Americas Fixed Broadband Market Trends and Opportunities, 2023 Update

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Americas Fixed Broadband Market Trends and Opportunities Report Overview

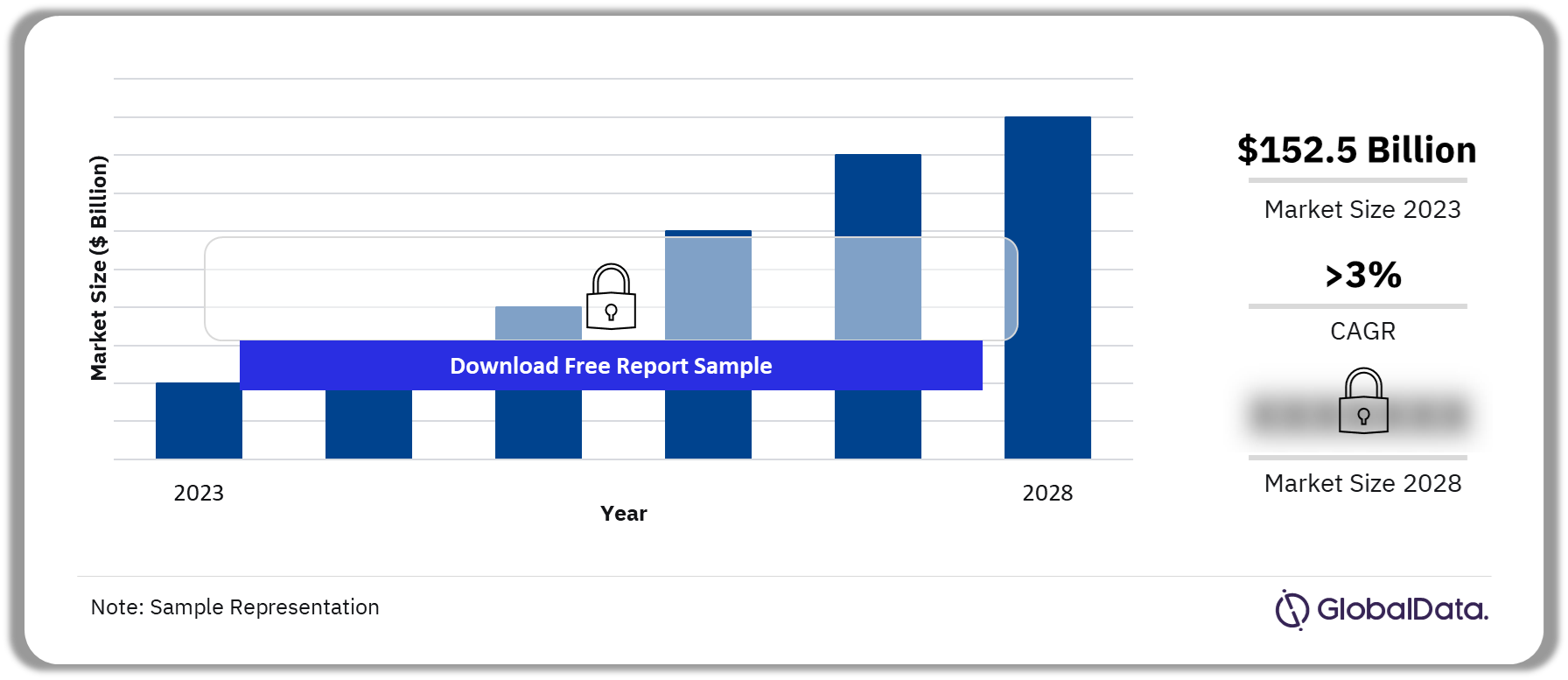

Americas fixed broadband revenue is estimated to be $152.5 billion in 2023. National broadband plans and public infrastructure projects will continue to support the rollout of fixed broadband services across the region. The national broadband plans will also bring opportunities for telcos and equipment vendors to participate in infrastructure contracts. This is likely to propel the market to grow at a CAGR of more than 3% during 2023-2028.

Americas Fixed Broadband Market Outlook 2023-2028 ($ Billion)

Buy the Full Report More Insights on the Americas Fixed Broadband Market Forecast

The “Americas Fixed Broadband Market Trends and Opportunities, 2023 Update”, the new Telecom Insider Report by GlobalData, provides an executive-level overview of the fixed broadband market in the Americas. It delivers quantitative and qualitative insights into the fixed market, analyzing key trends, competitive dynamics, and growth drivers in the region.

| Market Size (2023) | $152.5 Billion |

| CAGR (2023-2028) | >3% |

| Key Service | · Voice

· Internet |

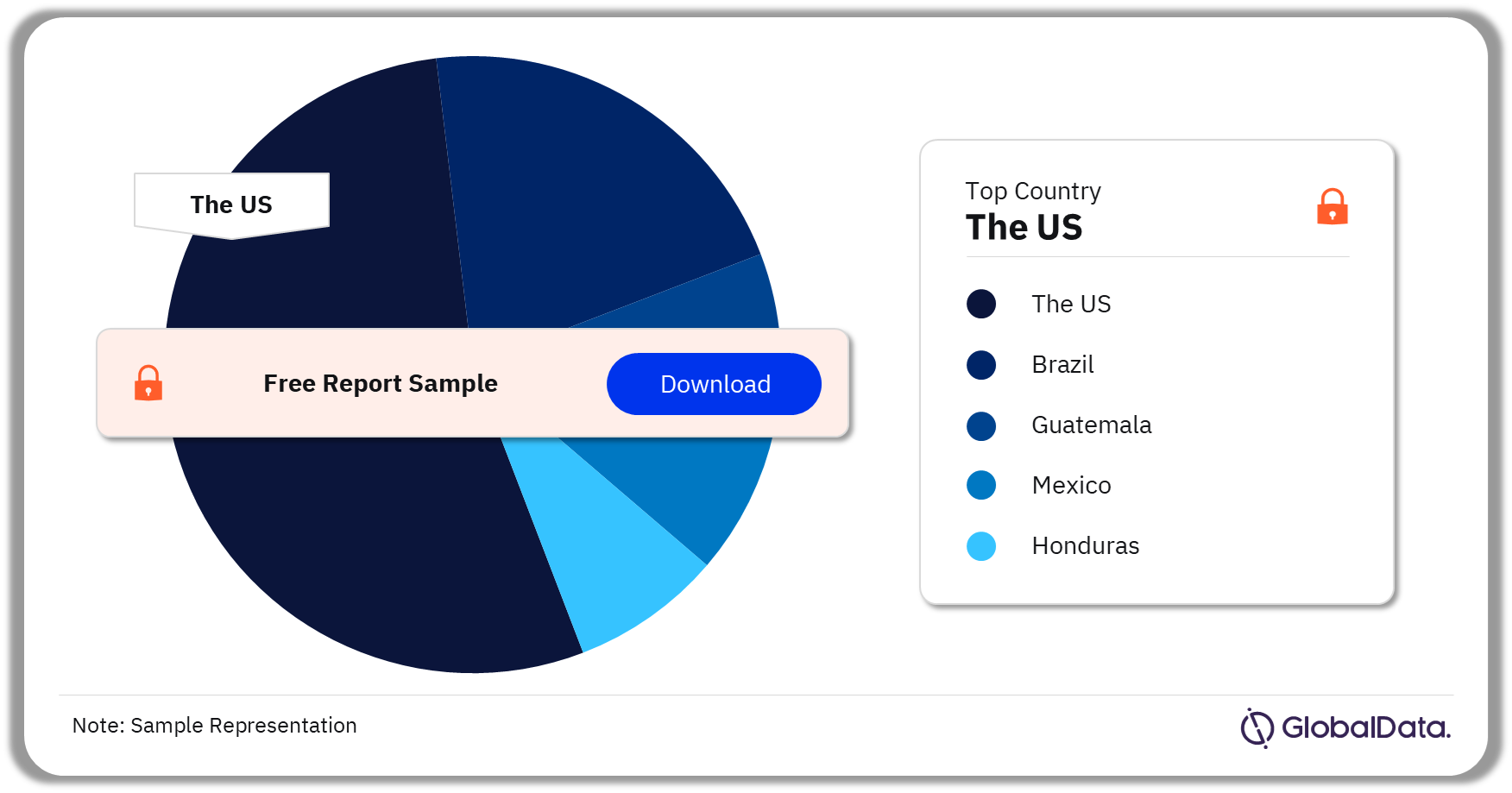

| Key Countries | · The US

· Brazil · Guatemala · Mexico · Honduras |

| Leading Companies | · T-Mobile

· Cable Wireless Panama · Flo Networks · Tigo Colombia · Altice |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Americas Fixed Broadband Subscription Trends

Internet User Trends in Americas: Fixed internet users in the Americas will increase significantly by 2028. This will be largely driven by governments and telcos’ initiatives to improve fixed broadband coverage in rural areas, especially through investments in fiber-optic networks. The total number of fixed broadband lines will also grow by 2028. Fixed broadband penetration of households will grow due to ongoing investments in fixed broadband expansion in countries such as Brazil, Mexico, Peru, Colombia, and Honduras.

Fixed Broadband Technology Trends in the Americas: Fiber will remain the leading fixed broadband technology during 2023-2028. Fiber will be driven by FTTH network expansions across several countries in the region.

Buy the Full Report for More Insights on Americas Fixed Broadband Subscription Trends

Americas Fixed Broadband Revenue Trends

Fixed Broadband ARPU in the Americas: Fixed broadband ARPU in the Americas will increase between 2023 and 2028. The rise in ARPU in the regions is supported by the steady rise in adoption of ultrafast broadband connections via FTTH, cable, and 5G FWA, with higher ARPU levels. Telecom operators can increase ARPU by offering a more-for-more proposition in affluent and emerging markets as households in the Americas become more affluent, they will be more receptive to higher internet speeds for a higher price.

Fixed Broadband Revenue Trends in Americas: Total fixed broadband revenue in the Americas will increase by 2027. Growth will be mainly supported by government broadband development initiatives and operators’ investment in fiber optic network infrastructure in countries such as the US, Brazil, and Mexico. At year-end 2023, the US will be the largest fixed broadband market in the Americas. The other key markets are Brazil, Guatemala, Mexico, and Honduras.

Top Americas Markets Analysis by Total Fixed Broadband Lines, 2023

Buy the Full Report for More Country-Wise Insights into the Americas Fixed Broadband Market

Americas Fixed Broadband Market – Competitive Landscape

The key companies in the fixed broadband market in the Americas are:

- T-Mobile

- Cable Wireless Panama

- Flo Networks

- Tigo Colombia

- Altice

In March 2021, US-based cable television provider Altice signed an agreement to acquire the assets of local broadband service provider Morris Broadband for $310 million.

Americas Fixed Broadband Market Players

Download a Free Sample Report for Information about the Americas Fixed Broadband Market Players

Scope

It provides an in-depth analysis of the following –

- Section 1: Americas in a Global Context: This section provides a comparison of Americas’ macroeconomic KPIs, fixed telecoms market size, and trends with other regions.

- Section 2: Regional Market Trends and Competitive Dynamics: This section analyzes the competitive dynamics that have been shaping the Americas fixed broadband markets over the past few years, including market entries, market exits, consolidations, and M&A activities.

- Section 3: Fixed Broadband Subscription Trends: Provides analysis, historical figures, and forecasts of fixed broadband subscriptions and usage trends in the region as well as their growth drivers.

- Section 4: Fixed Broadband Revenue Trends: Examines changes in the breakdown of overall revenue and ARPU over 2023-2028.

- Section 5: Key findings: A summary of key findings and growth opportunities for Americas’ fixed broadband market.

Reasons to Buy

- This Insider Report provides a comprehensive examination through a forward-looking analysis of Americas’ fixed broadband market trends in a concise analytical format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in Americas’ fixed broadband markets.

- The report is designed for an executive-level audience, with charts and tables boasting presentation quality.

- The broad perspective of the report coupled with comprehensive actionable insights will help operators, equipment vendors, and other telecom industry players better position to seize the growth opportunities in Americas’ evolving fixed broadband market.

Amazon

ARSAT

AT&T

BlackRock

BTG

Cable Wireless Panama

Cabletica

Claro Panama

DIRECTV

Entel

ETB

Flo Networks

Gigapower

Globenet

Hulu

Kacific

KKR

Liberty Global

Morris Broadband

Movistar Costa Rica

Movistar Peru

Netflix

Oi

OnNet Fibra

redIT

Rogers Canada

Shaw Communications

Sprint

Starlink

Telefonica

Tigo Colombia

T-Mobile

Transtelco

Ufinet

Table of Contents

Figures

Frequently asked questions

-

What is the Americas fixed broadband market size in 2023?

The total fixed service revenue in the Americas is estimated at $152.5 billion in 2023.

-

What will be the CAGR in the Americas fixed broadband market during 2023-2028?

The fixed services revenue in the Americas is likely to grow at a CAGR of more than 3% during 2023-2028.

-

Which are the leading players in the Americas fixed broadband market?

The key companies in the Americas fixed broadband market are T-Mobile, Cable Wireless Panama, Flo Networks, Tigo Colombia, and Altice among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Telecom Infrastructure reports