Morocco Defense Market Size, Trends, Budget Allocation, Regulations, Acquisitions, Competitive Landscape and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Morocco Defense Market Report Overview

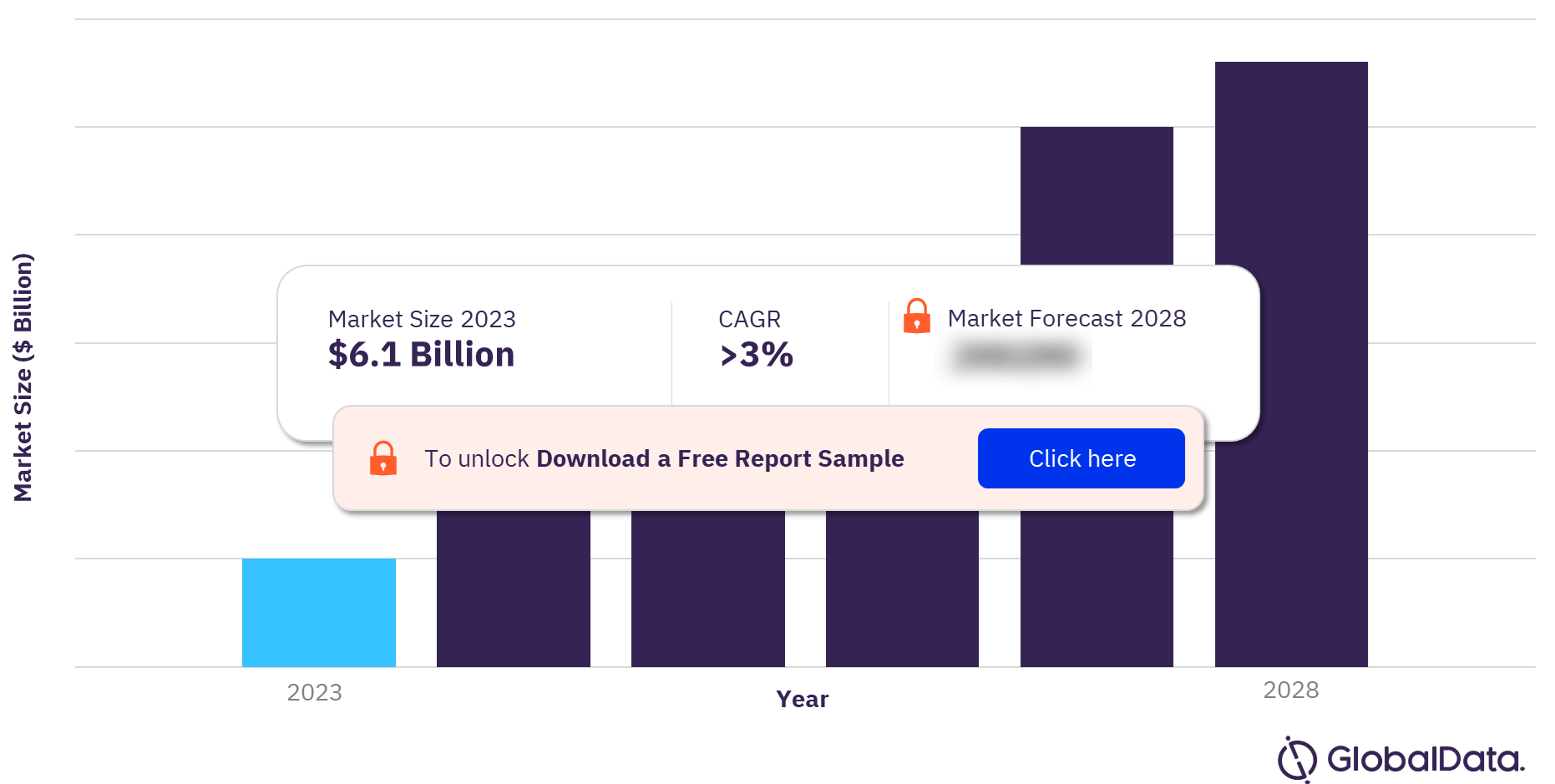

The Morocco defense budget is worth $6.1 billion in 2023 and is expected to achieve a CAGR of more than 3% during 2024-2028. The Morocco defense market research report provides the market size forecast and the projected growth rate for the next five years. The report covers industry analysis including the key market drivers, emerging technology trends, and major challenges faced by market participants. It also offers insights regarding key factors and government programs that are expected to influence the demand for military platforms over the forecast period.

Morocco Defense Market Outlook, 2023-2028 ($ Billion)

To gain more information about the Morocco defense market forecast, download a free report sample

Morocco Defense Market Trends

Morocco is seeking to strengthen and grow its defense industrial base. Therefore, developments associated with this growth, such as an increase in jobs and patents filed, will constitute the key market trends in Morocco. The trend of increasing job opportunities is likely to grow as Morocco explores the implementation of a formal commercial offset policy. In a similar vein to job listings, patent filings can also be expected to grow over the forecast period as Morocco’s defense industrial base gains traction and indigenous R&D work progress.

Morocco Military Doctrines and Defense Strategies

Moroccan military doctrine is largely shaped by its alliances, operating environment, and limited combat experiences. Being a major non-NATO ally, the Royal Armed Forces have exercised extensively with the US and have drawn much from its doctrine of maneuver and combined-arms warfare. This is particularly applicable to its armored and mechanized units, which are foremost equipped and trained to combat conventional forces such as Algeria’s on the wide-open desert plains of the Sahara.

By far the most dominant driver of Moroccan foreign relations and strategy is the rivalry with Algeria. Morocco’s military is equipped first and foremost for the possibility of having to fight a conventional war with the Algerian military, and its secondary security considerations over extremist militant threats are regarded as covered by an extensive infantry force who all receive counter-insurgency training.

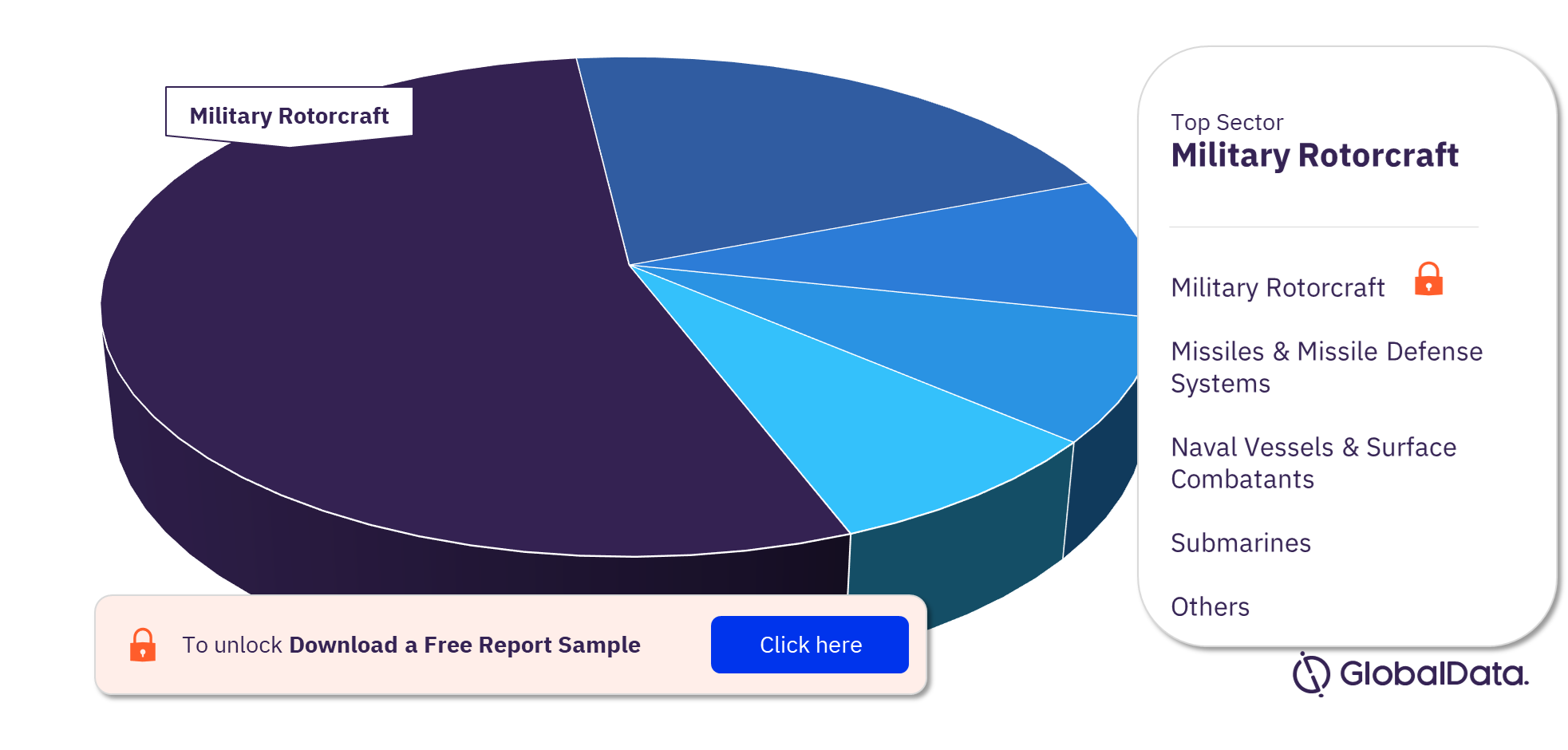

Morocco Defense Market Segmentation by Sectors

The key sectors in the Morocco defense market are military rotorcraft, missiles & missile defense systems, naval vessels & surface combatants, submarines, military fixed-wing aircraft, electronic warfare, military UAV, military radar, tactical communications systems, and EOIR, among others. The top sector in the Morocco defense market is military rotorcraft, followed by missiles & missile defense systems. Morocco’s recent purchases of T-129 Ataks, AH-64E Apaches, and H135s make military rotorcraft the largest sector in the market. Attack helicopters comprise most of the this sector’s value for the forecast period.

Morocco Defense Market Analysis by Sectors, 2023-2028 (%)

For more sector insights into the Morocco defense market, download a free report sample

Morocco Defense Market - Competitive Landscape

Some of the leading defense companies in Morocco are Mitsubishi Corp, Safran SA, Dassault Aviation SA, Howmet Aerospace Inc, Indra Sistemas SA, Moog Inc, Teledyne FLIR LLC, Hexcel Corp, and Safran Nacelles SA.

Morocco Defense Market Report Overview

| Market Size (2023) | $6.1 billion |

| CAGR | >3% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Sectors | Military Rotorcraft, Missiles & Missile Defense Systems, Naval Vessels & Surface Combatants, Submarines, Military Fixed-Wing Aircraft, Electronic Warfare, Military UAV, Military Radar, Tactical Communications Systems, and EOIR |

| Leading Companies | Mitsubishi Corp, Safran SA, Dassault Aviation SA, Howmet Aerospace Inc, Indra Sistemas SA, Moog Inc, Teledyne FLIR LLC, Hexcel Corp, and Safran Nacelles SA |

Segments Covered in the Report

Morocco Defense Sectors Outlook (Value, $ Billion, 2023-2028)

- Military Rotorcraft

- Missiles & Missile Defense Systems

- Naval Vessels & Surface Combatants

- Submarines

- Military Fixed-Wing Aircraft

- Electronic Warfare

- Military UAV

- Military Radar

- Tactical Communications Systems

- EOIR

Scope

The report provides an in-depth analysis of the following –

- Morocco defense budget: Detailed analysis of Morocco’s 2023 defense budget broken down into market size and market share. This is coupled with an examination of key current and future acquisitions.

- Regulation: The procurement policy and process is explained. This is coupled with an analysis of Morocco’s military doctrine and strategy to provide a comprehensive overview of Morocco’s military procurement regulation.

- Security Environment: Political alliances and perceived security threats to Morocco are examined; there help to explain trends in spending and modernization.

- Competitive landscape and strategic insights: Analysis of the competitive landscape of Morocco’s defense industry.

Key Highlights

• Morocco’s rivalry with Algeria is the defining aspect of its foreign relations and defense outlook. After Spain withdrew from Western Sahara, the relationship between Morocco and Algeria deteriorated

• Morocco has been gradually procuring modern and highly capable platforms and equipment that will prepare the military for a high-intensity conventional conflict

• The autocratic nature of the Moroccan political system creates a large deficit in accountability and has drawn criticism for its vulnerability to corruption

Reasons to Buy

- Determine prospective investment areas based on a detailed trend analysis of Morocco’s defense market over the next five years

- Gain an in-depth understanding of the underlying factors driving demand for different defense and internal security segments in the Moroccan market and identify the opportunities offered.

- Strengthen your understanding of the market in terms of demand drivers, market trends, and the latest technological developments, among others

- Identify the major threats that are driving Morocco’s defense market providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion

- Channel resources by focusing on the ongoing programs that are being undertaken by Morocco’s government

- Make correct business decisions based on in-depth analysis of the competitive landscape consisting of detailed profiles of the top defense equipment providers in the country. The company profiles also include information about the key products, alliances, recent contracts awarded, and financial analysis, wherever available

Raytheon Technologies

Fincantieri

The Boeing Co

Lockheed Martin Corp

Israel Aerospace Industries Ltd

Airbus Helicopters SAS

Table of Contents

Frequently asked questions

-

What is the Morocco defense market size in 2023?

The defense market size in Morocco is worth $6.1 billion in 2023.

-

What is the Morocco defense market growth rate?

The defense market in Morocco is expected to achieve a CAGR of more than 3% during 2024-2028.

-

What are the key sectors in the Morocco defense market?

The key sectors in the Moroccan defense market are military rotorcraft, missiles & missile defense systems, naval vessels & surface combatants, submarines, military fixed-wing aircraft, electronic warfare, military UAV, military radar, tactical communications systems, and EOIR, among others.

-

Which are the leading defense companies in the Morocco defense market?

Some of the leading defense companies in the Moroccan defense market are Mitsubishi Corp, Safran SA, Dassault Aviation SA, Howmet Aerospace Inc, Indra Sistemas SA, Moog Inc, Teledyne FLIR LLC, Hexcel Corp, and Safran Nacelles SA.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Aerospace and Defense reports