Petrochemicals New Build and Expansion Projects Analysis by Type, Development Stage, Key Countries, Region and Forecasts, 2023-2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Explore actionable market insights from the following data in our ‘Petrochemicals New Build and Expansion Projects Analysis’ report:

- Global petrochemicals projects cost by type, region, key commodities, and key countries for the period 2023–2027.

- Global petrochemicals projects capacity additions by type, key commodities, and key countries for the 2023–2027 outlook period.

- Major projects outlook of key petrochemical commodities – methanol, ethylene, polypropylene, urea, propylene, polyethylene, and ammonia – that are expected to start operations during 2023–2027.

How is the ‘Petrochemicals New Build and Expansion Projects Analysis’ report different from other reports in the market?

Businesses need to have a deeper understanding of the market dynamics to gain a competitive edge in the coming decade. Get our report today for valuable insights that will help you to make strategic decisions.

- Understand the outlook of global petrochemicals projects that are expected to start operations during 2023–2027.

- Keep abreast of the capacity and cost outlook of key petrochemical commodities – methanol, ethylene, polypropylene, urea, propylene, polyethylene, and ammonia.

- Facilitate decision-making based on strong petrochemicals project data.

- Develop business strategies with the help of specific insights on global petrochemicals projects.

- Assess your competitor’s upcoming petrochemical projects.

We recommend this valuable source of information to anyone involved in:

- Petrochemical Companies/Contractors/Engineers/Equipment suppliers/Materials Suppliers

- Technology Suppliers/Service Providers – Leaders and Start-ups

- C-suite Executives/ Business Strategist or BD Team Leads of the Chemicals industry

- Investment Banks/Consultants/Government Agencies

To Get a Snapshot of the Petrochemicals New Build and Expansion Projects Analysis Report

Petrochemicals New Build and Expansion Projects Analysis Report Overview

The total number of petrochemical projects that are expected to start operations during the 2023–2027 outlook period is 1,473. Polypropylene constitutes the highest number of projects, closely followed by polyethylene. The petrochemicals new build and expansion projects research report provides data regarding the global petrochemical projects count by type and development stage that are expected to start operations during 2023–2027.

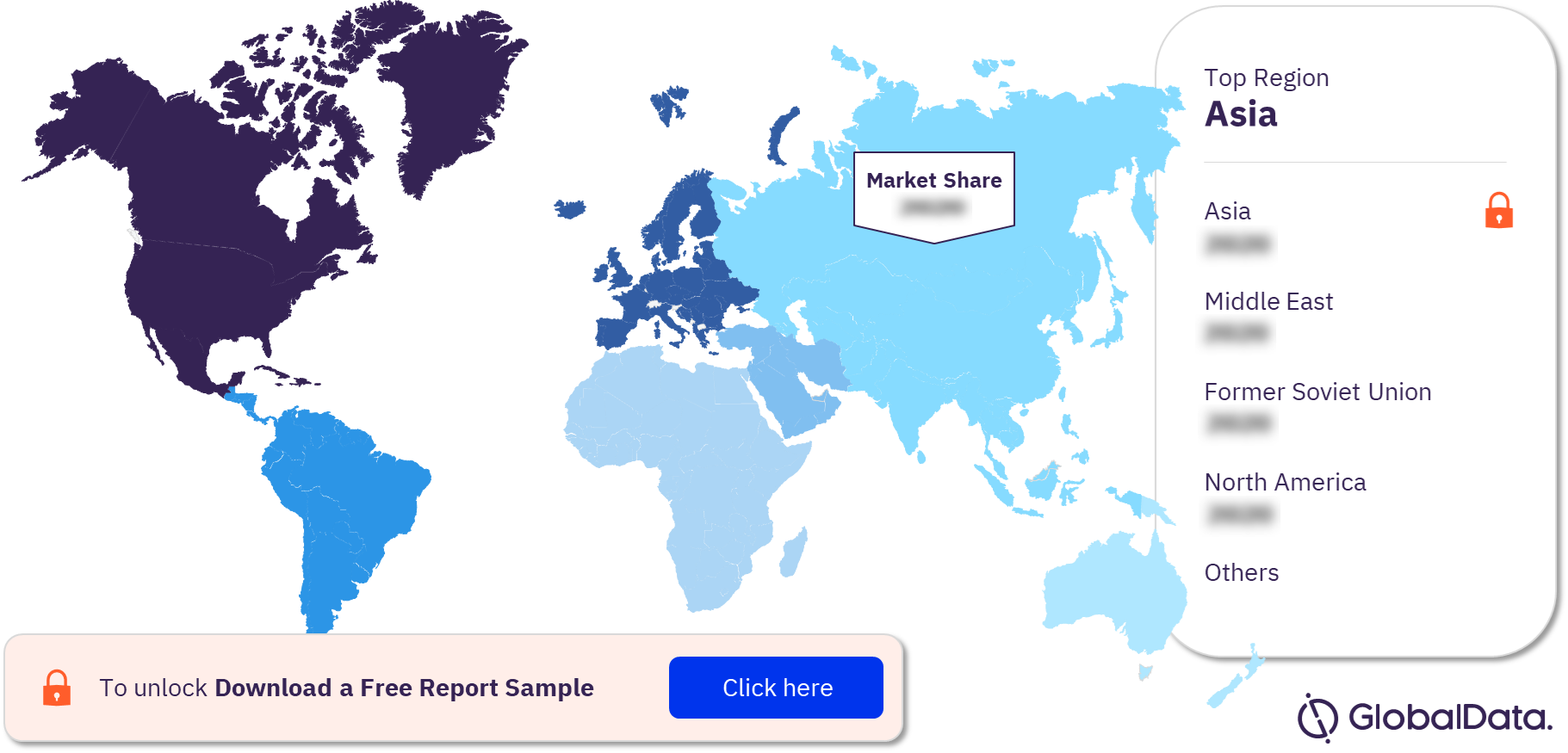

Petrochemicals New-Build and Expansion Projects Segmentation by Regions

The key regions in the petrochemicals new-build and expansion projects are Asia, the Middle East, the Former Soviet Union, North America, Africa, Oceania, Europe, and South America. Asia is expected to lead the petrochemical new build projects, followed by the Middle East and the Former Soviet Union.

Petrochemicals New-Build and Expansion Projects Analysis by Regions, 2023–2027 (%)

For more petrochemicals projects regional insights, download a free report sample

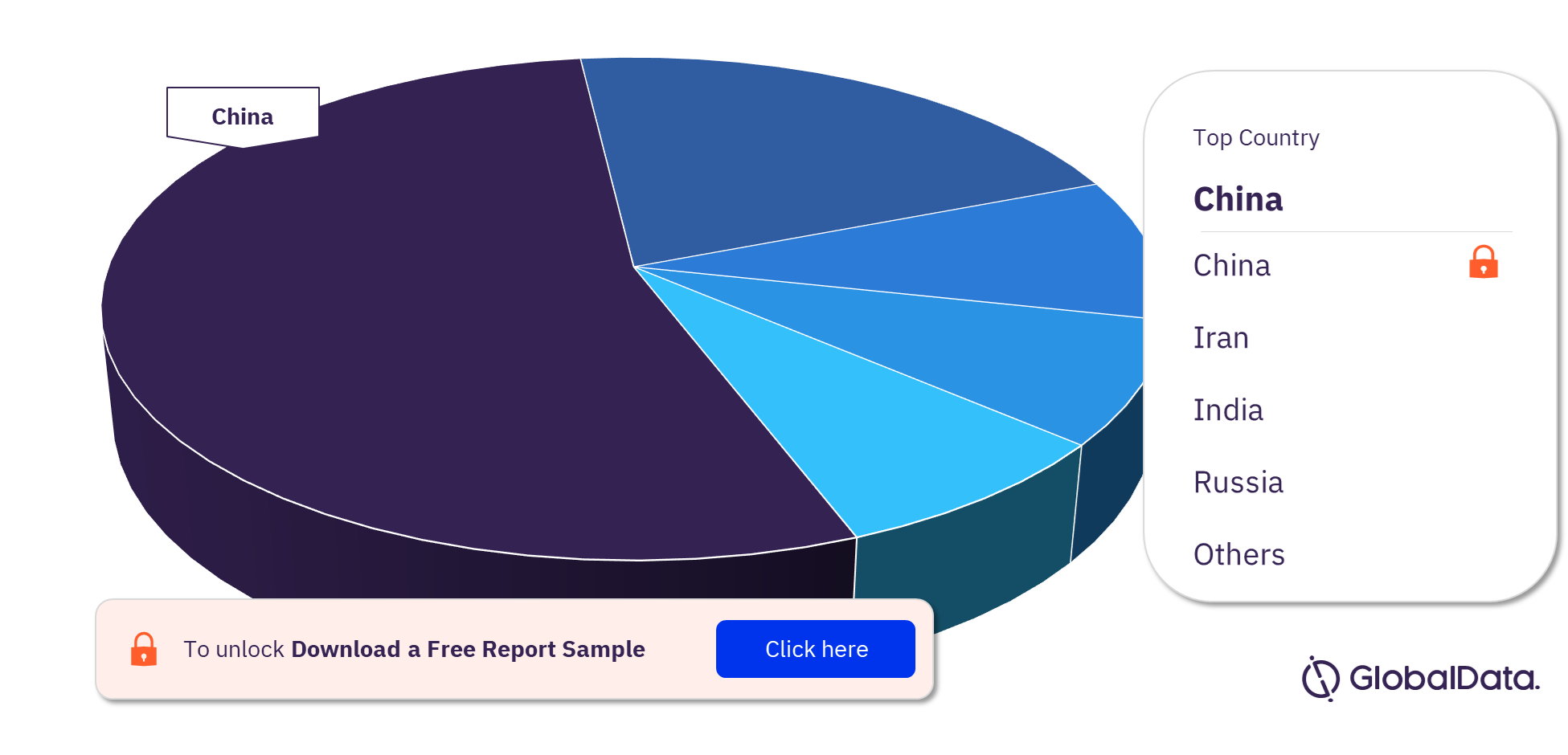

Petrochemicals New-Build and Expansion Project Segmentation by Key Countries

The key countries in the petrochemicals new-build and expansion projects are China, Iran, India, Russia, and the US. China is expected to be the leader in terms of petrochemical new build projects cost.

Petrochemicals New-Build and Expansion Projects Analysis by Countries, 2023–2027 (%)

For more petrochemicals project country insights, download a free report sample

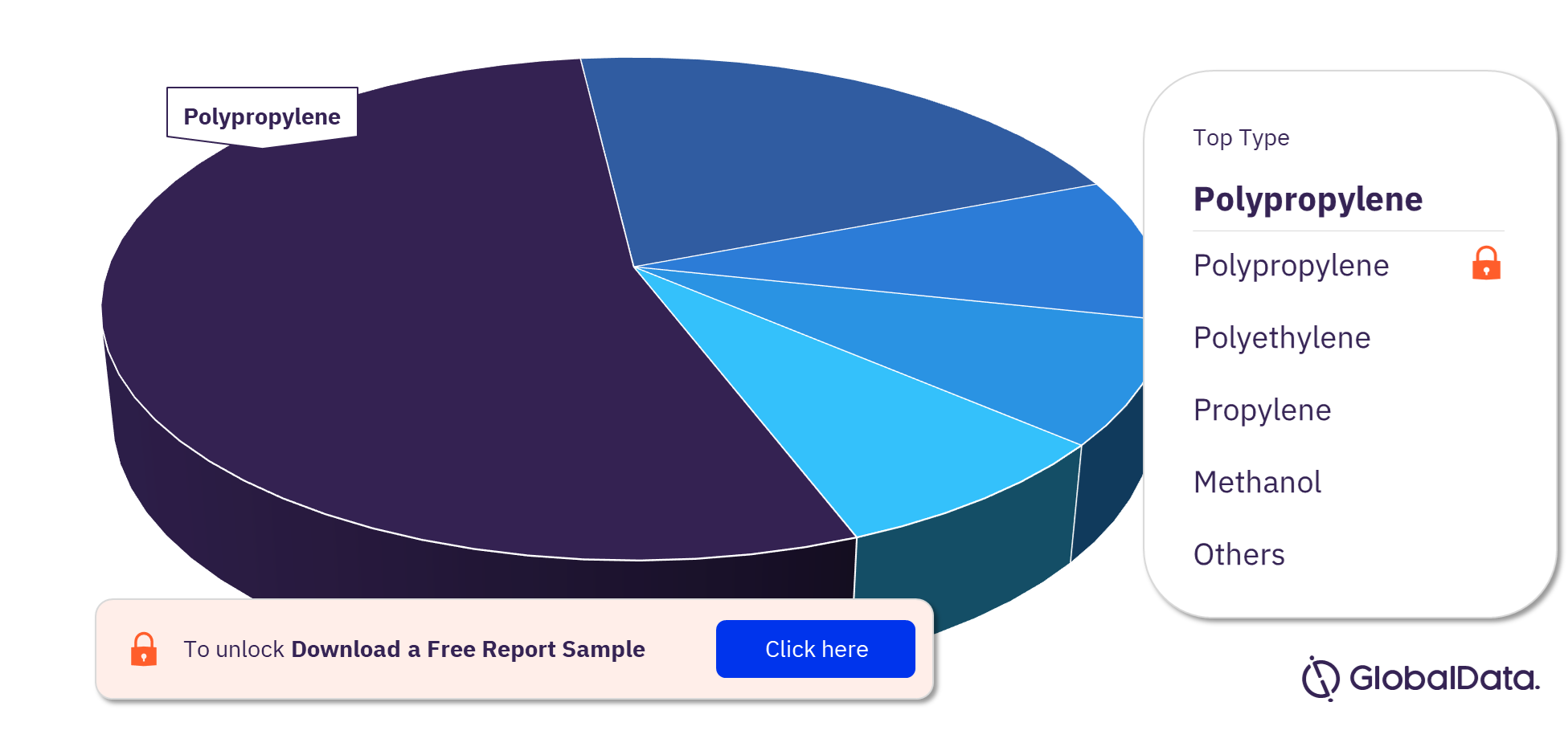

Petrochemicals New-Build and Expansion Project Segmentation by Commodities

The key commodities in the petrochemicals new-build and expansion projects are polypropylene, polyethylene, propylene, methanol, ethylene, ammonia, and urea, among others. Polypropylene will have the highest number of total projects in the outlook period.

Reliance Industries Jamnagar Polypropylene Plant 3 and PT Pertamina Rosneft Processing and Petrochemicals Tuban Polypropylene Plant are two of the major polypropylene projects.

Shell Basra Polyethylene Plant and Tatneft and Sibur Atyrau Polyethylene Plant are two of the major polyethylene projects.

Shandong Yulong Petrochemical Longkou Propylene Plant 1 and Reliance Industries Jamnagar Propylene Plant 3 are two of the major propylene projects.

Sherwood Energy Maysky Methanol Plant and Reliance Industries Jamnagar Methanol Plant are two of the major methanol projects.

Shandong Yulong Petrochemical Longkou Ethylene Plant 1 and Amur GCC Blagoveshchensk Ethylene Plant are two of the major ethylene projects.

Ascension Clean Energy Donaldsonville Ammonia Plant and Nakhodka Fertilizer Plant Nakhodka Ammonia Plant are two of the major ammonia projects.

Nakhodka Fertilizer Plant Nakhodka Urea Plant and Reliance Industries Jamnagar Urea Plant are two of the major urea projects.

Petrochemicals New-Build and Expansion Projects Analysis by Commodities, 2023–2027 (%)

For more petrochemical project commodity insights, download a free report sample

Petrochemicals New Build and Expansion Projects Report Overview

| Key Regions | Asia, the Middle East, the Former Soviet Union, North America, Africa, Oceania, Europe, and South America |

| Key Countries | The US, China, Iran, India, and Russia |

| Key Commodities | Polypropylene, Polyethylene, Propylene, Methanol, Ethylene, Ammonia, and Urea |

Segments Covered in the Report

Petrochemicals New-Build and Expansion Projects Commodities Outlook (Number of Projects, 2023-2027)

- Polypropylene

- Polyethylene

- Propylene

- Methanol

- Ethylene

- Ammonia

- Urea

Petrochemicals New-Build and Expansion Projects Regional Outlook (Number of Projects, 2023-2027)

- Asia

- Middle East

- Former Soviet Union

- North America

- Africa

- Oceania

- Europe

- South America

Petrochemicals New-Build and Expansion Projects Country Outlook (Number of Projects, 2023-2027)

- China

- Iran

- India

- Russia

- US

Table of Contents

Table

Figures

Frequently asked questions

-

How many petrochemical projects are expected to start operations during the 2023–2027?

The total number of petrochemical projects that are expected to start operations during the 2023–2027 outlook period is 1,473.

-

What are the key regions in the petrochemicals new-build and expansion projects?

The key regions in the petrochemicals new-build and expansion projects are Asia, the Middle East, the Former Soviet Union, North America, Africa, Oceania, Europe, and South America.

-

What are the key countries in the petrochemicals new-build and expansion projects?

The key countries in the petrochemicals new-build and expansion projects are China, Iran, India, Russia, and the US.

-

What are the key commodities in the petrochemicals new-build and expansion projects?

The key commodities in the petrochemicals new-build and expansion projects are polypropylene, polyethylene, propylene, methanol, ethylene, ammonia, and urea.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.