Emissions Reduction Strategies Adopted by the Oil and Gas Sector – Analyzing Current Emissions by Oil and Gas Sector and Companies, Future Targets, Reduction Strategies and Carbon Pricing

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Oil and Gas Emissions Reduction Market Overview

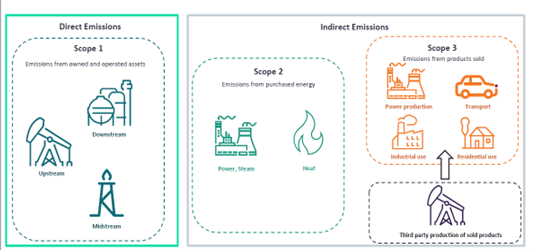

The oil and gas sector is responsible for about half of all energy-related emissions. The vast majority are from sold products or scope 3 emissions. Among direct, scope 1 and 2 emissions, the largest portion comes from upstream and downstream operations. Emissions can occur at all stages of the O&G value chain.

To address upstream emissions, common strategies include using renewable energy or carbon capture. On the downstream side, low-carbon hydrogen, electrification of heat processes, utilization of waste heat, and utilization of carbon for fuels can be used. Product emissions can be reduced by reducing the production of fossil fuels, producing renewable fuels like low carbon hydrogen or biofuels, carbon offsets, or carbon capture. The nine most active O&G companies in the energy transition have reported reductions in absolute emissions and emissions intensity in recent years. Carbon pricing is an effective emissions reduction measure that has been endorsed by most major O&G companies.

| Emission categories | Direct Emission (Scope 1) and Indirect Emission (Scope 2 and 3) |

| Emission reduction strategies | Upstream, Downstream, and Scope 3/Product Emissions |

| Key countries | The US, the UK, EU, Norway, Saudi Arabia, Canada, and the UAE |

| Leading companies | Equinor, Repsol, Shell, ExxonMobil, TotalEnergies, BP, Chevron, ConocoPhillips, and Eni |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Defining Emission Categories

Buy the full report to know more about emission categories, download a free report sample

Common Emission Reduction Strategies

Upstream

Powering offshore platforms using cleaner grid power or on-site renewables, like offshore wind farms.

Downstream

Using blue or green hydrogen in refineries and adopting electrification for some heat processes.

Scope 3/Product Emissions

Decreasing oil and gas sales via divestment of assets or decreasing production.

Buy the full report to know more about common emission reduction strategies, download a free report sample

Emission Reduction Strategies by Country

The US aims to reduce GHG emissions by half by 2030 compared to 2005 levels and reach net zero by 2050. The Biden Administration has implemented a social cost of carbon, but it is currently facing legal challenges in the US court system. The cost is used to guide policy, including oil and gas leases, and federal spending decisions by incorporating the cost of negative externalities associated with carbon emissions. In addition, 11 states use a social cost of carbon to guide similar decisions at the state level.

Aside from the US, the other countries discussed in the report for emission reduction strategies in the oil and gas sector are the UK, EU, Norway, Saudi Arabia, Canada, and the UAE.

Buy the full report to know more about targets and strategies of leading O&G companies, download a free report sample

Leading Companies in Energy Transition

Some of the leading companies in energy transition are Equinor, Repsol, Shell, ExxonMobil, TotalEnergies, BP, Chevron, ConocoPhillips, and Eni.

To know more about targets and strategies of leading O&G companies, download a free report sample

Scope

Global oil and gas sector CO2 emissions in 2019

Future CO2 emissions from global oil and gas remaining lifetime of reserves

Emissions reduction targets and strategies of 9 selected oil and gas majors

Global emissions reduction strategies

Reasons to Buy

- Obtain the most up-to-date information on emissions reduction strategies in major oil and gas producing nations and companies.

- Understand the origins of different emissions throughout the oil and gas value chain.

- Assess your competitor’s emissions reduction strategies and develop the most effective plan of action based on the trends in their absolute emissions and emissions intensities.

- Develop an understanding of the global carbon pricing scene.

Table of Contents

Table

Figures

Frequently asked questions

-

What are the defining emission categories in the oil and gas sector?

The defining emission categories in the oil and gas sector are direct emission (Scope 1) and indirect emission (Scope 2 and 3)

-

What are the emission reduction strategies in the oil and gas sector?

The emission reduction strategies in the oil and gas sector are upstream, downstream, and Scope 3/product emissions.

-

Which are the key countries acting on emission reduction?

The key countries acting on emission reduction are the US, the UK, the EU, Norway, Saudi Arabia, Canada, and the UAE.

-

Who are the leading companies in the oil and gas sector?

The leading companies in the oil and gas sector are Equinor, Repsol, Shell, ExxonMobil, TotalEnergies, BP, Chevron, ConocoPhillips, and Eni.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.