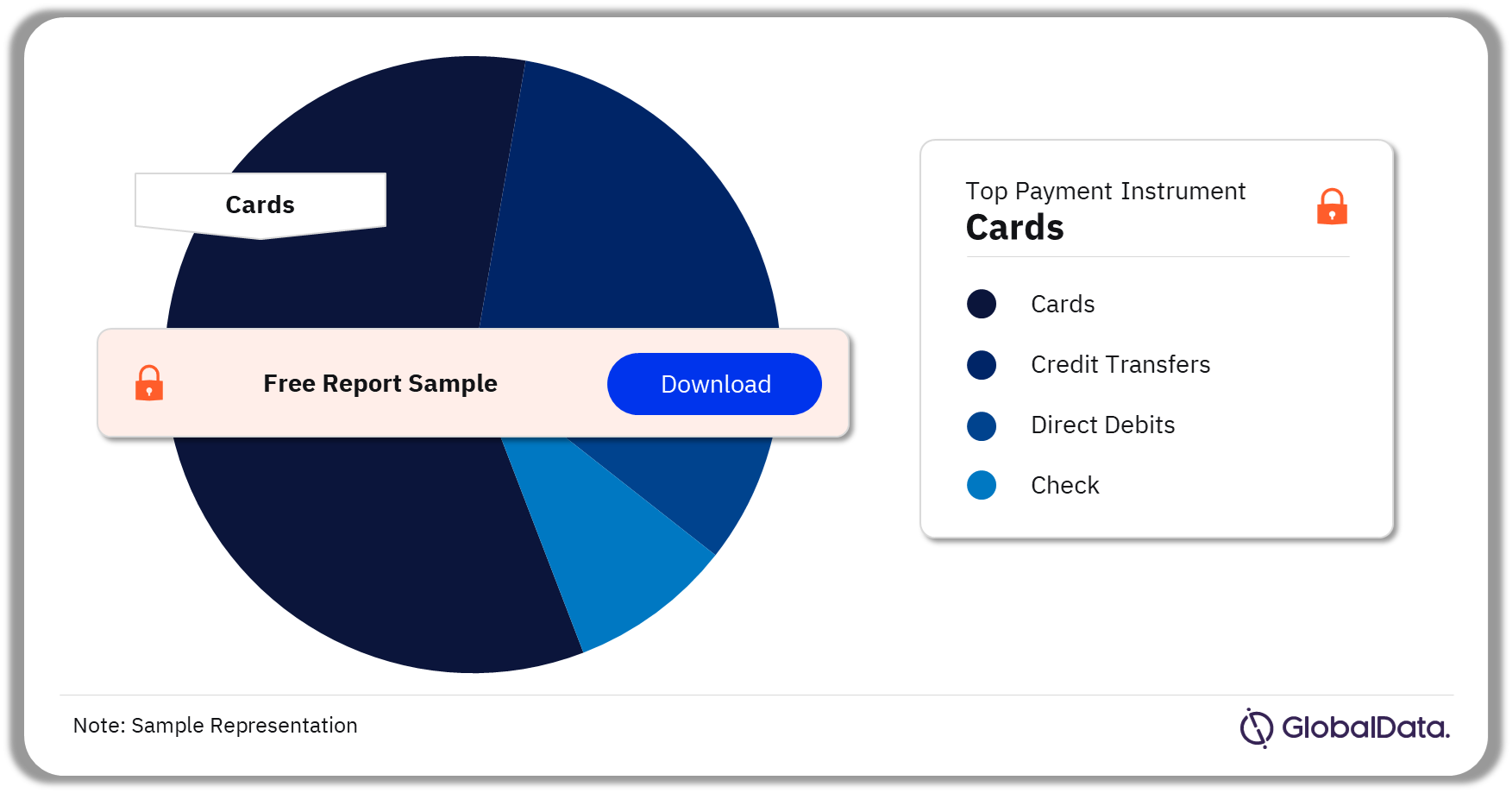

Cards had the highest share of payment transaction volume in 2023

The key payment instruments in the Morocco cards and payments market are credit transfers, cards, direct debits, and checks. In 2023, cards led the Morocco cards and payments market. Consumers in Morocco are gradually embracing card-based payments. The government and banks are striving to increase awareness levels to encourage electronic payments. By expanding into rural areas and establishing branches and ATMs, the banks are also supporting the government’s financial inclusion programs. The bank’s support coupled with the increase in merchant acceptance, the share held by payment cards increased over 2019–23e.

Morocco Cards and Payments Market Analysis by Payment Instruments (Volume Terms), 2023 (%)

Buy the Full Report for More Payment Instrument Insights into the Morocco Cards and Payments Market

Morocco Cards and Payments Market Segments

The key segments in the Morocco cards and payments market are card-based payments, e-commerce payments, and alternative payments.

E-Commerce Payments: The Moroccan e-commerce market is currently in a growth phase. This can be attributed to the country’s growing smartphone penetration and internet connectivity, coupled with the enhanced security of online transactions. This has resulted in high consumer confidence and participation in e-commerce.

Buy the Full Report for More Market Segment Insights into the Morocco Cards and Payments Market

Download a Free Sample Report

Morocco Cards and Payments Market - Competitive Landscape

A few of the leading players in the Morocco cards and payments market are Banque Populaire, Attijariwafa Bank, Bank of Africa, and Credit Agricole.

Morocco Cards and Payments Market Analysis by Players, 2023

Buy the Full Report to Know More about the Players in the Morocco Cards and Payments Market Download a Free Sample Report

Morocco Cards and Payments Market – Latest Developments

- In July 2023, Apple Pay was launched in Morocco. The solution allows consumers to make in-store, in-app, and online payments using their Apple devices. Users need to add their payment card details to the Apple Wallet app to make online payments at partner websites as well as contactless payments at partner merchants

- In February 2022, Mastercard and CIH Bank partnered to launch the CIH Pay mobile app. CIH Bank cardholders can digitize their cards via CIH Pay, which enables cardholders to make contactless payments at merchants.

Segments Covered in the Report

Morocco Cards and Payments Instruments Outlook (Value, $ Billion, 2019-2028)

- Cards

- Credit Transfers

- Direct Debits

- Check

Morocco Cards and Payments Market Segments Outlook (Value, $ Billion, 2019-2028)

- Card-Based Payments

- E-commerce Payments

- Alternative Payments

Scope

• Bank Al-Maghrib (BAM) (Morocco’s central bank) and the Moroccan Interbank Remote Clearing System launched instant bank transfers in the country on June 1, 2023. The system operates 24 hours a day, seven days a week, 365 days a year. The system currently supports individual fund transfers, which can be initiated via internet banking, mobile banking, and bank branches using the recipient’s account number. Users can transfer a maximum of MAD20,000 ($1,976.97) per transaction, with transfers completed within 20 seconds.

• Alternative payment solutions are gaining traction in the country. Apple Pay was launched in Morocco in July 2023. The solution allows consumers to make in-store, in-app, and online payments using their Apple devices. Users need to add their payment card details to Apple Wallet app to make online payments at partner websites as well as contactless payments at partner merchants. Apple Pay purchases offer a range of authentication methods, including biometrics, passwords, and unique security codes. As of February 2024, Apple Pay is supported by four banks: Attijariwafa Bank, Groupe Credit Agricole du Maroc, CIH, and L’bankalik (Attijariwafa Bank’s digital-only bank).

• Morocco’s ecommerce market has recorded strong growth. To capitalize on this trend, in March 2023, ecommerce platform Jumia launched an initiative to drive ecommerce growth in medium, small, and underserved cities in Morocco. The initiative aims to create awareness of the advantages of ecommerce, train individuals on how to use ecommerce platforms, and help individuals make purchases online. Meanwhile, DP World (a global provider of logistics services) launched its wholesale ecommerce platform DUBUY.com in June 2023.

Reasons to Buy

- Make strategic business decisions, using top-level historical and forecast market data related to the Moroccan cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Moroccan cards and payments industry.

- Assess the competitive dynamics in the Moroccan cards and payments industry.

- Gain insights into marketing strategies used for various card types in Morocco.

- Gain insights into key regulations governing the Moroccan cards and payments industry.

Table of Contents

Frequently asked questions

-

What was the annual value of card transactions in the Morocco cards and payments market in 2023?

The annual value of card transactions in the Morocco cards and payments market was $6.3 billion in 2023.

-

What will the Morocco cards market growth rate be during the forecast period?

The Morocco annual cards market value is expected to grow at a CAGR of more than 12% during 2024-2028.

-

Which was the leading payment instrument in the Morocco cards and payments market in 2023?

Card was the leading payment instrument in terms of transaction volume in the Morocco cards and payments market in 2023.

-

Which are the leading players in the Morocco cards and payments market?

A few of the leading players in the Morocco cards and payments market are Banque Populaire, Attijariwafa Bank, Bank of Africa, and Credit Agricole.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports