Peru Construction Market Size, Trend Analysis by Sector, Competitive Landscape and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Peru Construction Market Report Overview

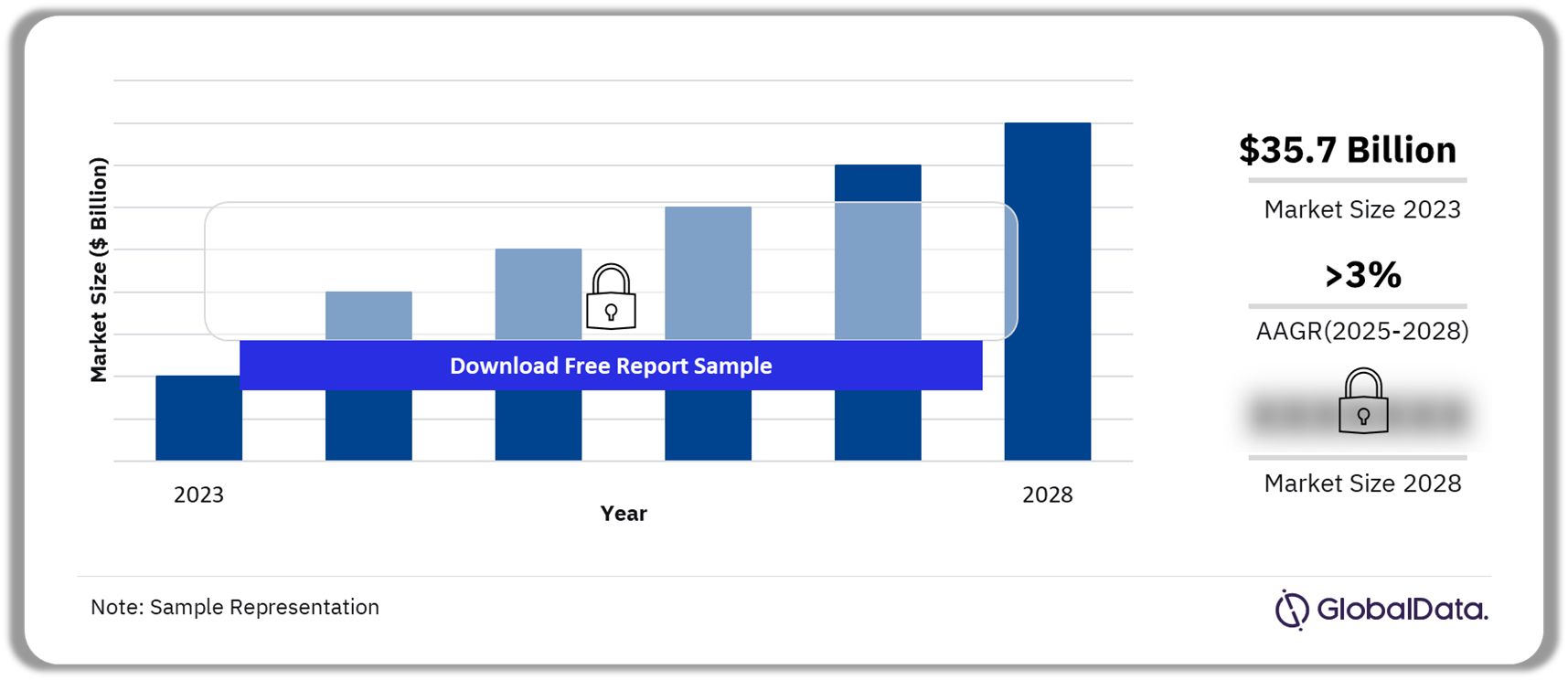

The Peru construction market size was $35.7 billion in 2023. The market will achieve an AAGR of 3% during 2025-2028. The growth is attributed to the rising investment in mining, housing, electricity, and transport infrastructure projects.

Peru Construction Market Outlook, 2023-2028 ($ Billion)

Buy the Full Report to Know More about the Peruvian construction Market Forecast

The Peru construction market research report offers a comprehensive understanding of project types and construction activities in the country. The market report discusses the key sectors in the construction market and their growth drivers. Along with reviewing the details of the construction projects, our analysts have elaborated on emerging trends and assessed key risks and opportunities that will influence the Peru construction market growth in the coming years.

| Market Size (2023) | $35.7 billion |

| AAGR (2025-2028) | 3% |

| Forecast Period | 2025-2028 |

| Historical Period | 2018-2023 |

| Key Sectors | · Commercial Construction

· Industrial Construction · Infrastructure Construction · Energy and Utilities Construction · Institutional Construction · Residential Construction |

| Key Contractors | · Actividades de Construccion y Servicios SA

· Cosapi SA · Webuild SpA · China Communications Construction Group Ltd · COSCO Shipping Ports Ltd · Ecopetrol SA |

| Key Consultants | · GEODATA SpA

· Egis Group · Ghenova Ingenieria SLU · Geocontrol SA · Dohwa Engineering Co Ltd · Sanderink Investments BV |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Peru Construction Market Segmentation by Sectors

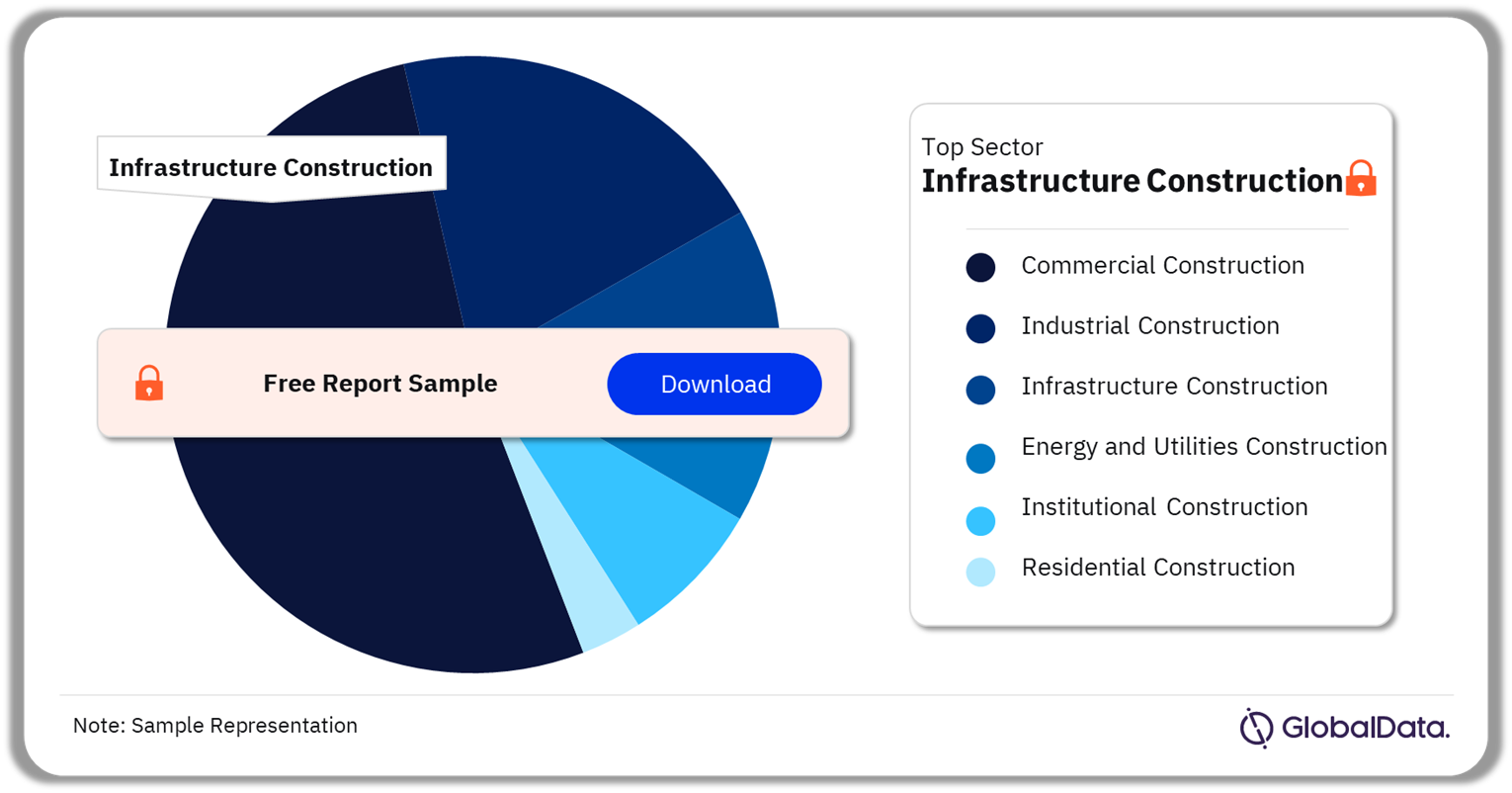

Infrastructure construction was the leading sector in the Peruvian construction market in 2023

The key sectors in the Peru construction market are commercial construction, industrial construction, infrastructure construction, energy and utilities construction, institutional construction, and residential construction. In 2023, the infrastructure construction sector accounted for the highest market share, followed by residential construction.

Infrastructure construction: The project types in this sector include rail infrastructure, road infrastructure, and other infrastructure projects. The government plans to continue its spending on infrastructure projects, with a strong focus on improving regional connectivity through the development of transport infrastructure across the country will support the sector’s growth during the forecast period.

Residential construction: The project types in this sector include single-family housing and multi-family housing. The government’s focus on addressing the housing gap of 1.8 million units as of October 2023 will drive the residential construction industry growth over the forecast period.

Energy and utilities construction: The project types in this sector include electricity and power, oil and gas, telecommunications, sewage infrastructure, and water infrastructure. The ongoing developments in the renewable energy sector to increase the share of renewable energy in the total electricity mix will drive the sector’s growth between 2025 and 2028.

Commercial construction: The project types in this sector include leisure and hospitality buildings, office buildings, outdoor leisure facilities, retail buildings, and other commercial construction. Factors such as growing investment in the construction of office and retail buildings will drive the commercial sector’s growth over the forecast period.

Industrial construction: The project types in this sector include chemical and pharmaceutical plants, manufacturing plants, metal and material production and processing plants, and waste processing plants. Government investment in the manufacturing and mining sectors, coupled with an increase in export activities in the country will drive the sector’s growth during the forecast period.

Institutional construction: The project types in this sector include educational buildings, healthcare buildings, institutional buildings, research facilities, and religious buildings. The government’s focus on developing the health and education sector across the country will fuel the institutional construction business during the forecast period.

Peru Construction Market Analysis by Sectors, 2023 (%)

Buy the Full Report for more Sector Insights into the Peru Construction Market

Peru Construction Market - Competitive Landscape

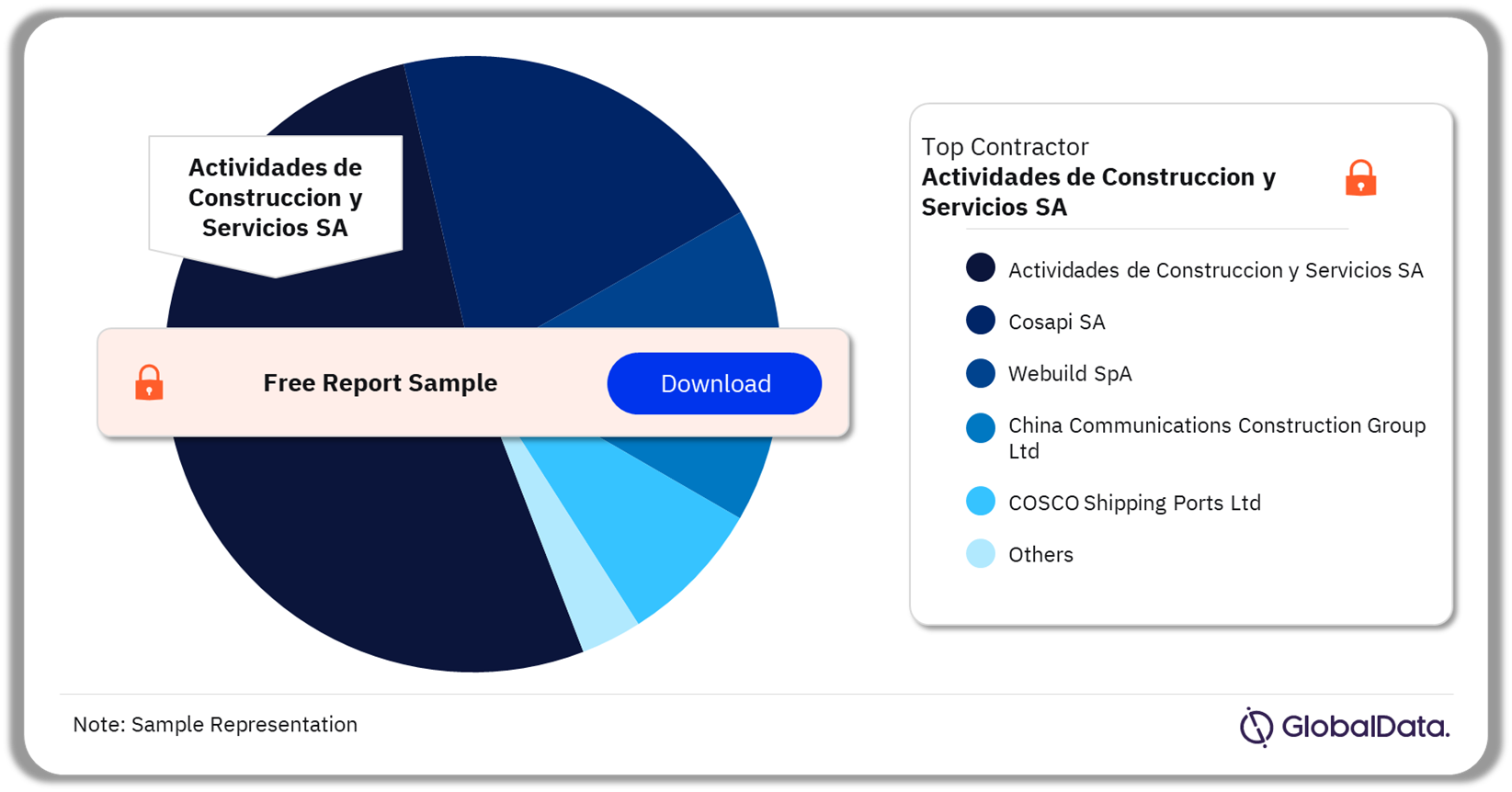

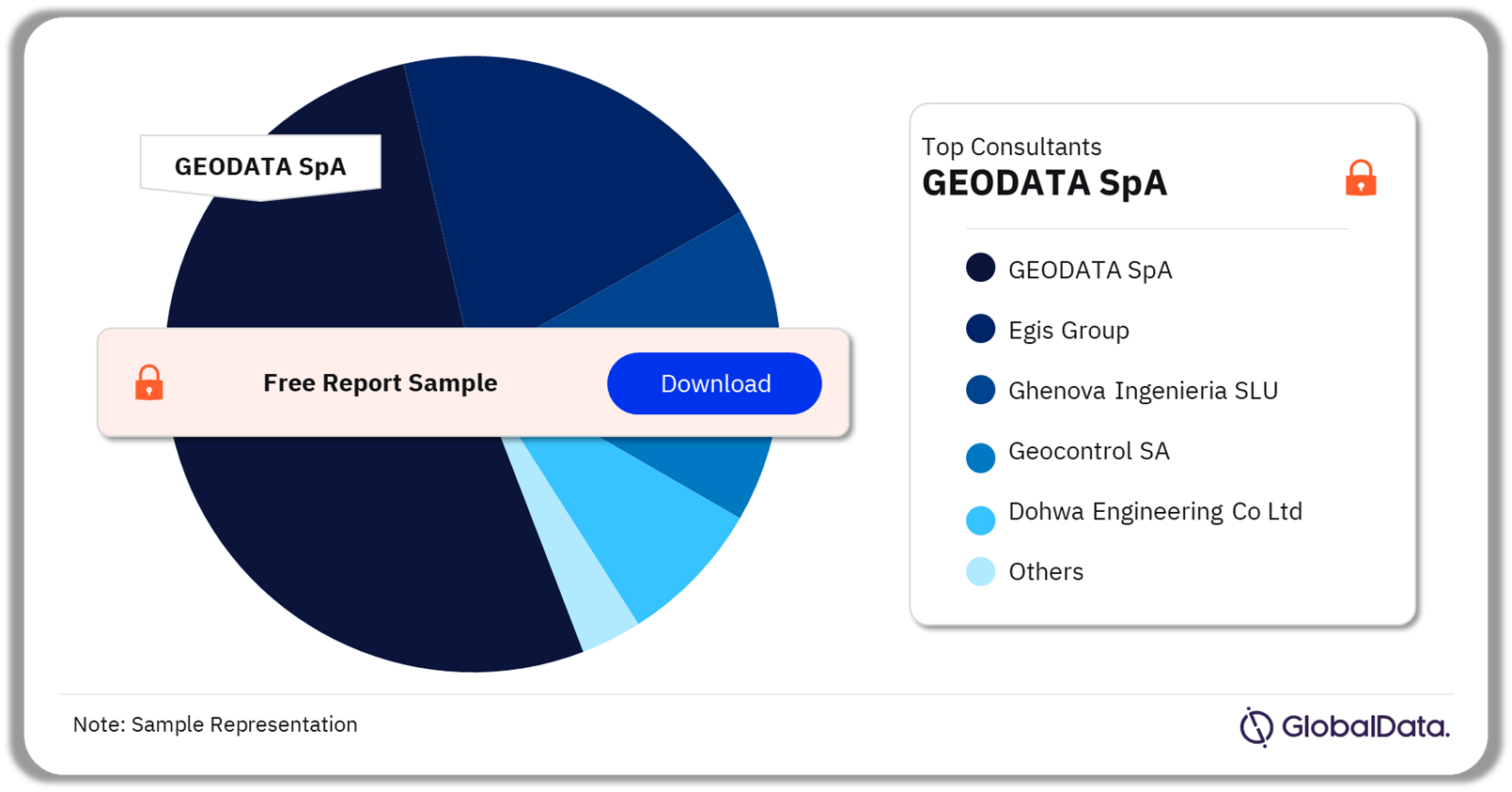

Actividades de Construccion y Servicios SA was the leading contractor and GEODATA SpA was the leading consultant in the Peru construction market in 2023

A few of the leading contractors in the Peru construction market are:

- Actividades de Construccion y Servicios SA

- Cosapi SA

- Webuild SpA

- China Communications Construction Group Ltd

- COSCO Shipping Ports Ltd

- Ecopetrol SA

Foreign contractors account for a majority share of the project pipeline for which a contract has been awarded. Firms based in Spain are the dominant foreign contractors, followed by Italy and Mexico.

Peru Construction Market Analysis by Contractors, 2023 (%)

Buy the Full Report to Know More about the Contractors in the Peru Construction Market

A few of the leading consultants in the Peru construction market are:

- GEODATA SpA

- Egis Group

- Ghenova Ingenieria SLU

- Geocontrol SA

- Dohwa Engineering Co Ltd

- Sanderink Investments BV

Consultants with headquarters outside Peru are involved in 68% of the overall project pipeline by value.

Peru Construction Market Analysis by Consultants, 2023 (%)

Buy the Full Report to Learn More about Consultants in the Peru Construction Market

Peru Construction Market - Latest Developments

- In January 2024, a Spain-based solar company Solarpack, commenced the construction of a 300MW San Martin solar project in Arequipa province. The project is expected to produce 830GWh of electricity annually and will be operational by the second quarter of 2025.

Segments Covered in the Report

Peru Construction Sectors Outlook (Value, $ Billion, 2019-2028)

- Commercial Construction

- Industrial Construction

- Infrastructure Construction

- Energy and Utilities Construction

- Institutional Construction

- Residential Construction

Scope

This report provides:

- A comprehensive analysis of the construction industry in Peru.

- Historical and forecast valuations of the construction industry in Peru, featuring details of key growth drivers.

- Segmentation by sector and by sub-sector.

- Analysis of the mega-project pipeline, including breakdowns by development stage across all sectors and projected spending on projects in the existing pipeline.

- Listings of major projects, in addition to details of leading contractors and consultants.

Reasons to Buy

- Identify and evaluate market opportunities using GlobalData’s standardized valuation and forecasting methodologies.

- Assess market growth potential at a micro-level with over 600 time-series data forecasts.

- Understand the latest industry and market trends.

- Formulate and validate strategy using GlobalData’s critical and actionable insight.

- Assess business risks, including cost, regulatory, and competitive pressures.

- Evaluate competitive risk and success factors.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Peru construction market size in 2023?

The construction market size in Peru was $35.7 billion in 2023.

-

What will the Peru construction market growth rate be during the forecast period?

The construction market in Peru is projected to achieve an AAGR of 3% during 2025-2028.

-

Which was the leading sector in the Peru construction market in 2023?

Infrastructure construction was the leading sector in the Peruvian construction market in 2023.

-

Which are the leading contractors in the Peru construction market?

The leading contractors in the Peru construction market are Actividades de Construccion y Servicios SA, Cosapi SA, Webuild SpA, China Communications Construction Group Ltd, COSCO Shipping Ports Ltd, and Ecopetrol SA among others.

-

Who are the leading consultants in the Peru construction market?

The leading consultants in the Peru construction market are GEODATA SpA, Egis Group, Ghenova Ingenieria SLU, Geocontrol SA, Dohwa Engineering Co Ltd, and Sanderink Investments BV among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.