Pharmaceutical Packaging Market Size, Share, Trends and Analysis by Region, Material, Product, Drug Type and Segment Forecast to 2026

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insight from the ‘Pharmaceutical Packaging’ report can help you:

- Make informed decisions about market entry, mergers & acquisitions, material and product selection and technology adoption

- Identify your market players capabilities (Strengths & Weaknesses) to take competitive advantage

- Identify promising material, product type, drug type, growth trends, segments, and markets to expand your product portfolio or successful investment

- Anticipate expected changes in demand and adjust your business development strategies

- Identify potential countries for growth opportunities

How is ‘Pharmaceutical Packaging’ different from other reports in the market?

- The report presents in-depth market sizing information at a segment and sub-segment level for 16 countries including historical and forecast analysis for the period 2019-2026 for market assessment

- Detailed segmentation by product type including primary, secondary, and tertiary packaging further segmented by material including glass, plastic, paper & paperboard, metals, and rubber. In addition, it offers an additional segmentation by drug type including prescription drugs & over-the-counter drugs

- Detailed value chain analysis helping businesses identify areas where they can improve their efficiency and effectiveness, identify process gaps, and enhance their competitive advantage.

- Latest trends and dynamics impacting and shaping the pharmaceutical packaging industry including recent M&A/venture financing deals, and patent filing.

- Competitive profiling and heat map analysis of key players in the market to provide deeper understanding of industry competition

We recommend this valuable source of information to anyone involved in:

- Healthcare Consulting

- Strategy & Product Development

- M&A Consulting

- Pharmaceutical Packaging & Testing

- Contract Manufacturing

- Pharmaceutical manufacturing

- Market Intelligence

- InvestmentBanks

- Sales

Pharmaceutical Packaging Market Report Overview

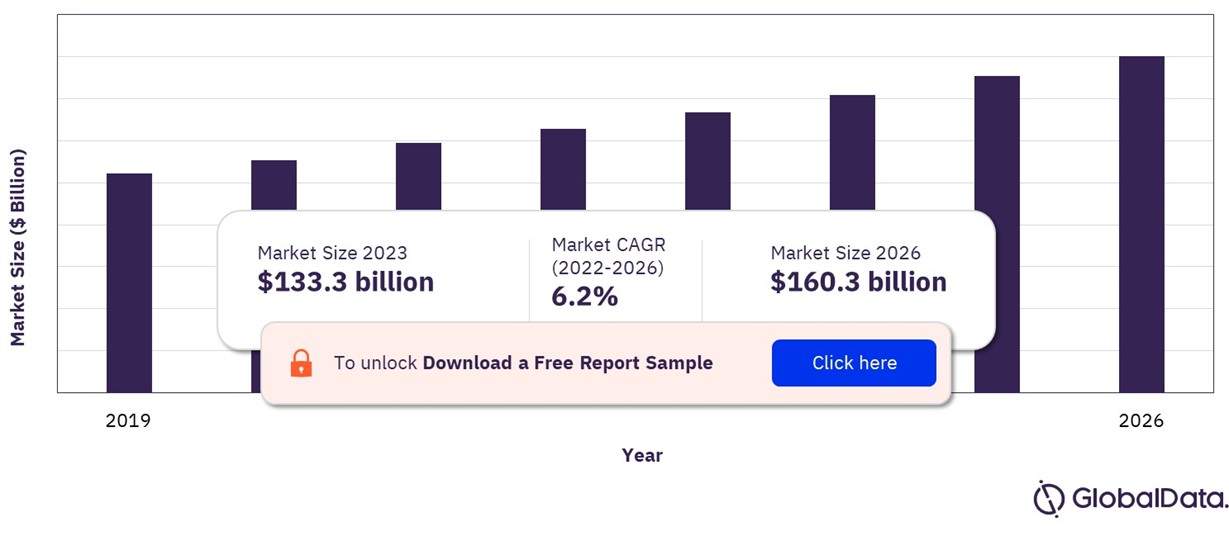

The pharmaceutical packaging market size will be US$ 133.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.2% over the forecast period. The rising demand in the end-use market, and the increasing technological innovations in manufacturing, such as blow fill seal (BFS) vials, anti-counterfeit packaging, AI-equipped inspection, and smart packaging techniques are contributing to the pharmaceutical packaging market growth.

However, pollution concerns rising from the increasing plastic packaging waste from packaging industries is attracting the focus of environmental regulatory authorities, which is compelling manufacturers to look for alternate sustainable materials, thus restraining overall market growth. Furthermore, the increasing demand for environment-friendly practices has resulted in recycling used packaging as well as the introduction of recycled content in the pharmaceutical packaging value chain. This is projected to create potential opportunities for recycled packaging in the market.

Pharmaceutical Packaging Market Outlook, 2019-2026 ($ billion)

View Sample Report for Additional Insights on the Pharmaceutical Packaging Market Forecast, Download a Free Report Sample

According to GlobalData estimates, the pharmaceutical packaging market will grow from US$ 133.3 billion in 2023 to US$ 160.3 billion in 2026. The industry experienced potential growth during the COVID-19 pandemic owing to the increased demand for pharmaceuticals to treat infected patients across the globe. Additionally, production of coronavirus vaccines has further supported the pharmaceutical packaging market growth.

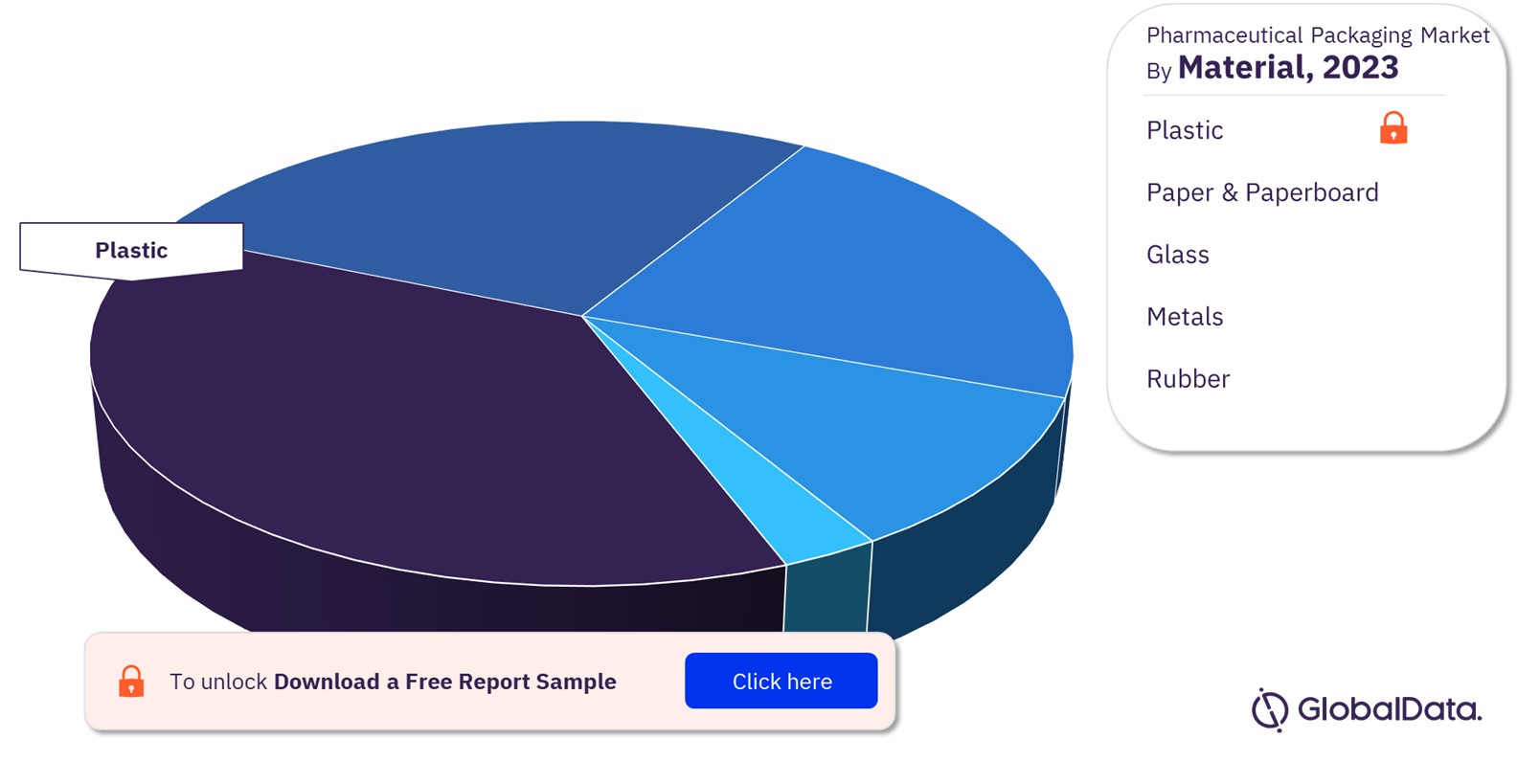

Pharmaceutical Packaging Market Segmentation by Material

The pharmaceutical packaging material segment is bifurcated into glass, plastic, paper & paperboard, metals, and rubber. The plastics segment dominated the pharmaceutical packaging market with a revenue share of 36.8% in 2021 and is projected to maintain its dominance throughout the forecast timeframe owing to its wider application across packaging solutions. The plastic material is used for manufacturing of products such as bottles & containers, pouches, caps & closures, blister packs, and trays & separators.

Pharmaceutical Packaging Market Share by Material, 2023 (%)

Fetch Sample PDF for Segment-specific Revenues and Shares, Download a Free Report Sample

Paper & paperboard material segment is projected to exhibit the fastest growth with a CAGR of 6.2% over the forecast timeframe. The increasing demand for the use of environment-friendly packaging solutions provided by this segment can help in achieving lesser carbon footprint and packaging waste.

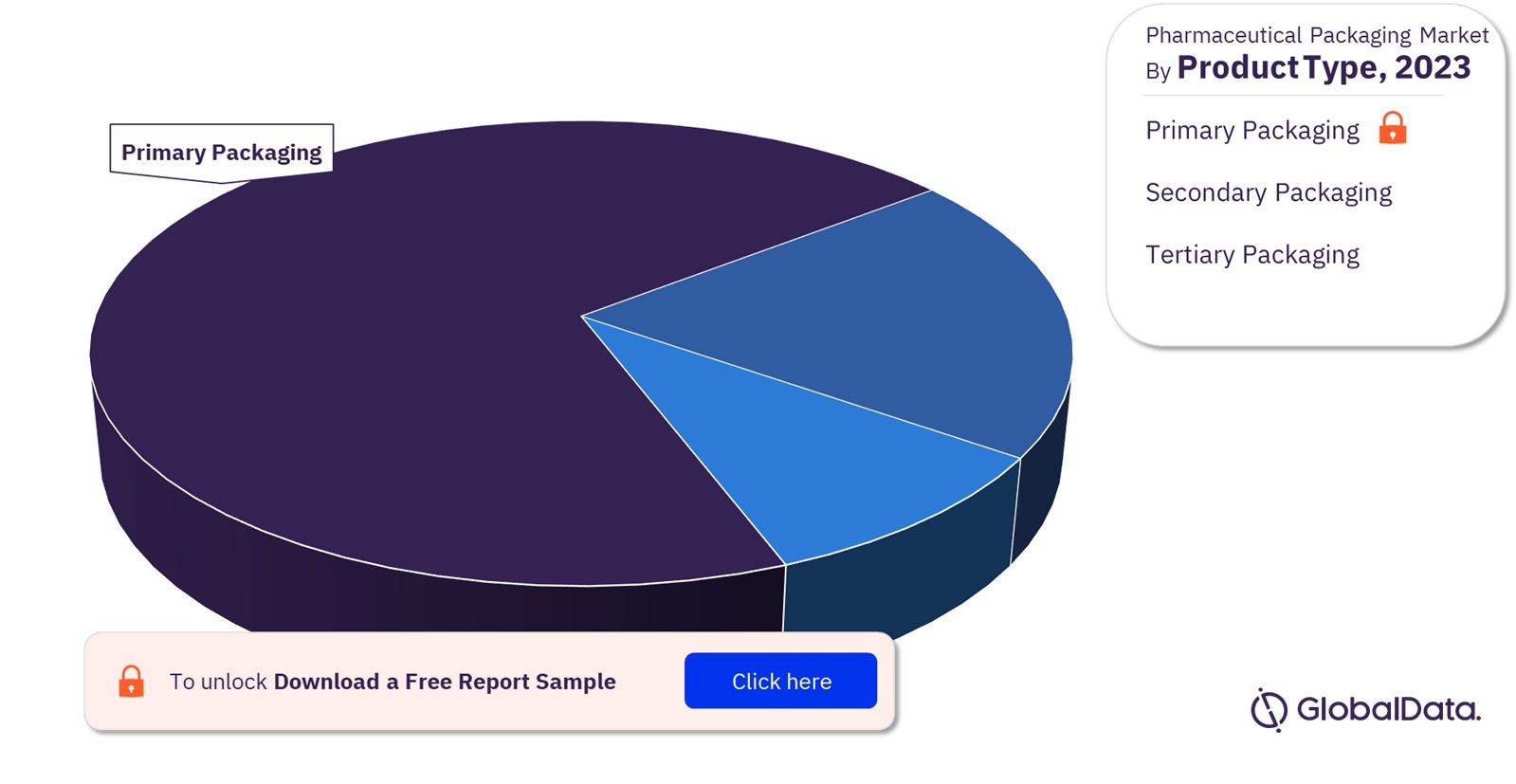

Pharmaceutical Packaging Market Segmentation by Product Type

The pharmaceutical packaging by product type segment is categorized as primary, secondary, and tertiary packaging. The primary packaging includes segments such as blister & strip packs, aerosols, bottles & containers, vials & ampoules, and caps & closures among others. The secondary packaging segment is comprised of boxes & cartons, labels & wraps, trays & separators, void-fill and temp-controlled packaging, and pouches & bags.

The primary packaging segment is leading the category owing to the increasing production of pharmaceutical products which typically require primary packaging for safety and protection. The caps and closures segment of primary packaging is projected to witness the fastest growth with a CAGR of 6.5% over the forecast period owing to their wide application across bottles & containers, vials & ampoules, and tubes among others.

Pharmaceutical Packaging Market Share by Product Type, 2023 (%)

Fetch Sample PDF for Segment-specific Revenues and Shares, Download a Free Report Sample

The tertiary packaging segment is anticipated to exhibit the fastest growth with a CAGR of 6.8% over the forecast period. The increasing import and export activities across the globe especially in emerging economies of Asia Pacific and Middle East & Africa region are supporting the demand for bulk packaging for the transportation of pharmaceutical products. There is an increasing potential for recycled paper & paperboard material in tertiary packaging across the globe.

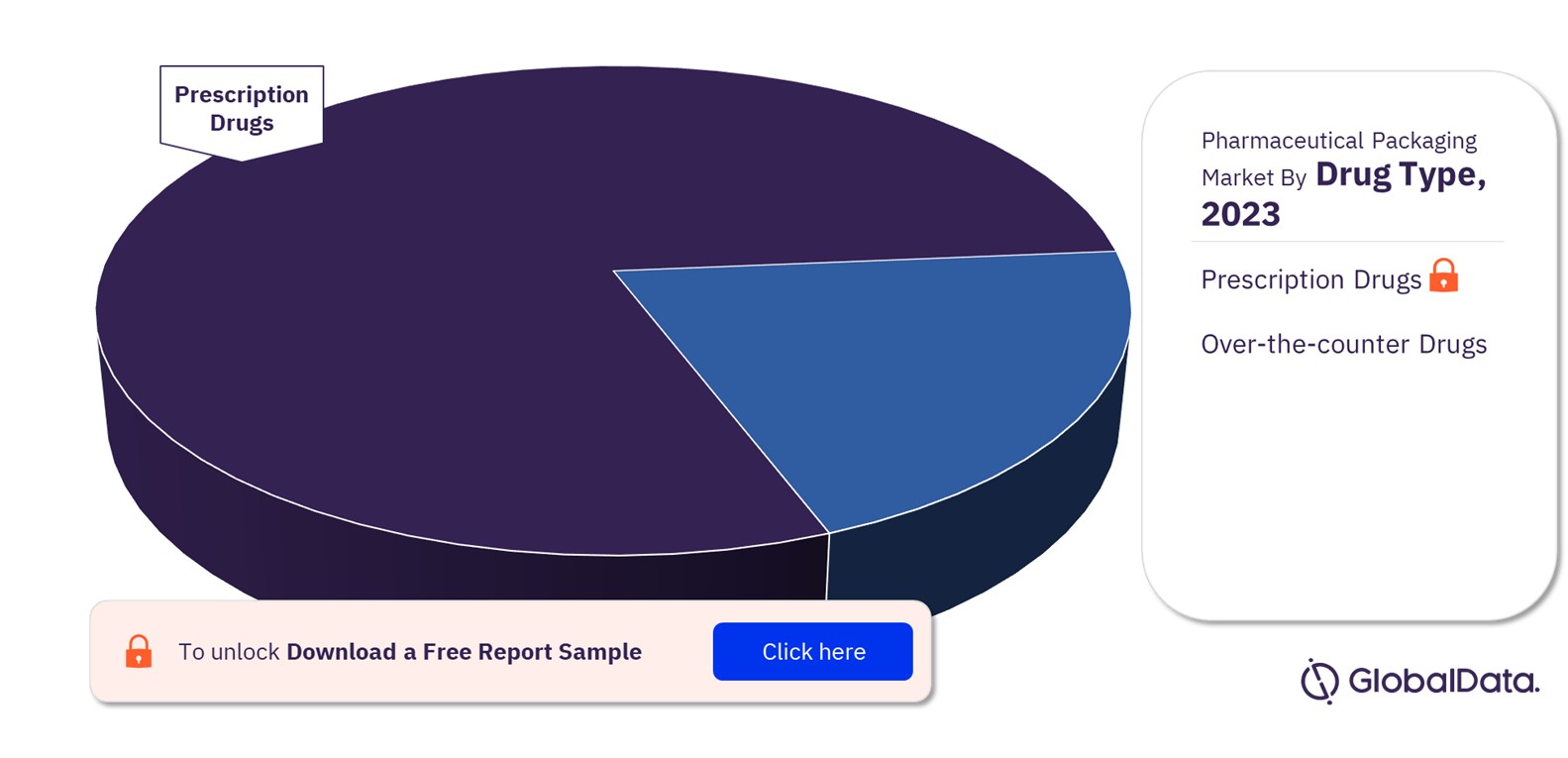

Pharmaceutical Packaging Market Segmentation by Drug Type

Prescription drugs remained the important drug type in the pharmaceutical packaging industry and are estimated to account for a majority of the share in 2023. An increasing number of patients with serious health conditions, who require lifetime medication to live a normal life is among the prime factors supporting the prescription drugs segment. The requirement of healthcare professional consultation for increasing chronic and infectious diseases is further supporting the growth of this segment.

Pharmaceutical Packaging Market Share by Drug Type, 2023 (%)

Pharmaceutical Packaging Market Outlook Report with Detailed Segment Analysis is Available with GlobalData Now! Download a Free Report Sample

The over-the-counter drugs segment is anticipated to exhibit the fastest growth with a compound annual growth rate of 6.7% across the globe owing to the increasing number of OTC drugs in the retail pharmacy market. Additionally, the increasing trust of consumers and healthcare professionals in non-prescription drugs due to approval by regulatory authorities after thorough clinical trials and testing, will further support demand for OTC drugs in the end-use market.

Pharmaceutical Packaging Market Analysis by Region

North America region accounted for the maximum share in terms of revenue and is projected to continue its dominance over the forecast timeframe. The region accounted for a market revenue share of 37.2% in 2021 with a compounded annual growth rate of 4.5% over the forecast period. The region is anticipated to observe a significant rise in production volumes of pharmaceutical drugs, especially in the US and Canada on account of the growing customer base especially among the geriatric population.

Asia Pacific is projected to witness the highest compound annual growth rate of 7.9% across the global pharmaceutical packaging market. Japan, India, and China are potential markets within the Asia Pacific region with the presence of leading packaging manufacturers and other supporting vendors of the value chain.

Asia-Pacific Pharmaceutical Packaging Market Share by Country, 2023 (%)

View Sample Report for Additional Pharmaceutical Packaging Market Insights, Download a Free Report Sample

Europe accounted for the third largest revenue share within the pharmaceutical packaging market. Prominent markets including Germany, France, the UK, Italy, and Spain are contributing to more than half of the regional revenue share. In addition, Germany is leading the regional market with the maximum revenue on account of the presence of a large customer base and packaging companies to meet the demand of pharmaceutical manufacturers.

The Middle East & Africa region is projected to witness the second-highest compounded annual growth rate of nearly 6.2% over the forecast period. The increasing investments in the major economies of the region including Saudi Arabia and South Africa are projected to support this growth. Saudi Arabia is leading the regional market with the maximum revenue share owing to the presence of a large customer base and pharmaceutical manufacturers in the country.

Pharmaceutical Packaging Market – Competitive Landscape

The pharmaceutical packaging market is highly competitive, characterized by the presence of differentiated products and services as well as pharmaceutical company based customized solutions. The market has witnessed several strategic initiatives including mergers and acquisitions, new product development, and capacity expansion among others. Key players in the pharmaceutical packaging market include SCHOTT AG, West Pharmaceutical Services, Inc., Berry Global Group Inc., Amcor plc, AptarGroup Inc, Becton Dickinson and Co (BD), WestRock Co, and Nipro Corp, among others.

Leading Players in the Pharmaceutical Packaging Market

- SCHOTT AG

- West Pharmaceutical Services, Inc.

- Berry Global Group Inc.

- Amcor plc

- AptarGroup Inc

- Becton Dickinson and Co (BD)

- WestRock Co

- Nipro Corp

- Gerresheimer AG

- CCL Industries Inc.

Other Pharmaceutical Packaging Market Vendors Mentioned

Sealed Air, UFlex Limited, Sonoco Products Company, Vetter Pharma International GmbH, Nelipak BV, and Wiicare.

Pharmaceutical Packaging Market Research Scope

| Market Size (2023) | US$ 133.3 billion |

| Market Size (2026) | US$ 160.3 billion |

| CAGR (2022-2026) | 6.2% |

| Forecast Period | 2022-2026 |

| Historic Data | 2019-2021 |

| Report Scope & Coverage | Revenue forecast, competitive landscape, company profiles, growth trends |

| Material Segment | Glass, Plastic, Paper & Paperboard, Metals, and Rubber |

| Product Type Segment | Primary Packaging, Secondary Packaging, and Tertiary Packaging |

| Drug Type Segment | Prescription Drugs and Over-the-counter Drugs |

| Key Companies | SCHOTT AG, West Pharmaceutical Services, Inc., Berry Global Group Inc., Amcor plc, AptarGroup Inc, Becton Dickinson and Co (BD), WestRock Co, Nipro Corp, Gerresheimer AG, and CCL Industries Inc. |

Pharmaceutical Packaging Market Segments and Scope

GlobalData Plc has segmented the pharmaceutical packaging market report by material, product type, drug type, and region:

Pharmaceutical Packaging Material Outlook (Revenue, US$ Million 2019-2026)

- Glass

- Plastic

- Paper & Paperboard

- Metals

- Rubber

Pharmaceutical Packaging Product Type Outlook (Revenue, US$ Million 2019-2026)

- Primary Packaging

- Blister & Strip Packs

- Aerosols

- Bottles & Containers

- Vials & Ampoules

- Caps & Closures

- Tubes

- Pouches/Sachets

- Pre-Filled Inhalers

- Pre-Filled Syringes

- Cartridges

- Secondary Packaging

- Boxes & Cartons

- Labels & Wraps

- Trays & Separators

- Void-Fill and Temp Controlled Packaging

- Pouches & Bags

- Tertiary Packaging

Pharmaceutical Packaging Drug Type Outlook (Revenue, US$ Million 2019-2026)

- Prescription Drugs

- Over-the-counter Drugs

Pharmaceutical Packaging Regional Outlook (Revenue, US$ Million 2019-2026)

- North America

- US

- Canada

- Europe

- Turkey

- Russia

- Kazakhstan

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- Central & South America

- Brazil

- Rest of Central & South America

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Reasons to Buy

- This market intelligence report offers a thorough, forward-looking analysis of the global pharmaceutical packaging market by material, product type, drug type, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in pharmaceutical packaging markets.

- The report also highlights key product type segments (Primary Packaging, Secondary Packaging, And Tertiary Packaging)

- The report also highlights key drug type segments (Prescription drugs, over-the-counter Drugs)

- With more than 20 charts and tables, the report is designed for an executive-level audience, enhancing presentation quality.

- The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in pharmaceutical packaging markets.

- The broad perspective of the report coupled with comprehensive, actionable detail will help stakeholders, service providers, and other pharmaceutical packaging players succeed in growing the pharmaceutical packaging market globally.

Key Players

SCHOTT AGWest Pharmaceutical Services, Inc.

Berry Global Group Inc.

Amcor plc

AptarGroup Inc

Becton Dickinson and Co (BD)

WestRock Co

Nipro Corp

Gerresheimer AG

CCL Industries Inc.

Table of Contents

Figures

Frequently asked questions

-

What was the pharmaceutical packaging market size in 2023?

The pharmaceutical packaging market size was evaluated at nearly US$ 133.3 billion in 2023.

-

What will be the pharmaceutical packaging market size in 2026?

The pharmaceutical packaging market size is expected to reach US$ 160.3 billion by 2026.

-

What is the pharmaceutical packaging market growth rate?

The pharmaceutical packaging market is expected to grow at a CAGR of 6.2% over the forecast period.

-

What is the key pharmaceutical packaging market driver?

The increasing investments in packaging facilities to meet the growing demand in the pharmaceutical manufacturing sector is driving the pharmaceutical packaging market growth.

-

What are the key pharmaceutical packaging market segments?

Material Segments: Glass, Plastic, Paper & Paperboard, Metals, and Rubber

Product Type Segments: Primary Packaging, Secondary Packaging, and Tertiary Packaging

Drug Type Segments: Prescription Drugs and Over-the-counter Drugs

-

Which are the leading pharmaceutical packaging companies globally?

Some of the leading pharmaceutical packaging companies are SCHOTT AG, West Pharmaceutical Services, Inc., Berry Global Group Inc., Amcor plc, AptarGroup Inc, Becton Dickinson and Co (BD), WestRock Co, Nipro Corp, Gerresheimer AG, and CCL Industries Inc.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.