Personalization in Banking – Thematic Research

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Personalization in Banking Report Overview

Highly personalized interactions are being used by banking and other financial institutions to identify customer preferences and financial needs through notifications, pop-up reminders, and personalized emails to increase customer engagement. Banks that do not offer customized services create a perception among consumers that all banks are the same and treat customers the same; therefore, they risk getting pushed down the value chain. Customized financial products show that the bank is customer centric. Gen Z prefers personalized banking for tips and advice to help stay within budget.

The Personalization in Banking thematic intelligence report identifies priority application areas for personalized banking and the vendors and banks delivering these experiences to end users. It provides an overview of the current landscape, including technology, macroeconomic and regulatory trends, and key players, while highlighting the value chain within the banking industry.

| Report Pages | 37 |

| Regions Covered | Global |

| Key Trends | Technology, Macroeconomic, and Regulatory |

| Value Chains | Product manufacture, Data management and Distribution |

| Leading Financial Service Providers in Personalized Banking | Ally Bank, American Express, ANZ, and CBA among others |

| Leading Technology Providers in Personalized Banking | Alphabet, Apple, Amazon and Earnix |

Personalization in Banking - Key Trends

The main trends shaping Personalization in Banking industry are classified into three categories: technology trends, regulatory trends, and macroeconomic trends.

- Technology trends – The key technology trends impacting personalization in banking include machine learning algorithms, legacy renewal and data consolidation, and personalization standards.

- Macroeconomic trends – The report analyses macroeconomic trends impacting the personalization in banking theme, which include the impact of the COVID-19 pandemic, financial well-being, declining revenue from the fee model as well as the reason personalization is not just about the next best offer.

- Regulatory trends – The report highlights the key regulatory trends impacting the theme, including open banking, data privacy, enhanced consent management, data storage, consent management, tracking tools such as web cookies, financial inclusion, and broader ESG considerations.

For more insights on key trends impacting Personalization in Banking industry, download a free report sample

Personalization in Banking – Industry Analysis

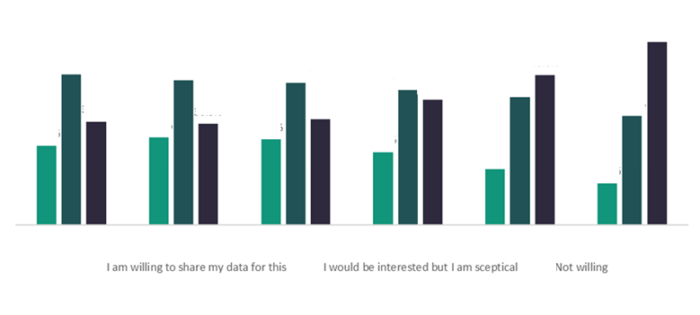

Personalization requires an increased propensity to share data, and only robust data privacy policies implemented by the banks will increase consumer willingness to share personal data. Banks can increase customer comfort levels by segmenting customers by privacy preference rather than assuming a one-size-fits-all policy. Delivering customized financial products also requires considerable strategic focus and investment by incumbent banks.

Different customers often feel differently about which data to share, when to share it, and how. The same customers can feel differently depending on what they get in return, the provider, or the sensitivity of data. Engaging in a personalized way will increase the chance of consent. Institutions can start by building trust around low-risk data types, such as data on product preferences, for example, and then gradually entice customers to share more sensitive data with more meaningful incentives.

The Personalization in Banking market analysis also covers:

- Mergers and acquisitions

- Timeline

For more Personalization in Banking industry analysis, download a free report sample

Personalization in Banking - Value Chain Analysis

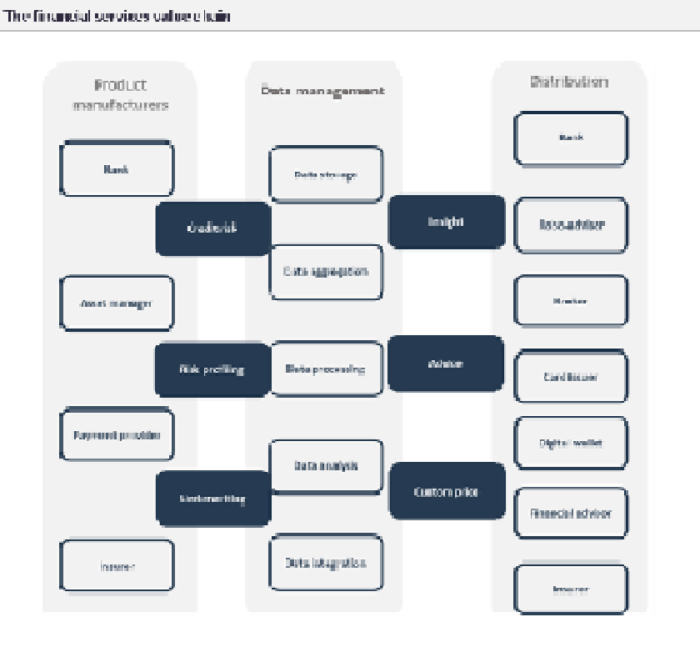

GlobalData’s value chain within banking and investments starts with product manufacture, to data management and ends at distribution through bank’s proprietary channels or various types of third-party platforms.

Product Manufacture:

Product development is a key part of the personalization process. Techniques like customer personas, journey maps, and design thinking help bring customers’ customized financial products. Poor segmentation, whether in products or processes, creates many second-round costs and are also hard to sell.

Financial Services Value Chain

For more insights on the financial service value chain, download a free report sample

Financial Service Providers Associated with Personalization in Banking

Some of the leading players making their mark within the personalization in banking theme:

- Ally Bank

- American Express

- ANZ

- CBA

Technology Providers Associated with Personalization in Banking theme

Some of the leading players making their mark within the personalization in banking theme:

- Alphabet

- Apple

- Amazon

- Earnix

To know more about leading companies associated with Personalization in Banking theme, download a free report sample

Personalization in Banking Overview

| Report Pages | 37 |

| Regions Covered | Global |

| Key Trends | Technology, Macroeconomic, and Regulatory |

| Value Chains | Product manufacture, Data management and Distribution |

| Leading Financial Service Providers in Personalized Banking | Ally Bank, American Express, ANZ, and CBA among others |

| Leading Technology Providers In Personalized Banking | Alphabet, Apple, Amazon and Earnix |

Reasons to Buy

- Understand key technology, macroeconomic, and regulatory trends impacting Personalization in Banking.

- Identity priority application areas for Personalization in Banking as well as the vendors and banks delivering these experiences to end users

- Access firm-level/case-study insight on the leading private and public players within the Personalization theme in Banking.

Apple

Alphabet

Tinkoff Bank

AIB

Capital One

WE Bank

MyBank

Monzo

NatWest/RBS

Danske Bank

DBS

TSB

BBVA

Citibank

mBank

Revolut

Credit Agricole

Barclays

CreditLadder

NovaCredit

Experian

Equifax

TransUnion

Tink

Bud

Plaid

TrueLayer

Cornami

Decentriq

Immuta

Inpher

Statice

Table of Contents

Frequently asked questions

-

What are the key technology trends shaping the Personalization in Banking sector?

The key technology trends impacting Personalization in Banking are machine learning algorithms, legacy renewal and data consolidation, personalization standards, along with trends such as personalization removes complexity of choice, privacy-enhancing technologies, personalization as a service, super apps, real-time personalization, in-branch personalization and remote advisory and chatbot personalization among others.

-

What are the key macroeconomic trends shaping the Personalization in Banking theme?

The macroeconomic trends impacting Personalization in Banking are the impact of COVID-19 pandemic, financial well-being, declining revenue from the fee model as well as why personalization is not just about the next best offer.

-

What are the key regulatory trends shaping the Personalization in Banking industry?

The key regulatory trends impacting Personalization in Banking are open banking, data privacy, enhance consent management, data storage, consent management, tracking tools such as web cookies, financial inclusion and broader ESG consideration.

-

What are the components of Personalization in Banking value chain?

GlobalData’s Personalization in Banking value chain is split into Product manufacture, Data management and Distribution.

-

Which are the leading financial service providers in Personalized Banking?

Some of the leading financial service providers in Personalized Banking making their mark are Ally Bank, American Express, ANZ, and CBA among others.

-

Which are the leading technology providers in Personalized Banking?

Some of the leading financial service providers in Personalized Banking making their mark are Alphabet, Apple, Amazon and Earnix among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports