1. Introduction 12

1.1 What is this Report About? 12

1.2 Market Definition 12

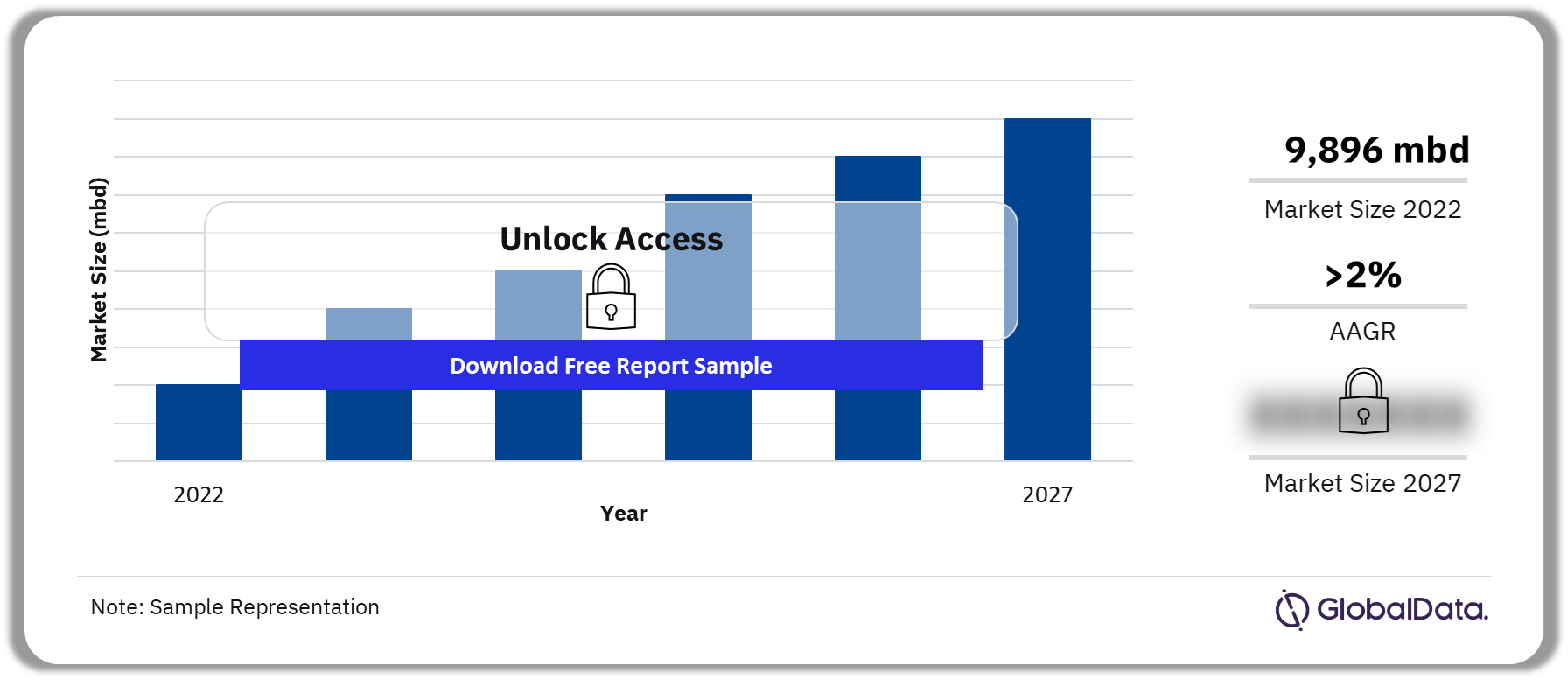

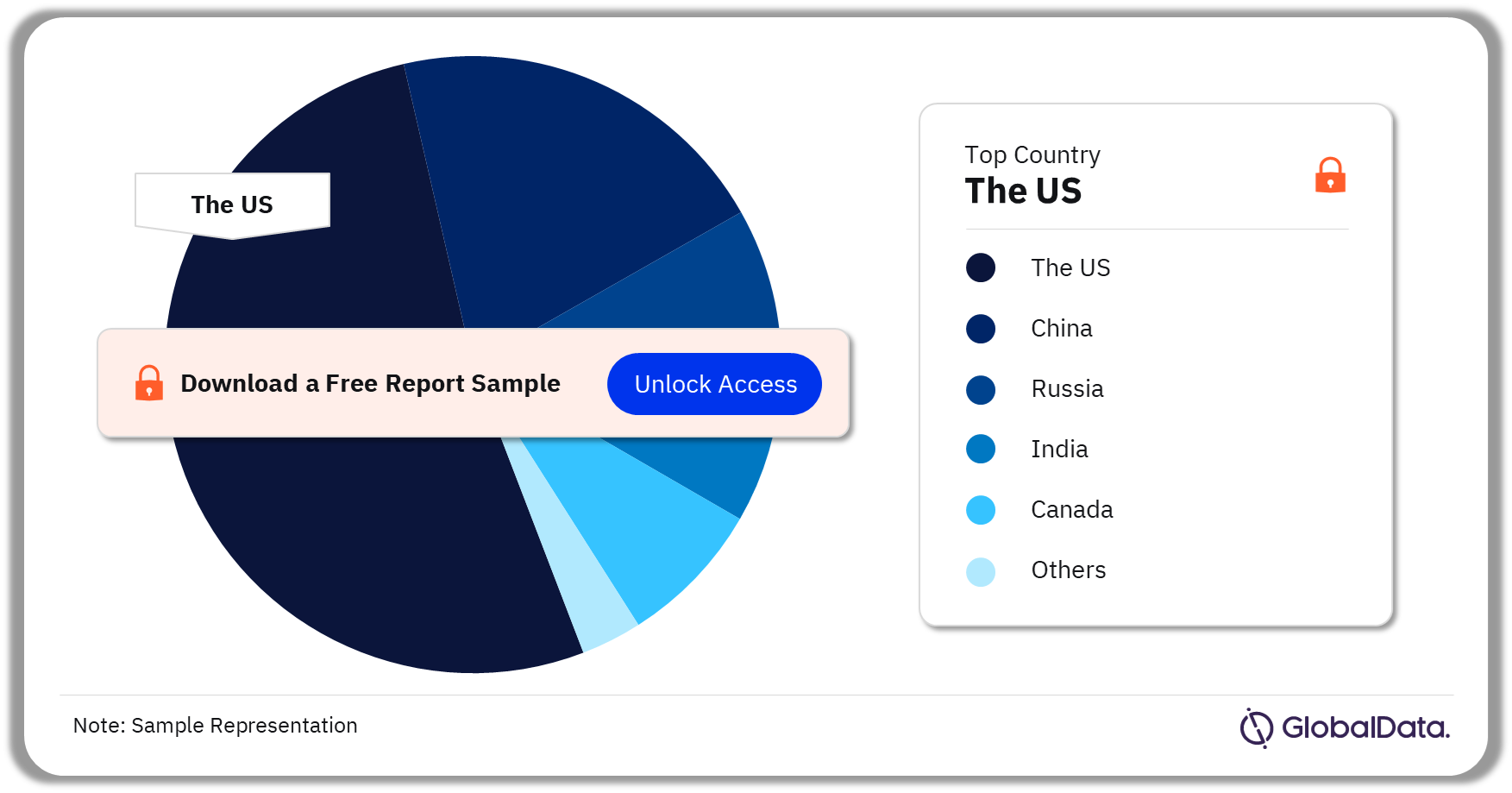

2. Global Refinery Coking Units, Snapshot 13

2.1 Global Refinery Coking Units, Key Data, 2022 13

Global Refinery Coking Units Capacity by Key Countries, 2017–2027 13

2.2 Global Refinery Coking Units, Planned and Announced Coking Units 15

Global Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for Coking Units 16

Global Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for Coking Units by Key Countries 17

2.3 Global Refinery Coking Units, New Coking Units and Capacity Expansions by Region 18

Global Refinery Coking Units, Coking Capacity Additions Through New and Existing Refinery Expansions by Region, 2023–2027 18

Global Refinery Coking Units, Coking Units Capacity Additions Through New Refineries by Region, 2023–2027 18

Global Refinery Coking Units, Coking Units Capacity Additions Existing Refinery Expansions by Region, 2023–2027 19

2.4 Global Refinery Coking Units, Regional Comparisons 20

Global Refinery Coking Units, Regional Comparison Based on Contribution to Global Coking Units Capacity, 2017–2027 20

3. Africa Refinery Coking Units 21

3.1 Africa Refinery Coking Units, Snapshot 21

Africa Refinery Coking Units, Key Data, 2022 21

Africa Refinery Coking Units Capacity by Key Countries, 2017–2027 22

3.2 Africa Refinery Coking Units, Planned and Announced Coking Units, Capacity Expansions and Capex by Country 23

Africa Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for Coking Units 24

Africa Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for Coking Units by Key Countries 25

3.3 Africa Refinery Coking Units, New Coking Units and Capacity Expansions by Key countries 26

Africa Refinery Coking Units, Coking Units Capacity Additions Through New Refineries by Key Countries, 2023–2027 26

3.4 Africa Refinery Coking Units, Egypt 27

Refinery Coking Units in Egypt, Coking Unit Capacity, 2017–2027 27

3.5 Africa Refinery Coking Units, Sudan 27

Refinery Coking Units in Sudan, Coking Unit Capacity, 2017–2027 27

4. Asia Refinery Coking Units 28

4.1 Asia Refinery Coking Units, Snapshot 28

Asia Refinery Coking Units, Key Data, 2022 28

Asia Refinery Coking Units Capacity by Key Countries, 2017–2027 29

4.2 Asia Refinery Coking Units, Planned and Announced Coking Units, Capacity Expansions and Capex by Country 30

Asia Refinery Coking Units, Planned and Announced Coking Units, 2023–2027 30

Asia Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for Coking Units 31

Asia Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for coking Units by Key Countries 32

4.3 Asia Refinery Coking Units, New Coking Units and Capacity Expansions by Key countries 33

Asia Refinery Coking Units, Coking Units Capacity Additions Through New and Existing Refinery Expansions by Key Countries, 2023–2027 33

Asia Refinery Coking Units, Coking Units Capacity Additions Through New Refineries by Key Countries, 2023–2027 33

Asia Refinery Coking Units, Coking Units Capacity Additions Existing Refinery Expansions by Countries, 2023–2027 34

4.4 Asia Refinery Coking Units, China 35

Refinery Coking Units in China, Coking Unit Capacity, 2017–2027 35

4.5 Asia Refinery Coking Units, India 41

Refinery Coking Units in India, Coking Unit Capacity, 2017–2027 41

4.6 Asia Refinery Coking Units, Japan 42

Refinery Coking Units in Japan, Coking Unit Capacity, 2017–2027 42

4.7 Asia Refinery Coking Units, South Korea 42

Refinery Coking Units in South Korea, Coking Unit Capacity, 2017–2027 42

4.8 Asia Refinery Coking Units, Philippines 43

Refinery Coking Units in Philippines, Coking Unit Capacity, 2017–2027 43

4.9 Asia Refinery Coking Units, Taiwan 43

Refinery Coking Units in Taiwan, Coking Unit Capacity, 2017–2027 43

4.10 Asia Refinery Coking Units, Indonesia 43

Refinery Coking Units in Indonesia, Coking Unit Capacity, 2017–2027 43

4.11 Asia Refinery Coking Units, Brunei 44

Refinery Coking Units in Brunei, Coking Unit Capacity, 2017–2027 44

4.12 Asia Refinery Coking Units, Malaysia 44

Refinery Coking Units in Malaysia, Coking Unit Capacity, 2017–2027 44

4.13 Asia Refinery Coking Units, Myanmar 44

Refinery Coking Units in Myanmar, Coking Unit Capacity, 2017–2027 44

5. Caribbean Refinery Coking Units 45

5.1 Caribbean Refinery Coking Units, Snapshot 45

Caribbean Refinery Coking Units, Key Data, 2022 45

Caribbean Refinery Coking Units Capacity by Key Countries, 2017–2027 46

5.2 Caribbean Refinery Coking Units, Aruba 47

Refinery Coking Units in Aruba, Coking Unit Capacity, 2017–2027 47

5.3 Caribbean Refinery Coking Units, U.S. Virgin Islands 47

Refinery Coking Units in U.S. Virgin Islands, Coking Unit Capacity, 2017–2027 47

6. Europe Refinery Coking Units 48

6.1 Europe Refinery Coking Units, Snapshot 48

Europe Refinery Coking Units, Key Data, 2022 48

Europe Refinery Coking Units Capacity by Key Countries, 2017–2027 49

6.2 Europe Refinery Coking Units, Planned and Announced Coking Units, Capacity Expansions and Capex by Country 50

Europe Refinery Coking Units, Planned and Announced Coking Units, 2023–2027 50

Europe Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for Coking Units 51

Europe Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for Coking Units by Key Countries 52

6.3 Europe Refinery Coking Units, New Coking Units and Capacity Expansions by Key countries 53

Europe Refinery Coking Units, Coking Units Capacity Additions Existing Refinery Expansions by Countries, 2023–2027 53

6.4 Europe Refinery Coking Units, Spain 54

Refinery Coking Units in Spain, Coking Unit Capacity, 2017–2027 54

6.5 Europe Refinery Coking Units, Germany 54

Refinery Coking Units in Germany, Coking Unit Capacity, 2017–2027 54

6.6 Europe Refinery Coking Units, United Kingdom 55

Refinery Coking Units in United Kingdom, Coking Unit Capacity, 2017–2027 55

6.7 Europe Refinery Coking Units, Romania 55

Refinery Coking Units in Romania, Coking Unit Capacity, 2017–2027 55

6.8 Europe Refinery Coking Units, Belgium 56

Refinery Coking Units in Belgium, Coking Unit Capacity, 2017–2027 56

6.9 Europe Refinery Coking Units, Netherlands 56

Refinery Coking Units in Netherlands, Coking Unit Capacity, 2017–2027 56

6.10 Europe Refinery Coking Units, Denmark 57

Refinery Coking Units in Denmark, Coking Unit Capacity, 2017–2027 57

6.11 Europe Refinery Coking Units, Norway 57

Refinery Coking Units in Norway, Coking Unit Capacity, 2017–2027 57

6.12 Europe Refinery Coking Units, Poland 57

Refinery Coking Units in Poland, Coking Unit Capacity, 2017–2027 57

6.13 Europe Refinery Coking Units, Hungary 58

Refinery Coking Units in Hungary, Coking Unit Capacity, 2017–2027 58

6.14 Europe Refinery Coking Units, Portugal 58

Refinery Coking Units in Portugal, Coking Unit Capacity, 2017–2027 58

6.15 Europe Refinery Coking Units, Sweden 58

Refinery Coking Units in Sweden, Coking Unit Capacity, 2017–2027 58

6.16 Europe Refinery Coking Units, Serbia 59

Refinery Coking Units in Serbia, Coking Unit Capacity, 2017–2027 59

6.17 Europe Refinery Coking Units, Albania 59

Refinery Coking Units in Albania, Coking Unit Capacity, 2017–2027 59

6.18 Europe Refinery Coking Units, Croatia 59

Refinery Coking Units in Croatia, Coking Unit Capacity, 2017–2027 59

7. Former Soviet Union Refinery Coking Units 60

7.1 Former Soviet Union Refinery Coking Units, Snapshot 60

Former Soviet Union Refinery Coking Units, Key Data, 2022 60

Former Soviet Union Refinery Coking Units Capacity by Key Countries, 2017–2027 61

7.2 Former Soviet Union Refinery Coking Units, Planned and Announced Coking Units, Capacity Expansions and Capex by Country 62

Former Soviet Union Refinery Coking Units, Planned and Announced Coking Units, 2023–2027 62

Former Soviet Union Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for Coking Units 63

Former Soviet Union Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for Coking Units by Key Countries 64

7.3 Former Soviet Union Refinery Coking Units, New Coking Units and Capacity Expansions by Key countries 65

Former Soviet Union Refinery Coking Units, Coking Units Capacity Additions Existing Refinery Expansions by Countries, 2023–2027 65

7.4 Former Soviet Union Refinery Coking Units, Russia 66

Refinery Coking Units in Russia, Coking Unit Capacity, 2017–2027 66

7.5 Former Soviet Union Refinery Coking Units, Turkmenistan 67

Refinery Coking Units in Turkmenistan, Coking Unit Capacity, 2017–2027 67

7.6 Former Soviet Union Refinery Coking Units, Kazakhstan 67

Refinery Coking Units in Kazakhstan, Coking Unit Capacity, 2017–2027 67

7.7 Former Soviet Union Refinery Coking Units, Azerbaijan 68

Refinery Coking Units in Azerbaijan, Coking Unit Capacity, 2017–2027 68

7.8 Former Soviet Union Refinery Coking Units, Belarus 68

Refinery Coking Units in Belarus, Coking Unit Capacity, 2017–2027 68

7.9 Former Soviet Union Refinery Coking Units, Uzbekistan 68

Refinery Coking Units in Uzbekistan, Coking Unit Capacity, 2017–2027 68

8. Middle East Refinery Coking Units 69

8.1 Middle East Refinery Coking Units, Snapshot 69

Middle East Refinery Coking Units, Key Data, 2022 69

Middle East Refinery Coking Units Capacity by Key Countries, 2017–2027 70

8.2 Middle East Refinery Coking Units, Planned and Announced Coking Units, Capacity Expansions and Capex by Country 71

Middle East Refinery Coking Units, Planned and Announced Coking Units, 2023–2027 71

Middle East Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for Coking Units 72

Middle East Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for Coking Units by Key Countries 73

8.3 Middle East Refinery Coking Units, New Coking Units and Capacity Expansions by Key countries 74

Middle East Refinery Coking Units, Coking Units Capacity Additions Through New Refineries by Key Countries, 2023–2027 74

8.4 Middle East Refinery Coking Units, Saudi Arabia 75

Refinery Coking Units in Saudi Arabia, Coking Unit Capacity, 2017–2027 75

8.5 Middle East Refinery Coking Units, Turkey 75

Refinery Coking Units in Turkey, Coking Unit Capacity, 2017–2027 75

8.6 Middle East Refinery Coking Units, Kuwait 76

Refinery Coking Units in Kuwait, Coking Unit Capacity, 2017–2027 76

8.7 Middle East Refinery Coking Units, United Arab Emirates 76

Refinery Coking Units in United Arab Emirates, Coking Unit Capacity, 2017–2027 76

8.8 Middle East Refinery Coking Units, Syria 77

Refinery Coking Units in Syria, Coking Unit Capacity, 2017–2027 77

8.9 Middle East Refinery Coking Units, Oman 77

Refinery Coking Units in Oman, Coking Unit Capacity, 2017–2027 77

8.10 Middle East Refinery Coking Units, Iraq 77

Refinery Coking Units in Iraq, Coking Unit Capacity, 2017–2027 77

9. North America Refinery Coking Units 78

9.1 North America Refinery Coking Units, Snapshot 78

North America Refinery Coking Units, Key Data, 2022 78

North America Refinery Coking Units Capacity by Key Countries, 2017–2027 79

9.2 North America Refinery Coking Units, Planned and Announced Coking Units, Capacity Expansions and Capex by Country 80

North America Refinery Coking Units, Planned and Announced coking Units, 2023–2027 80

North America Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for Coking Units 81

North America Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for Coking Units by Key Countries 82

9.3 North America Refinery Coking Units, New Coking Units and Capacity Expansions by Key countries 83

North America Refinery Coking Units, Coking Units Capacity Additions Through New and Existing Refinery Expansions by Key Countries, 2023–2027 83

North America Refinery Coking Units, Coking Units Capacity Additions Through New Refineries by Key Countries, 2023–2027 83

North America Refinery Coking Units, Coking Units Capacity Additions Existing Refinery Expansions by Countries, 2023–2027 83

9.4 Refinery Coking Units in the US, Gulf Coast (PADD 3) 84

Refinery Coking Units in Gulf Coast, Coking Unit Capacity, 2017–2027 84

9.5 Refinery Coking Units in the US, Midwest (PADD 2) 86

Refinery Coking Units in Midwest, Coking Unit Capacity, 2017–2027 86

9.6 Refinery Coking Units in the US, West Coast (PADD 5) 87

Refinery Coking Units in West Coast, Coking Unit Capacity, 2017–2027 87

9.7 Refinery Coking Units in the US, Rocky Mountain (PADD 4) 88

Refinery Coking Units in Rocky Mountain, Coking Unit Capacity, 2017–2027 88

9.8 Refinery Coking Units in the US, East Coast (PADD 1) 89

Refinery Coking Units in East Coast, Coking Unit Capacity, 2017–2027 89

9.9 North America Refinery Coking Units, Canada 90

Refinery Coking Units in Canada, Coking Unit Capacity, 2017–2027 90

9.10 North America Refinery Coking Units, Mexico 91

Refinery Coking Units in Mexico, Coking Unit Capacity, 2017–2027 91

10. South America Refinery Coking Units 92

10.1 South America Refinery Coking Units, Snapshot 92

South America Refinery Coking Units, Key Data, 2022 92

South America Refinery Coking Units Capacity by Key Countries, 2017–2027 93

10.2 South America Refinery Coking Units, Planned and Announced Coking Units, Capacity Expansions and Capex by Country 94

South America Refinery Coking Units, Planned and Announced Coking Units, 2023–2027 94

South America Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for Coking Units 95

South America Refinery Coking Units, Annual New Build and Expansion Capital Expenditure Outlook for Coking Units by Key Countries 96

10.3 South America Refinery Coking Units, New Coking Units and Capacity Expansions by Key Countries 97

South America Refinery Coking Units, Coking Units Capacity Additions Through New and Existing Refinery Expansions by Key Countries, 2023–2027 97

South America Refinery Coking Units, Coking Units Capacity Additions Through New Refineries by Key Countries, 2023–2027 97

South America Refinery Coking Units, Coking Units Capacity Additions Existing Refinery Expansions by Countries, 2023–2027 97

10.4 South America Refinery Coking Units, Brazil 98

Refinery Coking Units in Brazil, Coking Unit Capacity, 2017–2027 98

10.5 South America Refinery Coking Units, Venezuela 99

Refinery Coking Units in Venezuela, Coking Unit Capacity, 2017–2027 99

10.6 South America Refinery Coking Units, Argentina 99

Refinery Coking Units in Argentina, Coking Unit Capacity, 2017–2027 99

10.7 South America Refinery Coking Units, Colombia 100

Refinery Coking Units in Colombia, Coking Unit Capacity, 2017–2027 100

10.8 South America Refinery Coking Units, Chile 100

Refinery Coking Units in Chile, Coking Unit Capacity, 2017–2027 100

10.9 South America Refinery Coking Units, Peru 101

Refinery Coking Units in Peru, Coking Unit Capacity, 2017–2027 101

11. Appendix 102

11.1 Abbreviations 102

11.2 Status Definition 102

11.3 States by PADD Regions Included in the Report 103

11.4 Methodology 103

Coverage 103

Secondary Research 103

About GlobalData 104

Contact Us 105

![]()