Personal Accident and Health Insurance Market Trends and Analysis by Region, Competitive Landscape, Regulatory Overview and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Personal Accident and Health Insurance (PA&H) Market Report Overview

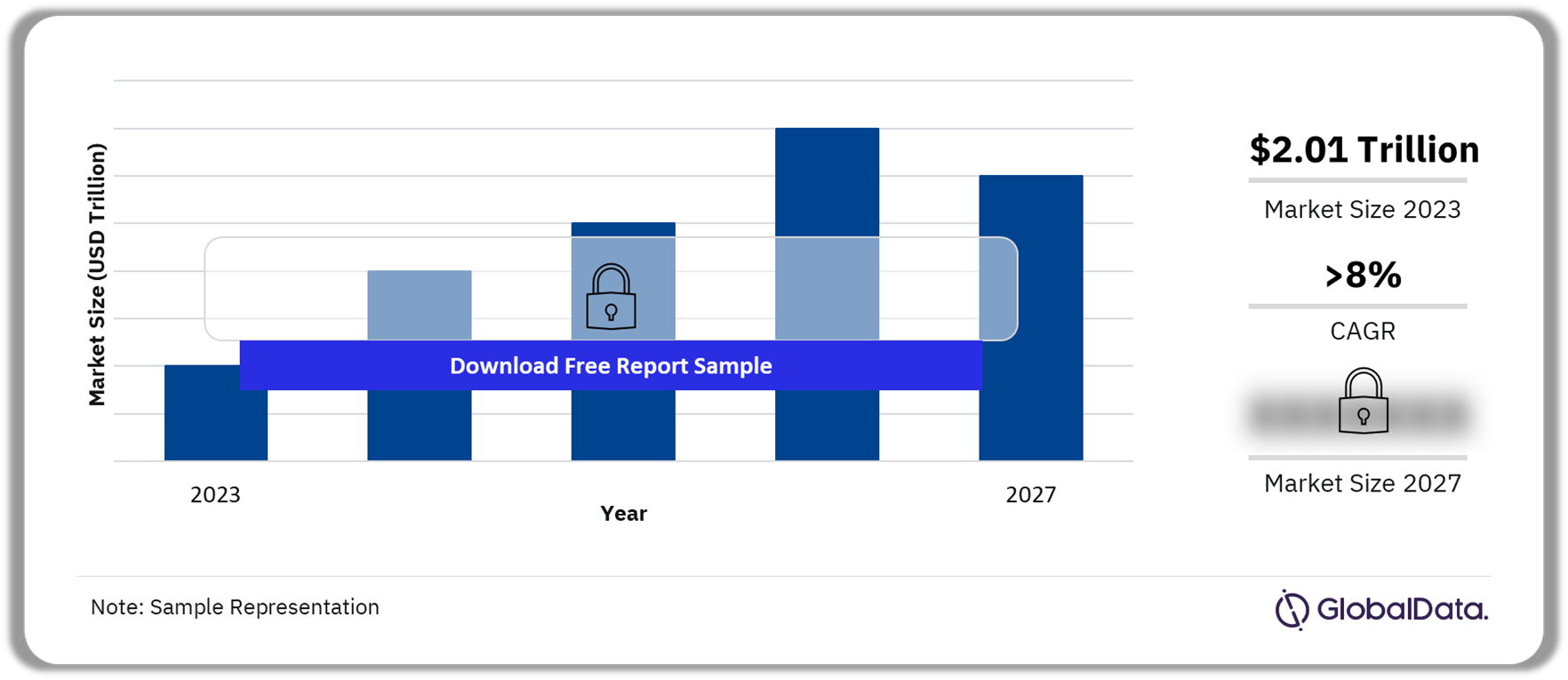

The total written premiums in the personal accident and health (PA&H) insurance industry reached $2.01 trillion in 2022. The PA&H insurance market will grow at a CAGR of more than 8% from 2023 to 2027. The PA&H insurance industry growth during the projected period is mainly attributed to increased awareness, innovation, and inflation in the medical industry.

PA&H Insurance Market Outlook 2022-2027 ($ Trillion)

Buy the Full Report for Additional Insights on the PA&H Market Forecasts, Download a Free Sample Report

The PA&H insurance market analysis report provides in-depth market analysis and actionable insights to achieve desired business growth. Furthermore, the report has documented a comprehensive overview of the global and regional PA&H insurance industry; key lines of business; key trends, drivers, and challenges; regulatory overview; and developments in the industry. Our PA&H insurance market study has also included a meticulous comparative analysis of leading companies and top insurance markets’ premium and profitability trends for every region. These data will help in evaluating the competitive landscape.

| Market Size (2023) | $2.01 trillion |

| CAGR (2023-2027) | >8% |

| Forecast Period | 2023-2027 |

| Historical Period | 2018-2022 |

| Key Trends | · Insurtech

· Inclusive Insurance |

| Key Regions | · North America

· Europe · Asia-Pacific · South and Central America · Middle East and Africa |

| Key Lines of Business | · General Insurance Health/Standalone Health

· General Insurance Personal Accident · Life Health · Life Travel · General Insurance Travel · Life Personal Accident |

| Leading Companies | · UnitedHealth

· Elevance Health · Centene · Humana · CVS Health |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

PA&H Insurance Market Trends

The key trends that will shape the PA&H insurance market during the projected period are growing popularity of inclusive insurance and rising awareness about insurtech.

Insurtech: Insurtech will continue to focus on automation in claims management and customer service. Customers are moving database consisting of doctors and medical institutions accredited by AXA Philippines.

PA&H Insurance Market Segmentation by Regions

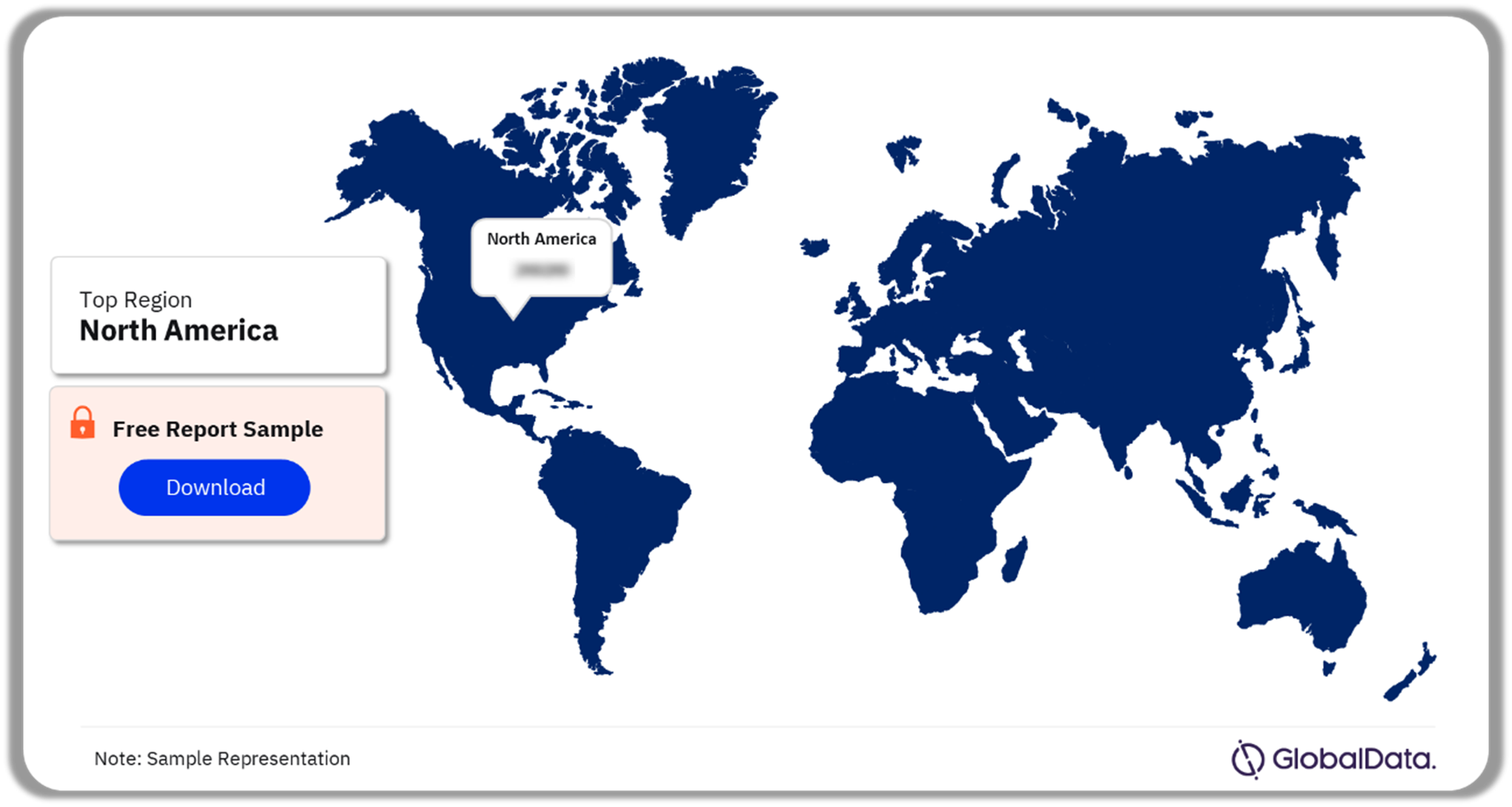

The key regions in the PA&H insurance market are North America, Europe, Asia-Pacific, South and Central America, and the Middle East and Africa. In 2023, North America dominated the PA&H insurance market and accounted for the largest market share. Also, the US was the leading market by written premiums in 2023.

PA&H Insurance Market Analysis by Regions, 2023 (%)

Buy the Full Report for Additional Regional Insights on the PA&H Insurance Market, Download a Free Sample Report

PA&H Insurance Market Segmentation by Lines of Business

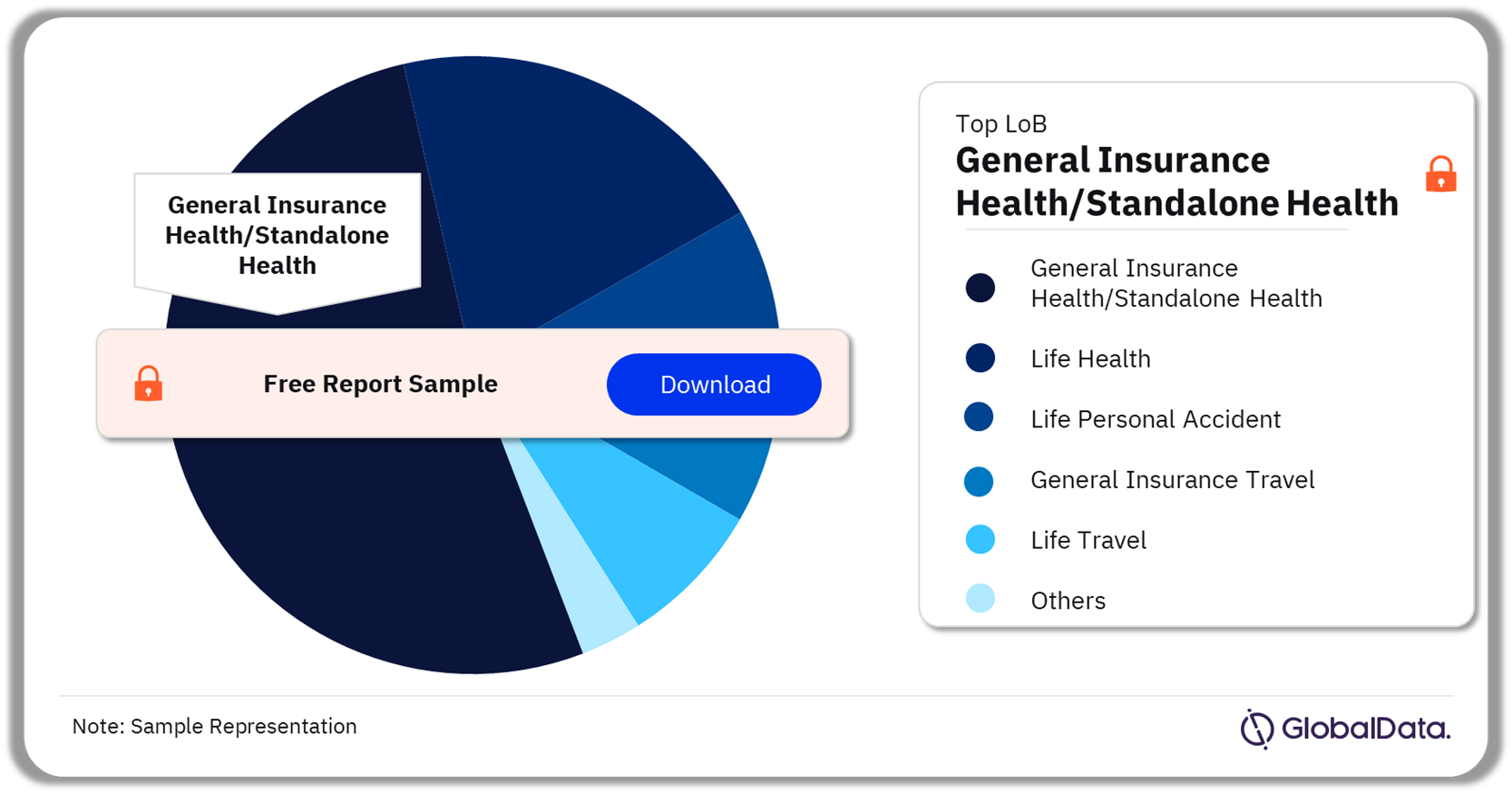

The key lines of business in the PA&H insurance market are general insurance health/standalone health, general insurance personal accident, life health, life travel, general insurance travel, and life personal accident among others. In 2022, general insurance health/standalone health was the leading line of business. The popularity of dental plans, critical illness plans, and auxiliary healthcare-related plans/cash benefits will drive the growth of this LoB in the coming years.

PA&H Insurance Market Analysis by Line of Business, 2023 (%)

Buy the Full Report for Additional LoB Insights on the PA&H Insurance Market, Download a Free Sample Report

PA&H Insurance Market – Competitive Landscape

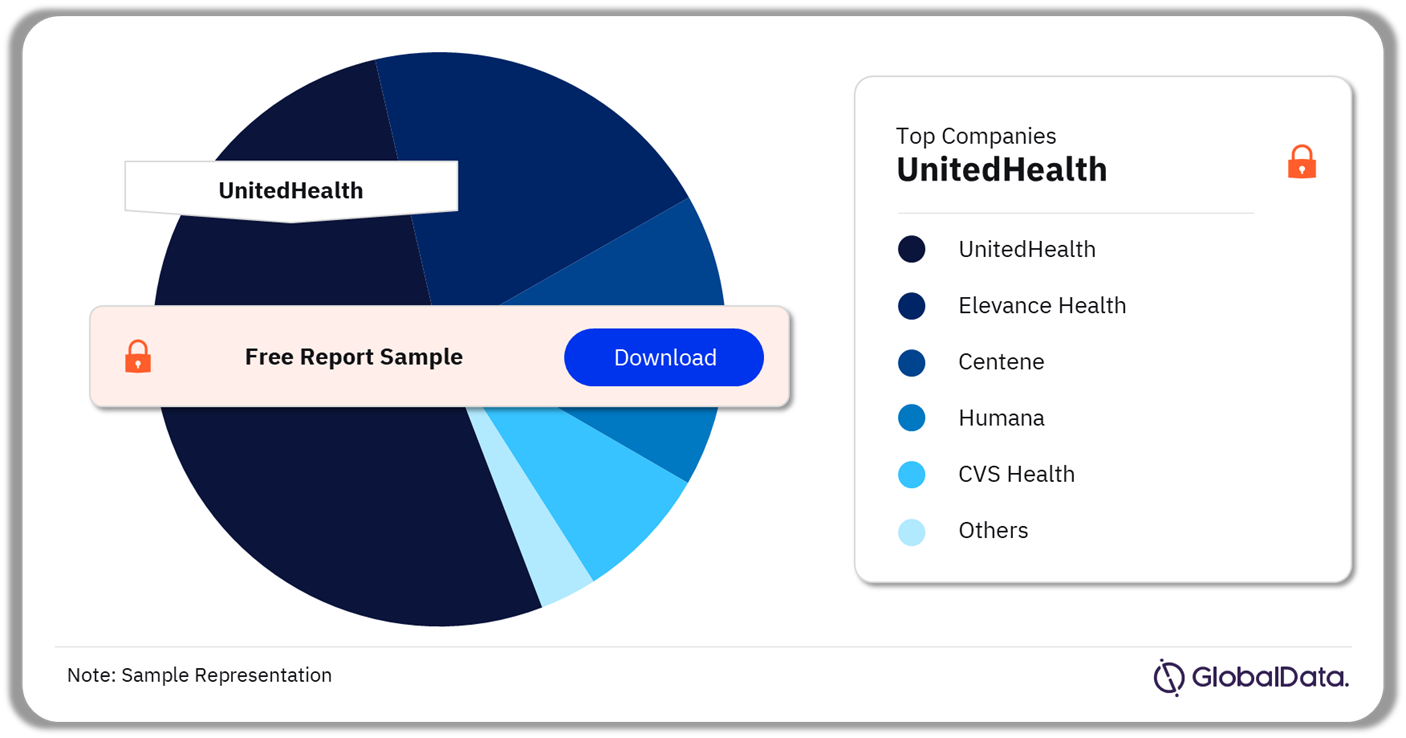

The leading companies in the PA&H insurance market are UnitedHealth, Elevance Health, Centene, Humana, CVS Health, HCSC, Cigna, Ping An, Independence Health, and Molina among others. In 2022, UnitedHealth garnered the highest PA&H insurance market share.

UnitedHealthcare provides the UnitedHealthcare app, which enables policyholders to view, update, and renew their policy details; submit and track claims; access digital medical cards; and locate nearby doctors, clinics, or hospitals. Also, policyholders can use the app to consult doctors 24/7; refill their prescriptions; view copays, annual deductibles, and out-of-pocket expenses; and access medication details and cost estimates for common procedures. Furthermore, in February 2023, the company introduced UnitedHealthcare Rewards. In this scheme, an annual reward of up to $1,000 is offered to eligible members (including spouses) for completing various daily and one-time health activities with the help of wearable devices.

PA&H Insurance Market Analysis by Companies, 2022 (%)

Buy the Full Report for Additional Company-Wise Insights in the PA&H Insurance Market, Download a Free Sample Report

Segments Covered in the Report

PA&H Insurance Regional Outlook (%, 2023)

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

PA&H Insurance LoB Outlook (USD Billion, 2018-2027)

- General Insurance Health/Standalone Health

- General Insurance Personal Accident

- Life Health

- Life Travel

- General Insurance Travel

- Life Personal Accident

Scope

- The report provides a comprehensive analysis of the global PA&H insurance industry.

- It provides historical values for the global and regional PA&H insurance industry for the report’s 2018-22 review period, and projected figures for the forecast period 2023-27.

- It offers a detailed analysis of the regional PA&H insurance industry and market forecasts for 2027.

- It provides key market trends in the global PA&H insurance industry.

- It provides rankings, premiums, and market share of top global and regional PA&H insurers and analyzes the competitive landscape.

Key Highlights

- Key insights and dynamics of the PA&H insurance industry.

- Insights on key market trends in the PA&H insurance industry.

- Insights on key growth and profitability challenges in the PA&H insurance industry.

- Comparative analysis of leading PA&H insurance providers.

- In-depth analysis of regional markets.

- Insight on the future growth trend and market outlook.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to the global and regional PA&H insurance industry.

- In-depth market analysis, information, and insights into the global PA&H insurance industry.

- In-depth analysis of the competitive landscape and top 20 regional markets.

- Understand the key dynamics, trends, and growth opportunities in the global and regional PA&H insurance industry.

- Identify key regulatory developments impacting market growth.

- Identify growth opportunities in key regional markets.

Coöperatie

VGZ

CZ Group

Munich Re

Allianz

Debeka

Menzis

AXA

Generali

Signal Iduna

Mutua Madrilena

Bayern

Sogaz

ASR Nederland

Barmenia

Continentale

Helsana

Swica

HanseMerkur

Bupa

Table of Contents

Frequently asked questions

-

What is the PA&H insurance market gross written premium in 2023?

The gross written premium of the PA&H insurance market is estimated at $2.01 trillion in 2023.

-

What is the growth rate of the PA&H insurance market?

The PA&H insurance is expected to register a CAGR of more than 8% during 2023-2027.

-

Which line of business holds the largest share of the PA&H insurance market?

General Insurance Health/Standalone Health is the leading line of business in the PA&H insurance market in 2023.

-

Which are the key companies operating in the PA&H insurance market?

The leading PA&H insurance market companies are UnitedHealth, Elevance Health, Centene, Humana, CVS Health, HCSC, Cigna, Ping An, Independence Health, and Molina among others among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports