Peru Copper Mining Market by Reserves and Production, Assets and Projects, Fiscal Regime with Taxes, Royalties and Forecast to 2030

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Empower your strategies with our Peru Copper Mining to 2026 report and make more profitable business decisions.

Peru Copper Mining Market Report Overview

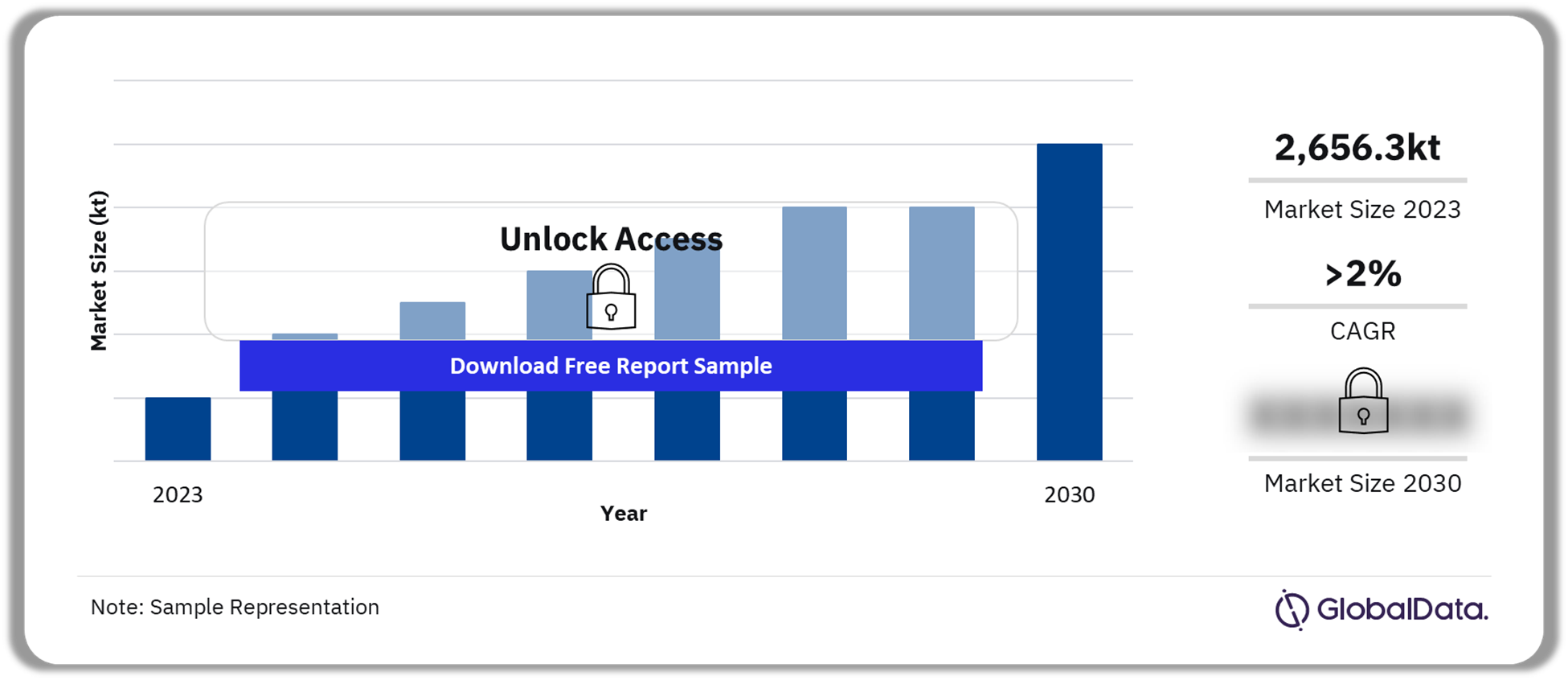

The copper production in Peru was estimated at 2,656.3kt in 2023 and is anticipated to grow at a CAGR of more than 2% during 2023-2030. This could be attributed to the scheduled commencement of several projects during this period including Haquira (2028), Zafranal (2027), Canariaco Norte (2026), Tia Maria and Antilla (2025).

Peru had the world’s third largest copper reserves after Chile and Australia with 81kt as of January 2023. Significant copper reserves are located at the Toquepala mine in Tacna and the Cerro Verde mine in Arequipa, with other major deposits at the Quellaveco project in Moquegua, the Toromocho project in Junin and the Las Bambas project in Apurimac.

Peru Copper Mining Market Outlook 2023-2030 (kt)

Get a free sample for detailed insights on the Peru copper mining market outlook.

The research report covers Peruvian reserves of copper, historic and forecast trends in the country’s copper production, and the key active, exploration and development copper mines and projects. The report also analyses factors affecting the country’s demand for copper and profiles the major copper producers.

| Market Size (2023) | 2,656.3kt |

| CAGR (2023-2030) | >2% |

| Historic Period | 2010-2022 |

| Forecast Period | 2023-2030 |

| Key Countries | Chile, Australia, Peru, Russia, Mexico, United States, and Poland |

| Key Copper Mining Assets | Cerro Verde Mine, Las Bambas Project, La Granja Project, Tia Maria Project, Antakori Project, Aguila Project, and Jasperoide Project |

| Leading Companies | Freeport-McMoRan Inc, Grupo Mexico SAB de CV, Glencore plc, China Minmetals Corp, BHP, and Sumitomo Metal Mining Co Ltd |

| Enquire and Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Latest Developments in the Copper Mining Market

- In March 2023, Rio Tinto formed a joint venture (JV) with First Quantum Minerals for the development of the project. The latter invested $105M and agreed to invest $546M as a part of the deal to acquire 55% in the JV.

- The Haquira project in Apurimac, which is currently at the prefeasibility stage, is wholly owned by First Quantum Minerals Ltd. With an annual production capacity of 153.2kt copper and mine life of 20 years, the project is predicted to begin operations in 2028.

- The Tia Maria project is a greenfield project in Arequipa and is majority-owned by Grupo Mexico SAB de CV. The project has completed its regulatory approvals and permissions. With an annual production capacity of 120kt of copper, it is expected to start its commercial production in 2025.

Learn more about the latest copper mining developments as you read our free sample report

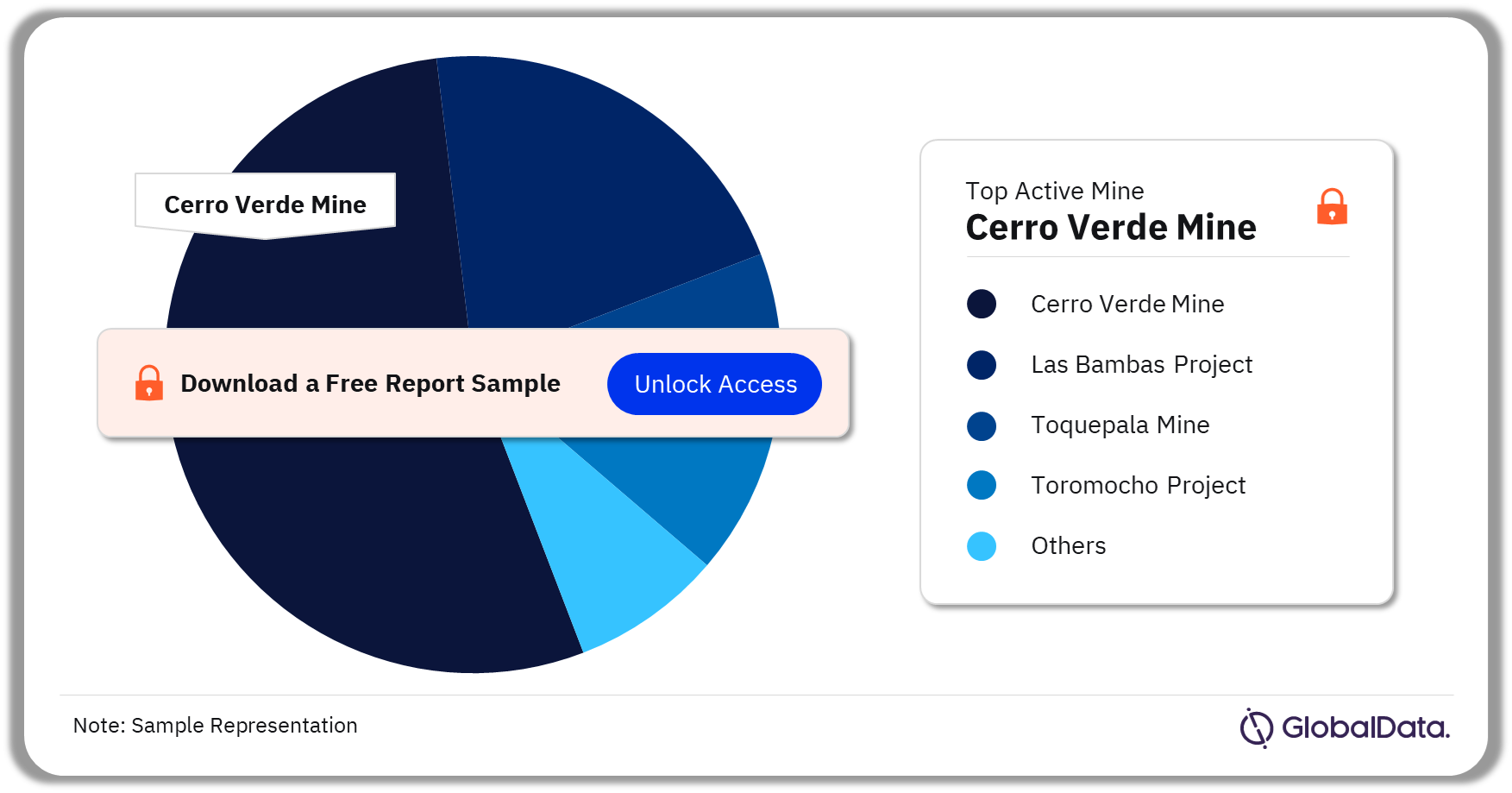

Cerro Verde Mine was the leading active copper mine with the largest copper reserves and production in Peru.

- Some of the active copper mines in Peru were Cerro Verde Mine, Las Bambas Project, Toquepala Mine, Toromocho Project, Antapaccay Mine, and Cuajone Mine among others. In 2023, Cerro Verde Mine was the market leading project.

- Some of the major copper mining development projects are La Granja Project, Rio Blanco Copper Mine, El Galeno Mine, Haquira Project, Tia Maria Project, and Conga Project among others.

- The key exploration copper mining projects are Antakori Project, Aguila Project, Pinaya Project, Tumipampa Property, Jasperoide Project, and Pashpap Property among others.

Peru Copper Mining Market Active Mines Insights, 2023 (%)

Grab your sample report copy for additional information on the active and upcoming copper mining assets.

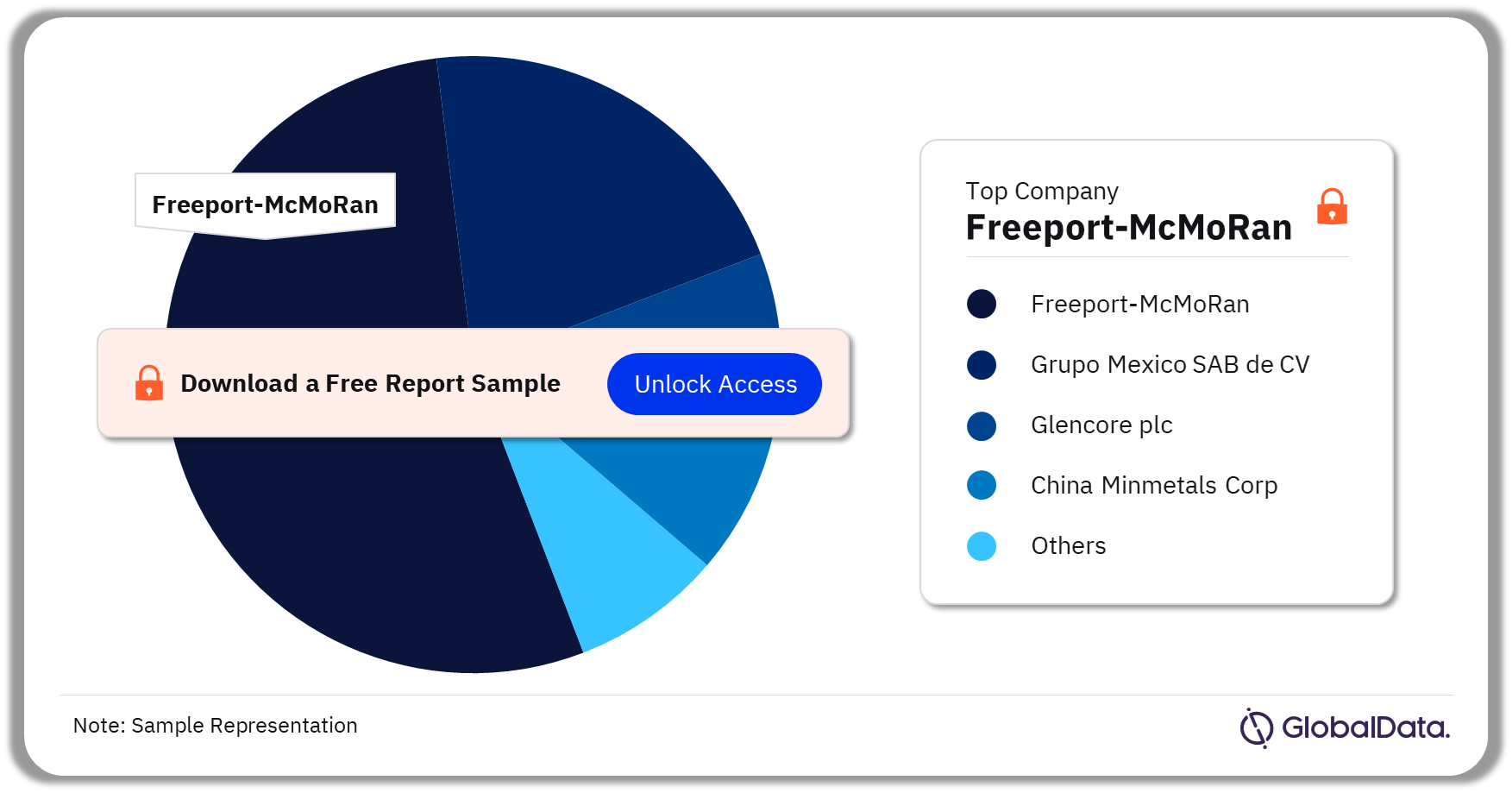

Freeport-McMoRan accounted for the largest Peru copper mining revenue in 2022.

- Freeport-McMoRan was Peru’s largest copper producer in 2022, with a production of 589.9kt, followed by Grupo Mexico SAB de CV and Glencore plc. The company operates several mines spread across North America, South America, Russia, and Indonesia.

- The Peruvian copper segment consists of the Cerro Verde mine, which is the company’s flagship operation and plays a crucial role in the company’s total copper production portfolio.

Peru Copper Mining Market Company Insights, 2022 (%)

Download PDF sample brochure: https://www.globaldata.com/store/talk-to-us/?report=2023465

Scope

- Overview of the Peru copper mining industry

- Key demand driving factors

- Historical and forecast data on copper production, production by company and reserves by country

- World copper prices

- Profiles of major copper producers

- Competitive landscape

- Major operating, explorational and developmental mines

Reasons to Buy

- In-depth Insights: Gain comprehensive industry insights into the Peru copper mining market and understand the key market drivers influencing production trends, reserves and market dynamics.

- Strategic market analysis: Access historical and forecast trends on Peru copper production to anticipate market shifts and make forward-looking decisions.

- Forge valuable partnerships: Identify the leading companies in the Peru copper mining market, including information on their sectors of operation, headquarters location, production capacity and owned copper mines.

- Uncover major projects: Dive into a detailed overview of major active, explorational, and developmental projects.

Table of Contents

Table

Figures

Frequently asked questions

-

What was copper mining production in Peru during 2023?

The copper production in Peru was estimated at 2,656.3kt in 2023.

-

What will be Peru copper mining market CAGR during 2023-2030?

The country’s copper mine production is anticipated to grow at a CAGR of more than 2% during 2023-2030.

-

Which was the most active mine in Peru copper mining market?

Cerro Verde Mine was the leading active copper mine with the largest copper reserves and production.

-

Which was the leading Peru copper mining market company?

Freeport-McMoRan was Peru’s largest copper producer in 2022.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.