Oil and Gas Industry Annual Contracts Analytics by Region, Sector, Planned and Awarded Contracts and Top Contractors

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Oil and Gas Industry Contracts Review Report Overview

The oil and gas industry reported more than 5,915 contracts during Q4 2023. The Oil and Gas Industry Contracts Review Report provides a count of the industry contracts by region, including a sector-wise update of Q4 2023. The report also discusses the terrain and scope types in the industry along with the key contractors & issuers making the oil and gas industry contracts.

| Key Sectors | · Upstream

· Downstream/petrochemical · Midstream |

| Key Regions | · Europe

· Asia · North America · Middle East · Africa · South America · Oceania |

| Key Contractors | · Saipem

· HD Hyundai · National Marine Dredging Co · Marie Tecnimont · Technip Energies Consolidated Contractors · Others |

| Key Issuers | · ADNOC

· Saudi Aramco · QatarEnergy · ENI · Total Energies · Others |

| Key Scope | · Operations & Maintenance (O&M)

· Procurement · Multiple · Design & Engineering · Construction and Installation · Asset Retirement |

| Key Terrains | · Onshore

· Onshore/offshore · Offshore |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

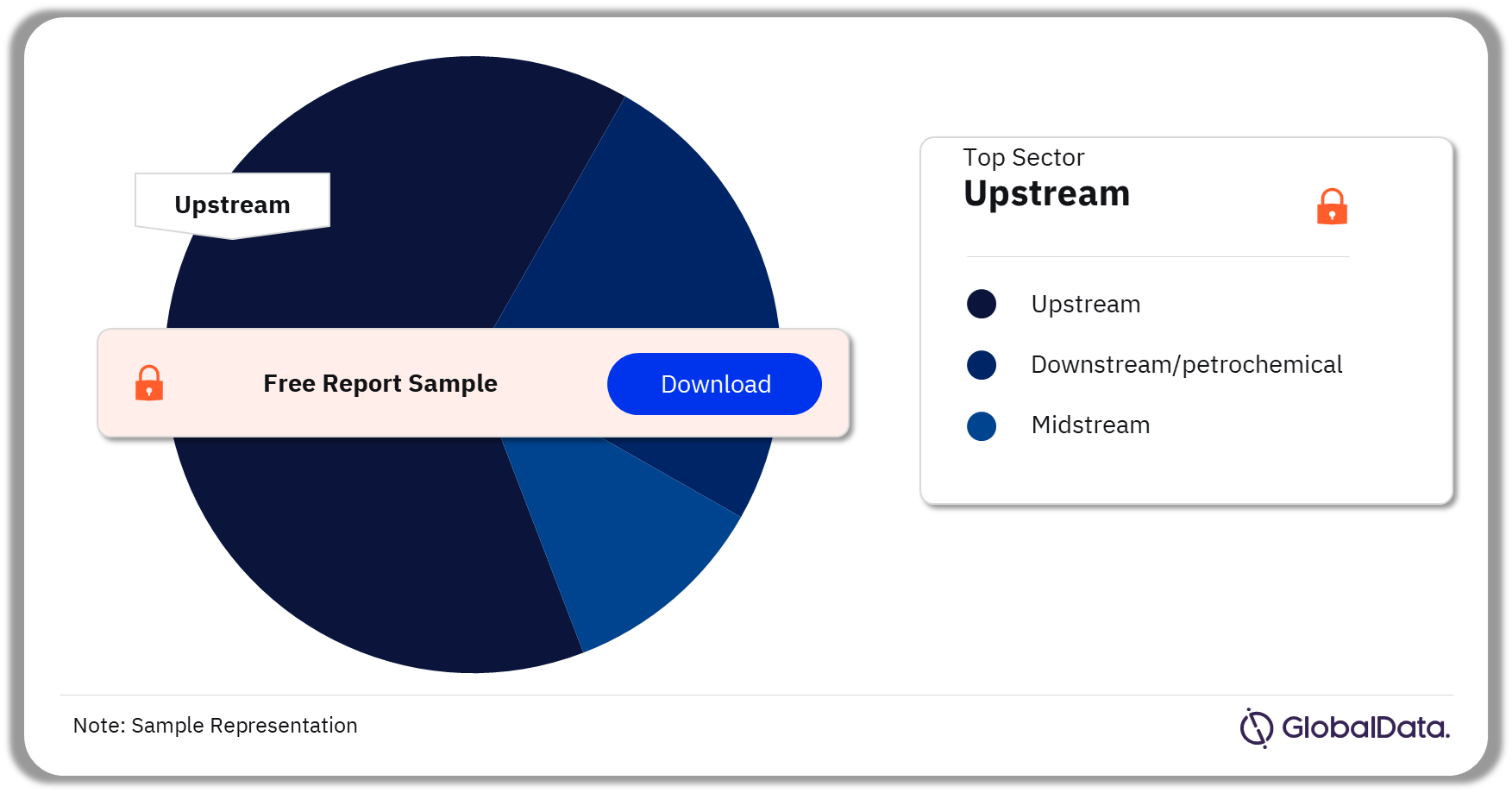

Oil and Gas Industry Contracts Segmentation by Sectors

The key sectors in the oil and gas industry contracts are upstream, downstream/petrochemical, and midstream. The upstream sector dominated the industry contracts landscape in Q4 2023.

Oil and Gas Industry Contracts Analysis by Sectors, Q4 2023 (%)

Buy the Full Report for More Sector Insights into Oil and Gas Industry Contracts

Oil and Gas Industry Contracts Segmentation by Regions

The key regions with oil and gas industry contracts are Asia, Europe, Africa, South America, the Middle East, North America, and Oceania. Europe recorded most of the contracts in Q4 2023, followed by North America and Asia.

Oil and Gas Industry Contracts Analysis by Regions, Q4 2023 (%)

Buy the Full Report for More Region Insights into Oil and Gas Industry Contracts

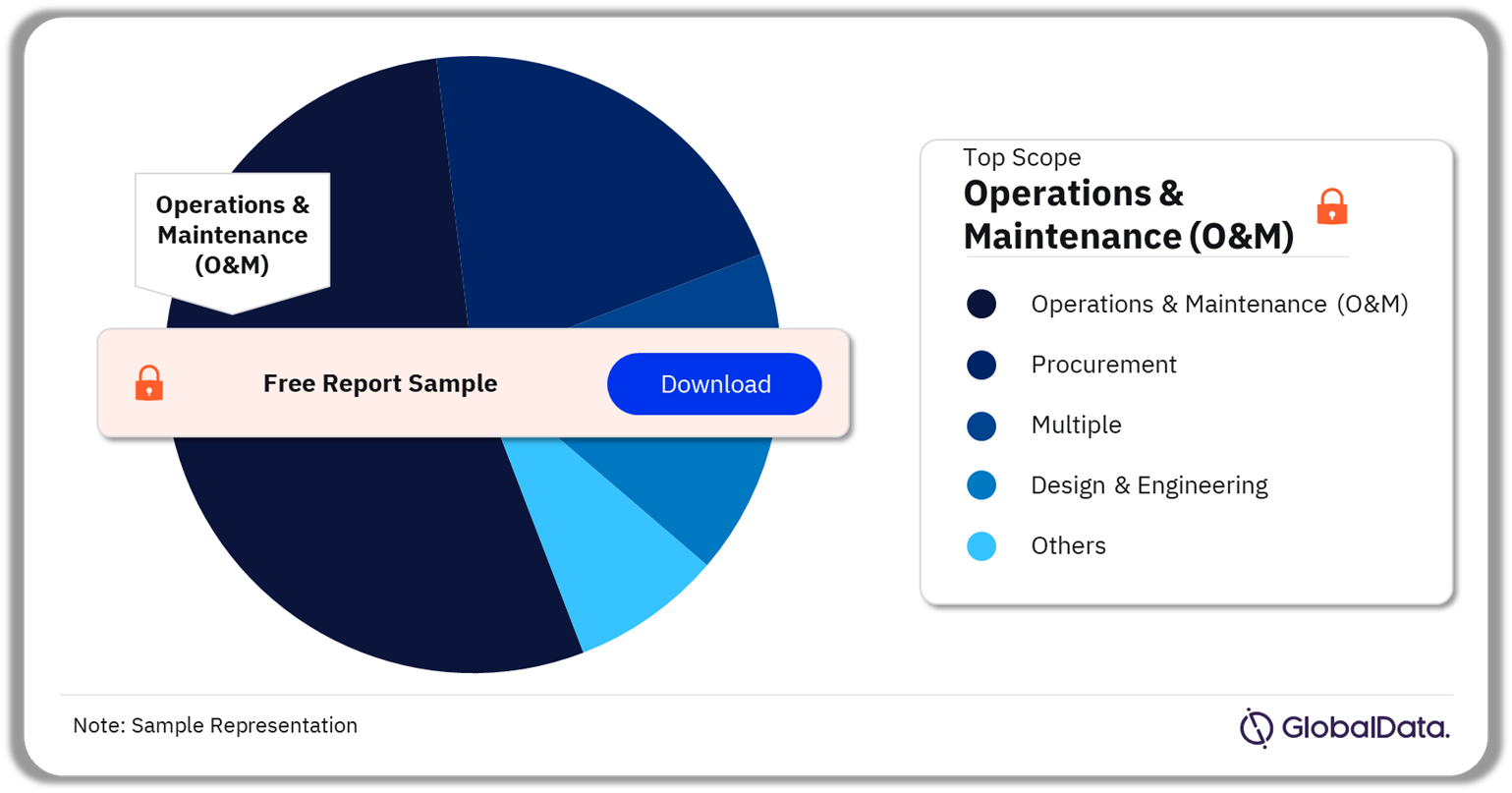

Oil and Gas Industry Contracts Segmentation by Scope

The key scope for oil and gas industry contracts are operations & maintenance (O&M), procurement, multiple, design & engineering, construction and installation, and asset retirement. In Q4 2023, operations & maintenance (O&M) recorded the maximum number of contracts.

Oil and Gas Industry Contracts Analysis by Scope, Q4 2023 (%)

Buy the Full Report for More Scope Insights into Oil and Gas Industry Contracts

Oil and Gas Industry Contracts - Contractors & Issuers

The primary contractors associated with oil and gas industry contracts are Saipem, HD Hyundai, National Marine Dredging Co, Marie Tecnimont and Technip Energies Consolidated Contractors among others. In Q4 2023, Saipem accounted for the highest share of the oil and gas industry contracts landscape in terms of value.

The key issuers associated with oil and gas industry contracts are ADNOC, Saudi Aramco, QatarEnergy , ENI and Total Energies among others.

Oil and Gas Industry Contracts Analysis by Contractors, Q4 2023 (%)

Buy the Full Report for More Contractors & Issuers Insights into Oil and Gas Industry Contracts

Oil and Gas Industry Contracts Segmentation by Terrains

The key terrains associated with oil and gas industry contracts are onshore, deep water, and offshore. In Q4 2023, onshore terrains accounted for the market’s highest share in the oil and gas industry contracts landscape.

Oil and Gas Industry Contracts Analysis by Terrains, Q4 2023 (%)

Buy the Full Report for More Terrains Insights into Oil and Gas Industry Contracts

Segments Covered in the Report

Oil and Gas Industry Contracts Sectors Outlook (Q4 2023)

- Upstream

- Downstream/petrochemical

- Midstream

Oil and Gas Industry Contracts Regional Outlook (Q4 2023)

- Asia

- Europe

- Africa

- South America

- Middle East

- North America

- Oceania

Oil and Gas Industry Contracts Regional Outlook (Q4 2023)

- Operations & Maintenance (O&M)

- Procurement

- Multiple

- Design & Engineering

- Construction and Installation

- Asset Retirement

Oil and Gas Industry Contracts Terrain Outlook (Q4 2023)

- Onshore

- Onshore/offshore

- Offshore

Scope

The report provides:

- Analysis of oil and gas contracts in the global arena.

- Review of contracts in the upstream sector – exploration and production, midstream sector – pipeline, transportation, storage, and processing, and in the downstream refining and marketing, and petrochemical sector.

- Information on the top awarded contracts by sector that took place in the oil and gas industry.

- Analysis of contracts in multiple regions including North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa.

- Summary of top contractors in the oil and gas industry over the past 12 months subdivided by the sectors.

- Summary of top issuers in the oil and gas industry over the past 12 months subdivided by the sectors.

Reasons to Buy

- Enhance your decision-making capability in a more rapid and time-sensitive manner.

- Identify the major contracts-focused sectors for investments in your industry.

- Understand the contract activity in the oil and gas industry.

- Evaluate the type of services offered by key contractors.

- Identify growth sectors and regions wherein contract opportunities are more lucrative.

- Look for key contractors/issuers if you are looking to award a contract or are interested in contract activity within the oil and gas industry.

Table of Contents

Table

Figures

Frequently asked questions

-

Which was the leading sector among oil and gas industry contracts in Q4 2023?

The upstream sector dominated the oil and gas industry contracts landscape in Q4 2023.

-

Which was the region with the leading number of oil and gas industry contracts in Q4 2023?

Europe was the leading region globally with the highest number of oil and gas industry contracts in Q4 2023.

-

Which was the leading terrain associated with oil and gas industry contracts in Q4 2023?

In Q4 2023, the majority of the oil and gas industry contracts were awarded to onshore terrain.

-

Which are the key contractors associated with oil and gas industry contracts?

The primary contractors associated with oil and gas industry contracts Saipem, HD Hyundai, National Marine Dredging Co, Marie Tecnimont, Technip Energies Consolidated Contractors among others.

-

Which are the key issuers associated with oil and gas industry contracts?

The key issuers associated with oil and gas industry contracts are ADNOC, Saudi Aramco, QatarEnergy , ENI, Total Energies among among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.