Personal Hygiene Market Opportunities, Trends, Growth Analysis and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Personal Hygiene Market Report Overview

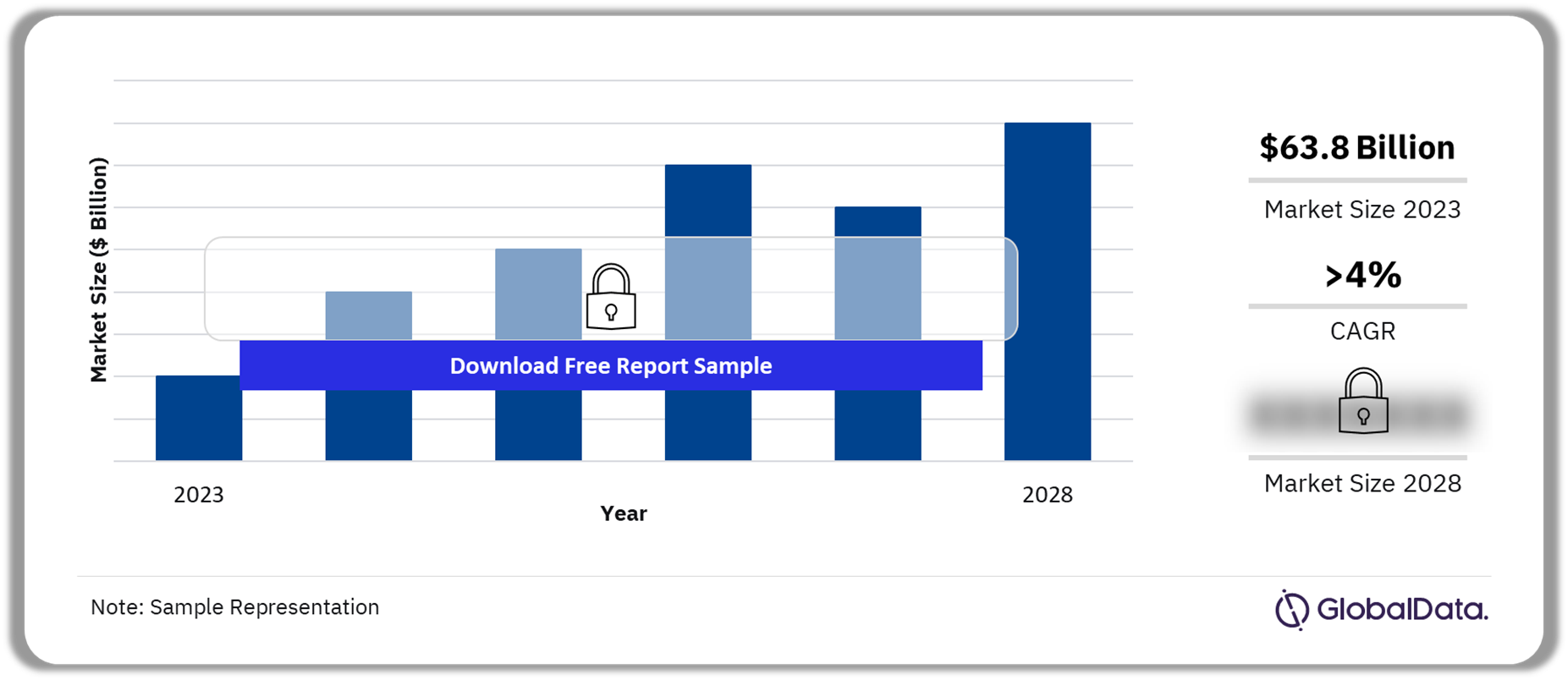

The personal hygiene market size was valued at $63.8 billion in 2023 and is likely to grow at a CAGR of more than 4% from 2023 to 2028. The growing consumer awareness of the importance of personal hygiene, especially during the COVID-19 pandemic, has supported the sector’s sales growth. Natural and plant-based ingredients in personal hygiene products have garnered significant interest, resulting in high demand for products bearing tags such as paraben-free and sulfate-free.

Personal Hygiene Market Outlook 2023-2028 ($ Billion)

Buy the Full Report for the Personal Hygiene Market Forecast

Download a Free Sample Report

The personal hygiene market research report includes a comprehensive overview of the consumption dynamics in the health and beauty industry, including Personal hygiene, for the period 2018-2028. The report covers high-potential countries based on key factors such as economic development, governance, socio-demography, and technological infrastructure to understand future market opportunities. Also, leverage our elaborate list of leading global and regional brands along with their product profile and market shares. Furthermore, our analysts have reviewed the distribution channels and the packaging materials based on volume sales of products, to identify better avenues for market reach and product exposure.

| Market Size (2023) | $63.8 billion |

| CAGR (2023-2028) | >4% |

| Historic Period | 2017-2023 |

| Forecast Period | 2023-2028 |

| Key Categories | · Antiperspirants & deodorants

· Soap · Bath & shower products |

| Key Regions | · The Americas

· Asia-Pacific · Middle East and Africa · Western Europe · Eastern Europe |

| Key Pack Material | · Rigid Plastics

· Flexible Packaging · Rigid Metal · Paper & board · Glass |

| Key Distribution Channels | · Hypermarkets & Supermarkets

· Convenience stores · Health & beauty stores · Department stores · Others |

| Leading Companies | · Unilever

· Colgate-Palmolive Company · Procter & Gamble · Beiersdorf · Henkel |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

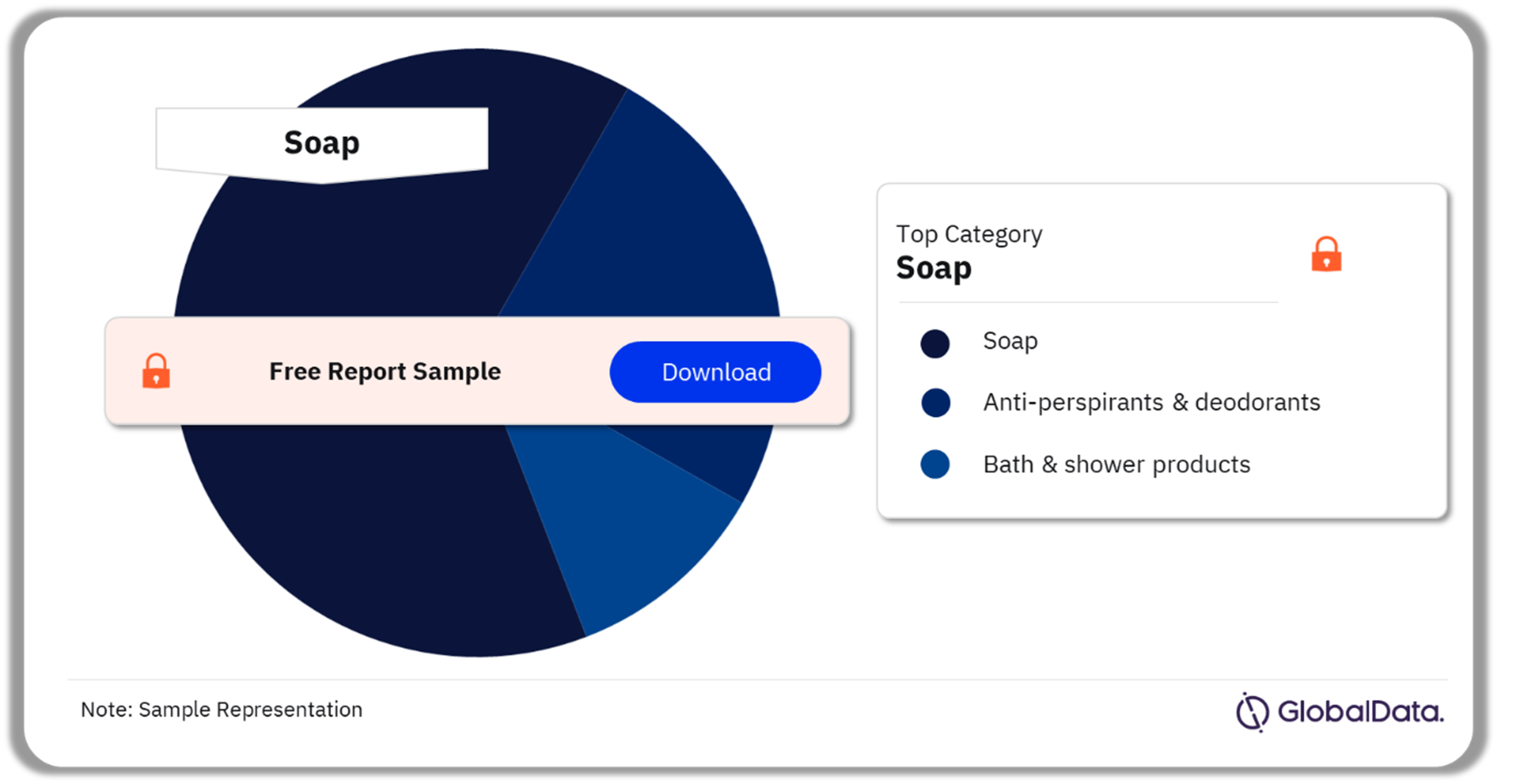

Personal Hygiene Market Segmentation by Category

The key categories in the personal hygiene market are anti-perspirants & deodorants, soap, and bath & shower products. In 2023, the soap category accounted for the highest value sales, followed by anti-perspirants & deodorants.

Personal Hygiene Market Analysis by Category, 2023 (%)

Buy the Full Report for More Insights on Categories in the Personal Hygiene Market

Download a Free Sample Report

Personal Hygiene Market Segmentation by Regions

The key regions in the personal hygiene market are the Americas, Asia-Pacific, the Middle East and Africa, Western Europe, and Eastern Europe. In 2023, Americas accounted for the highest sales in the personal hygiene market. Undoubtedly, the US was the leading market in the region.

Personal Hygiene Market Analysis by Regions, 2023 (%)

Buy the Full Report for More Insights on Regions in the Personal Hygiene Market

Download a Free Sample Report

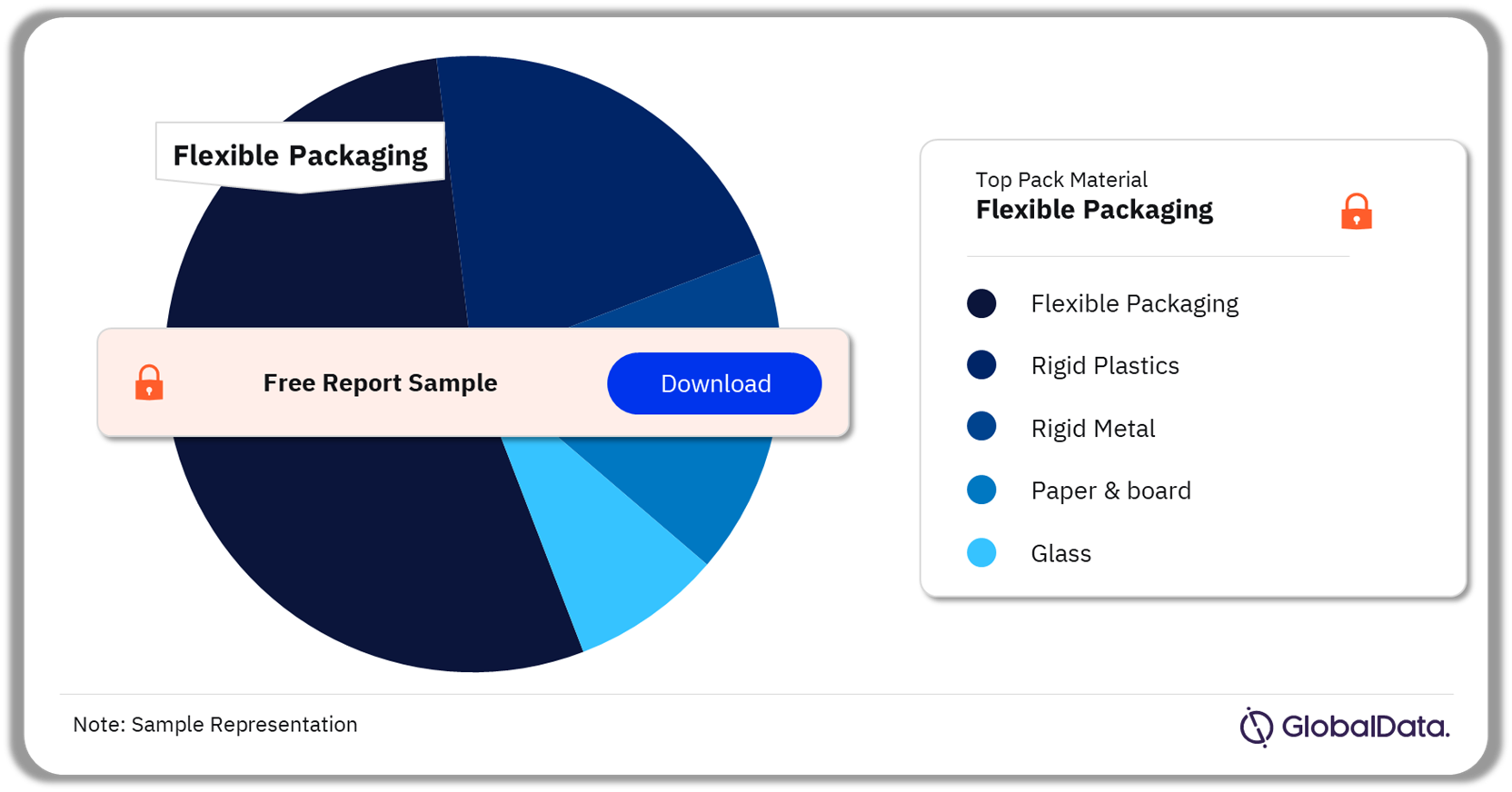

Personal Hygiene Market Segmentation by Pack Materials

The key pack materials in the personal hygiene market are rigid plastics, flexible packaging, rigid metal, paper & board, and glass. In 2023, Flexible packaging emerged as the most used pack material in the Personal hygiene market. Among packaging types, the film pack type was the most used, followed by the bottle.

Personal Hygiene Market Analysis by Pack Materials, 2023 (%)

Buy the Full Report for More Insights on Pack Materials in the Personal Hygiene Market

Download a Free Sample Report

Personal hygiene Market Segmentation by Distribution Channel

The key distribution channels in the personal hygiene market are hypermarkets & supermarkets, convenience stores, health & beauty stores, and department stores among others. In 2023, hypermarkets & supermarkets were the largest distribution channel in the personal hygiene sector, followed by convenience stores.

Personal Hygiene Market Analysis by Distribution Channel, 2023 (%)

Buy the Full Report for More Insights on Distribution Channels in the Personal Hygiene Market

Download a Free Sample Report

Personal Hygiene Market – Competitive Landscape

The key companies in the personal hygiene market are Unilever, Colgate-Palmolive Company, Procter & Gamble, Beiersdorf and Henkel. In 2023, Unilever emerged as the market leader. A few of the key brands of Unilever are Dove, Rexona, Axe, Lux, and Lifebuoy among others.

Personal Hygiene Market Analysis by Companies, 2023 (%)

Buy the Full Report for More Insights on Companies in the Personal Hygiene Market

Download a Free Sample Report

Key Segments Covered in this Report.

Personal hygiene Category Outlook (Value, $ Billion, 2017-2028)

- Anti-perspirants & deodorants

- Soap

- Bath & shower products

Personal Hygiene Distribution Channel Outlook (Value, $ Billion, 2017-2028)

- Hypermarkets & Supermarkets

- Convenience stores

- Health & beauty stores

- Department stores

- Others

Scope

This report brings together multiple data sources to provide a comprehensive overview of the global Personal hygiene sector, analyzing data from 108 countries. It includes an analysis of the following:

- Sector overview: Provides an overview of the current sector scenarios in terms of ingredients, manufacturer claims, labeling, and packaging. The analysis also provides a regional overview across five regions-Asia-Pacific, Middle East and Africa, the Americas, Western Europe, and Eastern Europe-highlighting sector size, growth drivers, the latest developments, and future challenges for each region. This data includes both on-trade and off-trade data.

- Change in consumption: Provides an overview of consumption changes in the overall health and beauty industry, including Personal hygiene products, over 2018-2028 at global and regional levels.

- High-potential countries: Provides risk-reward analysis of the top two high-potential countries in each region based on market assessment, economic development, governance indicators,

sociodemographic factors, and technological infrastructure.

- Country and regional analysis: Provides a deep-dive analysis of 10 high-potential countries covering value growth during 2023-2028, key challenges, consumer demographics, and key trends. It also includes regional analysis covering the future outlook for each region. Market size includes both on-trade and off-trade data, while only off-trade data is used in company and brand analysis, distribution analysis, and packaging analysis.

- Competitive landscape: Provides an overview of the leading brands at global and regional levels. In the next section, the product profile, country-level presence, and market shares of private labels in each region are detailed.

- Key distribution channels: Provides an analysis of the leading distribution channels in the global Personal hygiene sector in 2023. It covers “dollar stores”, variety stores and general merchandise retailers, cash & carries and warehouse clubs, chemists/pharmacies, convenience stores, department stores, direct sellers, e-retailers, health & beauty stores, hypermarkets & supermarkets, para pharmacies/drugstores, and others.

- Packaging analysis: The report provides percentage share (in 2023) and growth analysis (during 2023-2028) for various pack materials, pack types, closures, and primary outer types based on volume sales of Personal hygiene products.

Key Highlights

Due to growing health and wellness concerns among consumers, there has been an increase in demand for natural and plant-based ingredients in personal hygiene products. Consumers are looking for toxin-free ingredients and are avoiding harmful chemicals such as parabens, Sodium laureth sulfate, and sulfates. This has led manufacturers to formulate personal hygiene products using naturally sourced and safe ingredients. Consumers are increasingly opting for products that provide clear information. Therefore, brands are focusing on strengthening their communication on pack labels, to increase safety in product usage.

Reasons to Buy

Manufacturers and retailers seek the latest information on how the market is evolving to formulate their sales and marketing strategies. Also, there is a demand for authentic market data with a high level of detail. Thus, this report has been created to provide you with up-to-date information and analysis to uncover emerging opportunities for growth within the sector in the region. The report provides:

- A detailed analysis of the region and high-potential countries, covering the key challenges, competitive landscape, and demographic analysis, can help companies gain an edge in the market.

- Insights on the key trends that drive consumer choice and the future opportunities that can be explored in the region, that can help companies in revenue expansion.

- Information about leading brands in the sector in the region with details about their market share and growth rates.

Colgate-Palmolive Company

Procter & Gamble

Beiersdorf

Henkel

Table of Contents

Table

Figures

Frequently asked questions

-

What was the personal hygiene market size in 2023?

The personal hygiene market size was estimated at $63.8 billion in 2023.

-

What will the CAGR growth rate of the personal hygiene market during 2023-2028?

The personal hygiene sector is likely to grow at a CAGR of more than 4% from 2023 to 2028.

-

Which was the leading category in the personal hygiene market in 2023?

The soaps category accounted for the highest share of the personal hygiene market in 2023.

-

Which was the dominant distribution channel in the personal hygiene market in 2023?

The hypermarkets & supermarkets emerged as the leading distribution channel in the personal hygiene market in 2023.

-

Which are the key companies in the personal hygiene market?

The key companies in the personal hygiene market are Unilever, Colgate-Palmolive Company, Procter & Gamble, Beiersdorf and Henkel.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.